Nu Holdings (NYSE:NU) is the holding company for Nubank, a rapidly growing Latin American digital bank with branches in Brazil, Mexico, and Colombia. When I last wrote about the company, it was only a little over two months after its December 2021 initial public offering (IPO) and shortly after the company released its fourth quarter 2021 earnings report in February 2022. Even though the Brazilian economy was in a recession in the latter half of 2021, the company displayed blazing-hot revenue growth of 224.3%. However, the company was unprofitable, with a net loss of $66.2 million for the fourth quarter and a net loss of $165.3 million for the year. Although things looked bleak for the company’s near-term prospects, and the stock was below its $9 IPO price at $7.94, I still recommended a buy for aggressive growth investors due to its excellent long-term growth prospects in an enormous total addressable market – TAM. According to Oliver Wyman’s report mentioned in the company’s F-1, the bank’s TAM should reach $269 billion by 2025. Unfortunately, any investor who took my advice to buy the stock lost some money on paper due to the high inflation and rising interest rates worldwide, making a terrible environment for fintech and neobanks in 2022.

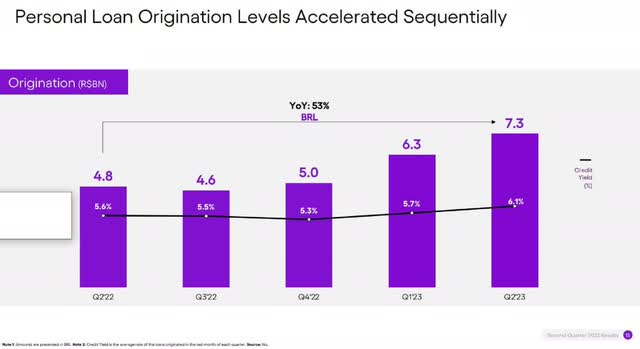

However, with inflation dropping quickly in Brazil and the nation’s central bank cutting interest rates by a half point in August, the stress is easing on the Brazilian economy, which is a favorable tailwind for Nubank’s lending business. During the second quarter earnings call, Chief Executing Officer Guilherme Lago said, “As our lending portfolio continues to show strong resilience and a better-than-expected performance, we have once again increased our risk appetite and origination levels.” The company raised its loan origination by 53% over the previous year’s comparable quarter in the second quarter report, which could help improve revenue growth in future quarters.

Nu Holdings Second Quarter 2023 Earnings Presentation

Nu Bank’s net interest margin (NIM) rose 860 basis points to 18.3% in the second quarter — hands down more than the NIM of an average U.S. bank. Net interest income (NII) rose to $1.05 billion. You can think of a bank’s NIM and NII as its gross margin and gross profit, respectively. These numbers are important for investors as NII makes up the lion’s share of the company’s reported $1.87 billion in revenue.

Nu Holdings Second Quarter 2023 Investor Presentation

Investors like the numbers the company is putting up. When Nu Holdings reported its second-quarter earnings, it easily beat analysts’ revenue forecasts by $93.34 million and earnings-per-share expectations by $0.02, despite uncertain conditions in Brazil, Colombia, and Mexico.

