We maintain our hold rating on Palantir (NYSE:PLTR). We continue to believe Palantir is uniquely positioned to leverage the A.I. growth opportunity with its position with the U.S. government, strong status in servicing military and defense, and AIP launch, but we don’t see the stock outperforming materially in the near-term. Consistent with our expectations in early August, the stock’s outperformance has moderated after running up on A.I. hype in 1H23 and part of 2H23.

The recent $250M deal with the US Defense Department for R&D into A.I. and machine learning does not change our near-term sentiment; the deal pushed PLTR higher over the past five days, up 14% versus the S&P 500, down 1% during the same period. We think the market is getting ahead of itself with excitement about the impact the deal will have on Palantir’s profit growth. Service deals tend to have lower margins than software deals, and Palantir continues to face slower software deal growth; in H1 FY23, the company faced a slower growth rate in government revenue and commercial revenue, with total revenue coming in-line with estimates despite the launch of AIP during the quarter. We think Palantir is overhyped on A.I. and trading at a premium valuation, creating an unfavorable risk-reward profile for 2H23.

Additionally, we think the issue of monetizing A.I., or AIP, remains present; AIP monetization remains low, and we don’t think increased visibility from government deals will offset the cost-cutting environment in 2H23. The Fed continues to push for a higher-for-longer strategy, and budgets are tight under macro uncertainty. So, while we’re constructive on management’s quick launch of AIP and decades of A.I. and data mining capabilities, we don’t see a clear near-term growth path for the stock and expect Palantir to be in a difficult spot to accelerate organic growth to justify its higher multiple. We recommend investors stay on the sideline as we don’t see the stock working in 2H23.

Quick rundown on the US Defense Department Deal

The three-year deal shows how close Palantir is with the U.S. government, as well as the intersection of A.I. and defense. The deal is for Palantir to “conduct research and development services” in A.I. and machine learning, utilizing a lot of its previous work since 2018 with the Army Research Lab. The deal isn’t entirely surprising – Palantir’s services have been used by the U.S. military, CIA, and Western militaries for years, and the support for the U.S. and its allies is at the core of Palantir’s identity. We think financial outperformance will be driven by an uptick in commercial revenue and government revenue rather than just the latter. We believe under the current macro environment, it’ll be more difficult for the company to achieve a reacceleration in top-line growth.

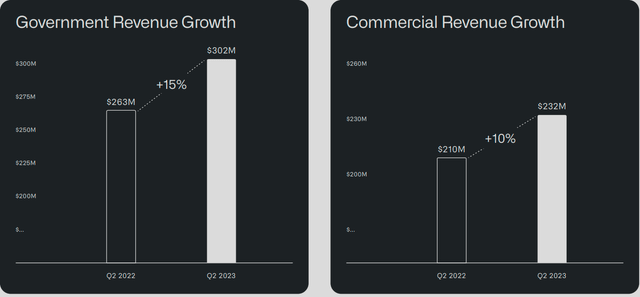

The following graph outlines government and commercial revenue growth in 2Q23.

PLTR 2Q23 earning presentation

Valuation

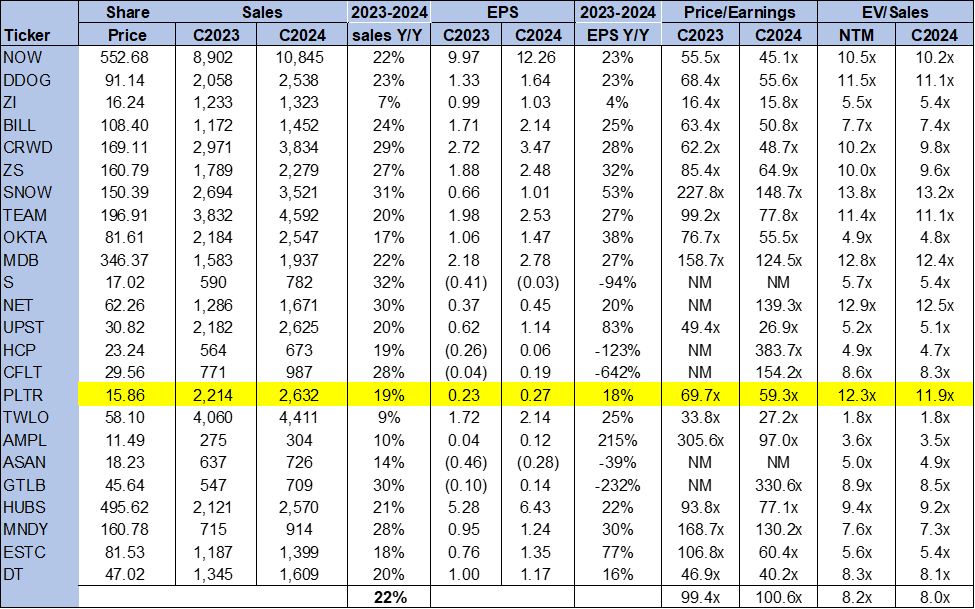

The stock is trading well above the peer group average at 11.9x EV/C2024 Sales versus the peer group average of 8.0x. On a P/E basis, the stock is trading at 59.3x C2024 EPS $0.27 compared to the peer group average of 100.6x. We think the valuation premium is unjustified for Palantir’s near-term growth rate. We don’t see favorable entry points at current levels.

The following chart outlines PLTR’s valuation against the peer group average.

TSP

Word on Wall Street

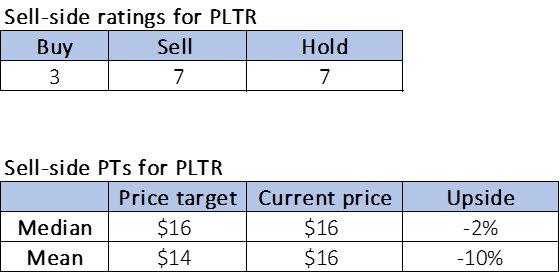

Wall Street’s sentiment on the stock has shifted more bearish over the past quarter. Of the 17 analysts covering the stock, three are buy-rated, seven are hold-rated, and the remaining are sell-rated. The stock is currently priced at $16 per share. The median price target is $16, while the mean is $14 for a potential downside of 2-10%

The following charts outline PLTR’s sell-side ratings and price-targets.

TSP

What to do with the stock

We’re hold-rated on Palantir; the new deal with the U.S. Defense Department changes our negative thesis about slower revenue growth for Palantir in the near-term due to the cost-cutting environment. We think Palantir stock is giving back some of its A.I. rally gains as investors wake up to the reality that A.I. capabilities don’t necessarily mean A.I. monetization. We think near-term macro headwinds have not been factored into the stock fully and recommend investors stay on the sidelines for 2H23.

Read the full article here