JPMorgan Chase (NYSE:JPM) reports Q3 results on Friday before the market opens. As always, earnings season is kicked off by the big banks, with Wells Fargo (WFC) and Citi (C) also due to come to the confessional box. As the largest bank in the US, JPMorgan emerged as the biggest winner of the spring bank crisis- buying the scraps of First Republic (OTCPK:FRCB) on the cheap. It’s likely that JPMorgan will reveal that they’re continuing to do well, but the earnings conference call will be closely watched for CEO Jamie Dimon’s comments on the economy, interest rates, and inflation. Without further ado, let’s take a look at JPMorgan with the key questions that investors should be able to answer.

1. Is The Regional Bank Crisis Really Over?

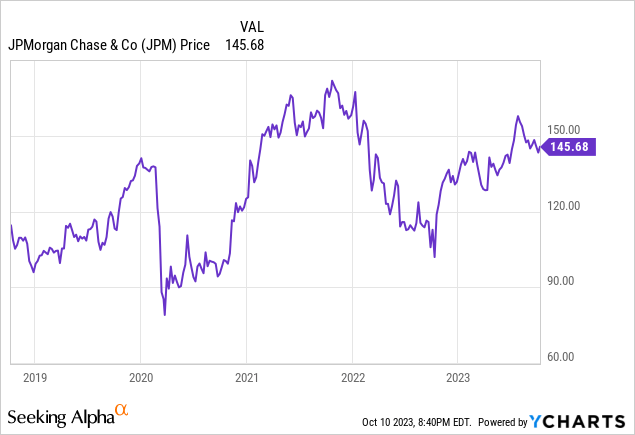

As mentioned, JPMorgan emerged as a big winner from the regional bank crisis. During the crisis, deposits fled from shaky regional banks into megabanks like JPMorgan Chase. Even better for JPM, being the biggest bank in America meant JPMorgan was in a prime position to get a great deal on First Republic. As such, JPM is one of the few large banks that has seen positive returns this year.

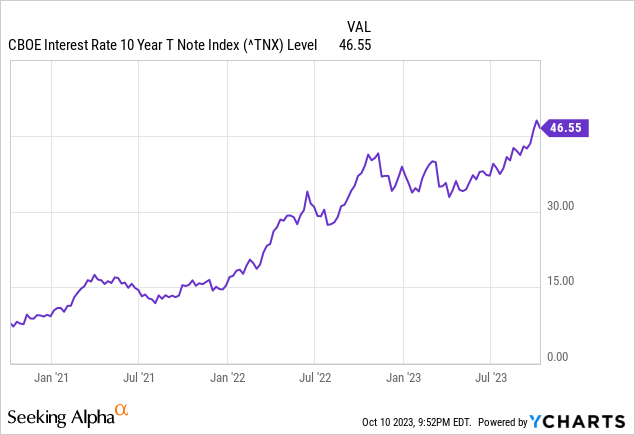

Thinking back to the regional bank crisis in March, what caused these banks to fail was too much exposure to rising interest rates. Interest rates retreated in March and April and financial conditions loosened, but since then?

See the huge drop in March in yields, then the steady increase after? Yields have breached the highest levels they’d been at post-2008, so the losses at regional banks are likely bigger now, not smaller than they were 3-6 months ago.

The question then becomes whether banks have ample liquidity, which they do seem to have for now. My guess is that the regional bank crisis is not over and that there will be a second act from some combination of bad commercial real estate loans, rising interest rate exposure, and lack of liquidity. It’s not the end of the world, but it likely will be the end of the current business cycle. Note that this isn’t necessarily bad for JPM, as they’re likely to be a beneficiary of future bank consolidation. Dimon is likely to get questions about this as well, so it will be interesting to see what his thoughts are.

Dimon tends to be much more bearish than Bank of America CEO Brian Moynihan, but his bearishness pays off in the form of higher shareholder returns. Bank of America isn’t a bad stock, but they have much more interest rate/duration exposure than JPM does. Maybe we should be more bullish on bearish CEOs.

