Overview

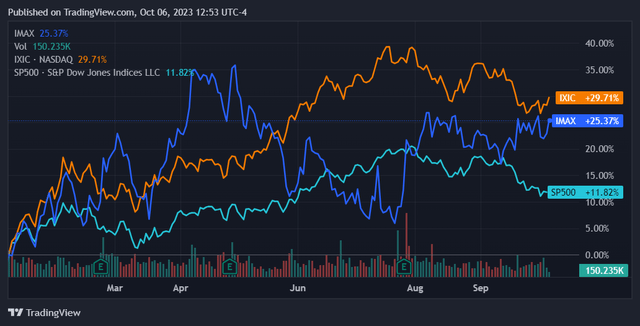

IMAX (NYSE:IMAX) stock has had a volatile trajectory this year as it heads into its Q3 ’23 earnings release. While initially appreciating well beyond the NASDAQ Composite as well as the S&P500 Index, the stock was sold off during the summer and is now trailing the NASDAQ. Notably, it is still well beyond the S&P 500’s price return year-to-date. As a technology company that relies on consumers, I will note that both indices are relevant. That said, there is certainly some intra-year momentum heading into this next earnings release, which is slated to occur on October 26th.

Seeking Alpha

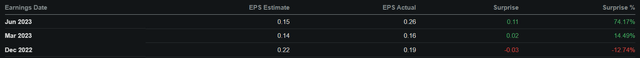

What’s particularly salient about this chart is that IMAX stock has not responded identically to its recent performance against (non-GAAP) earnings expectations.

While IMAX underperformed against consensus EPS for its fiscal Q4 (ending late February), the stock appreciated significantly.

This trend then reversed when IMAX released its fiscal Q1 earnings report (ending May), even though it outperformed EPS estimates by close to 15% for that period.

This reversed again when IMAX released its Q2 ’23 results, outperforming consensus significantly (74.2%) and then settling into its current price of about $19.60 per share.

Seeking Alpha

As such, it appears that the recent causal relationship between IMAX’s share price and its performance against consensus EPS is not so simple. Investors in this security are not simply buying or selling based on quarterly earnings results. This can be due to uncertainty around its long-term prospects, valuation, or other, less-visible, metrics.

Nonetheless, the narrative that I had previously established for IMAX has held up. The company has gotten past its pandemic-era rut and returned to earnings growth, benefitting nicely from this past summer’s slate of box office hits. Shares are up about 30% over the past year. The question is now whether earnings growth can be maintained as well as how it will ultimately impact the share price. In this article, I’ll establish a view for IMAX’s upcoming quarterly results as well as a medium-term outlook for the stock.

Quarterly Results

Consensus estimates for non-GAAP EPS currently stand at $0.16 for Q3 2023. This is exactly $0.01 more per share than what we saw last quarter. This presumes the exact level of per-share profitability that we saw for fiscal Q4 ’23. Off the bat, I think this is a conservative estimate due to the high-profile film releases that we’ve seen this past summer. Popular films such as Barbie and Oppenheimer should continue earning elevated royalties for longer than lower-profile films, further benefitting IMAX at the box office.

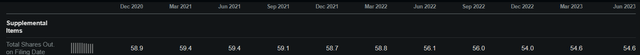

The contrasting force here, however, is total shares outstanding. While buybacks decreased IMAX’s total shares over the last ten quarters, this number has started to creep back up. We can already see an increase of 600K shares (roughly 1.1%) in the most recent quarter versus Q4 ’22 (ending Dec ’22). If this number ticks up further, per-share profitability could be dampened proportionally.

Seeking Alpha

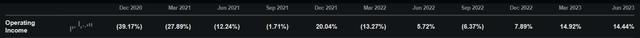

For now, we can proceed by assuming that the share count will remain identical while looking at other comparable metrics. Margins are especially relevant here. IMAX has made significant progress here in recent periods. Its post-pandemic comeback is particularly visible across operating margins, which are now nearly double what they were for Q4 ’22.

Seeking Alpha

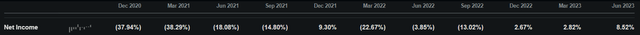

This has also been reflected in net margins. While they haven’t moved in lockstep with operating margins, they have certainly moved upwards. The most recent quarter’s net margins were more than three times what they were for Q4 ’22.

