At a Glance

Navigating Jazz Pharmaceuticals’ (NASDAQ:JAZZ) operational and financial matrices poses a unique analytical challenge, accentuated since my last dissection. Clinically, the company continues to make strategic headway, most notably with Xywav’s alignment to sodium-reduction guidelines and Epidiolex’s market penetration into long-term care settings. However, operational glitches in the supply chain pose a concern, potentially putting a damper on revenue. Financially, while the robust liquidity metrics are reassuring, the increasing dilution rate of 15.9% merits investor caution. As we delve into the data points, key questions emerge about how these diverse aspects interplay to inform Jazz’s investment narrative, a topic warranting nuanced scrutiny.

Q2 Earnings

To begin my analysis, looking at Jazz Pharmaceuticals’ most recent earnings report for Q2 2023, total revenues increased modestly to $957.3M from $932.9M in Q2 2022. A key highlight is the reduction in operating expenses to $799.7M from $847.3M YoY, driven largely by lowered costs in selling, general and administrative expenses. Net income soared to $104.4M, reflecting a significant uptick from $34.7M YoY. The diluted EPS stood at $1.52 compared to last year’s $0.55. However, there’s a concerning increase in weighted-average ordinary shares used in diluted per share calculations, from 63,431 in 2022 to 73,540 in 2023, indicating a 15.9% share dilution. This dilution offsets some of the earnings improvements and could pressure future EPS.

Financial Health

Turning to Jazz Pharmaceuticals’ balance sheet, as of June 2023, the company holds $1.28B in ‘cash and cash equivalents’ and an additional $80M in ‘investments,’ aggregating to a total of $1.36B in highly liquid assets. The ‘current ratio’ stands at approximately 3.18, indicative of strong liquidity. Jazz’s total debt, combining current and long-term portions, is approximately $5.72B. Therefore, its liquid assets to debt ratio is 0.24. On the operational side, the firm generated a net cash inflow from operating activities of $617.5M over the last six months, translating to a positive monthly cash addition of about $102.9M. It’s crucial to note that these financial figures are based on past performance and may not be indicative of future results.

Based on the cash inflow from operating activities, Jazz appears well-capitalized and self-sustaining, adding a buffer to its financial position. Given the positive cash flow from operations and a robust current ratio, the necessity for additional external financing in the next twelve months seems to be on the lower end of the probability spectrum. These are my personal observations, and other analysts might interpret the data differently.

Equity Analysis

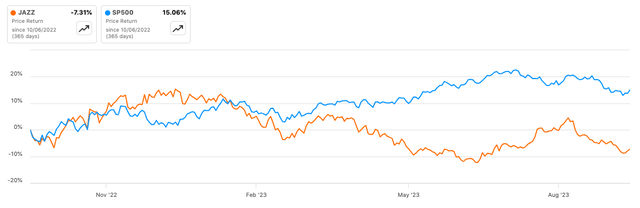

According to Seeking Alpha data, Jazz Pharmaceuticals’ $8.09B market cap aligns with reasonable market confidence, especially given an FY1 EPS growth of 41.02%. Analysts project a revenue increase to $4.35B by 2025, reinforcing growth prospects. In terms of momentum, JAZZ’s performance lagged SPY, dropping 19.56% over 9 months compared to SPY’s +11.82% gain. Its 24-month beta of 0.52 indicates lower volatility compared to the broader market.

Seeking Alpha

Options expiring in December show high open interest at $130 strike calls, pointing towards market sentiment skewing bullish but also expecting some volatility. Short interest stands at 5.43%, not alarmingly high but worth monitoring. Ownership is primarily institutional, at 88.35%, with new positions amounting to 1.62M shares and sold-out positions at 984,805 shares. Recent insider activity shows a net buy, fostering a degree of confidence. Overall, the market is cautiously optimistic about Jazz, but short-term headwinds and stock underperformance require vigilant monitoring.

Xywav Shakes Salt Off to Lead Oxybate Race

Management appears strategically focused on differentiating their products in crowded markets, particularly for Xywav in the oxybate space. The Q2 2023 revenues for Xywav at $327 million, marking a 39% YoY growth, underscore not just market acceptance but also resilience against new high-sodium oxybate entrants. It’s clear that they’re banking on Xywav’s low-sodium profile as a competitive edge, a smart move given increasing medical scrutiny on sodium intake. They’re also leveraging the drug’s dosing flexibility, a non-trivial factor in patient compliance and satisfaction.

An intriguing point is the company’s efforts to educate about the health impacts of sodium, particularly in narcolepsy patients who are already at higher cardiovascular risk. This targeted educational approach could solidify Xywav’s market positioning and may signify a long-term play to influence prescribing behavior.

While they acknowledged an operational glitch in the pharmacy supply chain that delayed Xywav refills, they were quick to reassure that this is in line for resolution. In the backdrop of pharmaceutical logistics often being a silent revenue-impacting factor, this indicates agility in managing operational roadblocks.

In terms of Epidiolex, the 15% YoY growth to $202 million suggests that the market sees value in the drug’s unique attributes. The company’s increased focus on long-term care settings points towards an untapped patient population, and the strategy to emphasize not just seizure control but other caregiver-reported outcomes provides a multidimensional value proposition that could resonate well in real-world settings.

For Rylaze, it’s worth noting the 39% YoY increase to $102 million. The attention here seems to be on providing a high-quality, reliable supply of asparaginase—a key factor in cancer care where therapy cannot be easily substituted. Their European aspirations backed by positive CHMP opinion could be a revenue multiplier but also place them in direct competition with established players.

Zepzelca’s 3% growth to $70 million suggests a challenging market but also underlines the opportunity in earlier stages of small cell lung cancer. The planned Phase III trial with Tecentriq opens up a possibility of combination therapy, potentially increasing its market footprint.

My Analysis & Recommendation

In conclusion, the 10% stock slide in Jazz Pharmaceuticals since my last update appears to be a disconnect from its Q2 fundamentals, which by several metrics are robust. The reduced operating expenses and significantly increased net income affirm operational efficiency, and the strong liquidity ratios suggest minimal need for external financing in the near term. However, the dilution in share count is a yellow flag that investors should not ignore; this could create an overhang that suppresses EPS, even in the face of improving profitability.

Turning to the drug portfolio, the buoyant YoY growth figures for Xywav and Epidiolex, in particular, demonstrate that Jazz is successfully navigating clinical and market complexities. The sodium-education campaign for Xywav seems particularly prescient, considering the rising healthcare concerns around sodium intake in patients with existing cardiovascular risks. As for Epidiolex, the push into long-term care facilities offers a largely untapped market that could provide an incremental revenue stream. Although Zepzelca faces a tougher competitive landscape, its potential synergistic application with Tecentriq in upcoming clinical trials could change the dynamics.

Investors should keep an eye on several elements. First, the resolution of the supply chain hiccup for Xywav, as these operational details can have a cascading effect on revenues and customer satisfaction. Second, any further dilution events that could potentially undermine EPS growth. Lastly, the market’s reaction to the upcoming data release for Tecentriq; this could serve as a key catalyst in re-rating the stock.

Taking into account the antifragile aspects of Jazz’s drug portfolio—namely its diversification and adaptability in crowded markets—and the fact that they have demonstrated agility in their strategic plays, I maintain a “Hold” recommendation. The current stock dip could be a buying opportunity for long-term investors who recognize Jazz’s strategic resilience and upside growth prospects. However, short-term headwinds do exist, and a cautious approach would be prudent.

Read the full article here