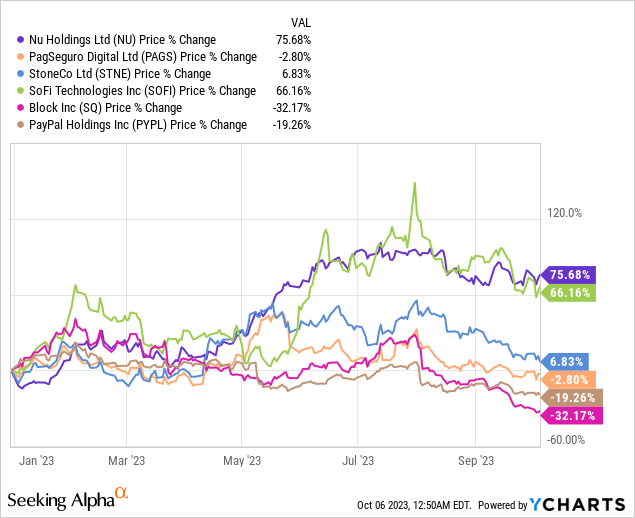

You can see on the chart below that with similar 2023 business tailwinds, Nu Holdings’ stock has easily outperformed its Brazilian peers PagSeguro Digital (PAGS) and StoneCo (STNE) year-to-date. It has even beaten its U.S. fintech and neobank peers, with the only company keeping up with its performance being SoFi Technologies (SOFI).

If you are looking for a superior growth stock for long-term gains, it is time to do some due diligence on this Latin American neobank.

Why the company is outperforming

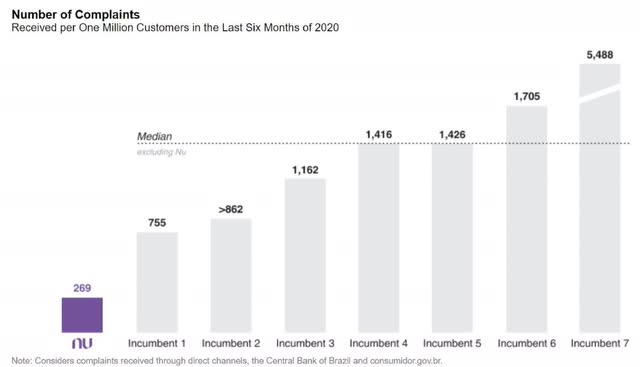

David Vélez, co-founded Nubank to provide a low-cost, customer-friendly, and convenient banking service in Brazil, something the small number of large incumbent banks failed to deliver. This neobank has taken the Brazilian banking industry by storm. You can measure how much better customer service the bank has by looking at its number of complaints compared to its larger competitors. The following chart shows how many complaints Nu received compared to incumbent banks in 2020.

Nu Holding F-1

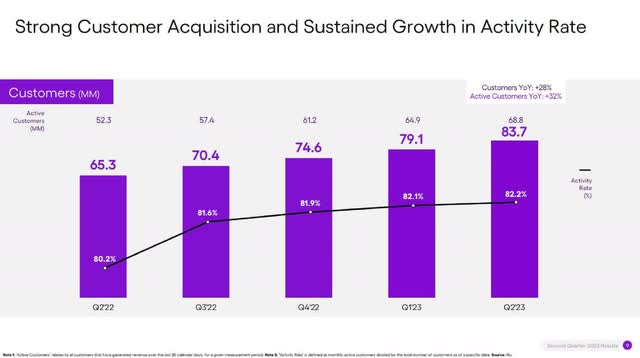

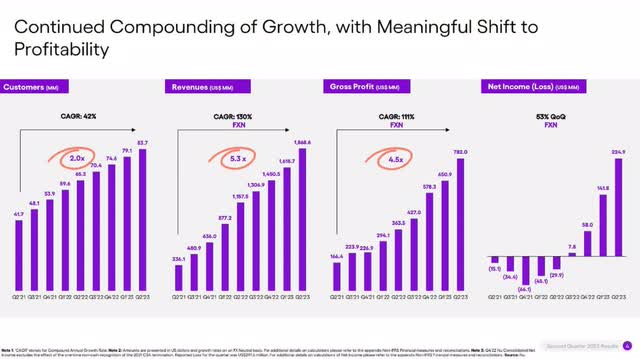

The company’s superior customer service has translated to robust membership and engagement gains. Nu Holdings grew its membership base by 28% year-over-year to 83.7 million, and the activity rate, an engagement number, rose to 82.2%. The engagement number is extremely important and can translate into a loyal customer base.

