All the world’s a stage and most of us are desperately unrehearsed.”― Seán O’Casey

It seems every time you believe 2023 can’t possibly get more bizarre, some unknown deity says ‘hold my beer‘. Last week, we saw the position of Speaker of the House be vacated for the first time in U.S. history. Then, this weekend Israel suffered the largest attack on its territory in a half a century. This is all as the largest land war in Europe since WWII is about to hit its 20-month mark.

As far as the market is concerned, the NASDAQ managed to ride a huge rally Friday to post a gain of 1.6% for the week. The S&P 500 also broke a four-week losing streak with just under a half percent gain. However, breadth in the market was lousy, as it has been for most of 2023.

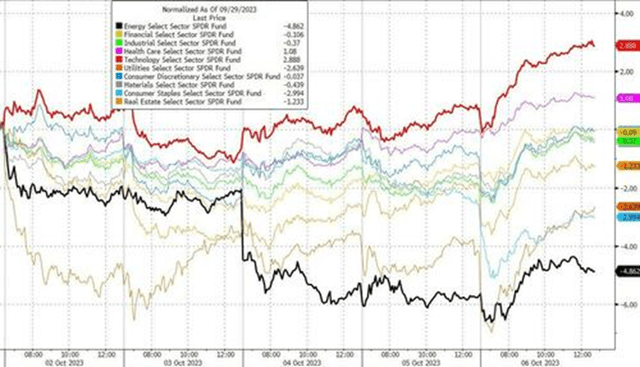

ZeroHedge

The Russell 2000 was off two percent for the week and the small cap index is now in the red for the year. Only two (Technology and Healthcare) of the 11 sectors in the S&P were up on the week with the energy sector getting shellacked thanks to a better than $7 a barrel drop in oil during the week.

10-Year Treasury Yield (MarketWatch)

During the week, the yield on the 10-Year Treasury moved past the 4.8% mark for the first time since just before the onset of the Great Financial Crisis. Average mortgage rates also hit their highest levels since the beginning of this century. This pushed housing affordability to all-time lows. A $500,000 home is now approximately $1,400 a month more expensive than it would have been with a three percent mortgage that was being handed out like candy through most of 2020 and 2021.

Jamie Dimon of JPMorgan Chase & Co. (JPM) was out earlier this month warning that Chairman Powell might have to take the Fed Funds rate all the way up to 7% to crush inflation. I do not believe that will be the case as I think that if the Federal Reserve takes interest rates up to six percent or even leaves them where they are now for a significant amount of time, it will push the country into a recession. This, in turn, will crush inflation and allow interest rates to eventually come down. Unfortunately, the economy and the markets will bear the pain of the coming economic contraction.

However, it is hard to see a scenario where inflation gets to the Fed’s official two percent target any other way. Interest rates where they are already are playing havoc across the economy and the full impacts of recent rate-hikes are not even fully reflected yet. Something that is called monetary lag.

Now higher interest rates are and will continue to have significant impacts across the consumer discretionary space, which I recently covered ‘The Consumer Is Toast’.

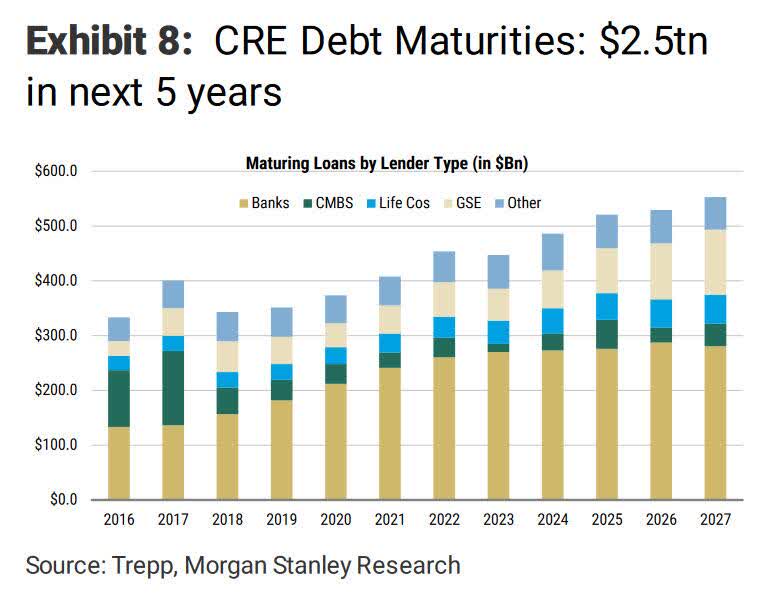

I have also covered the coming debacle in commercial real estate due to higher interest rates many times on these pages starting with an article entitled ‘Commercial Real Estate: The New Potential ‘Subprime” A quick synopsis of the CRE space is that some $2.5 trillion of CRE loans need to be rolled over during the next five years at much higher interest rates. Roughly 30% of that is against office properties, where asset values are imploding in major cities across the U.S. This is due largely to explosion of the virtual workforce since the pandemic as well as well-documented crime surges since then as well in places like San Francisco, New York City and Chicago.

Trepp, Morgan Stanley Research

Delinquency rates on loans tied to office buildings shot up to 5.58% in August, according to Trepp, after starting 2023 below the two percent threshold. The best-case scenario is that increasing write offs will cause some sort of ‘credit crunch‘ as banks pull back on lending and raise credit criteria further. The worst-case scenario is anybody’s guess at this point.

