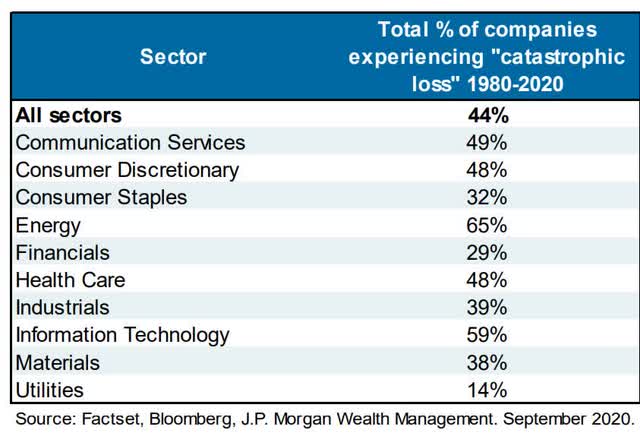

Nothing is more important in long-term successful investing than avoiding the disasters that are half of U.S. stocks.

JPMorgan Asset Management

The data is always shifting, the facts are always changing, the only constant is change, and even the world’s safest aristocrats are only ever 99% safe in a severe recession.

- 100% safety score = 1% risk of a cut in a Great Recession or Pandemic level downturn.

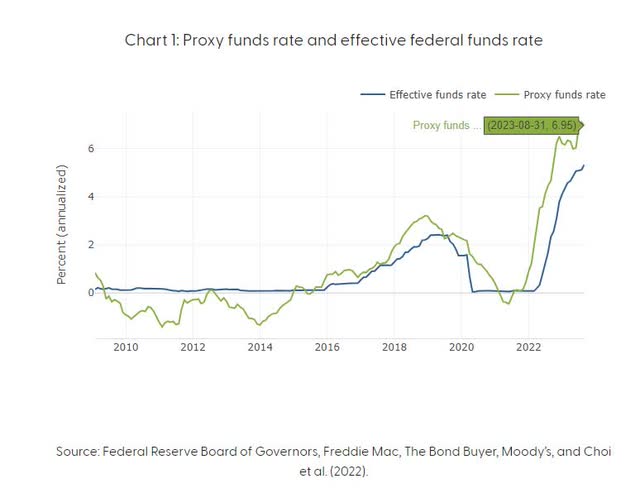

7% worth of interest rate hikes are starting to take their toll, and more and more companies are seeing their fundamentals deteriorate.

San Francisco Fed

The San Francisco Fed estimates that if you account for QT (reverse money printing) and the U.S. Treasury sucking $1.5 trillion out of the economy, it’s like the Fed has hiked rates from 0% to 7% in 18 months (pre-GFC before QE existed).

It’s not possible for rates to go up this high, this fast, and for the Fed to hold them steady until November of next year (the Fed’s plan) without causing major problems for some companies.