Nu Bank Second Quarter 2023 Investor Presentation

By constantly creating new products and successfully cross-selling and upselling them to its rapidly growing and loyal membership base, Nu Holdings has grown revenue more quickly than its peers. Among the reasons why the stock outperforms its Brazilian peers becomes self-evident when comparing second-quarter revenue growth metrics. Nu grew revenue by 60% over the previous year’s comparable quarter, much faster than PagSeguro Digital, whose revenue shrank 2% in the same quarter, and StoneCo, which only grew revenue by 28%. The company also grew second-quarter revenue faster than U.S.-based fintech peers like SoFi Technologies (SOFI), which grew revenue 37% year-over-year. This company is one of the fastest-growing digital banks publicly traded on U.S. markets that you can find.

Even better for its investors is that Nu has rapidly improved its profitability as revenue grows. The company reported gross margin of 41.8% in the second quarter of 2023, 1040 basis points higher than its reported gross margin of 31.4% in the second quarter of 2022. This margin improvement helped gross profit grow 113% over the previous year’s comparable quarter to $782 million.

Nu Holdings Second Quarter Investor Presentation

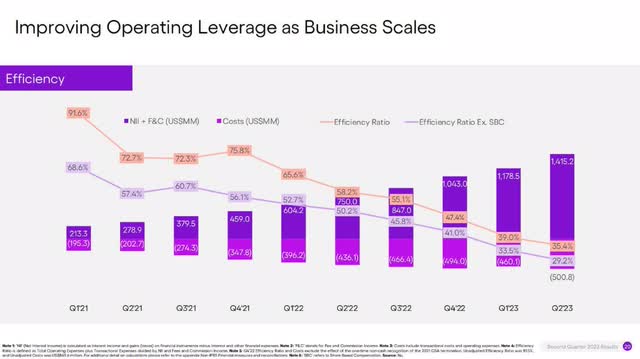

Another appealing attribute of the company for investors is that it has designed its business to grow its bottom-line profits faster than revenue growth by keeping its costs to operate its digital banking platform low. You can easily measure Nu Holdings’ effectiveness at keeping costs down by tracking its efficiency ratio. The chart below shows that the bank has quickly lowered its efficiency ratio over the last two years, from 91.6% in the first quarter of 2021 to 35.4% in the second quarter of 2023.

Nu Holdings Second Quarter Investor Presentation

This lowering of the efficiency ratio has allowed the company to continue membership and revenue growth while growing bottom-line profitability. The company finally became profitable in the third quarter of 2022, as seen in the image below.

Nu Holdings Second Quarter 2023 Investor Presentation

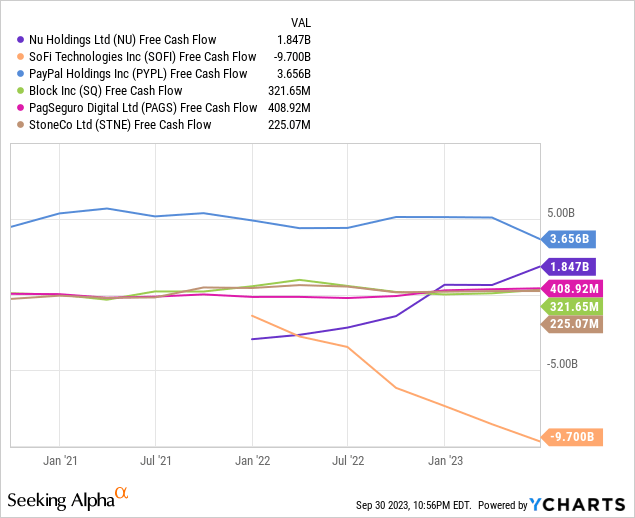

The company has increased its FCF to $1.8 billion in the second quarter, higher than most of its fintech peers. While PayPal may have higher FCF, it has flatlined over the last several years and declined in its latest quarter compared to Nu Holdings, which is trending up.

Nu Holdings generated $4.194 billion trailing 12-month revenue as of the end of the second quarter of 2023. Using its estimated TAM of $269 billion, the bank has only penetrated 1.55% of its TAM. The above attributes make this stock extremely attractive to aggressive growth investors.

