The ABNB Investment Thesis Remains Robust, But Not At These Lofty Valuations

We previously covered Airbnb (NASDAQ:ABNB) in May 2023, discussing its decelerating booking trend compared to its travel peers, naturally triggering its underwhelming financial and stock performance then.

While there had been multiple long-term growth drivers, including the Airbnb-Friendly Apartment and Airbnb Rooms, we had rated the stock as a Hold then, since the uncertain macroeconomic outlook over the next few years remained headwinds to its prospects.

For now, it appears that ABNB continues to face uncertainties as the rental revenue growth decelerates and global active listings grow, with many similar anecdotal examples reported by Bloomberg.

The same has been hinted by the company’s FQ2’23 results, with over 7M total active listings (+0.4M from FY2022 levels of 6.6M and +1M from FY2021 levels of 6M).

In the same quarter, ABNB’s Average Daily Rates also stabilized at $165.94 (-1.4% QoQ from $168.45/ +1.2% YoY from $163.90), compared to its historical high growth trend, such as FY2022 averages of $160.52 (+2.8% YoY), FY2021 averages of $156.02 (+26.1% YoY), and FY2020 averages of $123.7 (-3.1% YoY).

Then again, investors need not fret, since all of these are part of the management’s plan to drive improved affordability and volume growth:

I think our long-term growth is going to only be as strong as our supply. If we were to back out, what happened in 2020, 2021, as that demand grew faster than supply. And initially, this was a great thing.

But the problem is when demand grows faster than supply and there’s supply constraints, prices generally go up. And as prices have risen, while that’s been good for the bottom line, affordability in this economy is a major issue.

And so one of the most important things we can do to make Airbnb affordable is to make sure we have enough supply in the platform. (Seeking Alpha – Brian Chesky)

Ultimately, investors must be reminded that ABNB is a travel booking platform, similar to Booking (BKNG) and Expedia (EXPE), which thrive on competitive pricing and volume based transactions, allowing the fittest host to survive.

This is a direct difference to hotel chain owners, such as Marriott International (MAR) and Hilton Worldwide Holdings (HLT), where the management may be more concerned about the delicate balance between room supply, consumer demand, and room rate growth.

While short-term rental platforms such as ABNB may be sensitive toward the ongoing regulatory tightening, we are not overly concerned, since the global listing supply has been more than robust. This is significantly aided by its higher ADRs at $165.94, compared to the global hotel ADRs of $150 (+11.8% YoY) for the week ending September 23, 2023.

We believe that the management’s way of maintaining the affordability of its Airbnb offerings is highly strategic during these times of elevated interest rate environment, as it implies increased options for discerning consumers as the competition in the alternative stay segment heats up.

While ABNB may have been the pioneer of alternative stays, it is apparent that many other platforms have encroached into the space, including BKNG, EXPE, and many others. Even hotel chains such as MAR and HLT have started to offer apartment and villa stays for both budget-conscious and luxury travelers.

Despite so, ABNB’s revenues continue to grow to $2.48B (+37% QoQ/ +18.1% YoY) and gross margins improve to 82.6% (+6.1 points QoQ/ +1.1 points YoY) in FQ2’23, albeit at a normalized rate compared to FQ2’22 top-line growth of +57.6% YoY and FQ2’21 growth of +298.8% YoY.

Its improved operating scale has also brought forth excellent adj EBITDA margins of 33% (-19 points QoQ/ inline YoY), compared to its FY2020 levels of -7%.

These demonstrate that the ABNB management’s FY2023 guidance of “an Adjusted EBITDA margin that is modestly higher than the full-year 2022” is not overly ambitious, in our opinion.