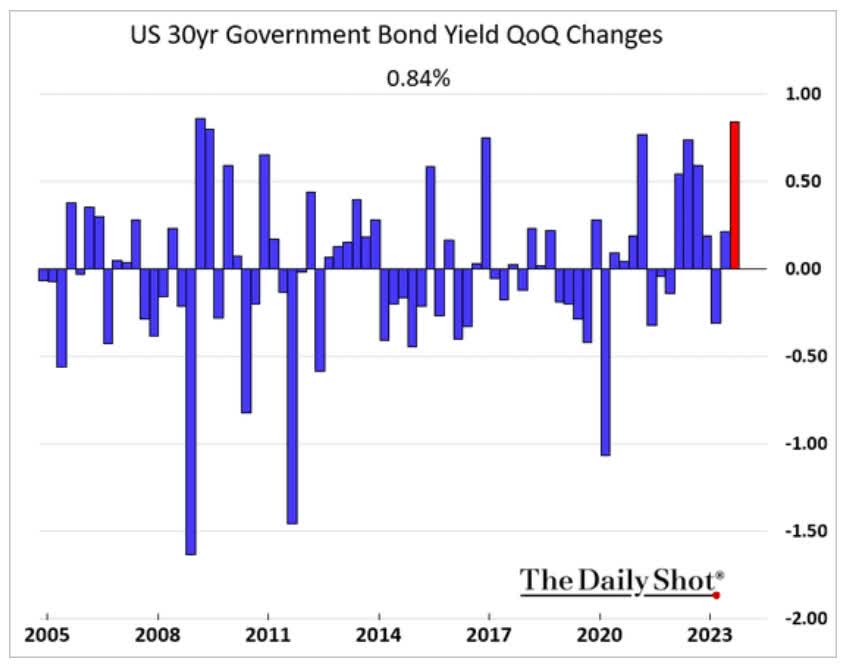

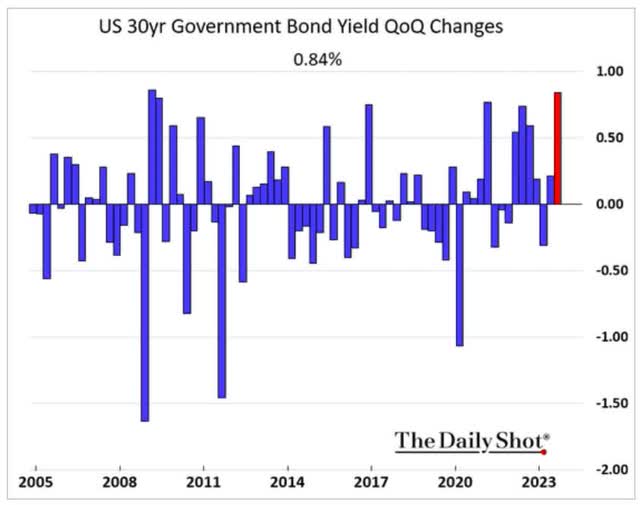

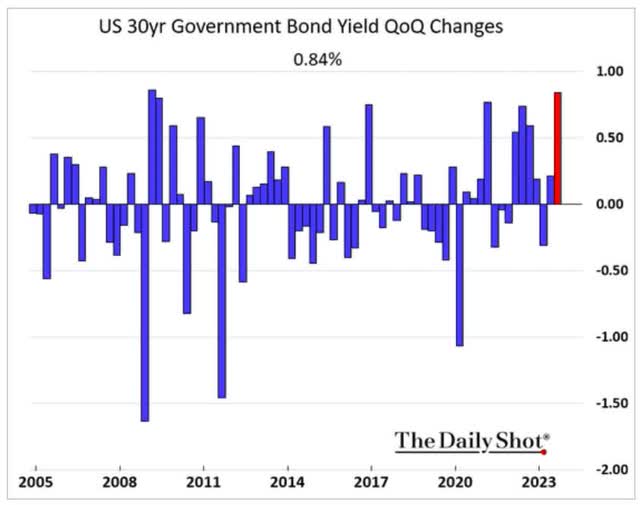

Daily Shot

The Fed has caused 9 of the last 13 recessions. And if the Fed doesn’t cause the recession, the U.S. treasury just might.

Daily Shot

Long-term rates haven’t gone up this quickly in a single quarter in over 20 years.

