Introduction

Earnings season is starting, and we are used to paying close attention to what the major North American banks will report to feel the pulse of the economy. Yet, among the first companies to report their results, there are a few belonging to two particular sectors I believe to be extremely interesting to understand how the economy is doing. I am talking about those companies linked to transportation (railroads and truck manufacturers) and staffing companies. In this article, I would like to over the first one focusing, in particular, on Volvo Group (OTCPK:VOLAF) (OTCPK:VOLVF) (OTCPK:VLVLY).

Summary of previous coverage

Volvo Group is the most profitable truck manufacturer, and it is gaining a role as one of the leading players when considering BEV trucks. Its financials are healthy, with a 7.7% annual net income growth, and a growing and well-supported dividend (4.58% CAGR over the past decade). In 2012, FCF was negative at $1.58 per share. Free cash flow has also grown consistently from negative territory in 2012 when it was -$1.58 per share, to $0.45 per share considering the TTM.

Volvo Group has also shown to be led by a good managing team. In fact, it was among the first manufacturers to understand what was happening with supply chain constraints and inflationary pressure. Seeing this situation would have caused pressure on its margins, Volvo Group started way earlier than its peers to pursue a restrictive order intake policy. Clearly, this policy is possible when one is the market leader and is confident in demand for its products.

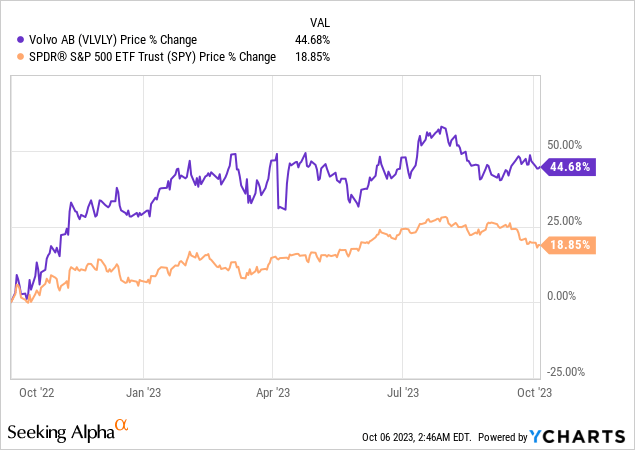

What then happened proved Volvo’s decision to be right. The company stood out in the industry as it started to take orders with better visibility and production costs, unlike its peers. Since last October, also because of this, the stock outperformed the S&P500, which is quite an achievement for a stock of an industrial company operating in a highly competitive industry.

As we have seen, Martin Lundsted, President and CEO of Volvo Group, nailed it when he wrote in the Q1 2023 earnings report: “A good profitability is important for us to be able to continue to increase our investments in the biggest technological shift ever in our industries”. Investors rewarded these words and, in particular, the financial results they generated.

All in all, Volvo showed it was in great shape, with healthy order intake and continued pent-up demand that was still unfulfilled, making me consider Volvo Group the most interesting pick within the industry.

Recent Financials

The Volvo Group reports its financials in Swedish krona ($1=SEK kr 11 at the time of writing). We

First of all, investors should know Volvo Group has been quite transparent on its financial targets, based on which it should be assessed. In detail:

- The operating margin has to be over 10% over a business cycle. Between 2018 and 2022, the average operating margin was 9.9% and the adj. was 10.3%.

- Industrial operations, apart from provisions for post-employment benefits and lease liabilities, need to run without net financial indebtedness. At the end of 2022, the industrial operations had a net financial asset position of SEK 73.9 billion.

- The ROE in financial services needs to be between 12% and 15% at an equity ratio above 8%. In 2022, the return on equity amounted to -0.3%. Excluding the negative effect of provisioning of assets related to Russia, the return on equity actually amounted to 15.1%. The average over the last business cycle (2018-2022) was 14.3%.

As the first half of the year ended, Volvo Group reported good results:

- Net sales increased 18% to SEK 140.8 billion.

- Since operating income was SEK 21.73 million, the adj. operating margin was 15.4% vs. 11.6% the year before (the adj. margin excluded the negative effect of SEK 1.27 million from the restructuring provision in Nova Bus).

- EPS amounted to SEK 5.30 vs. 5.14 in Q2 2022

- Return on capital employed in industrial operations was 30.2% vs 26.8% the year prior.

Now, that sales are growing isn’t a surprise. In fact, many manufacturing companies are still working to fulfill all the pent-up demand accumulated during 2021-2022. However, increasing sales doesn’t necessarily mean the overall profitability must increase as well. Volvo Group did improve its overall financials, showing that the company is managed correctly.

However, investing is about future performance. On one side, The Volvo Group has proven repeatedly it is a well-managed company. But alongside this, we also need to understand how order intake is doing. In Q2 it declined by 10% to 48.300 vehicles. For the first time, Volvo didn’t only mention its restrictiveness in slotting orders, but had to talk about more cautiousness among its customers. In particular, construction equipment saw a 41% order intake decrease as a consequence of weakening demand in markets such as Europe and China.

What to expect from the upcoming Q3 earnings

Let’s get this straight. The Volvo Group, together with PACCAR (PCAR), is a step above its other peers in terms of financials and execution. As business cycles come one after the other, the Volvo Group has usually sailed through them with steady improvement.

So, overall, I don’t think we will see concerning financials.

Usually, Q3 is the slowest one in terms of deliveries, due to the summer holidays. Therefore, I expect sales to be in the range of 52k-55k and the operating margin should be still rather high. The reason is simple, most of the delivered trucks were ordered in late 2022 when inflation was peaking. Therefore, most of these trucks have been manufactured while inflation started trending downward. This is helpful for margins because these trucks have been sold at high prices that were compensating for high inflation, but their manufacturing costs were sustained with lower-than-expected inflation. I would be surprised if we saw an operating margin below 13.5%.

