Almost a year ago, I wrote a cautious initiation article on the Clough Global Opportunities Fund (NYSE:GLO), arguing that the fund’s 19.8% distribution yield was likely unsustainable given poor investment performance. Since my article, the GLO fund has dramatically slashed its distribution, from $0.0943 / month to $0.0483 / month. Given the dramatic 49% cut to the distribution, has expectations for the GLO fund been reset, and can the fund recover from a series of bad macro calls?

Brief Fund Overview

The Clough Global Opportunities Fund is a closed-end fund (“CEF”) managed by star manager, Charles Clough, that opportunistically invests in a global portfolio of equities and fixed income securities.

Mr. Clough is an all-star investment strategist with over 50 years of experience. Prior to managing money, Mr. Clough was the Chief Global Investment Strategist for Merrill Lynch & Co. for over a decade and was named to the Institutional Investor All-American Research Team for 12 years and was the top ranked strategist on three separate occasions.

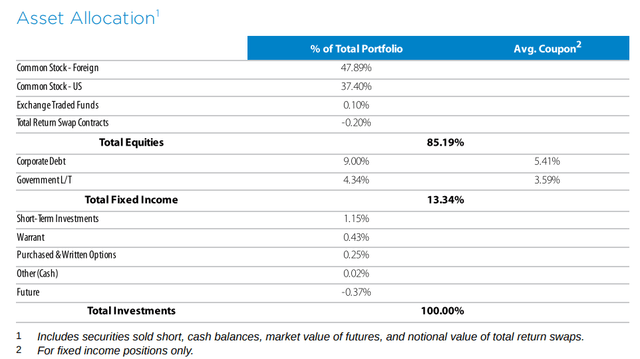

As of July 31, 2023, the GLO fund $263 million in net assets with 26.8% leverage. Figure 1 shows the fund’s asset allocation, with 85.2% invested in equities and 13.3% invested in bonds.

Figure 1 – GLO asset allocation (GLO factsheet)

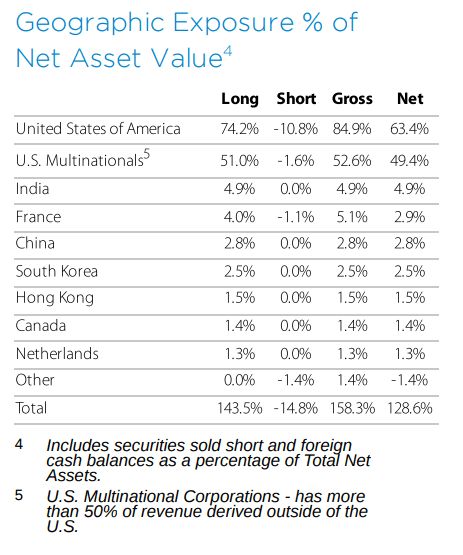

The GLO fund’s geographical exposure is shown in Figure 2. Notably, GLO’s global investment theme in 2023 is focused on India with a 4.9% net weight, on the premise that global investors would divert their investments from China to India given heightened geopolitical risks.

Figure 2 – GLO geographical allocation (GLO factsheet)

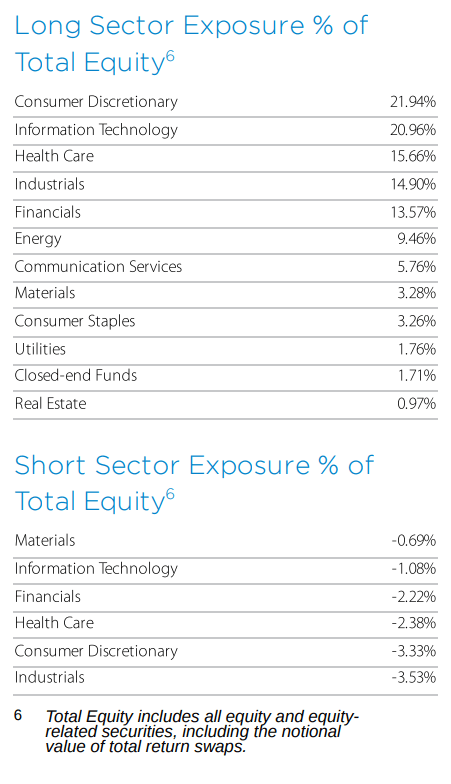

Figure 3 shows the GLO fund’s sector allocation. Other key investment themes for the GLO fund for 2023 are Health Care, Aerospace & Defense, and Oil & Energy, leading to sector over weights in those areas.

