In early June of this year, MDU Resources Group (MDU) completed the spinoff of its aggregates and construction services business that has come to be known since then as Knife River Corporation (NYSE:KNF). This company, which currently has a market capitalization of $2.26 billion, has done quite well for itself from a revenue perspective over the past few years. Profits and cash flows have been rather mixed, but management remains optimistic about what the future holds. This year in particular, the firm seems to be doing really well for itself and, relative to most other players, shares look attractively priced. Given these factors, I have decided to rate the enterprise a soft ‘buy’ to reflect my view that the stock should probably outperform the broader market for the foreseeable future.

A new aggregates business

Even though the operations of Knife River are not exactly new, its status as a standalone, publicly traded company, most certainly is. It was only in June of this year that the company became independent of its former parent. Before we dive into why I feel the company offers upside potential, it might be helpful to have a better understanding of what the company does and how exactly it operates. According to management, the firm is one of the leading providers of crushed stone, sand, and gravel in the US. It has operations across 14 states and it boasts 1.1 billion tons of aggregate reserves at this time.

There are many aggregates companies out there that simply sell their products off to other players to deal with as they will. However, approximately 40% of the aggregates produced by Knife River are retained by the company for the purpose of creating value-added downstream products. Examples here would be ready-mix concrete and asphalt. 16% of the company’s revenue comes from aggregates. 19% comes from ready-mix concrete, while 14% is attributable to asphalt. Another 13% of revenue comes from miscellaneous offerings. And the largest chunk of revenue, 38% in all, comes from contracting services. Contracting services provided by the company center around heavy civil construction activities, asphalt paving, concrete construction, site development, grading services, and other similar activities.

Author – SEC EDGAR Data

Over the past few years, management has done a really great job growing the company’s top line. Revenue has gone from $2.18 billion in 2020 to $2.54 billion in 2022. There has not been one major revenue source that has stuck out as the primary driver here. The fact of the matter is that all of the company’s major revenue centers reported sales increases during this three-year window. We do know, however, that most of its sales increase can be attributed to a combination of higher volume of products shipped and higher pricing for what it offers. As an example, sales of aggregates grew from 30.9 million tons to 34 million tons. Ready-mix concrete sales actually dropped slightly during this time, and asphalt remained more or less unchanged. But the pricing for all of these offerings increased in recent years. The average selling price for aggregates grew from $13.14 per ton to $14.61 per ton. Ready-mix concrete grew from $133.86 per cubic yard to $151.80. And finally, asphalt prices went from $48.58 per ton to $58.93 per ton.

On the bottom line, the picture has been far more complicated. Net income has actually dropped over the past three years, falling from $147 million to $116 million. Operating cash flow dropped from $232 million to $208 million. Even if we adjust for changes in working capital, we get a minor decline from $235 million to $229 million. And lastly, we have EBITDA. It is the only profitability metric to improve during this window of time, inching up from $287 million to $296 million.

Author – SEC EDGAR Data

So far this year, financial performance has been largely positive. Revenue of $1.09 billion beat out the $1.02 billion reported one year earlier. Profitability fared even better. The company went from generating a net loss of $1.4 million in the first half of 2022 to generating a profit of $15.5 million the same time this year. Operating cash flow improved from negative $147.8 million to negative $70.4 million. If we adjust for changes in working capital, it went from $57.1 million to $70.6 million, while EBITDA expanded from $74.5 million to $112.5 million. A lot of this improvement from a profitability perspective came about even as volumes shipped by the company declined year over year. These declines were more than offset by strong pricing. For instance, aggregates pricing per ton went from $14.77 in the first six months of 2022 to $16.37 the same time this year. Ready-mix concrete pricing went from $147.67 to $168.30, while asphalt pricing grew from $57.77 per ton to $66.24.

Author – SEC EDGAR Data

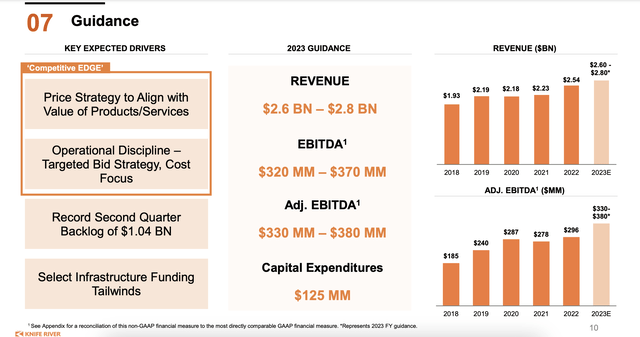

For 2023 in its entirety, management is forecasting revenue of between $2.6 billion and $2.8 billion. From a profitability perspective, guidance calls for EBITDA of between $330 million and $380 million. If we take the midpoint here of $355 million, this should translate to adjusted operating cash flow of $275 million and net profits of approximately $139 million.

