This week, we reshuffled some of our mortgage REIT preferreds holdings in the High Income Portfolio. In this article, we focus in on one of these updates – specifically the move within the Chimera Investment Corp (NYSE:CIM) suit of four preferreds. Our goal was three-fold – to take advantage of relative value in the suite, to marginally derisk portfolio exposure in light of a frothy credit market, and to lower the fix-for-life risk that we saw in other preferreds this year.

The CIM Rotation

Chimera Investment is a hybrid mortgage REIT (i.e. one that takes the credit risk of underlying mortgages) with a focus on residential mortgage loans, specifically re-performing loans, nonqualified and business purpose (i.e. investment property) loans. Its business model revolves around the acquisition and securitization of mortgage loans, with Chimera retaining the subordinate and interest-only securities.

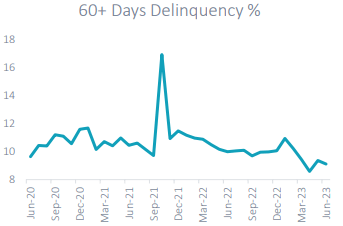

The underlying loan portfolio is very seasoned, with over 80% of the loans originated more than 15 years ago. The delinquency rate is modest for its loan type and is low relative to the last few years, in part due to historic levels of home equity given the rise in home prices.

CIM

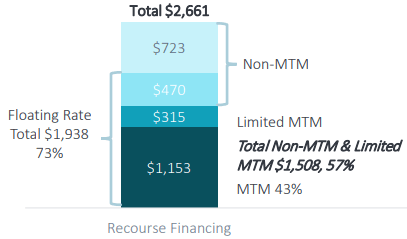

The company’s book value has fallen over time, pushing its equity / preferreds coverage lower to around 2.8x now. That said, its recourse leverage is only 1x and the majority of its financing is no-or-limited mark-to-market.

CIM

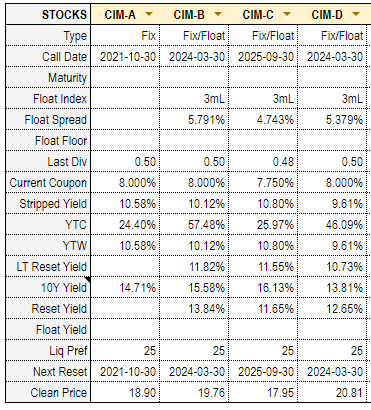

We first allocated to Chimera preferreds in early 2021, choosing to go with the Series D (NYSE:CIM.PR.D). The suite consists of four preferreds, three being Libor-based Fix/Float and one fixed-rate.

Systematic Income Preferreds Tool

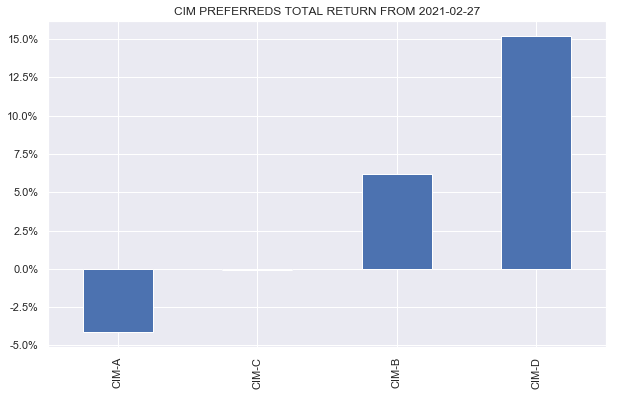

Since our initial allocation, D has delivered a pretty strong total return of over 15% (unannualized), sharply outperforming the rest of the suite. This is owed in large part to its high initial yield, a high reset yield (the expected yield on the first call date when converted to a floating-rate stock) and a very short duration profile (given the floating-rate conversion, if not redeemed).