Figure 3 – GLO sector allocation (GLO factsheet)

Returns Fail To Rebound

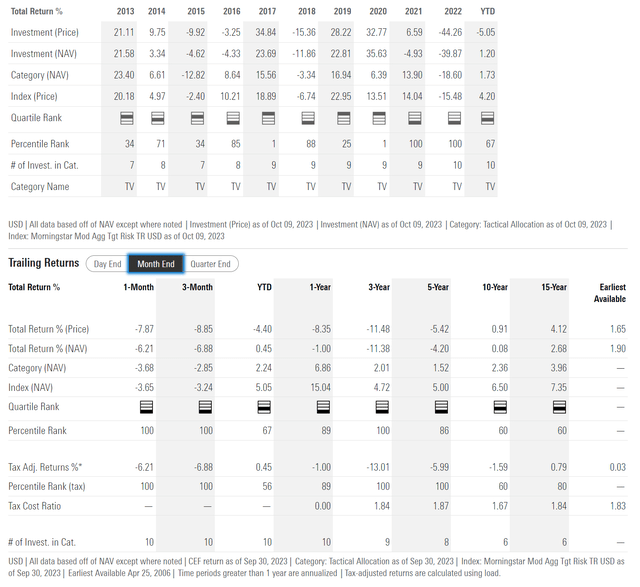

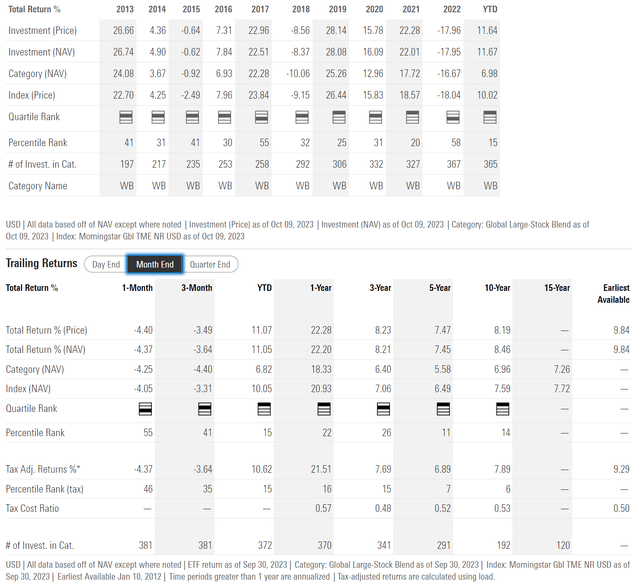

As we wrote about in our prior article, 2022 was a disaster year for the GLO fund, with the fund declining by 39.9% on a NAV basis (Figure 4), far worse than the MSCI World Index, as modeled by the iShares MSCI World ETF (URTH), which only lost 18.0% in 2022 (Figure 5).

Figure 4 – GLO historical returns (morningstar.com)

Figure 5 – URTH historical returns (morningstar.com)

The primary driver behind 2022’s poor performance was a series of bad macro calls, including believing inflation was transitory and betting on a rebound in Chinese equities.

Although 2022 was an abysmal year in terms of absolute and relative performance, 2023 is shaping up to be another bad year in relative terms, as the GLO fund has only appreciated by 0.5% to the end of September while the URTH has gained 11.1%, or a relative underperformance of 10.6% YTD.

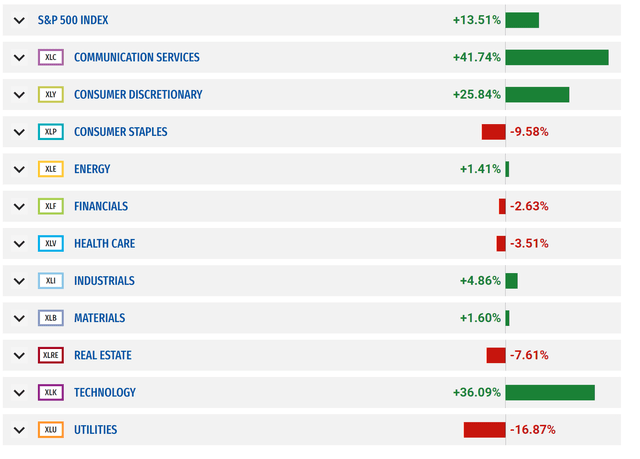

This is because Health Care and Energy, two of GLO’s big macro bets, have been two of weakest sectors YTD (Figure 6).