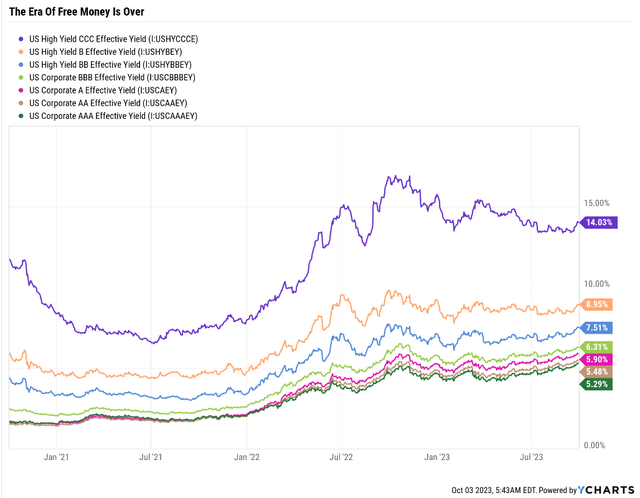

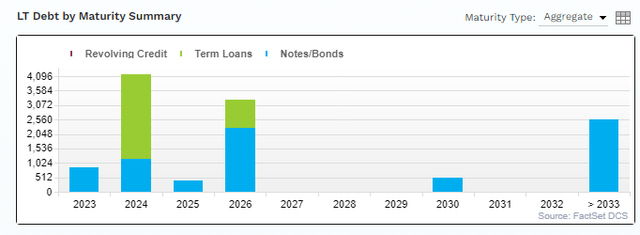

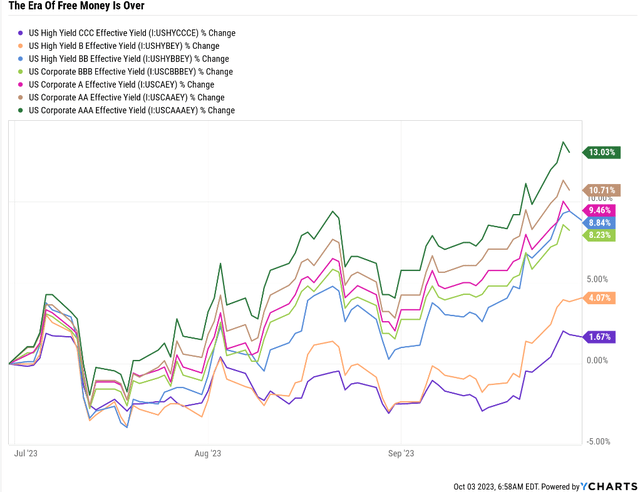

The borrowing costs for U.S. companies have now risen up to 5X from Pandemic record lows. In 2024 and 2025, $2.5 trillion in corporate debt matures and has to be repaid or refinanced at much higher rates.

YCharts

How do we know when a safe dividend becomes unsafe? How can we tell you if a 7%, 8%, or even 10% yield is worth buying instead of a dangerous yield trap to avoid like the plague?

We have a 3,000-point safety and quality model powered with data coming in from FactSet, Bloomberg, Morningstar, Google, and more, an ocean of world-class data and analysis that’s all getting crunched by our algos that are eight years, 20,000 people hours, and $1 million in R&D in the making.

And I just got a report from Bloomberg that made me do something we rarely do for a dividend aristocrat. I’m recommending selling Walgreens Boots Alliance, Inc. (NASDAQ:WBA). Not a potential trim/sell, not a warning of a rising rise. Sell Walgreens today, before a 16% to 33% likely dividend cut, and buy higher-yielding and much safer British American Tobacco p.l.c. (BTI), Altria Group, Inc. (MO), or MPLX LP (MPLX).

And here’s why.

Why I Would Sell Walgreens Right Now

Walgreens is in trouble. Bloomberg just sent me a report about how soaring rates could kill WBA’s 47-year dividend growth streak and even more impressive 91 years without a dividend cut.

Daily Shot

Long-term rates are soaring, and Bloomberg thinks things could get worse before they get better.

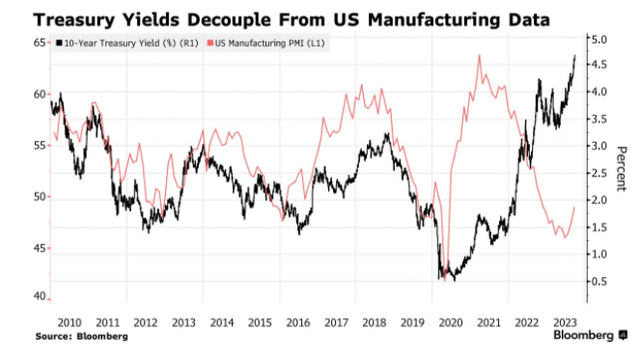

Bloomberg

Bonds are not doing what they usually do: track economic fundamentals.

