With interest rates at 23 year highs, it can be a challenge to find quality prospects that pay out more attractive distributions than what owning government debt can grant you. Back when interest rates were around 0%, owning shares of a company that got you 3% or 4% was not terribly difficult and the payout was acceptable. But today, beating interest rates does not come easy, especially if you want to keep your risk profile on the safer side. One company that does offer such an opportunity, boasting a yield as of this writing of nearly 7.1% (on top of the occasional supplemental distribution), is BDC (business development company) Main Street Capital (NYSE:MAIN).

Earlier this year, I had a rather neutral opinion of the enterprise, even rating it a ‘hold’. Broader economic uncertainty and the valuation of the company at the time led me to take that cautious approach. To be clear, economic uncertainty has only grown since then. But it’s not all about the economy. Fundamentals also play an important role in any investment decision. And when you look at the recent performance achieved by Main Street Capital, a case could be made that the company is now more attractive than it was back in June, though there are some signs investors should keep a close eye on. Given the changes that we have seen, I have now decided to upgrade the stock from a ‘hold’ to a ‘buy’ to reflect my view that shares are likely to outperform the broader market for the foreseeable future. But investors would be wise to be diligent and keep a close eye on some important metrics if they do elect to buy into it.

The picture is getting better

Having followed Main Street Capital for some time now, I would never go so far as to say that the company has achieved poor performance. When your primary business is lending out capital and collecting it with interest from debt securities or appreciation from equity securities, particularly the former, it’s difficult to achieve bad performance so long as you remain diversified and principled. And it’s diversification and an adherence to certain principles that the management team at this prospect embodies.

I don’t believe that it would be terribly valuable in this article to perform a deep dive into all aspects of Main Street Capital and how it operates. This is because, in the past, I have done so. My very first article on the enterprise, published in May of 2018, did precisely that. So instead of rehashing those details, I would encourage you to read it here. This doesn’t mean, however, that we can’t or shouldn’t go over some recent and important portfolio metrics.

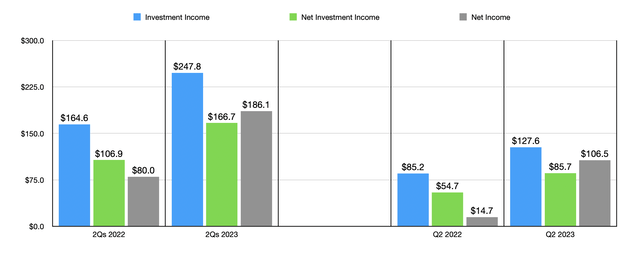

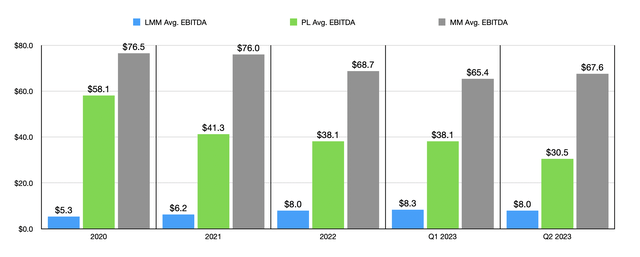

Author – SEC EDGAR Data

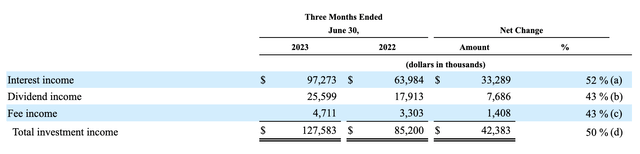

It might be helpful, however, to start with the income the company has been generating. Take, as an example, the second quarter of the company’s 2023 fiscal year. Net investment income for the enterprise totaled $85.7 million for the quarter. That’s up significantly compared to the $54.7 million the company generated one year earlier. The primary driver behind this increase was gross interest income. It skyrocketed 52% from $64 million to $97.3 million. Higher interest rates for the economy led to Main Street Capital benefiting from parts of its portfolio that include debt that is structured to be floating. An increase in interest rate spreads on new investments and higher average levels of income producing debt investments were also contributors. Of course, there were other areas in which the company improved as well. Dividend income, for instance, shot up by 43%, though approximately half of that improvement is considered non-recurring. However, the company did benefit from strong recurring dividend income from its portfolio of companies. Fee income, meanwhile, shot up 43% as well, with this increase attributable to higher originations of investment portfolio assets for the most part.

Main Street Capital

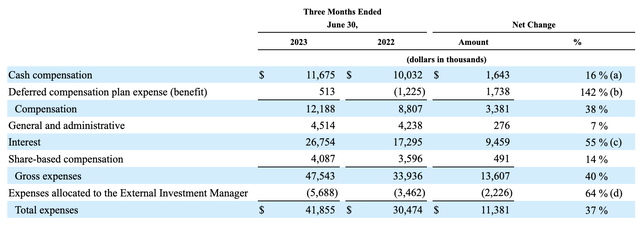

This is not to say that there were not any negative developments. The interest that it pays, for instance, shot up by 55% year over year. There were other cost increases as well. However, because many of the companies cost items are only semi variable in nature, while others have a fixed component, total expenses grew only 37%. This allowed net income for the company to skyrocket from $14.7 million to $106.5 million. It should be noted that the second quarter was not a blip on the radar, though it certainly was a truly stellar quarter. As you can see in the first chart in this article, financial performance for the first half of this year relative to the same time last year was also really great. Gross investment income, net investment income, and net profits were all higher year over year.

