W. P. Carey (NYSE:WPC) has plunged since announcing plans to spin off its office assets. That has led to a flurry of downgrades from my peers, but in light of the proposed transaction – as well as the valuation reset – I am taking the opposing view. I expect this transaction to be viewed favorably when viewed in hindsight in several years’ time and for WPC stock to eventually earn the re-rating sought from the transaction. Even excluding the office assets, the stock is trading at cheap valuations on both an FFO and dividend yield basis. There is a saying that controversy can create buying opportunities – this case is no different. I am upgrading WPC stock to strong buy though the rising interest rate environment may help to create even more attractive buying opportunities down the line.

WPC Stock Price

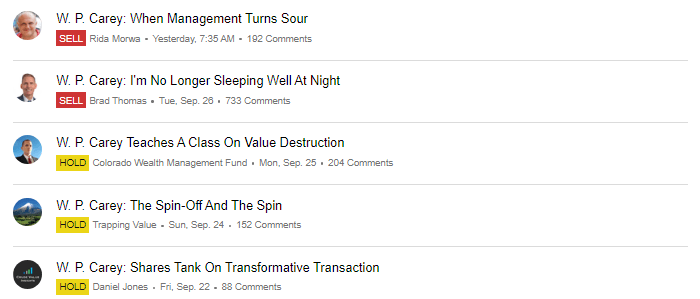

I last covered WPC in May where I recommended avoiding the stock as the valuation did not make sense. The stock is down 20% since then, but I am surprised to see more downgrades than upgrades. Many of my esteemed peers have issued critical evaluations of the upcoming spin-off transaction.

Seeking Alpha

I find it ironic for former bulls to be downgrading the stock just as a former skeptic (yours truly) is turning bullish.

WPC Stock Key Metrics

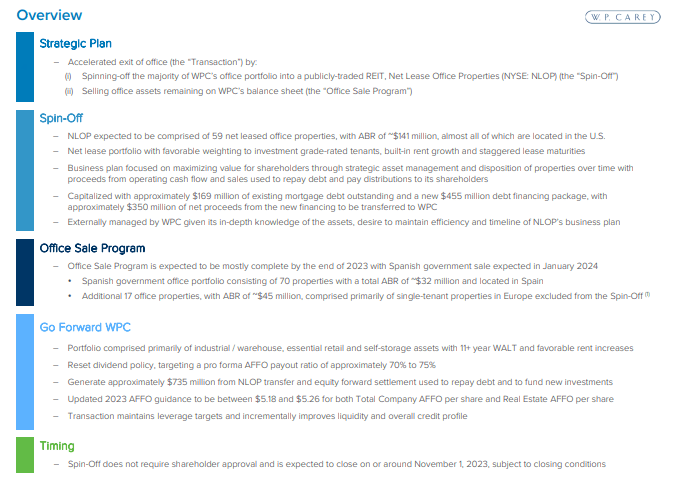

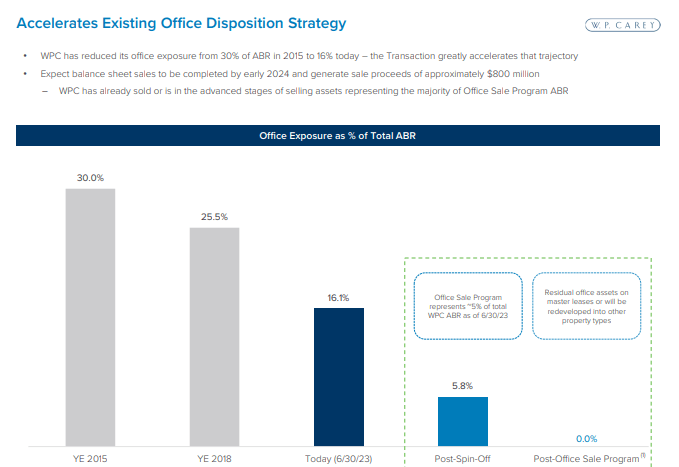

In late September, WPC announced plans to spin off its office properties in order to accelerate its exit from the office sector.

Strategic Plan to Exit Office Presentation

The announcement is consistent with the company’s ongoing strategy to exit the sector but is clearly more aggressive than gradually selling off the properties.

