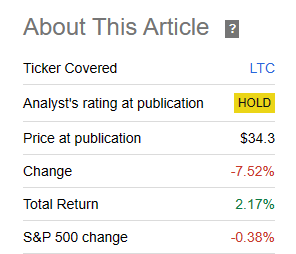

LTC Properties Inc. (NYSE:LTC) has been resilient. The stock got a hold rating on our last coverage but we were highly certain that the stresses in their tenant ranks would break the monthly dividend model. Spoiler alert. It didn’t. The stock also held up on a relative basis and delivered a 2.17% total return while continuing to line investors’ pockets with a monthly dividend.

Seeking Alpha

We look at the key metrics today to see if we were wrong or just early (which is no different than being wrong in capital markets).

Q2-2023

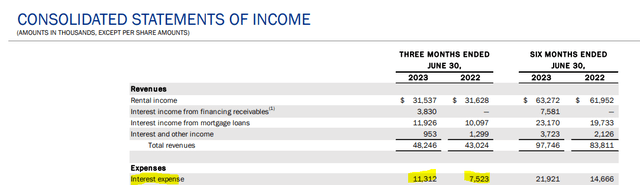

Q2-2023 showed the rising rate pressures all REITs have been facing with interest expenses up more than 50% year over year.

LTC Q2-2023 Presentation

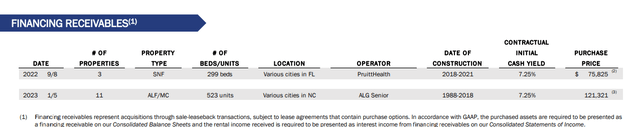

If you examine the revenue lines though, you will see that there was big surge in interest income as well. “Surge” is bit loose of a word here as there was no interest income last year. The income is from financing receivables, something all senior housing REITs have indulged in at some point or another.

LTC Q2-2023 Presentation

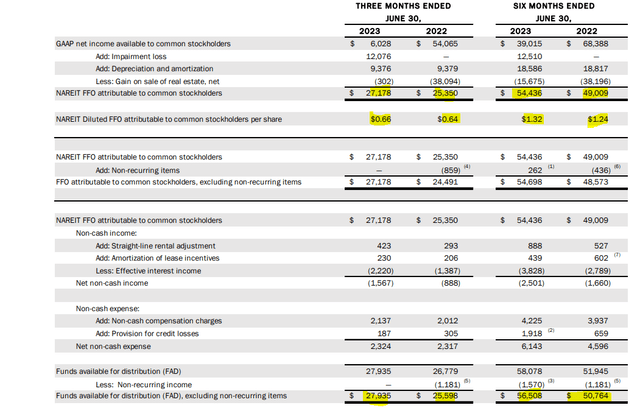

This is not a problem per se as real estate here tends to hold its value, but it is definitely one to keep your eye on as this is a bit further out from standard REIT model. Overall the results looked ok at first blush with funds from operations (FFO) increasing modestly from last year.

LTC Q2-2023 Presentation

Funds available for distribution or FAD, which is a less standardized measure, also increased and improved the dividend buffer. FAD was around 66 cents and the dividend is currently at 57 cents a quarter (19 cents a month).

The Real Key Metrics

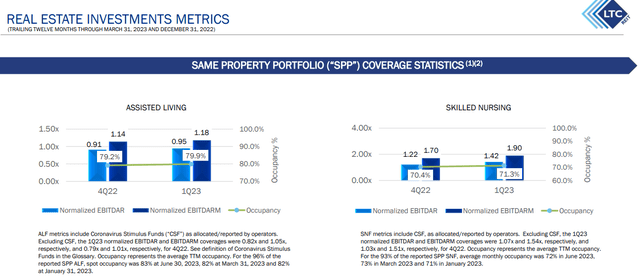

LTC’s tenants were the beneficiaries of improving occupancy levels from Q4-2022 to Q1-2023. These are reported with one quarter delay, so those are the latest numbers you can get in Q2-2023. It also appears that those operators finally got a grip on their expenses and were likely able to push through some solid price hikes. The improvement in both EBITDAR (earnings before interest, taxes, depreciation, amortization & rent) and EBITDARM (just add management to that) were quite remarkable.

LTC Q2-2023 Presentation

There was definitely a margin explosion here and this exceeded our most positive forecasts. When you combine this with the FAD dividend coverage, it is really difficult to say that there is any risk to the dividend over the next 12 months. But we are not done yet.

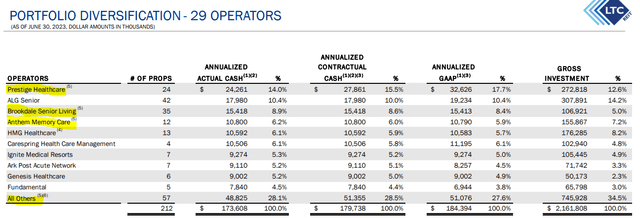

While the overall numbers look great, it is always the outliers that create havoc. Here we see in LTC”s portfolio list, multiple operators that are given the numerical values next to them, indicating there are footnotes you need to see.