However, the impact on the federal government budget of higher interest rates has not garnered nearly the attention in the media that it deserves.

Through the first 11 months of the federal government’s fiscal year (ending September 30th), the interest cost to service the Federal debt was $808 billion, some $130 billion more than the same period a year ago. Given the Federal Reserve has to refinance approximately 30% of the $33 trillion in federal debt over the next 12 months and just over half of it over the next three years, the number is likely move substantially higher in the years ahead. To put this in context, the United States spent only $376 billion to service all of its debt in the pre-pandemic year of 2019. The U.S. will pay more interest on its debt in FY2023 than its massive military budget if one wants to look at it another way.

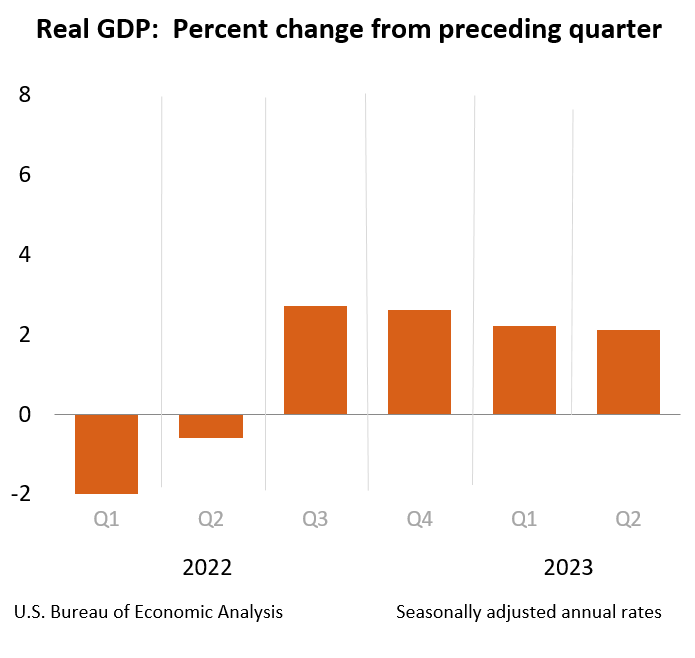

U.S. Bureau of Economic Analysis

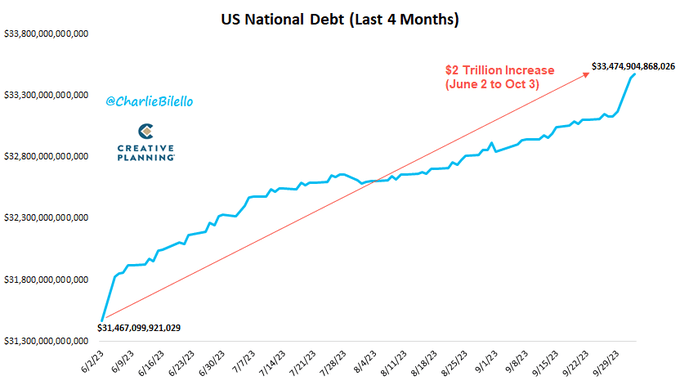

GDP grew at roughly two percent in the first half of the year and is likely to do the same or slightly better when the initial third quarter GDP estimate comes out at the end of the month. However, a good portion of this ‘growth’ has been powered by massive government spending programs (Ex, The CHIPs Act, The Inflation Reduction Act, etc…). To enable this, the government has added some $2 trillion to the national debt just in the four months since the debt ceiling was lifted.

U.S. National Debt

Obviously, this isn’t sustainable and frankly is downright scary given we are not even in a recession yet. I expect fourth quarter GDP to be down from the third quarter and believe we will see negative economic growth in the first half of 2024, much like the U.S. experienced in the first half of 2022 when the central bank first began lifting its Fed Funds rates. Except this time around, there will be no new huge government spending programs to help reverse the economic direction. Therefore, I think overall GDP growth in FY2024 will be negative.

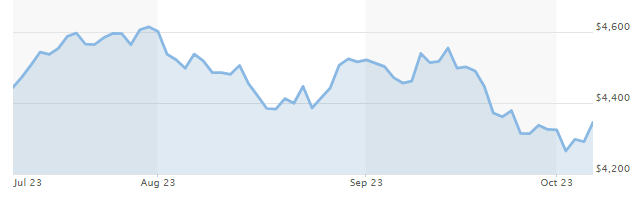

S&P 500 (MarketWatch)

Obviously, the markets are not priced for that scenario. As investors give up their hopes for a ‘soft landing‘, equities will head down from current levels. This is why half my portfolio is short term treasuries that currently yield 5.5%. I also think we will see at least a 20% pull back in the S&P 500 from its recent peak levels on July 31st. This would put us roughly at the 3,700 level on the S&P 500.

Anticipating this, I built up a solid holding of out of the money, long-dated bear put spreads against the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) in June and July when the S&P VIX Index (VIX) traded in a range of just 12-14 during those months. They were cheap ‘portfolio insurance‘ as they will pay out 8 to 12 to 1 if my prediction of a 20% decline in the S&P 500 comes to fruition by next summer. A scenario whose likelihood seems to be growing each week in recent months as higher interest rates continue to take a cumulative toll on the economy.

Life is not like water. Things in life don’t necessarily flow over the shortest possible route.“― Haruki Murakami

Read the full article here