By Tony DeSpirito

With all eyes on generative AI (genAI) and its transformative potential, individual investors’ interest has been piqued. The market-moving innovation certainly has generated a lot of hype – and questions. Equity CIO Tony DeSpirito parses three reasons for excitement and three areas for awareness.

GenAI has commanded attention and moved markets this year, earning comparisons to the internet and smartphones for its transformative potential. We believe genAI is also setting up to be a key contributor to market dispersion, as it has the potential to send some businesses soaring while disrupting or displacing others. We sponsored some internal debate on the topic and offer the following observations on this critical innovation:

Worthy of excitement

1. Universal application

Unlike other technology innovations that had fleeting fame before fading to the background, we see genAI having a far-reaching and lasting impact. Leaders of our technology team believe its usage is poised to be unprecedented relative to prior innovations with a more limited scope (e.g., 3D printing, augmented reality, metaverse). The key distinction: GenAI is a platform with elements of humanlike intelligence that give it universal applicability that can extend across industries, businesses, and disciplines.

Companies selling the “picks and shovels” of the AI gold rush are the initial beneficiaries. The early rewards for users are likely to take the form of cost savings – eliminating some jobs while making humans more efficient at others. Later in the AI evolution, we expect to see the emergence of new revenue-generating business models.

2. Investment opportunity now – and for years to come

GenAI is evolving and the realization of its full merit will take time, making this a multi-decade opportunity. Yet companies are spending real money on genAI now in an effort to harness its enormous potential. In the building phase, the investment opportunities reside primarily in the technology space. The key is to know where we are in the AI lifecycle and what portions of the technology “stack” may be positioned to benefit.

Consider this: The substantial investment in the current internet, which is powered primarily by CPU chips, will transition toward GPUs (the graphics processing units that are optimized for AI). We see the creation of an AI-supported web driving years-long investment opportunities.

We view investing in genAI as an active pursuit, given the need to be nimble and know where the opportunity is at each stage of progress. An analysis of the technology stack (shown below) illustrates current and potential opportunities – all subject to change as genAI itself sharpens, smartens, and evolves.

The genAI technology investment stack

|

What it is |

Where to invest |

|

|

IV. Tools & applications |

The tools to create apps and the actual instruments and apps powered by generative AI. |

Companies that build apps and the tools to create them. Existing apps will be enhanced; many start-ups likely to emerge. |

|

III. Data(private & public/free) |

The information upon whichAI models will “think,” process and generate content. |

Suppliers of information and analytics, and those involved in data staging. AI makes private data more useful and, therefore, more valuable. |

|

II. AI models(proprietary & open source) |

The software required to trainAI to “think” and do. |

Companies involved in the research and development of AI learning and language models. |

|

I. Infrastructure & cloud |

The hardware and computing resources needed to enable AI function and growth. Includes GPUs, storage and memory. |

Cloud service providers building AI-enabled data centers; semiconductors and makers of chip manufacturing equipment are critical inputs. |

Source: BlackRock Fundamental Equities, September 2023.

3. Opportunity well beyond tech

Beyond the impacts and opportunities in the technology sector are the eventual use cases for AI that will emerge throughout the economy. Call centers will likely be replaced. Elsewhere, the uses may be less transformative and more nuanced, such as an AI-powered co-pilot added to an existing software package. We see public and private investment opportunities from AI, with many early-stage opportunities perhaps best expressed through private investments.

Warranting awareness

1. Great expectations

Given high valuations in the first part of the technology stack, some AI-related stocks could be vulnerable to disappointment, even from just a slowdown in the rate of growth. A shortage of critical chips (GPUs) has allowed companies that make them to temporarily earn an abnormally high margin, posing a risk once supply catches up to demand and competition kicks in. Business history is riddled with stories of supply shortages that eventually turned to supply gluts.

In general, the early stages of a technology hype cycle include a lot of excitement and speculation, yet innovations in their infancy are difficult to value. Constant monitoring is required to assess whether expectations are aligned to the financial and fundamental realities. Questions around the unknown but inevitable regulation of AI globally also complicate the calculus.

2. Build it and they will come?

In past cycles, new technologies were not always fully utilized after the structures to support them were built. AI’s universality could make this time different. Another critical element to the functioning of AI for enterprises and organizations is data. While AI models can be trained on public data, that data must be enriched with the proprietary kind to make decisions for a particular business. This is an area where many organizations are hamstrung due to insufficient, unorganized, or siloed data, potentially slowing or limiting AI uptake.

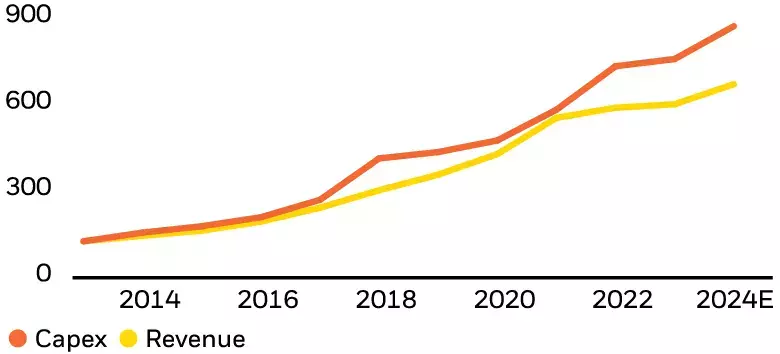

3. Capital chasing the unknown

Capital expenditures on genAI have increased in advance of the revenue it generates, as shown in the chart below. A key question is whether companies will follow through and use the services to sustain the wave of spending. Some of the early investment may constitute FOMO (fear of missing out) – companies don’t want to fall behind if they fail to invest in a winning innovation. But businesses will have to assess whether AI, for the productivity boost it offers, is worth continuous spending – investing less on hype and more on ROI (return on investment) calculations.

Investing for an (eventual) AI payday

Hyperscale data centers, capex and revenue, 2013-2024

Source: BlackRock Fundamental Equities, Aug. 4, 2023. Chart shows the aggregate amount of annual capex spent and revenue generated among the eight largest cloud companies globally for their investment in large data centers to support genAI. Estimates for 2023 and 2024 are based on consensus analyst estimates. Data is indexed and rebased to 100 as of Jan. 1, 2013.

Regardless of whether there is a near-term hiccup, the long-term potential for AI appears bright. As the amount of data increases and the cost of processing it comes down across time, we expect AI will continue to grow. Yet AI applications will ultimately meet with varying degrees of success, suggesting genAI could contribute to dispersion across individual companies and their stock prices. For this reason, we include AI among 5 factors favoring stock selection in what we describe as a new era for equity investing.

The bottom line

We see generative AI on an improvement curve with prospects to transform businesses around the world. Yet it is precisely because genAI is new, exciting, and evolving that it requires an active investment approach. As fundamental-based stock pickers, we are continually fact-checking the investment case as the cycle around generative AI advances from peak expectations to enlightenment and productivity. The genAI story has only just begun and, we expect, will be written for many years to come.

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here