Figure 6 – Health Care and Energy have been weak YTD 2023 (sectorspdrs.com)

Star Manager Is Striking Out

Overall, GLO’s long-term track record leaves much to be desired with a 10 year average annual return of 0.1% to September 30, 2023 compared to 8.5% for URTH.

As we observed in our prior article, GLO’s investment strategy revolves around its star manager making differentiated macro calls. In some years, it pays off like in 2020 when GLO returned 35.6% vs. 16.1% for the URTH. However, over the long-run, this over-reliance on differentiated macro calls may be flawed as inevitably, big bets can lead to big losses and large underperformance. The GLO fund has now massively underperformed URTH ETF for 3 years in a row.

To understand why this strategy underperforms, investors should go read the latest memo by Howard Marks titled “Fewer Losers, More Winners?”.

Mr. Mark’s memos were inspired by the investment record of David VanBenschoten, the head of the General Mills pension fund. In his 14 years running the pension fund, Mr. VanBenschoten was a solid 2nd quartile manager, never ranking above 27th percentile nor below 47th percentile. However, Mr. VanBenschoten’s cumulative 14 year track record was 4th percentile!

“Most investors aiming for top-decile performance eventually shoot themselves in the foot.”

By striving for differentiated macro calls that lead to outperformance like in 2020, the GLO fund introduces extreme volatility and huge losses that can’t be easily recouped. In the long run, it leads to underperformance.

Distribution & Yield

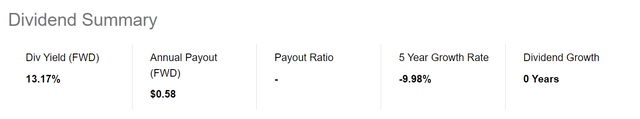

One saving grace for the GLO fund may be its attractive distribution yield. The GLO fund pays a monthly distribution currently set at $0.0483 / month for a 13.2% yield (Figure 7). Due to the GLO fund trading at a massive discount to NAV, it is only yielding 10.6% on NAV.

Figure 7 – GLO distribution yield (Seeking Alpha)

However, given the fund’s poor short- and long-term track record (3Yr average annual return of -11.4% p.a. and 10Yr average annual return of 0.1% p.a.), I worry this distribution yield may have to be cut yet again in the new year.

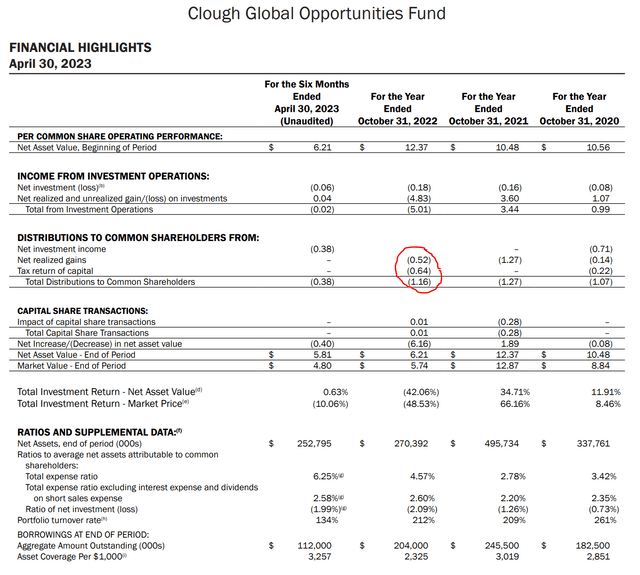

The GLO fund heavily utilized return of capital (“ROC”) to fund its fiscal 2022 distribution, and will likely have fund distributions via ROC in 2023, given its portfolio generates little in net investment income and the fund has run out of gains to harvest (Figure 8).

Figure 8 – GLO relied on ROC in 2022 (GLO semi-annual report)

Enormous Fees For Abysmal Performance

To add insult to injury, the GLO fund charges an outrageous 6.25% annualized expense ratio in the 6 months to April 30, 2023.

Conclusion

My main criticism of the GLO fund remains unchanged. It relies too heavily on its star manager to make differentiated macro calls to generate outperformance. This strategy is unsustainable as even the best managers only get 60% of the calls right.

Unfortunately, it appears the GLO fund is in the midst of a terrible streak of bad calls, as the fund has massively underperformed for 3 years in a row with an -11.4% p.a. return over 3 years compared to 8.2% p.a. for a passive ETF that charges 1/25th of the fees (0.24% net expense ratio vs. 6.25%!).

I recommend investors avoid the GLO fund and its over-reliance on ‘differentiated macro calls’ and seek their global exposure elsewhere.

Read the full article here