Net financial indebtedness should still see a net asset financial position for the simple reason that Q3 is usually a slow quarter that runs smoothly. In fact, the most “dangerous” quarter when we look at net financial indebtedness among industrials is Q1, when these companies purchase the raw materials and parts to be assembled during the year.

Orders and Deliveries

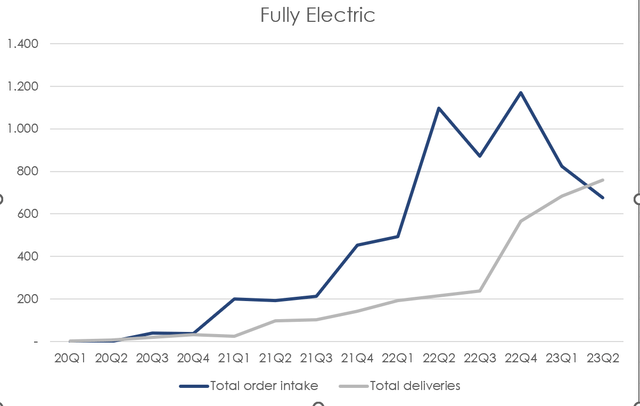

Let’s start from what currently is a minor segment, but is set to become the largest: electric trucks.

Author, with data from The Volvo Group

We see something that might be a bit unexpected. Even though we are in the early innings of electric trucks, we see a decline in demand during the last two quarters. In fact, the blue line shows how total order intake picked up speed only until the end of last year. In the meantime, deliveries have caught up and in Q2 were higher than orders. This may make us think about how the first little cycle of electric trucks has somewhat peaked. Let’s keep this in mind when we look at the larger picture described below.

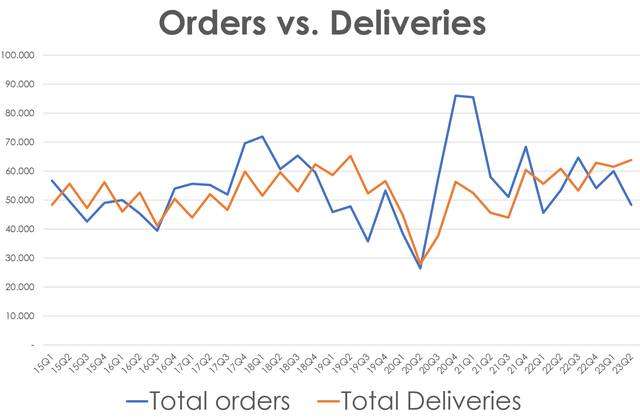

I put together the quarterly order intake and deliveries from 2015 until the most recent quarter. We can see how the cycle works. Quite simply, for around 2 years orders surpass deliveries (from Q4 2016 to Q4 2018) and then for the next two years they reverse, with higher deliveries than orders. The last two years were a bit disrupted by supply chain bottlenecks, but we can see how from the pandemic onwards, we have had two years of higher orders than deliveries. Then as 2022 ended and 2023 started, the reversion started once again, with deliveries reaching an all-time-high, mainly led by increases of light commercial vehicles for the Renault brand, as Volvo’s CEO reported during the last earnings call.

The Volvo Group

I think it is very likely we will see this trend continue in Q3, with deliveries being higher than orders. It would be a major surprise worthy of investigation if this doesn’t happen.

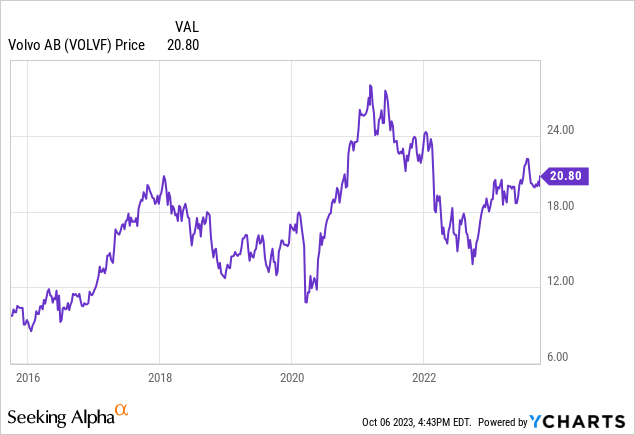

Now, if we look at the graph of Volvo’s price below which starts in 2015 and extends until today, there is a clearer correlation between price and orders rather than deliveries. This makes sense since investing is forward-looking.

So, I wouldn’t be surprised to see sudden downward pressure on the stock.

Valuation and Conclusion

We will need to look carefully at new orders once the Q3 report is released. This is the main driver of stock price movement, as far as I can tell.

Currently, I downgraded Volvo from buy to hold. The reason is simple: the stock reached a few months ago my target price of $23-25, and it has had only a slight pullback from there. Given what I have said about the correlation between order intake and stock price, I don’t see the stock as the best opportunity at the moment. Yes, Volvo is the leader in its industry. But, even for a leader, there is a right time to step in and invest and there is another time when it is better to sit on the sideline and just be patient. In case of further drops into the low $10s, we will have a situation where The Volvo Group will be of very deep value. Right now, its valuation sees a fwd P/E of 8 and a fwd EV/EBITDA of 7.50. I see these multiples as fair in case of a mild downturn, which I am actually expecting. Yet, they don’t offer a big enough margin of safety in case of a more severe event. Therefore, investors are before a double choice: those who hold the stock may decide to lock in some gains and move on; those who are in for the long-term should just hold and maybe add on some upcoming weakness.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here