Investment Thesis

Global Payments (NYSE:GPN) is a payment company, with a global presence. They are a Fortune 500 company, with an investment-grade balance sheet. And they wish to remain an investment-grade company.

However, its balance sheet carries a substantial amount of debt. More specifically, Global Payments carries around $15 billion of net debt. What’s more, the business’ growth rates are around the high single digits, but not much faster.

On the surface, the business looks incredibly cheap, at around 9x forward EPS. But, once we consider its hyper-competitive landscape plus weigh up its overburdened balance sheet, I’m forced to be neutral on this name.

Global Payment’s Near-Term Prospects

Global Payments is a payments technology company operating in over 170 countries, serving approximately 4 million merchant locations and over 1,500 financial institutions.

They specialize in delivering innovative software and services that facilitate efficient business operations across various global channels. They operate within the payments technology industry, providing payment processing services, merchant acceptance solutions, and value-added services.

Their strategic focus includes leveraging technology and entering new markets through acquisitions, indeed, often willing to make large, expensive acquisitions.

They emphasize delivering commerce enablement solutions globally while prioritizing customer experiences.

During its earnings call, Global Payments highlighted its technology-enabled strategy and diverse set of solutions. Declaring that one of its top advantages over its peers (more on this soon) is its focus on partners, vertical market software, and point-of-sale software businesses.

Global Payments also argues that its commitment to providing streamlined and customized payment solutions for partners sets it apart in a competitive landscape.

Additionally, Global Payments’ expansion into faster-growing markets, investments in e-commerce and omnichannel capabilities, and the successful integration of EVO Payments (its large recent acquisition) offer a solid foundation for future growth.

Undoubtedly, Global Payments has a compelling narrative. But now we must delve further and discuss its financials.

Revenue Growth Rates Stabilize

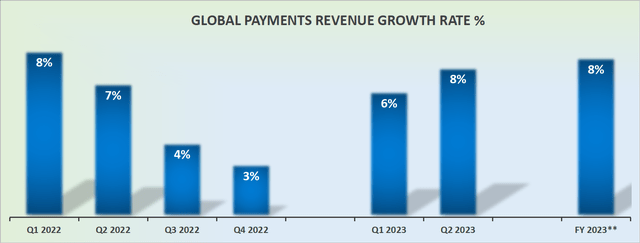

GPN revenue growth rates

Looking back over time, it’s difficult to imagine that only a couple of years ago, Global Payments could be counted on for double-digit revenue growth rates. And that today, the best investors can hope to see is high single-digit growth rates.

Even though Global Payments typically raises its outlook each quarter, the raises have become progressively smaller throughout 2023. Moreover, the raises in the Q1 and Q2 2023 have only been to the bottom side of its range.

Consequently, Global Payments’ high-end of its guidance has remained unchanged of late.

Furthermore, even if its comparables with Q4 2022 ease and Global Payments ends up delivering 10% CAGR, I don’t believe that many investors could make the argument that this is a high-growth story. And if we come to terms with the fact that this is now a mature business, then investors will be unwilling to pay a growth multiple on a stock that’s already matured. A mighty important consideration we’ll turn to discuss next.

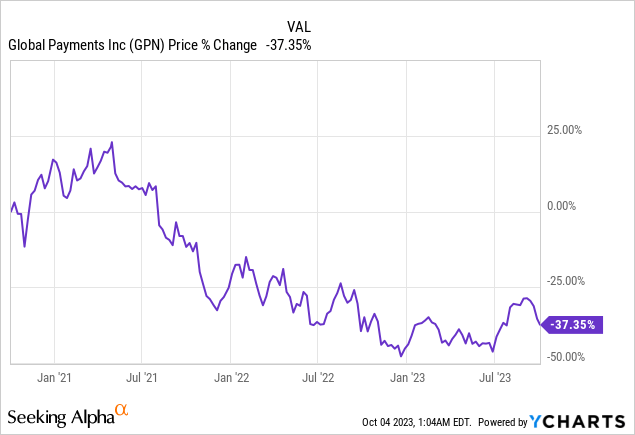

GPN’s Stock Valuation — Fairly Valued

This is where Global Payment’s story becomes more complex.