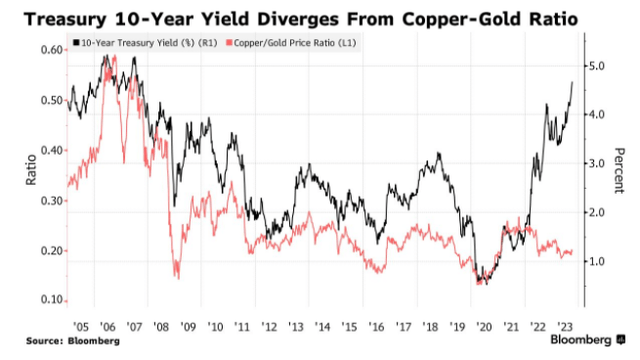

Bloomberg

The economic data says that 10-year yields should be 1% to 1.5%, but they are screaming toward 5%.

Why?

The worry is that the escalating federal budget deficit will create more supply of bonds than demand can meet, requiring higher yields to clear the market,” Yardeni, the president of Yardeni Research Inc., wrote in a research note published Tuesday. “That worry has been the Bond Vigilantes’ entrance cue.” – Bloomberg.

In the 2nd half of this year, courtesy of the debt ceiling drama, the U.S. Treasury will have to sell $1.5 trillion in bonds.

Next year, assuming no recession, the Congressional Budget Office estimates $1.7 trillion in net bonds (deficit size 6.4% of GDP).

With the Fed still reverse money printing, i.e., effectively selling bonds, and Japan’s interest rates at the highest level in over a decade, it’s the perfect storm for this bond bear market.

- banks used to be the biggest buyers of bonds, now they have $700 billion in paper bond losses

- Japanese bond buyers are on gone due to buying their own bonds

- China has been steadily selling US bonds for years

- all the big institutional money already bought bonds near 4% and has little dry powder left

- retail investors have been buying long bond ETFs all year but have started to sell (they just can’t take the pain anymore)

- bond market still hasn’t priced in the Fed’s consensus plan.

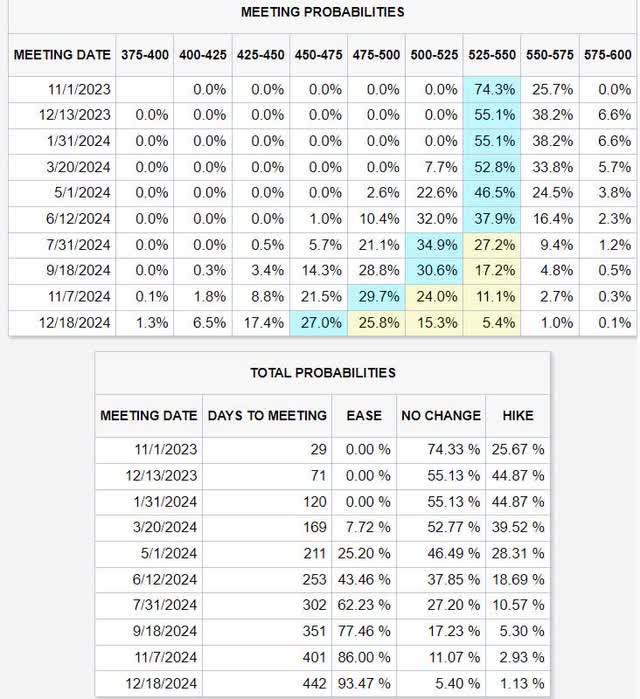

CME

The Fed’s consensus in the dot plot is 5.5% rates held until Nov 2024. That’s one more hike in Nov and then one year with zero cuts. That’s the base-case for the Fed.

The bond market thinks the Fed will hold and start cutting in July or September.

So no, today’s rates don’t yet price in the Fed’s current plan, though the Fed’s plan could change.