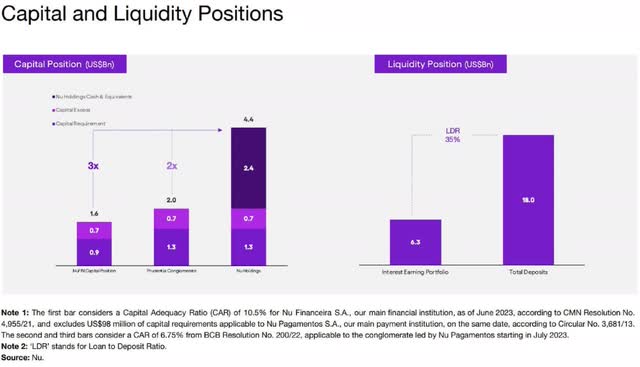

Nu Holdings operates on the safe side

Due to a volatile economic environment, management has operated the bank conservatively over the last few years. The chart below shows that Nu Holdings operates well above its capital requirements and maintains a loan-to-deposit ratio (LDR) of 35%, which is low. According to S&P Global Market Intelligence data, the average LDR for U.S. banks was 63.6% in the fourth quarter of 2022. Although running at exceptionally low LDRs is part of the company’s strategy, it has plenty of room to raise the number if it desires to accelerate revenue growth.

Nu Holdings Second Quarter 2023 Earnings Release

Brazilian households have been under heavy financial pressure due to drought, recession, inflation, and high-interest rates since 2020. The chart below shows 15-90 non-performing loans (NPL), which management considers a leading indicator of financial stress, rising 310 basis points from 1.2% in the third quarter of 2020 to 4.3% in the second quarter of 2023.

Nu Holdings Second Quarter 2023 Earnings Release

The good news is that as the Brazilian economy improves and NPLs go lower, the bank has plenty of dry powder to increase interest-bearing loans — helping increase its revenue growth and profits.

The company has a high valuation

Nu Holding’s strengths have not gone unnoticed by investors. After all, Warren Buffett was an early investor in this stock. Additionally, it came to the U.S. public market with tons of hype. Hence, it was no surprise that the underwriting banks priced Nu’s IPO at an extremely high valuation.

Today, the stock trades at a price-to-sales ratio of 8.289, significantly higher than its fintech peers, so it is little wonder the stock still trades below its IPO price of $9. Considering the bank operates in a region with a long political and economic instability history, the risk is high that the market has overvalued the stock at current prices.

Alternatively, you could see the stock’s valuation as a sign that Nu Holdings is a much better fintech opportunity than its peers. The company has superior revenue growth and rapidly growing profitability and FCF. Therefore, bullish investors would think the valuation is justified.

How does Wall Street look at it?

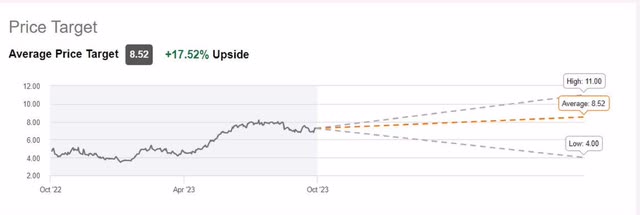

The consensus ratings from Wall Street and Seeking Alpha analysts of Nu Holdings are a buy. Wall Street Analysts average price target is $8.52, 17.52% above its September 29 closing price.

Nu Holdings Average Analyst Price Targets (Seeking Alpha)

Seeking Alpha reported on September 11, 2023, that J.P. Morgan analyst Yuri Fernandes upgraded the stock to Overweight from Neutral. Fernandes wrote a note that implies the company will continue gaining market share in Brazil.

Should you buy the stock?

Nu Holdings has considerable revenue and earnings growth prospects in Brazil, and should it repeat that success in Colombia, Mexico, and other Latin American countries, the stock should handily beat the market’s returns. This company is a buy for aggressive growth investors looking for high-upside opportunities over the long term.

Read the full article here