Strategic Plan to Exit Office Presentation

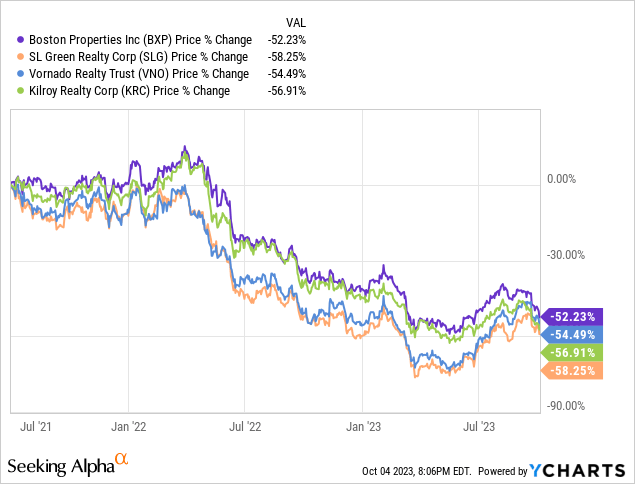

The new company, named Net Lease Office Properties (‘NLOP’) will raise $455 million in financing at expensive double-digit rates, meaning that on a combined basis the overall cash flow generation is likely to fall. Further, I expect NLOP to trade at valuations lower than that of WPC, meaning that there would be some negative impact on shareholder valuations unless the surviving entity trades at higher valuations (thus far the market has decided against such judgment). AFFO per share at the surviving WPC entity is expected to come in at between $5.18 and $5.26, slightly lower than the prior guidance of $5.32 and $5.38. With an expected AFFO payout ratio of between 70% and 75%, that implies a dividend of between $3.63 and $3.95 per share, a significant decline from the current $4.28 payout. These reasons appear to be the crux of why many investors are taking the transaction so negatively, but in my opinion such an assessment misses the big picture. It is worth noting that the AFFO guidance looks quite impressive given that it implies just around a 2% decline in spite of NLOP having around 10% of ABR. But more importantly, it is well known at this point that the office REIT sector is going through significant troubles, with many top operators seeing their stocks crashing hard from the highs.

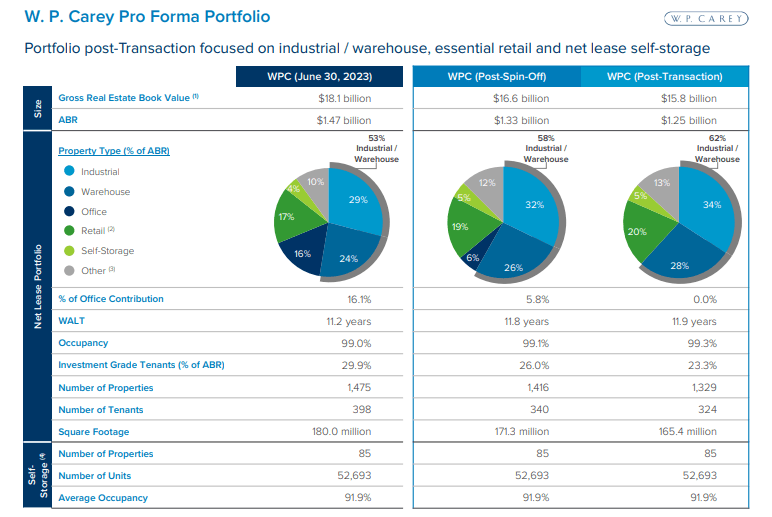

Following the transaction, WPC would see its exposure to office properties decline to just 6% and the company has outlined plans to aggressively sell off the rest of its properties later. That would lead to exposure to industrial and warehouse properties to rise to as much as 62% once all the office properties are sold off.

Strategic Plan to Exit Office Presentation

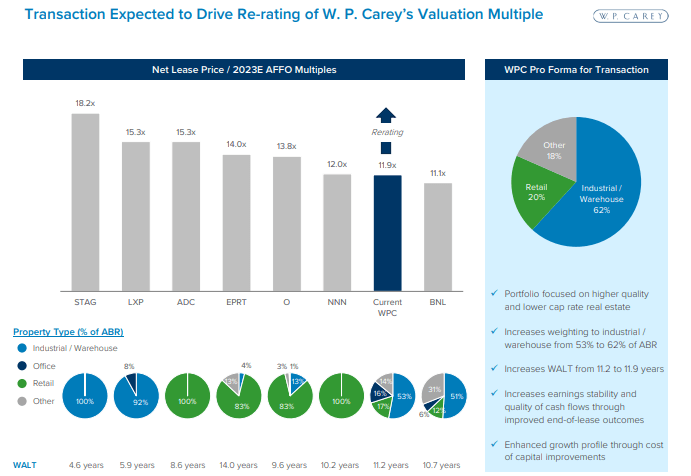

That observation is important given that industrial REITs trade at premium valuations within the REIT sector – this is due to industrial properties having higher annual lease escalators, higher mark-to-market potential, and stronger tenant profiles backed by long term secular tailwinds. Over time, I expect WPC to trade at a significant premium to conventional NNN REIT peers and move closer to where industrial REITs trade. If that re-rating does not occur, I wouldn’t be surprised if the company further spins out the industrial/warehouse exposure into its own company to realize that value. That implies significant multiple expansion potential.

