Stocks are rising despite a stack of reasons to fall: war in the Middle East, confounding economic data, and a House of Representatives without a speaker. Thank a decline in bond yields driven by less-hawkish comments from Federal Reserve officials, plus investors seeking safety in Treasuries.

The

S&P 500

had been on a losing streak until recently, leaving it down about 5.5% in the three weeks through Thursday. Despite all the negative headlines, the index has bounced back since then, rising nearly 3% in three trading days, including a gain of 1.1% as of midday Tuesday.

That initial decline and subsequent rebound in stocks has coincided with a change in direction for bond yields. They rose strongly for most of August and September, but have been dropping since late last week.

“A market obsessively focused on Treasury yields saw rates edge lower due to the market’s interpretation of the remarks in addition to global buying of Treasuries as a safe haven during the intensifying conflict between Israel and Hamas,” wrote Quincy Krosby, chief global strategist for LPL Financial, on Tuesday.

The yield on the

10-year U.S. Treasury note

hit 4.80% on Oct. 3, rising a full percentage point since late July to its highest since 2007, while the 2-year yield was at 5.15%. Since then, the 10-year yield has pulled back to 4.63% and the 2-year yield has dropped to 4.94%.

Higher bond yields mean more competition for stocks in investors’ portfolios, while also increasing borrowing costs for businesses and consumers. That is an essential element of the Federal Reserve’s campaign against inflation. Tighter financial conditions slow down the economy and spending, reducing the upward pressure on prices.

In recent days, Fed officials have acknowledged the rise in bond yields and how it affects the economy and financial conditions, helping the bank to put the brakes on demand and inflation—effectively doing some of the Fed’s work for it.

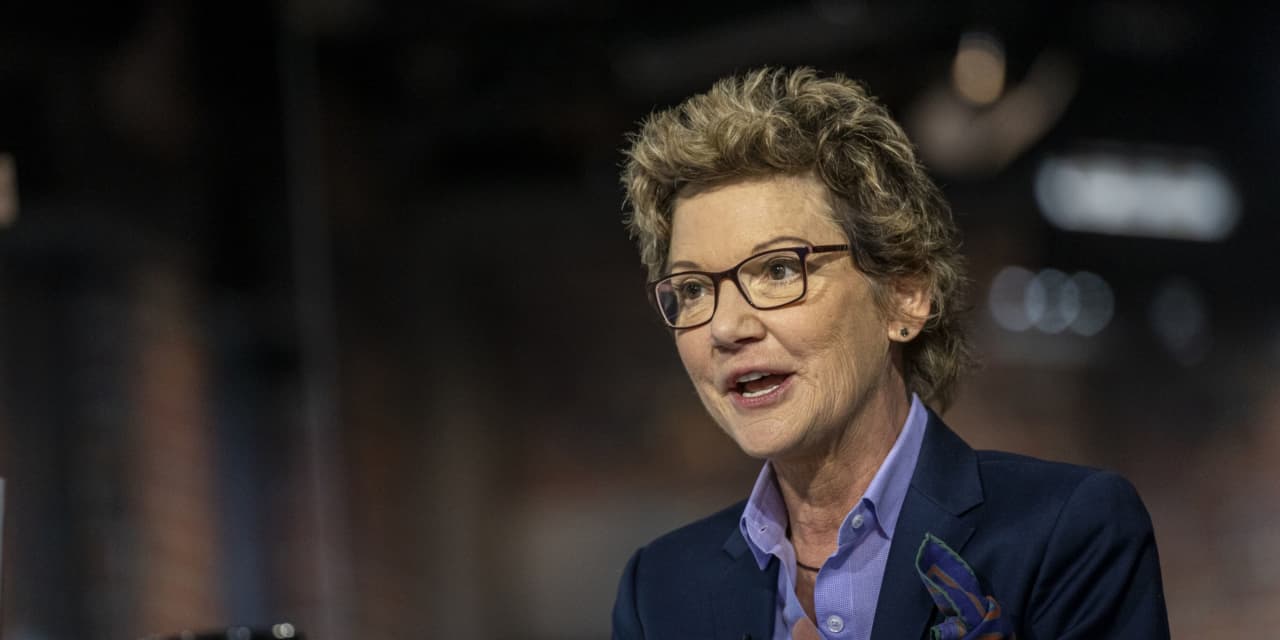

“If financial conditions, which have tightened considerably in the past 90 days, remain tight, the need for us to take further action is diminished,” Federal Reserve Bank of San Francisco President Mary Daly said last Thursday.

“If long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed-funds rate,” Dallas Fed President Lorie Logan said on Monday.

Atlanta Fed President Raphael Bostic cut straight to the point in remarks on Tuesday morning. “I don’t think we need to increase rates anymore,” he said.

Accordingly, interest-rate futures markets have moved to price in lower odds of additional increases in the fed-funds rate this year. Bond yields have declined, boosting stocks.

A rebound was in the cards after weeks of declines, but stock investors aren’t out of the woods yet. Should the war between Israel and Hamas escalate into wider regional hostilities that disrupt oil and gas supplies, it will push the price of the commodities higher, adding to inflation.

Since the summer, investors have viewed strong jobs and economic data through a good-news-is-bad-news lens. The logic has been that signs of strength in the economy mean that it could weather more interest-rate hikes from the Fed if central bankers decide that is needed to stamp out inflation. That same dynamic, which remains in play, also affects the odds of cuts in 2024.

The next wild-card for investors lands this Thursday with the release of the consumer price index for September. On average, economists are predicting increases of 0.3% in both the headline CPI and the core CPI, which excludes food and energy. That would leave the annual inflation rates for those metrics at 3.6% and 4.1%, respectively—lower than they were in August.

If the inflation numbers come in higher than expected, expect another jump in bond yields and a decline for stocks. And vice versa.

“The Fed is shifting away from further rate hikes, and its tightening bias too may be dropped by December,” wrote Macquarie Group strategist Thierry Wizman on Tuesday. “But for the Fed to also ease up on ‘high for long’ may require more evidence of a weakening U.S. economy—led by the consumer. That’s not now, but could be by early 2024 if the coming slowdown is significant. If so, [Treasury] bonds are cheap.”

Write to Nicholas Jasinski at [email protected]

Read the full article here