The ideal investment is in a company that has not only historically achieved attractive growth, while being affordable, but that has also demonstrated that it’s likely to continue that growth for the foreseeable future. Given how busy people are and their daily lives, it can be easy to turn your investments on autopilot and assume that financial performance will continue if it has been that way in the past. But this would be a bad way to go about handling your investments. The fact of the matter is that conditions change and, when they do change, it’s important for investors to adapt. And one company that has demonstrated some change for the worse is Marten Transport (NASDAQ:MRTN), a logistics business that focuses on both refrigerated and dry truck-based transportation activities. After a stellar 2022 fiscal year, financial performance has started to weaken. Shares are not exactly expensive, but they are a bit pricey compared to similar enterprises. Add on top of this broader economic uncertainty, and I don’t think it would be wrong to take a more cautious approach to the company for the time being.

A great run and a modest downgrade

Some of the best investment opportunities involve companies or industries that might not traditionally be seen as appealing. The transportation and logistics market, while massive in size, is not known for being particularly fast growing or to enjoy fat margins. But when shares are purchased at an attractive price, the upside for shareholders can be particularly appealing. It was this kind of mindset, combined with individual financial performance, that led me to rate Marten Transport a ‘buy’ in April of 2022. That kind of rating denotes a scenario where I believe that shares should outperform the broader market for the foreseeable future. And since then, that is exactly what has transpired. Shares are up 19.3% since the publication of that article. That stacks up nicely against the 3.7% decline seen by the S&P 500 over the same window of time.

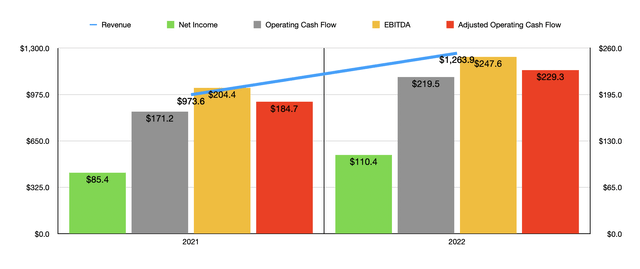

Author – SEC EDGAR Data

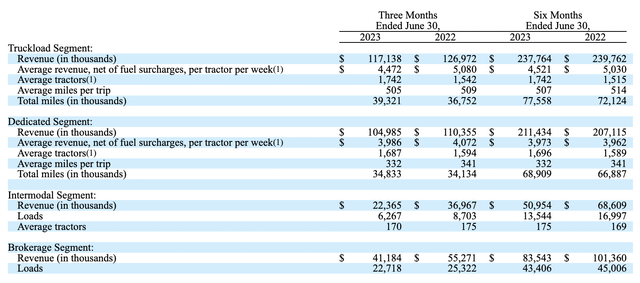

This performance seems to be largely attributable to how the company performed in 2022. Revenue for that year totaled $1.26 billion. That’s 29.8% higher than the $973.6 million the company generated only one year earlier. Given that it’s better to focus on newer data rather than older data, I won’t go terribly far into why performance was so strong year over year. Rather, I will refer you to the image below that shows the different segments of the company and what the key revenue drivers were from year to year. In short, it really boils down to higher charges, net of fuel surcharges, that the company was able to push on to its customers, combined with more miles traveled compared to the same time the prior year. The Brokerage segment also performed incredibly well, benefiting from a 43.8% surge in loads handled as demand in that space skyrocketed because of robust economic strength and continued supply chain issues.

Marten Transport

Profitability also came in strong for that year. Net income of $110.4 million was 29.3% higher than the $85.4 million reported one year earlier. Operating cash flow jumped from $171.2 million to $219.5 million, with that number climbing from $184.7 million to $229.3 million if we adjust for changes in working capital. And finally, EBITDA for the company expanded from $204.4 million to $247.6 million. As with any asset-intensive business, growth in revenue caused by higher pricing and higher asset utilization usually helps the bottom line improve drastically. And that’s precisely what we saw here.

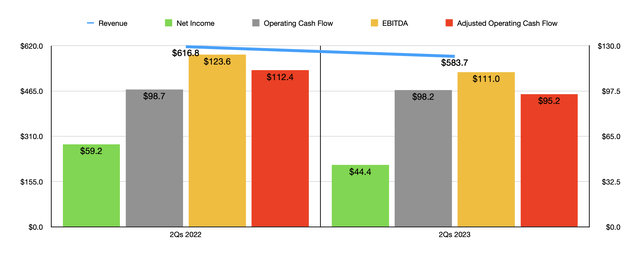

Author – SEC EDGAR Data

Fast forward to today, and we are starting to see some issues. In the first half of 2023, for instance, revenue came in at $583.7 million. That’s 5.4% lower than the $616.8 million reported one year earlier. In one of the four segments for the company, average revenue, net of fuel surcharges, per tractor per week declined, while in the Intermodal and Brokerage segments, revenue per load plummeted. The drop in the Truckload segment was from $5,030 per tractor per week to $4,521 per tractor per week. The Intermodal segment saw a decline reported a decline from $4,037 per load to $3,762 per load, with that pain being magnified by a 20.3% plunge in the total number of loads. Meanwhile, the Brokerage segment reported a drop in the revenue per load from $2,252 to $1,925 per load as the number of loads also fell by 3.6%.