The economic fundamentals say bond yields should be lower, but in the short term, 95% of prices are driven by sentiment and momentum, and right now, the momentum is in one direction only.

Path of least resistance for rates remains to the upside” – FactSet.

Why does this matter to Walgreens?

FactSet Research Terminal

Because 25% of WBA’s debt matures in 2024, and the Fed’s plan is not to start cutting until November.

If we don’t get a recession next year, and 43% of economists think it’s coming in 2025, then WBA could see its interest costs rise by as much as $150 million next year.

Why does that matter? Because WBA is spending $1.7 billion on its dividend.

In 2024, WBA is expected to pay a $1.95 dividend. Its free cash flow per share next year? $2.00.

That’s a 98% payout ratio in 2024.

- 708% payout ratio in 2023.

Next year, WBA’s dividend is expected to leave it with $43 billion in free cash flow.

And the extra interest cost could be almost 4X that much.

S&P already has WBA on a negative watch for a downgrade to BBB- and Walgreens isn’t likely to risk a downgrade to preserve its dividend streak.

How do we know? For 47 years, WBA always announced a Q3 dividend hike.

For the first time since 1976, WBA didn’t hike its dividend in the 3rd quarter.

How much would a token 1 penny per quarter hike have cost? About $36 million per year.

How about a 1/4th of a penny per quarter hike that would have kept the streak alive? $9 million yearly.

Walgreens seems worried about $36 million or even $9 million, and it’s potentially staring down the barrel of a possible $150 million interest rate hike.

Bloomberg points out that regarding turnarounds like the one WBA has spent four years and 3 CEOs struggling with, about 33% of the time, the turnaround succeeds, and 66% of the time, it fails.

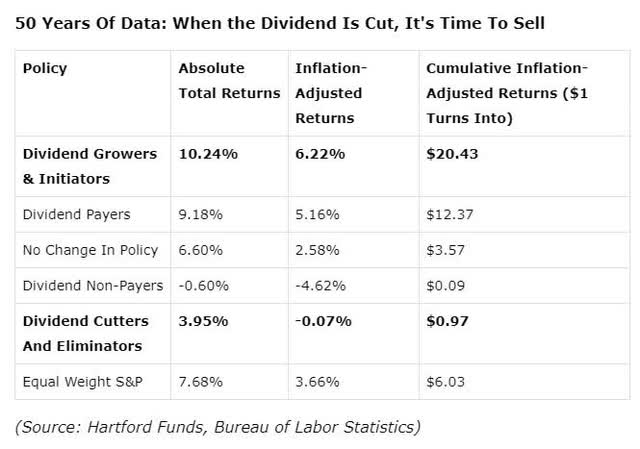

And historical data is clear.

Hartford Funds

If Walgreens cuts its almost 9% yielding dividend, everyone who has stuck with it because it’s a dividend aristocrat who hasn’t cut its dividend in 91 years is going to realize something very important.

Walgreens fundamentals are the worst they have been in at least 91 years. Worse than even the Great Depression.

No matter what spin management tries to put on a dividend cut, there is only one objective truth, which is that the business is floundering and management can’t cope with the hurricane of headwinds it’s facing.

Stock prices are vanity, cash flow is sanity, and dividends are reality.

When interest rates were at 20% in 1980? Walgreens adapted and kept on raising its dividends.

When the stock market fell 22% in a single day in 1987, Walgreens didn’t care and kept hiking the dividend.

When the financial markets melted down in 2008, Walgreens kept on raising its dividend.

When the Pandemic locked down the global economy, Walgreens kept hiking its dividend.

But in 4 more quarters, if they don’t hike the dividend? Then this time will be different.

And if Walgreens cuts? Then they will have proven Warren Buffett right.

When a manager with a reputation for brilliance tackles a business with a reputation for bad economics, the reputation of the business remains intact.” – Warren Buffett.

Walgreens is expected to generate negative growth between 2017 and 2027.

That means a 90% statistical probability that this is a bad business.