Strategic Plan to Exit Office Presentation

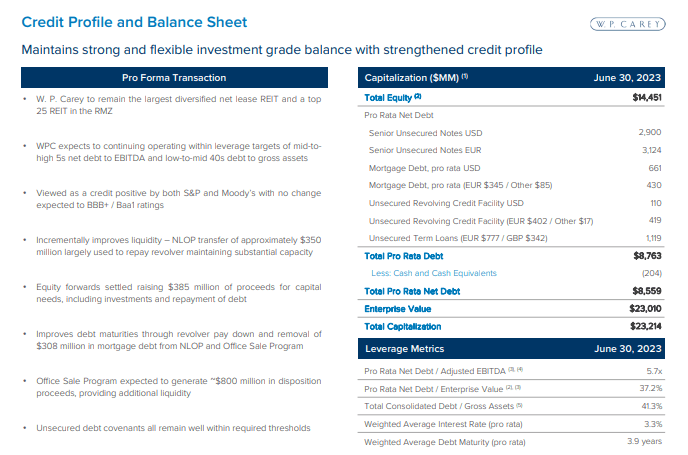

WPC has stated that the transaction will be leverage neutral. NLOP will pay $350 million of its $455 million in new financing back to WPC as a dividend, and based on the filings will pay an initial $7.5 annualized external management fee to WPC. My math indicates that this may still lead to leverage rising slightly, but again, the net impact is just 10% of ABR so impact on leverage will be minimal at worst. With debt to EBITDA around 5.7x, WPC is in no immediate need of deleveraging and would exit the transaction with a legitimately higher quality portfolio.

Strategic Plan to Exit Office Presentation

Is WPC Stock A Buy, Sell, or Hold?

Yet why is WPC still declining? I suspect that investors did not like that the company would be sacrificing its long 25 years of consecutive dividend growth, but I take the opposing view: WPC is making the disciplined decision to give up that growth history in order to jettison the office properties now while it still can.

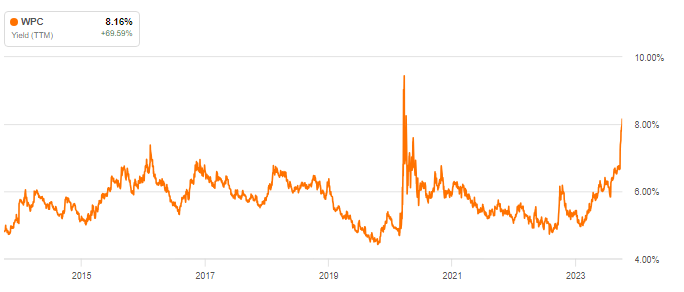

It is ironic that after announcing a significantly positive transaction, the stock is trading at among its highest dividend yield over the past decade.

Seeking Alpha

Even based on the lower end of the projected dividend payout, the stock is trading at around 7% and that yield should be after including NLOP’s value. It is interesting to me that investors seem to be so concerned about the company cutting its dividend – as a shareholder, it is the earnings, not the dividend that matters most. WPC is trading at a 10% AFFO yield (again that is not including any value from NLOP) with any retained cash flow available to help grow AFFO. I estimate that the stock is trading at an implied cap rate of around 6.9%, meaning that external acquisitions at the trailing 7.3% cap rate can still create value above returning cash to shareholders. It is possible that management may seek to invest more aggressively in industrial and warehouse properties at lower cap rates, which may pose some drag on expected growth rates, but over time I do expect the increasing industrial property exposure to lead to a re-rating upwards.

I was previously critical of the stock in large part due to the valuation. But with the stock now yielding at least 7% on a post-spin basis (plus any value from NLOP) and trading at a 10x AFFO, there are legitimate reasons to count on multiple expansion. Whereas at a 6% dividend yield the stock was offering total return potential of just around 9% (from the dividend yield and growth), now the stock is offering significantly more attractive prospective returns between the 7% yield, 3% of retained cash flow, 2% from annual lease escalators, and finally 10% to 20% from multiple expansion potential. This transaction has increased the last two items on that list as office properties were previously posing headwinds there. I am double-upgrading WPC from “hold” to “strong buy” as I see the stock eventually trading at a significant premium to Realty Income (O). It may take some time, but investors are paid generously to wait.

Read the full article here