The S&P 500 (Index: SPX) dropped 0.7% from its previous week’s close to end the third calendar quarter of 2023 at 4288.05.

The main reason the market fell during the final week of 2023-Q3 is the developing consensus the Federal Reserve will hold interest rates higher for longer because inflation has not yet been adequately suppressed.

We looked for signs a looming shutdown of nonessential federal government operations at the end of its fiscal year was negatively impacting stock prices, but given the long-running dysfunctionality of Washington, D.C., news related to this year’s looming shutdown contributed imperceptible levels of noise to the trajectory of stock prices.

The past week’s news related to the looming shutdown has not affected stock prices in any meaningful way.

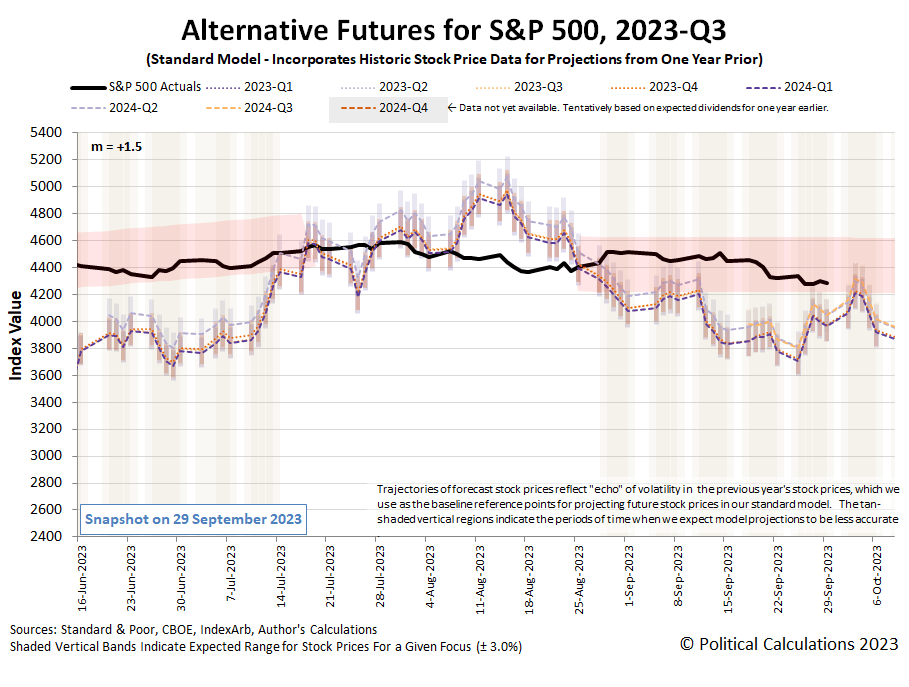

Speaking of which, the trajectory of the S&P 500 remains well within the latest redzone forecast range shown on the dividend futures-based model‘s alternature futures chart, though trending down into the lower portion of it.

The trajectory of the latest redzone forecast range itself has similarly altered its trajectory downward since we first introduced it several weeks ago, coinciding with rising expectations the Fed will hold interest rates higher for longer than investors were expecting when we first drafted it.

Looking forward, we’ll update this chart one last time before rolling out a first look at the alternative futures chart for 2023-Q4, which will take us through the end of the year.

Here’s our recap of the meaningful market-moving news headlines for the final week of 2023-Q3:

Monday, 25 September 2023

- Signs and portents for the U.S. economy:

- Traders calling foul on Fed officials’ bluff, Fed officials may have added to financial instability, suggest they may seek another rate hike:

- Bigger trouble, stimulus developing in China:

- Bigger stimulus developing in Japan, BOJ officials

- ECB officials thinking about sitting on their hands again:

- Wall Street posts gains as investors eye rate outlook

Tuesday, 26 September 2023

- Signs and portents for the U.S. economy:

- Most dovish Fed officials say betting odds of higher rates are rising:

- Signs China’s stimulus efforts are getting traction:

- BOJ officials to keep never-ending stimulus alive longer:

- Bigger trouble developing in Eurozone:

- Wall St pounded as investors grapple with higher rates

Wednesday, 27 September 2023

- Signs and portents for the U.S. economy:

- Fed official says they don’t think they’ve beaten inflation yet, BofA CEO says they have, Reuters mouthpiece says they need to move goalposts to accept higher inflation:

- “Precise, forceful” stimulus developing in China:

- BOJ officials becoming less sure about keeping never-ending stimulus policy alive:

- ECB officials claim they may not be done with rate hikes, excited to shrink money supply:

- S&P 500 ekes out slim gain as investors weigh elevated yields

Thursday, 28 September 2023

- Signs and portents for the U.S. economy:

- Fed officials say they’re not sure what way they’ll go with rate hikes:

- Signs of stimulus getting traction in China:

- Bigger trouble developing in the Eurozone:

- Wall St ends higher as investors digest economic data ahead of inflation report

Friday, 29 September 2023

- Signs and portents for the U.S. economy:

- Fed officials keep playing “will they or won’t they” on rate hikes:

- BOJ officials told to keep deflation from coming back:

- ECB officials get good news and bad news:

- S&P 500 dips after US inflation data, ending weak third quarter

The CME Group’s FedWatch Tool continues to project the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% through July (2024-Q3).

Starting from 31 July (2024-Q3), investors expect deteriorating economic conditions will force the Fed to start a series of quarter-point rate cuts at six- to twelve-week intervals through the end of 2024.

The Atlanta Fed’s GDPNow tool’s forecast of annualized real growth rate during 2023-Q3 held steady for a second consecutive at +4.9%.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here