The VRTX Investment Thesis Remains Robust Here, For So Long That Management Delivers On Its Premium Valuations

Vertex Pharmaceuticals (NASDAQ:VRTX) is an interesting biotech stock to observe, attributed to the management’s decision to embark on multiple clinical/ research programs for rare, life-threatening genetic diseases.

With it boasting multiple US FDA approved therapies for Cystic Fibrosis [CF] since 2012, it is unsurprising that the company commands a near monopoly in the market.

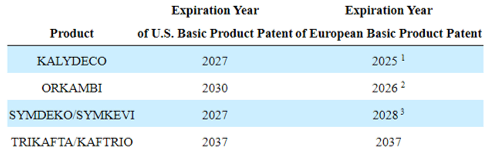

VRTX’s Patent Expiry

Seeking Alpha

VRTX’s TRIKAFTA/KAFTRIO’s patent expiry in the US and the EU remained elongated through 2037, implying the continued safety of its top and bottom lines, since the therapy comprise 89.9% of its sales (+1.8 points QoQ/ +3.6 points YoY) at $2.24B in FQ2’23 (+7.1% QoQ/ +18.5% YoY).

Despite only having four products, the biotech company has also been able to record an impressive profitability, with operating margins of 45.6% (-1.7 points QoQ/ -5.9 YoY) and GAAP EPS of $3.52 (+30.8% QoQ/ +12.4% YoY) in the latest quarter.

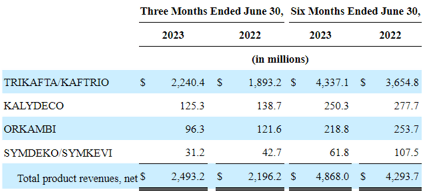

VRTX’s Product Revenues In FQ2’23

Seeking Alpha

Therefore, while VRTX’s three other therapies are expiring over the next five years (in some regions), we are not overly concerned, especially due to their reduced top-line contributions thus far.

For example, KALYDECO is expected is expected to expire in the EU by 2025, ORKAMBI in the EU by 2026, and SYMDEKO/SYMKEVI in the US by 2027.

These only comprise 5% (-0.2 points QoQ/ -1.3 points YoY), 3.8% (-1.3 points QoQ/ -1.7 points YoY), and 1.2% (inline QoQ/ -0.7 points YoY) of the biotech company’s top-line in FQ2’23.

Despite TRIKAFTA/KAFTRIO’s outperformance, the VRTX management is not resting on its laurels as well, based on the aggressive pipeline including:

- CF therapy, Vanzacaftor–Tezacaftor–Deutivacaftor at Clinical Phase 3.

- Pain, VX-548 at Clinical Phase 3, as a potential non-opioid medicines for the treatment of both acute and neuropathic pain.

- Sickle Cell Disease/ Beta Thalassemia at Clinical Phase 2/3.

- APOL1-mediated kidney disease at Clinical Phase 2/3 (no results yet), with the rest still in earlier clinical stages.

While it remains to be seen if VRTX may be able to successfully bring all of these pipelines through to FDA approval, we are cautiously optimistic, due to the promising early results/ peer-reviews as individually linked above.

Most importantly, the biotech company has also obtained Fast Track designations and/ or Regenerative Medicine Advanced Therapy [RMAT] and/ or Orphan Drug Designations for most of these pipelines. These allow expedited review processes with the US FDA/ EU EMA and potentially, streamlined commercialization.

VRTX’s prospects from these pipelines are excellent as well, based on the market analysts’ projections below, warranting its intensified R&D efforts at $896.2M (-17.7% QoQ/ +35.3% YoY) in FQ2’23:

- The global Cystic Fibrosis market size is expected to grow from $10.86B in 2022 to $24.35B in 2028, expanding at a CAGR of +14.4%.

- The global Sickle Cell Disease market size from $1.73B in 2021 to $8.75B in 2029, at a CAGR of +21.4%.

- The global Beta Thalassemia market size from $8.32b in 2022 to $11.22B in 2030, at a CAGR of +8%.

- This is on top of the management’s projection of Acute Pain market size of $4B in 2023, compared to the general pain management therapeutics market size growth from $72.41B in 2021 to $105.77B in 2030, at a CAGR of +4.3%.

These optimistic numbers are also concurred by the management’s raised FY2023 revenue guidance to $9.75B at the midpoint (+9.1% YoY), compared to the previous guidance of $9.62B (+7.7% YoY), “primarily driven by the strong uptake of TRIKAFTA/KAFTRIO globally.”

So, Is VRTX Stock A Buy, Sell, Or Hold?

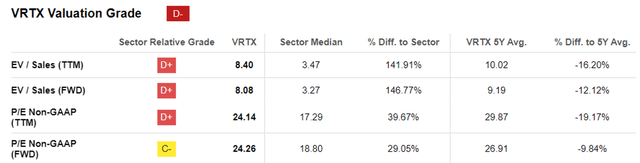

VRTX Valuations

Seeking Alpha

As a result of these promising developments, we can understand why Mr. Market has rewarded the VRTX stock with its premium valuations compared to the sector medians, maintaining the same trend over the past five years.

We believe these valuations are justified as well, nearing AbbVie’s (ABBV) normalized FWD P/E of 25.54x attributed to its best-selling global drug, Humira at peak annual revenues of $21.23B, or Merck’s (MRK) FWD P/E of 48.01x with Keytruda at $20.93B.

Based on VRTX’s consensus FY2025 adj EPS estimates of $17.55, we are also looking at a long-term price target of $425.76, implying a more than decent upside potential of +19.2% from current levels.

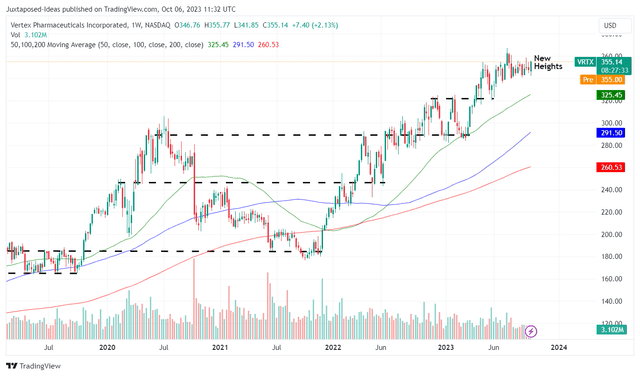

VRTX 5Y Stock Price

Trading View

Then again, with VRTX already charting new heights at the time of writing, investors may want to adopt a wait/ see attitude and only add at any pullbacks. Since the stock does not pay any dividends, there is no harm in patience as well.

Based on its sideways trading pattern since April 2023, it remains to be seen how the stock may perform in the short term.

Therefore, while we may rate VRTX as a Buy, there is no specific entry point to this rating, since it depends on individual investors’ dollar cost averages, risk appetite, and portfolio allocation.

Naturally, there are risks to this investment thesis, since the stock’s valuations remain rich, despite the slight moderation from its 1Y and 5Y means. Assuming any earnings miss and/ or lowered forward guidance, we may also see the stock potentially tumble from these lofty levels.

In addition, the common issues faced by other biotech/ pharmaceutical companies remain relevant to VRTX, as the ongoing clinical trials are no guarantees to future results. For example, the company had been working on its CF pipeline for more than ten years, prior to its first US FDA approval in 2012.

As a result of the potential volatility, investors that add here may also want to keep their biotech portfolio appropriately sized according to their risk appetites, since VRTX’s eventual pipeline success remains speculative.

Read the full article here