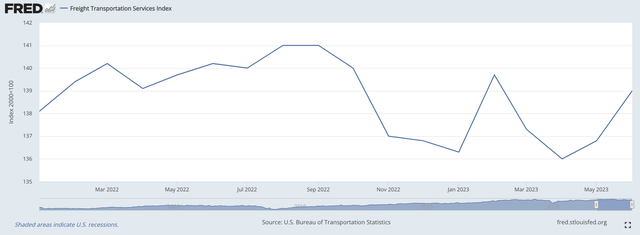

Federal Reserve

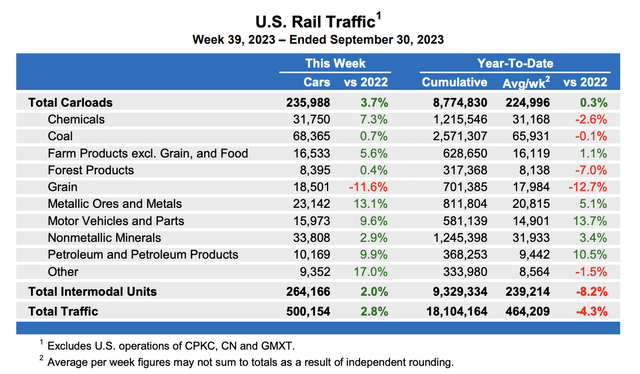

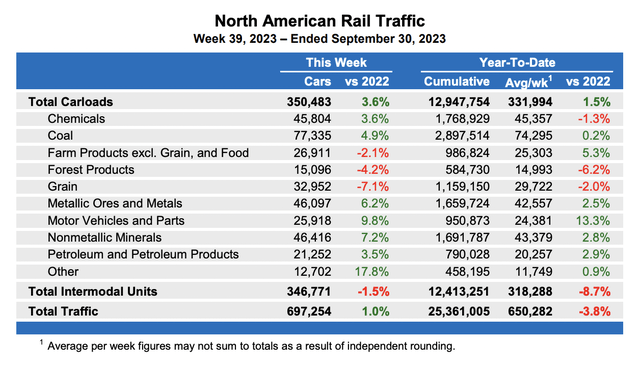

Considering broader economic data, I’m not terribly surprised by this. The Freight Transportation Services Index, for instance, is down about 1.8% on a year-to-date basis compared to the same time last year. In July of this year alone, the most recent month for which data is available, it’s down 2.4%. This index keeps track of the volume of freight transported by the for higher freight transportation industry. When it comes to the rail industry, year to date volumes for the first 39 weeks of 2023, for the US only, are down 4.3%. That’s driven by an 8.2% drop in intermodal unit shipments. For North America as a whole, it’s down 8.7%. It does appear as though the combination of inventory unwinding implemented by many companies, and high interest rates aimed at combating inflation, is causing an impact. We are also seeing this in the freight industry from a hiring perspective. The unemployment rate in that market is 4.9%. That’s up from the 4.3% seen one year earlier.

Association of American Railroads

Association of American Railroads

Naturally, weak top line results will lead to weak bottom line results. Net income of $44.4 million achieved in the first half of 2023 came in lower than the $59.2 million reported one year earlier. Operating cash flow barely budged, dipping from $98.7 million to $98.2 million. But if we adjust for changes in working capital, we would get a more significant drop from $112.4 million to $95.2 million. And finally, EBITDA dropped from $123.6 million to $111 million. Despite these weaknesses, we should keep in mind that Marten Transport has no debt on its books and it enjoys $80.5 million worth of cash and cash equivalents. Though small compared to its market capitalization, it does provide a nice amount of liquidity for the company should times get truly tough.

Author – SEC EDGAR Data

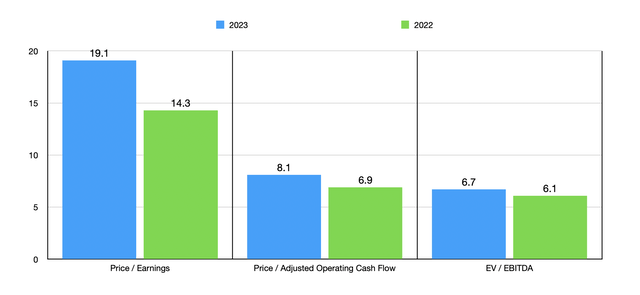

Since management does not provide guidance for the year, we are left on our own when it comes to that. If we annualize results experienced so far, we would expect net income of $82.8 million, adjusted operating cash flow of $194.2 million, and EBITDA of $222.4 million. Using these figures, I was able to value the company as shown in the chart above. As you can see, the stock is more expensive than if we were to use data from 2022. But with the exception of the price to earnings multiple, it’s not pricey from an absolute basis. I did, in the table below, compare it to five similar firms. And what I found is that it is the most expensive of the group on a price to earnings basis. And when it comes to the other two profitability metrics, it’s more expensive than four of the five enterprises.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Marten Transport | 19.1 | 8.1 | 6.7 |

| P.A.M. Transportation Services (PTSI) | 8.3 | 2.9 | 3.8 |

| ArcBest Corp (ARCB) | 10.4 | 6.3 | 5.7 |

| Werner Enterprises (WERN) | 13.9 | 5.3 | 5.5 |

| Landstar System (LSTR) | 18.7 | 10.5 | 11.8 |

| Knight-Swift Transportation Holdings (KNX) | 15.4 | 5.5 | 6.6 |

Takeaway

Operationally speaking, Marten Transport is showing some weakness so far this year. In truth, I wouldn’t be surprised if that weakness intensifies over the next several months. The balance sheet of the company is in good shape and the long-term prospects for the company as a whole are certainly positive. But when you factor in current weakening, the prospect of additional weakening, and how pricey shares are compared to similar firms, not to mention how much of a run up the stock has seen compared to the broader market already, I would argue that a modest downgrade from a ‘buy’ to a ‘hold’ is appropriate at this time.

Read the full article here