Comstock Resources (NYSE:CRK) is still likely to burn cash during the second half of 2023, but natural gas strip prices have improved enough so that it is now projected to generate a bit over $200 million in 2024 free cash flows before dividends. With approximately $139 million in annual dividends, Comstock should thus be able to modestly reduce its net debt next year. This is an improvement compared to the slight post-dividend cash burn that I had previously predicted for it in 2024.

Comstock is roughly fairly priced for long-term $3.75 NYMEX gas and I estimate its value at approximately $14.75 per share at long-term $4.00 NYMEX gas.

I am keeping my estimate of long-term natural gas prices at $3.75 for now, but could bump this up in the future based on overall production trends. Overall natural gas production growth has been relatively flat and the Haynesville rig count is down to a level that should result in declining production.

Potential 2024 Outlook

I am continuing to model Comstock’s 2024 production at 1,450 MMCFE per day with a $1 billion capex budget.

The current NYMEX gas strip for 2024 is approximately $3.65, which is a price that should allow Comstock to generate $1.802 billion in oil and gas revenues. Comstock has minimal oil production, so oil prices do not have a material impact on Comstock’s results.

Comstock added 2024 hedges covering 120 MMCF per day in natural gas production at approximately $3.60 per Mcf between its Q2 2023 earnings report and its September 2023 investor presentation.

It now has hedges covering 250 MMCF per day in 2024 natural gas production at an average price of $3.55. Comstock’s hedges have around negative $9 million in valued at current 2024 strip, and cover around 17% of its projected 2024 natural gas production.

|

Type |

Barrels/Mcf |

Realized $ Per Barrel/Mcf |

Revenue ($ Million) |

|

Oil (Barrels) |

55,000 |

$71.00 |

$4 |

|

Natural Gas [MCF] |

528,920,000 |

$3.40 |

$1,798 |

|

Net Gas Services |

$20 |

||

|

Hedge Value |

-$9 |

||

|

Total |

$1,813 |

Comstock is now projected to generate $206 million in free cash flow in 2024 before dividends while growing production slightly from its average 2023 levels. After dividends, Comstock would generate $67 million in positive cash flow.

|

$ Million |

|

|

Lease Operating Expense |

$138 |

|

Production and Other Taxes |

$99 |

|

Gathering and Transportation |

$180 |

|

Cash G&A |

$35 |

|

Cash Interest |

$155 |

|

Dividends |

$139 |

|

CapEx and Leasing |

$1,000 |

|

Total Expenses |

$1,746 |

Notes On Debt

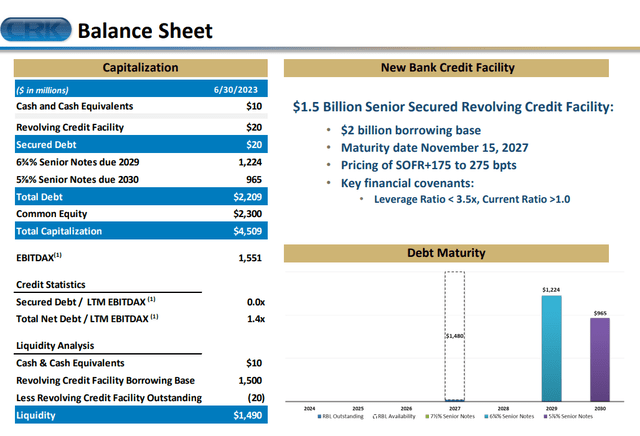

I currently project Comstock to end 2023 with around $200 million in net credit facility debt. Comstock’s 2024 free cash flow (after dividends) would reduce its net credit facility debt slightly to around $133 million by the end of 2024.

Comstock also has $2.189 billion in unsecured notes maturing in 2029 and 2030. These notes are currently yielding approximately 8.6% to maturity. I believe Comstock’s unsecured notes are a reasonably good value with little credit facility debt ahead of the notes in the capital structure, and Jerry Jones’s large ownership stake in Comstock’s common shares.

Comstock’s Debt (comstockresources.com)

Estimated Valuation

Comstock’s projected free cash flow over the next year and a bit has gone up modestly due to improved strip price. As a result, I’ve increased Comstock’s estimated value to around $12.75 per share at long-term (after 2024) $3.75 NYMEX gas and $14.75 per share at long-term (after 2024) $4.00 NYMEX gas.

I am still maintaining my long-term natural gas price at $3.75, although the three-year natural gas strip (from 2024 to 2026) is currently around $3.90.

There is a reasonable case to be made for $4.00 longer-term gas prices with Haynesville production likely to start dropping with the Haynesville rig count down to 39 now, compared to a high of 96 rigs in January.

I believe that $4 NYMEX natural gas prices may be necessary for the Haynesville to contribute meaningfully to overall natural gas production growth.

Conclusion

Natural gas strip prices have improved, resulting in a projection of $206 million in 2024 free cash flow for Comstock before dividends now at current strip (roughly $3.60 NYMEX gas).

I am keeping my long-term natural gas price at $3.75 for now, which is a natural gas price that I consider Comstock (at $12.50 per share) to be a hold at. Comstock’s bonds look reasonably attractive with a 8.6% yield to maturity currently.

At long-term $4.00 NYMEX gas, Comstock has some upside to around $14.75 per share. I am considering moving my long-term natural gas price to $4.00, but am being more conservative for the time being.

Read the full article here