The growth consensus has fallen to -0.1%, so higher rates mean WBA is a no-growth business.

- Even at -0.1% growth, the dividend will eventually have to be cut.

And why on earth would anyone want to own a failing business, for which I can think of no reason for its continued existence when you can buy the safest 9% yield on Wall Street?

Why British American, Altria, and MPLX Are The Safest 9% Yields On Wall Street

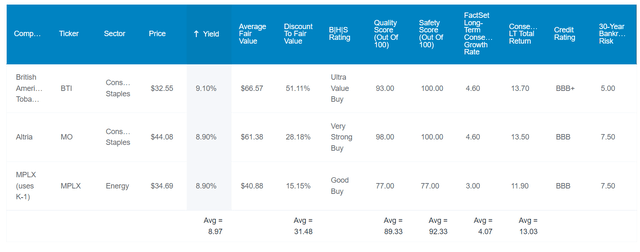

Here’s a quick screen I did in the Dividend Kings Zen Research Terminal for superior alternatives to WBA.

- higher yield

- 81% safety or better (2% or lower cut risk)

- investment grade (BBB- or higher credit rating)

- non-speculative (no turnaround stocks).

Dividend Kings Zen Research Terminal

I’ve linked to articles explaining each of these companies’ investment thesis, risk profile, and total return potential.

- British American

- Altria

- MPLX – K1 tax form.

Fundamental Summary

- yield: 9.0%

- dividend safety score: 92% very safe (1.4% cut risk)

- overall quality: 89% low-risk Ultra SWAN

- growth consensus: 4.1%

- long-term return potential: 13.0% vs. 10.2% S&P 500 and 12.5% Nasdaq

- discount to fair value: 32%

- 10-year valuation boost: 3.9% per year

- 10-year consensus total return potential: 16.9% per year vs. 10.1% S&P

- 10-year consensus total return potential: 377% vs. 167% S&P.

What if you’re down a lot on WBA? Ask yourself what is the best way to get that money back. Hoping and praying that Walgreens somehow pulls off its turnaround and starts growing at its historical 10%?

Or own these ultra-yield Ultra SWANs that keep growing at a modest 4% over time?

2025 Consensus Total Return Potentials

- if and only if each company grows as analysts expect

- and returns to historical market-determined fair value

- this is what you will make.

