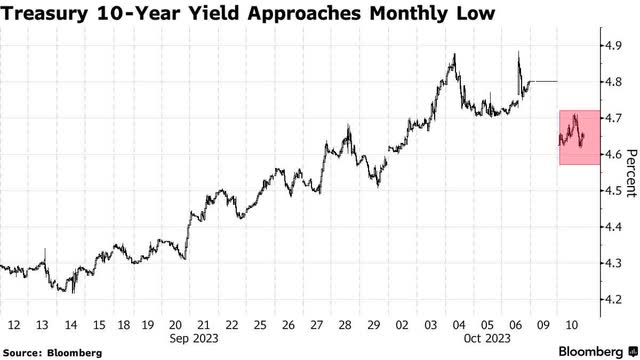

Stocks prices rose broadly for a third day in a row in what looks like the first inning of the year-end rally I have been expecting, but yesterday’s price action had a new tailwind – falling interest rates. Bond yields fell sharply with the 10-year closing 13 basis points lower to 4.66%, while the 2-year fell 11 basis points to 4.97%. This calls into question the prediction that the Fed will raise rates again, much less keep them “higher for longer.” It was this fear that instigated the sell-off in stock prices at the beginning of August. It was also a fear that I felt was misplaced, and it seems some Fed officials are finally starting to acknowledge that.

Finviz

Not long after I suggested that the cure for rising interest rates was rising interest rates, Fed Vice Chair Phillip Jefferson and Fed President Lorie Logan both indicated on Monday that the recent surge in bond yields had tightened financial conditions to the extent that the Fed may no longer need to do more. Fed President Raphael Bostic went as far to say that “policy is restrictive enough to lower prices to the 2% goal.” Bostic is not a voting member this year, but I think he is saying what most voting members are thinking.

Bloomberg

I seriously doubt we will hear a consensus at the Fed express his view for fear that financial conditions loosen before the 2% target is within sight. Instead, members will continue to use rhetoric to raise doubts, as they have been doing for months, while bears lean on those doubts to support the higher-for-longer narrative. I think this is a bear trap that investors should avoid.

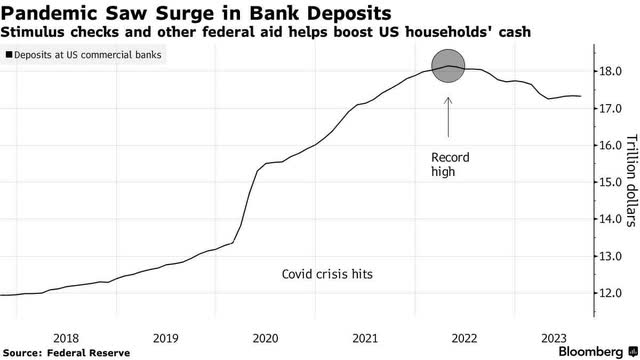

If bond yields have peaked and start to edge lower, that will be a welcome tailwind for risk asset prices that strengthens the outlook for a soft landing in 2024. Perhaps more important is news that consumers are sitting on far more excess savings than originally thought at this juncture in the business cycle. Most market pundits who are forecasting a recession in coming months were relying on this mountain of spending power to be gone by now.

The Bureau of Economic Analysis (BEA) recently completed a comprehensive update of national economic data that lowered the savings rate prior to the pandemic and increased it in 2020 and 2021. This basically reflected a change in the way the BEA accounts for income from mutual funds and REITS. The bottom line is that it has forced Wall Street economists to increase their excess savings projections to date by as much as $600 billion to $1 trillion, depending on the economics team.

Bloomberg

This has forced some to push out their recession calls by six months or more and reduce the size of the expected contraction, while others see better odds of a soft landing. The larger amount of excess savings helps explain the resilience we see in the ISM and S&P Global service sector surveys.

Critics of this new data will say that most of this excess cash is held by wealthier households, which may be true, but that does not mean they won’t spend some of it in the coming year. That will help support a continuation of real consumer spending growth, which is the backbone of the expansion.

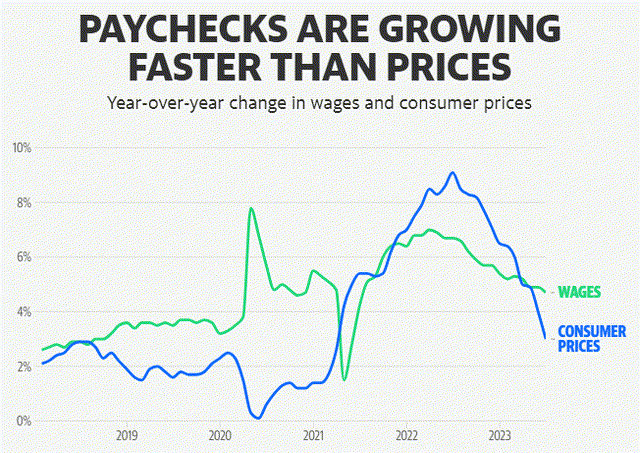

Furthermore, real incomes for most consumers are finally starting to grow again, as the rate of inflation falls below nominal wage gains. That is more important than excess savings when it comes to the middle-income households who do most of the heavy lifting for economic growth.

Yahoo Finance

I think the market correction is over, and the Fed’s rate-hike cycle has concluded, which means long-term bond yields have probably peaked, and the dollar should start to weaken modestly. If corporate earnings are stronger than expected, which is also my expectation, we should see an impressive rally in risk assets prices during the fourth quarter. Furthermore, the BEA just uncovered as many as $1 trillion new reasons for me to stick with my outlook for a soft landing.

Read the full article here