Seeking Alpha

All of this bodes well for IMAX being able to outperform consensus earnings expectations in the upcoming quarter. To reiterate, current expectations assume that IMAX will replicate its per-share (non-GAAP) profitability from Q4 ’22. A review of the metrics indicates that this is fairly conservative and is very likely to happen. As mentioned, however, IMAX stock may not appreciate directly as a result – even though it looks to be on track to maintain or beat consensus expectations. At a minimum, this should reduce immediate downside risk. Nonetheless, we must review the company’s relative financial positioning and establish a perspective more attuned to buy-and-hold investment.

Valuation and Momentum

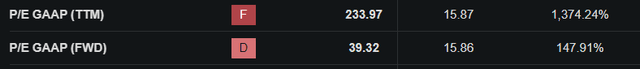

While IMAX earnings results have been non-GAAP, it is also worth noting that the company is profitable on a GAAP basis. As such, we can make use of GAAP profits and their associated valuation multiples in order to compare it to its peers. On this basis, IMAX is relatively expensive at present. While exceptionally expensive on a trailing twelve-month basis, IMAX is also pricey on a forward P/E basis.

Seeking Alpha

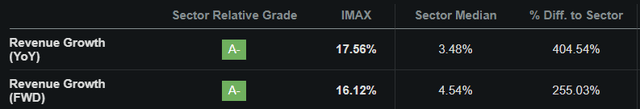

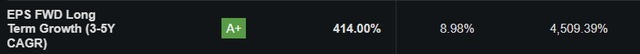

This looks to be a ‘growth’ valuation. Essentially, this company’s multiple is elevated because investors are pricing in future growth. A multiple this high cannot be considered as anything but that, as the present certainly does not provide a firm foundation for it to rest upon. Indeed, IMAX’s valuation is undergirded by stellar growth metrics across both the top and bottom lines.

Seeking Alpha

IMAX is well ahead of its sector peers here, particularly when it comes to EPS. Since EPS estimates also appear relatively conservative in the near term, this appears fair overall.

Seeking Alpha

The risk with this kind of valuation is that the stock can depreciate quite significantly if and when growth slows down. Given the vagaries of the movie business and the fact that IMAX earns most of its revenues from pocketing a portion of ticket prices, this kind of variability is even more likely in the short term. Over a longer horizon, I believe the company’s product differentiation and its de facto monopoly on upmarket cinema should see it continue to do well.

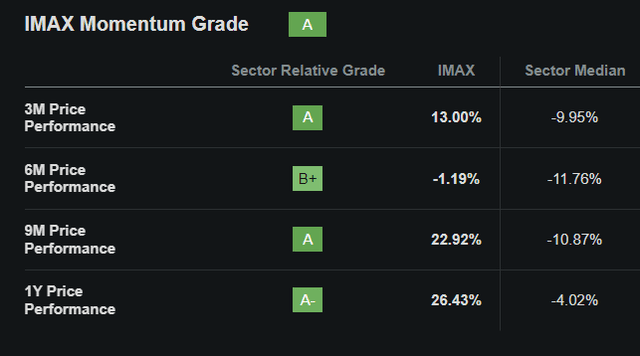

As to momentum, IMAX continues to do well. Even with the mid-year volatility that we’ve seen I believe that it’s fair to consider this stock as having momentum. Across every 3-month timeframe across the entire past year, it has received more investor interest than its sector peers.

Seeking Alpha

Overall it’s clear that IMAX is trading as a forward-looking stock. At this juncture, investors have already priced in a continuing recovery. This could indicate that the post-pandemic trade here is already tapped out.

Conclusion

Considering the full picture around this stock, I would have to say that it nets out to a hold. It has appreciated significantly after its pandemic trough and is now trading at a very high multiple on a GAAP basis. While growth is undoubtedly high, IMAX’s revenue model is ultimately contingent on box office hits. Since summer is usually the time for releases such as these, things could very well slow down over the next few quarters. This is also before we even consider labor problems in Hollywood or the uptick in share count that we’re seeing with the firm. Considering all of this, I think long-term investors should take some profits at this point and that new investors should await a lower entry point for the stock.

Read the full article here