Its Valuations Remain Rich, As ABNB Transitions To A New Business Model

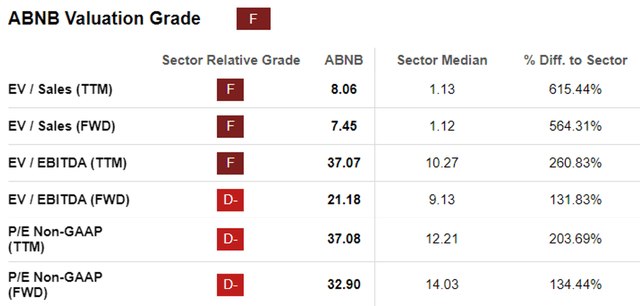

ABNB Valuations

Seeking Alpha

For now, as ABNB’s growth decelerates, we can understand why its FWD valuations have been impacted compared to its 1Y means, though still elevated compared to the sector medians.

ABNB Valuations

Seeking Alpha

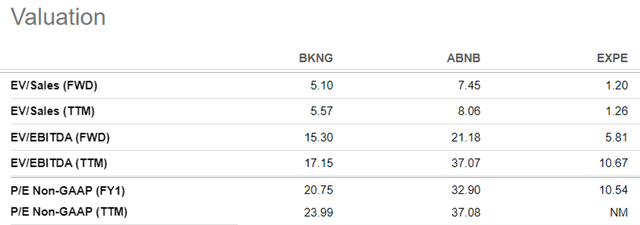

Then again, ABNB still trades at a notable premium FWD EV/ EBITDA of 21.18x, compared to its other travel booking stocks, such as BKNG at 15.30x and EXPE at 5.81x.

We maintain our conviction that ABNB’s valuations appear to be lofty, especially since the consensus estimates that it may only record a bottom line CAGR of +17.4% through FY2025, compared to BKNG’s +19.9% and EXPE’s +12.5% at the same time.

Combined with ABNB’s consistently moderating FWD EV/ EBITDA valuation since its February 2022 heights of 57.33x and July 2023 heights of 26.65x, we believe its correction may not be over yet.

Based on its FQ2’23 annualized adj EBITDA of $3.27B (+212.5% QoQ/ +15.1% YoY) and share count of 665M, we are looking at an adj EBITDA per share of $4.92.

Combined with its moderated FWD EV/ EBITDA valuations of 21.18, the ABNB stock is also trading way above its fair value of $104.20, offering investors with a minimal margin of safety at current levels.

So, Is ABNB Stock A Buy, Sell, or Hold?

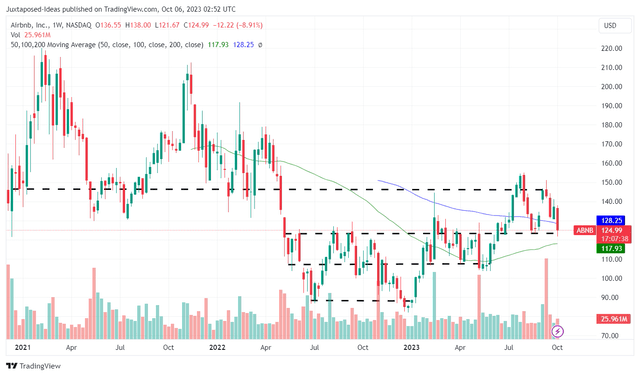

ABNB 3Y Stock Price

Trading View

While ABNB has already recorded an impressive recovery of +18.52% since our previous Hold article, well outpacing the SPY at +3.04%, the stock has also failed to break out of its resistance levels of $145 twice, with it currently retesting its critical support levels of $120s.

Since the North American region comprises the lion’s share of its overall FQ2’23 revenues at 47.9%, we believe the stock may not be able to hold on to its gains, due to the pessimism surrounding the restart of the US federal student loan repayment from October 2023 onwards.

Combined with the 6.34% of short interest at the time of writing, we prefer to rate the ABNB stock as a Hold here. It may be more prudent to observe the situation a little longer.

Interested investors may want to wait for a further retracement to its May 2023 support levels of $105 for an improved upside potential to our long-term price target of $149.53, based on the consensus FY2025 adj EBITDA estimates of $4.7B.

Even then, portfolios must also be sized appropriately since it remains to be seen if the premium embedded in the ABNB stock valuation is sustainable.

Read the full article here