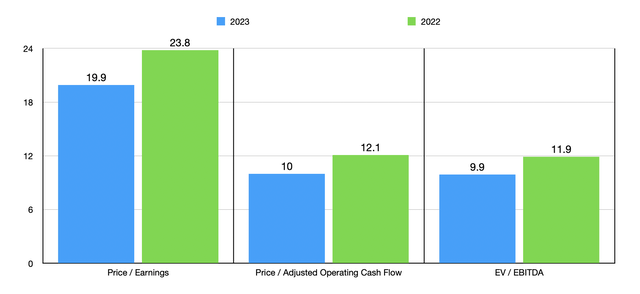

Knife River Corporation

Using these figures, I was able to value the company as shown in the chart above. And in the table below, I compared the enterprise to five similar firms. On a price-to-earnings basis, Knife River ended up being the second cheapest of the group. When it comes to the price to operating cash flow approach, it is the cheapest. Meanwhile, using the EV to EBITDA approach, I found that three of the five companies ended up being cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Knife River Corporation | 19.9 | 10.0 | 9.9 |

| Summit Materials (SUM) | 22.1 | 10.3 | 9.2 |

| Compass Minerals International (CMP) | 122.4 | 11.3 | 8.8 |

| Eagle Materials (EXP) | 12.3 | 10.5 | 8.8 |

| Vulcan Materials (VMC) | 36.8 | 20.1 | 17.4 |

| James Hardie Industries (JHX) | 22.0 | 15.8 | 12.8 |

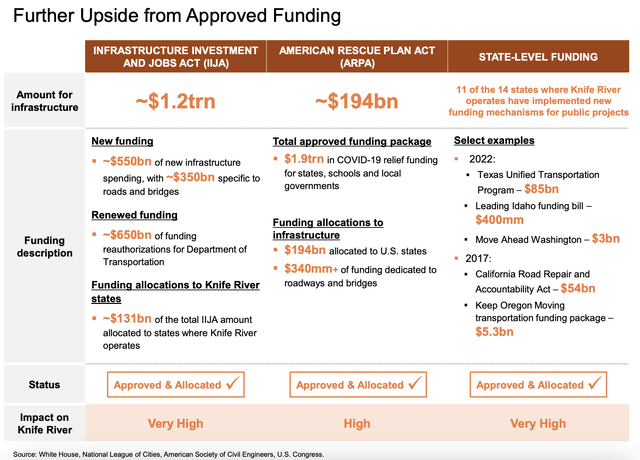

Nobody knows what the future holds. However, management does seem very optimistic. Using midpoint estimates for this year, we end up with an EBITDA margin of 13.1%. Through cost-cutting initiatives and refocusing to emphasize a higher mix of aggregates, management expects to increase this margin to 15% by 2025. Even if sales don’t rise, achieving this margin improvement would translate to an extra $51.3 million in EBITDA per year. I would imagine, however, that the bottom line impact will actually be larger than this because I believe that an increase in sales is highly probable between now and then. You see, a lot of what the company does is reliant on government spending. And according to management, there is a lot of money being used on a lot of projects. For instance, the Infrastructure Investment and Jobs Act can open up $1.2 trillion worth of infrastructure spending. Of this, $550 billion is new funding, with $350 billion of that amount being specific to roads and bridges. The other $650 billion is renewed funding.

Knife River Corporation

Of course, it only matters if some of the funding has been earmarked for states in which Knife River operates. The good news is that this number comes out to roughly $131 billion. The American Rescue Plan Act resulted in another $194 billion being allocated across states for infrastructure activities. And 11 of the 14 states where the company operates have implemented new spending initiatives that relate to infrastructure. Obviously, higher spending like this will lead to higher demand. And higher demand leads to more revenue and profits for a company like our prospect.

Takeaway

From what I can see, Knife River is a fairly solid company. I don’t like the weakness on the bottom line over the past few years. But strong pricing this year has helped the enterprise quite a bit. There certainly is a growth catalyst for the company to benefit from in the form of higher public spending. And relative to most of its peers, the stock does look fairly attractively priced. Due to these factors, I have decided to rate the business a soft ‘buy’ for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here