First I’ll discuss the bullish consideration, before discussing a negative element.

Let’s assume for the sake of our discussion that Global Payments reaches its guided $10.44 in EPS this year, and since this year is almost over, let us contemplate 2024.

Along these lines, let’s presume that next year Global Payments EPS grows by 15% y/y to $12 per share, largely consistent with 2023. Altogether, this means that investors today are being asked to pay 9x next year’s EPS. I believe that most investors would agree that this is not an expensive valuation.

But now, let’s address management’s quote from the earnings call,

During the quarter, we reduced outstanding debt by approximately $650 million. Our balance sheet remains healthy. We have over $2.5 billion of available liquidity and our leverage position is roughly 3.7 times currently, a reduction from the peak levels we realized upon closing of the EVO transaction. We remain on track to return to a leverage level consistent with our longer term targets in the low 3s by the end of 2023 while maintaining existing investment-grade ratings.

Global Payments holds about $15 billion of net debt. For a business with a market cap of $30 billion, that’s a significant amount of debt. Furthermore, looking back to 2021 and 2022, Global Payments repurchased $2.5 billion and $2.9 billion worth of stock, respectively, even though the share price today is lower than when these massive share repurchase programs got underway.

Meanwhile, we acknowledge that the pace of these capital repurchases has been diminishing, with H1 2023 repurchasing around $450 million (including repurchases associated with management’s compensation package) compared with approximately $1.3 billion in the same period a year ago.

Naturally, given management’s eagerness to pay down its debt, this will mean that looking out in the near-term Global Payments’ shareholder returns will slowdown, which will suppress its ability to deliver very strong EPS figures in 2024, as its revenue growth lines grow at approximately high single digits.

Further Aspects to Think About

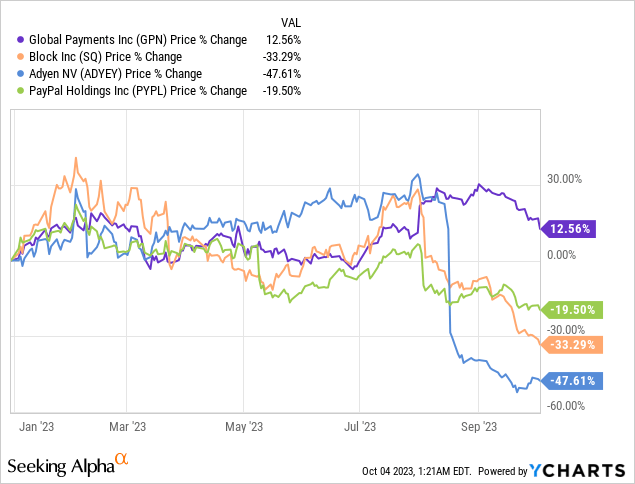

Global Payments is in intense competition with fintech giants like Block (SQ), PayPal (PYPL), and Adyen (OTCPK:ADYEY), meaning that these peers are determined to innovate and expand their payment processing services and Global Payments will have to keep up.

As you can see above, Global Payments has dramatically outperformed its peers in 2023. And these peers are large mega-cap companies resolute on taking back market share, and will often find themselves having to compete on price with Global Payments and little else.

The Bottom Line

Global Payments is a payment company operating globally.

They focus on innovative software and services to streamline business operations across various channels and emphasize delivering commerce-enablement solutions. Their recent acquisition of EVO Payments and expansion into faster-growing markets provide a strong foundation for growth.

However, revenue growth rates have stabilized at high single digits, impacting the stock’s valuation.

While the stock appears fairly valued with a low forward EPS multiple, it carries a substantial amount of debt, and management’s focus on debt reduction may limit near-term shareholder returns.

Additionally, Global Payments faces intense competition from fintech giants like Block, PayPal, and Adyen, which adds complexity to its growth prospects.

I find myself neutral on this stock.

Read the full article here