Systematic Income

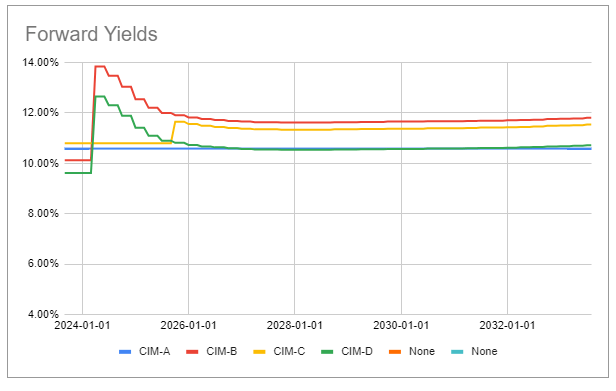

As CIM.PR.D has outperformed since our initial allocation, its yield has fallen relative to the suite and is now less compelling. In fact its yield is dominated by CIM.PR.B as we can see in the chart below which is why we chose to rotate part of the D position to B this week. Both B and D have a first call date on 30-Mar next year when they are expected to switch to a floating-rate coupon, enjoying a yield bump in the process.

Systematic Income Preferreds Tool

As many investors are well aware, a number of issuers fixed their Fix/Float preferreds for life, including State Street, Morgan Stanley, PennyMac and others. An important question, therefore, is what will happen if Chimera does the same. In this scenario the coupon of CIM.PR.D will remain the same as will its yield of 10.1% at the current price.

In our reading of the prospectus, CIM preferreds should transition to SOFR because they rely on an appointment of a calculation agent who will determine whether there is an industry accepted successor rate to Libor. Of course there is such a successor rate – SOFR. The Libor Act gives the calculation agent safe harbor (i.e. protection from liability) to choose SOFR and this is what we expect to happen.

That said, the Libor Act is complicated and, as they say, good people can disagree. In the unlikely chance CIM does fix the preferreds for life it would be a disappointment and the price will likely move lower. However, we need to balance that scenario with the more likely possibility that CIM.PR.B switches to a very attractive floating-rate (a nearly 14% yield at the outset which is then expected to deflate to around 11.8% over the longer term as the Fed starts to cut rates). The downside is a fixing for life, however this is still a double-digit yield or a 25% immediate return if redeemed.

Outside of the floating rate-fixing risk, credit valuations look somewhat frothy to us. In this context we decided to only rotate half of our D position to B, with the other half going to a more resilient security and one that does not carry the same fix-for-life risk. This CIM preferred position reduction allows us to both marginally derisk the portfolio and reduce the rate-fixing risk.

Where To?

As we discussed above our choice was to move half the CIM.PR.D position to CIM.PR.B. However, this may not please everyone as it retains the fix-for-life risk.

For investors who want to stay within the Chimera suite but avoid the potential fixing-for-life should consider the CIM.PR.C. Although it is CIM.PR.A which is the only fixed-rate security in the suite, if C is fixed for life, its stripped yield will remain above that of A (see the chart above).

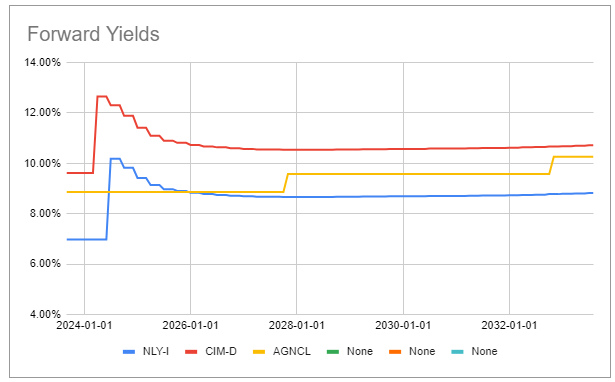

For investors who want to remain allocated to mREITs but derisk further and reduce the fix-for-life risk should consider the Agency mREIT preferreds NLY.PR.I and AGNCL. NLY has already floated its Series F to SOFR while AGNCL will switch to a 5-year Treasury yield rate unless redeemed.

Systematic Income Preferreds Tool

Finally, for investors who are happy to look further afield for opportunities and want to derisk and reduce the fix-for-life risk should consider CLO Debt ETFs like CLOZ or JBBB with portfolio yields of 10.8% and 9.7% respectively. We expect these ETFs to be more resilient in a sell-off while being fully floating-rate at present.

Read the full article here