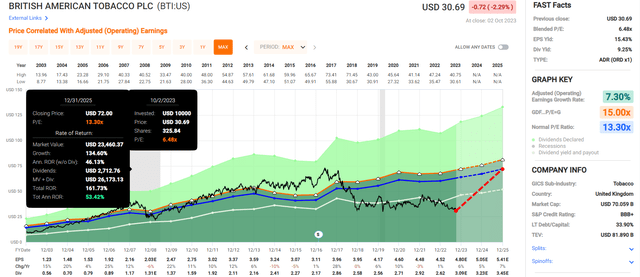

British American Tobacco

FAST graphs, FactSet

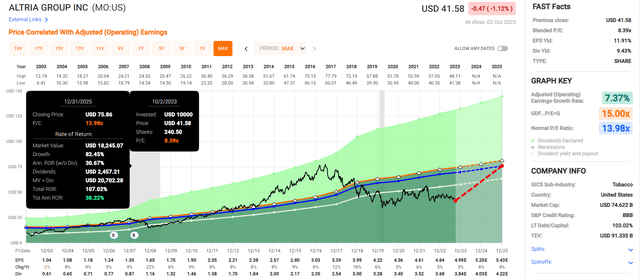

Altria

FAST graphs, FactSet

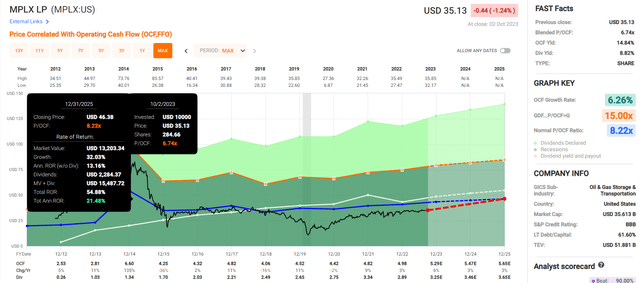

MPLX

FAST graphs, FactSet

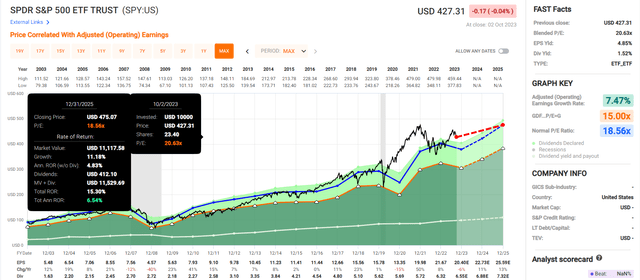

S&P 500

FAST graphs, FactSet

S&P 2-year consensus total return potential: 15% or 7% per year.

These WBA alternatives? 108% or 37% per year.

Buffett-like return potential from 3 blue-chip bargains growing steadily unlike WBA, hiding in plain sight.

Bottom Line: Sell Walgreens And Buy The Safest 9% Yields On Wall Street

When the facts change I change my mind, what do you do sir?” – John Maynard Keynes.

What has changed in the last three months to make WBA a complete dumpster fire?

Daily Shot

Long bond rates have soared at the fastest quarterly rate in over 20 years.

YCharts

Borrowing costs for all corporations are screaming higher, and the higher the credit rating, the faster the increase.

BBB-rated companies saw their borrowing costs increase 8% in the last quarter, a rate of 0.75% per week, averaging 0.15% per day.

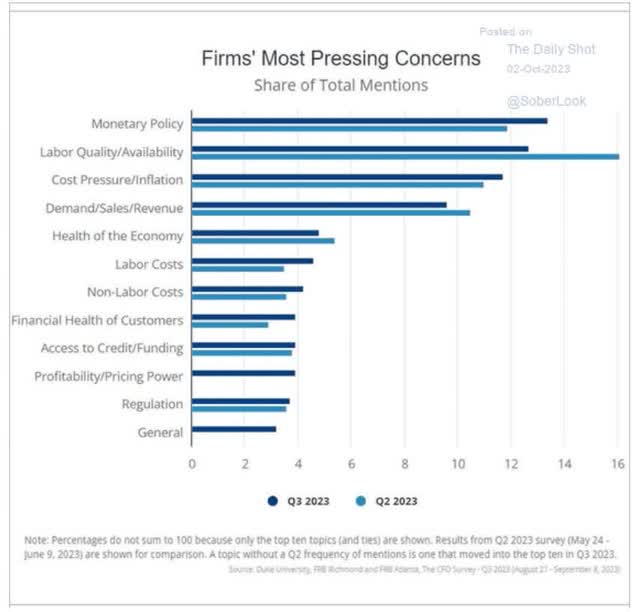

Companies are coming out warning that rates are now the biggest threat to them.

Daily Shot

The Fed’s war on inflation is now the biggest threat to corporate America.

The longer the recession takes to happen, the higher long-term rates are likely to go before they peak.

- 5.25% potential peak, according to BAC and Wells Fargo

- 5.5%, according to Bill Ackmann

- 7% to 9%, according to Jamie Dimon.

Good news is bad news for some companies, like Walgreens.

Anyone relying on low-cost debt to stay profitable or execute a turnaround could face a tough few years.

But do you know who I’m not worried about? And neither are analysts, rating agencies, or the bond market.

BTI, MO, and MPLX have the safest 9% yields on Wall Street and are growing steadily, exactly as management has been guiding for.

They are not speculative turnaround stories; they are executing their plans.

They are not value or yield traps, unlike WBA, whose dividend is potentially at a 66% risk of a cut if rates stay at current levels indefinitely.

- a no landing scenario = 66% likely WBA dividend cut.

Read the full article here