Main Street Capital

To the cautious, value-oriented investor like me, this does slightly concerning. I love seeing higher performance, but a lot of my early investment experiences involved navigating treacherous waters during the 2008 and 2009 financial collapse. I have always been on the lookout for the negative to returns that appear to be abnormal. That’s why, for a company like this, you cannot afford to just look at surface level data. Yes, things might be fine now. But when you consider the debt investments that it has, you can also imagine what impact higher interest rates are having on the companies that are having to pay that debt each month or each quarter. The worst thing for a company like Main Street Capital would be a systemic downturn in which many of its portfolio companies start to struggle.

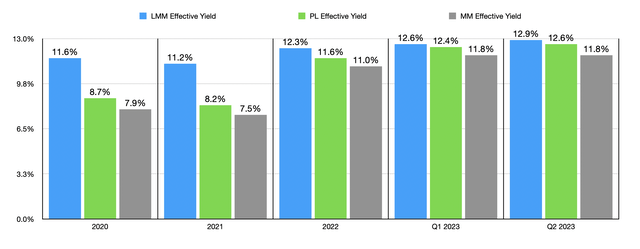

Author – SEC EDGAR Data

On the interest rate side of things, we have seen evidence that companies are having to pay more. Back in 2021, the effect of yield for the company’s LMM (lower middle market) investments came in at 11.2%. This managed to grow to 12.3% in 2022 before hitting 12.6% in the first quarter of this year. In the second quarter of this year, this figure increased even more to 12.9%. We have seen a similar phenomenon occur when it comes to the other assets that the company has. Its private loan portfolio has gone from an effective yield of 8.2% to 12.6% today, while the MM (middle market) portfolio has seen its effective yield jump from 7.5% to 11.8%. This on its own tells us that those companies are paying more this management indicated. But it doesn’t tell us whether those companies are in a financial position to make good on their commitments.

Author – SEC EDGAR Data

To get some reassurance, I first decided to revisit the financial results of the companies in its portfolio. This data is, admittedly, mixed. Back in 2020, the average EBITDA of an LMM investment was $5.3 million. This number eventually grew to $8.3 million as of the end of the first quarter this year. We have seen a slight pull back to $8 million as of the second quarter period but that’s not exactly large. What is fairly large, though, is the decline seen in the private loan portfolio. This has dropped from $38.1 million in the first quarter of this year to only $30.5 million in the second quarter. And with the number of companies in the private loan category increasing only modestly from 86 to 88, it looks more likely than not that these companies have seen some weakening. And this is most certainly an area that investors should be mindful of. The good news, however, is that the average EBITDA associated with MM holdings increased from $65.4 million to $67.6 million.

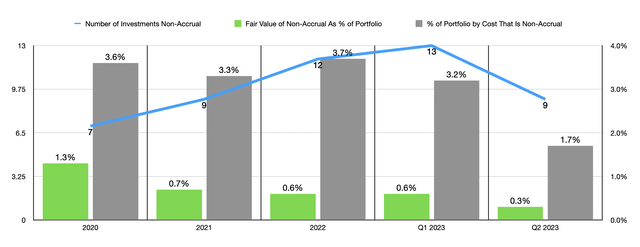

When taken as a whole, the declines in profitability associated with companies in two of the three categories do concern me and are definitely a net negative. But while that could be a sign of some pain ahead, the fundamental picture for those enterprises at the moment seems solid. I say this based on the accrual status of certain investments. Typically speaking, if there is a loan or debt security that a portfolio company owes on that is 90 days or more past due, that investment will be classified as non-accrual until such time that it can begin making regular payments again.

Author – SEC EDGAR Data

In prior years, the number of companies that were classified as being non-accrual had increased. But the percent of the portfolio by cost that fell under this category remained in a fairly narrow range while the percent of the portfolio’s fair value that was non-accrual had declined year over year for a couple of years. As of the most recent quarter, the company actually saw a drop in the number of non-accrual investments from 13 to 9, while the percent of the portfolio, by cost, that was non-accrual plunged from 3.2% to 1.7%. Over that same window of time, the percent that was non-accrual as a percentage of fair value was cut in half from 0.6% to 0.3%. The fact that this occurred at a time when sales and cash flows are coming in stronger is a positive thing.

It is worth noting that, on October 13th, the management team at Main Street Capital announced an increase in credit facility capacity under its SPV Credit Facility in the amount of $175 million. When combined with the potential for another $80 million in ATM (at-the-market) funding from potential stock issuances, that gives the business another $255 million in funding that it can use for further growth. That is yet another reason to be happy with how the picture is changing.

Takeaway

Fundamentally speaking, Main Street Capital is going through some interesting times. Profitability is growing nicely this year compared to the same time last year, though there are some signs, such as the average EBITDA of its portfolio companies, that investors should keep a close eye on matters. But between the hefty profits and the fact that non-accrual status for its investments is on the decline, I would argue that the good at the moment outweighs the bad. Given these developments, I’ve decided to upgrade the company from a ‘hold’ to a ‘buy’, but with the caveat that a watchful eye is needed regarding the profitability of its portfolio investments. If this does continue to worsen, then that could be a reason to downgrade the stock back to where it was previously.

Read the full article here