2. How Is The First Republic Acquisition Doing, And Will There Be More?

Due to JPM simply being so massive, the First Republic acquisition was more of an incremental add-on a total game-changer for JPM. However, it is important to see how the acquisition is going (reading between the lines of course), not only for the deal itself but also to see what JPMorgan’s appetite may be for doing more rescues in the next 12-18 months. If JPM has the acquisition machine functioning smoothly, then it’s not inconceivable that they could take over one or more other regional banks at a solid price. An update on the First Republic deal will certainly be welcome for these reasons

To my earlier point on First Republic, big banks may have some trouble making big acquisitions due to the new capital rules proposed by US regulators. Acquisitions may still happen due to necessity, but buybacks and dividends could be curtailed even by no fault of JPM’s management. On the plus side, JPM trades for only ~9x earnings. There’s potentially some solid value here- it’s not hard to imagine the stock doubling in 3-5 years from a combination of multiple expansion and earnings growth if they can make it through a recession relatively unscathed. Analysts have already started to price a recession in JPM’s earnings (ironically while revising current year earnings higher), but after the cycle troughs, EPS might surprise to the upside. It’s simply not that hard to beat low expectations.

3. How’s The US Economy Doing?

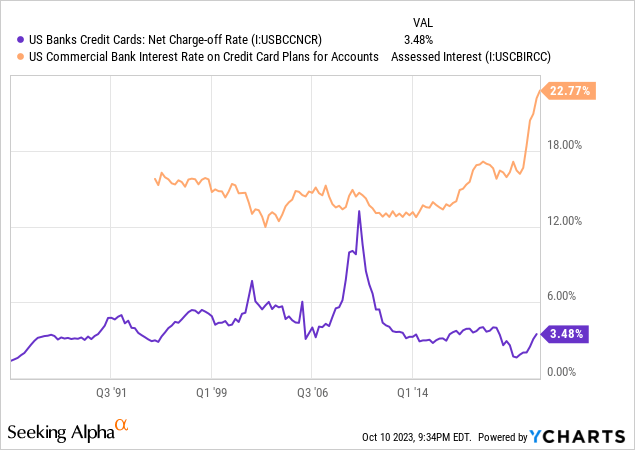

One of the privileges of running the largest bank in the US is the sheer amount of data that JPM has on American consumers. If the economy and consumer spending is slowing, JPMorgan will be first to know. My educated guess is that the economy is slowing considerably from higher interest rates, the resumption of student loans, and the exhaustion of previous savings built up before and during the pandemic. The most anticipated recession ever is still coming- there’s simply no way that there isn’t dead wood to burn after 14 years of zero-interest rate policy.

But the question here is not whether the U.S. economy will enter recession, but whether JPM stock is worth buying. At ~9x earnings, you’re getting plenty of compensation for this. JPM is very likely good for its 3% dividend yield, and the 6.2% qualified dividend yield in the preferred stock (NYSE:JPM.PR.C) is even more solid. In JPM’s case, the higher interest rates aren’t hurting them very much because they can get away with paying 0% on checking. A rise in the unemployment rate would drive loan defaults, and that will hurt JPM’s earnings. Remember that even at the worst of the 2008 financial crisis and ensuing recession, credit card companies still made money.

You can and should worry about the macroeconomy, but the risks to JPM stock shouldn’t be as severe as they are in more high-flying stocks with higher multiples. At least they don’t seem to be! JPM is certainly not a recession-proof stock. It can certainly get cheaper. But if you’re willing to hold it for 3-5 years you seem to be getting a great price at today’s levels!

Bottom Line

I’ve said it before and I’ll repeat it again. The common and preferred stocks of too-big-to-fail megabanks are buys, most smaller banks are holds, and banks that have runs or rumors of insolvency are sells. JPM common stock is buyable here and looks undervalued compared to its prospects over the coming 5 years. JPM preferred stock is also worth a look as well for one of the safer 6.2% yields you can find on the market today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here