LTC Q2-2023 Presentation

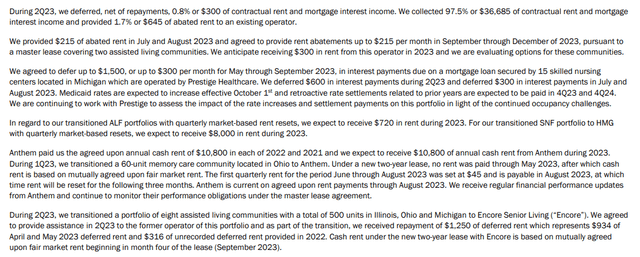

The footnote number 5, expanded below for your viewing, shows just how the rent abatement process is going. Numerous operators and those include 3 of the 5 largest ones have asked for some sort of relief or been trying to create a new more suitable setup.

LTC Q2-2023 Presentation

This has been ongoing for a long time, even before the pandemic. See this article from 2019 for the full context of what was happening even then.

Seeking Alpha

One aspect here that we got wrong is that these operators are still hanging around years after they went into a distressed state. We would have assumed things would have ended with some defaults and a new operator likely would get a big rent break. Nope. So chalk that as a clear defeat for our analysis. On the plus side, the decision to stay out has not been remotely expensive. The stock has provided a negative total return over the last 4.5 years.

Verdict

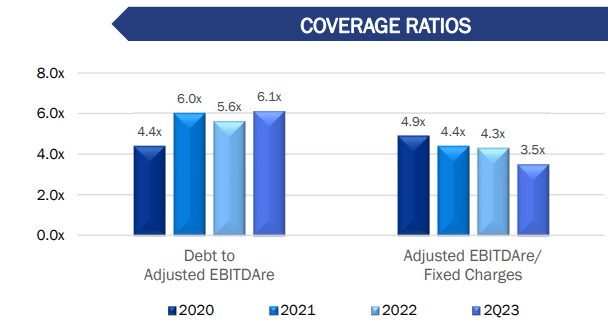

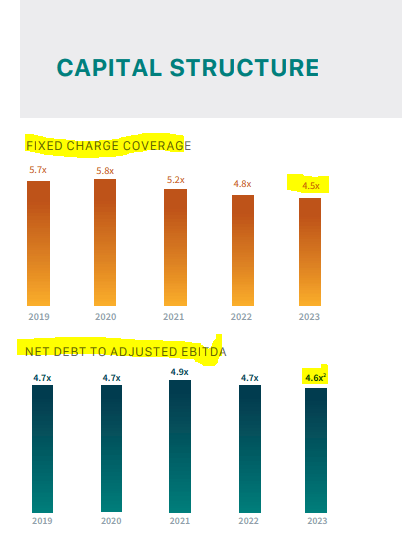

One aspect that should worry investors even now is that debt to EBITDA ratio keeps climbing. We are at 6.1X now and annualized EBITDA to fixed charges is now down to 3.5X.

LTC Q2-2023 Presentation

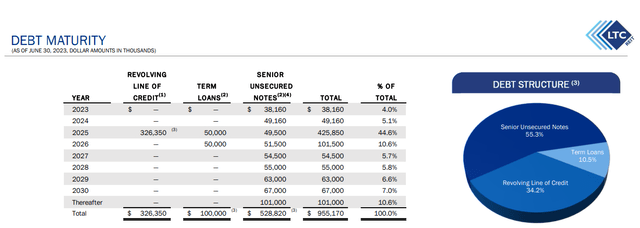

The offset here is that we may be in the sweet part of the cycle where the demand for senior housing is strong and supply has tailed off after a harrowing post pandemic period. Supply simply took a backstage as COVID-19 wrecked most havoc on the senior population. So even this 6.1X is unlikely to kill the firm. The debt maturity profile is pretty good with well spaced out term notes, but the revolving line is one we would watch out for.

LTC Q2-2023 Presentation

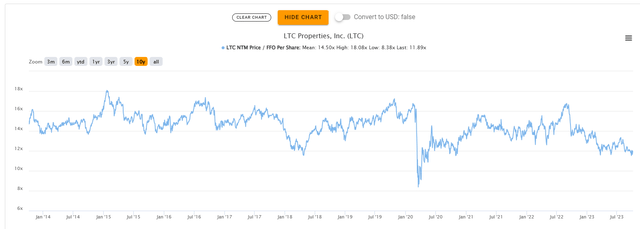

44.6% of the total debt comes due in 2025 and one better hope for relatively loose financing conditions then. On a valuation basis the REIT has moved to the low-end of its FFO multiple range (excluding the COVID-19 crash).

TIKR

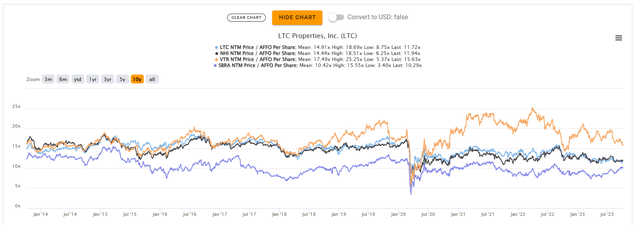

The valuation looks appealing as is, but we have seen a compression in multiple for all REITs. With senior housing, Ventas Inc (VTR) appears expensive and Sabra Healthcare Inc (SBRA) appears cheap if you use just the FFO multiple.

TIKR

National Health Investors Inc. (NHI) has the same multiple as LTC (black line above) and we prefer it here for a couple of reasons. The first being that it is a larger firm with an investment grade credit rating. Both the fixed charge coverage and net debt to EBITDA are also far superior.

NHI Q2-2023 Presentation

So if we had to pick one here it would be NHI. LTC remains a hold but we have to acknowledge that the firm has done far better than what we anticipated.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here