TriplePoint Venture Growth (NYSE:TPVG) is a small-cap BDC that made waves in 2023 because of a surge in problematic loans the investment firm has in its portfolio. Although the investment company still covers its dividend with NII, I believe a dividend cut is potentially lurking in the shadows. Given the poor quality of the BDC’s current loan portfolio, I also believe that the P/NAV ratio is not attractive enough for investors to risk their capital in this BDC. Considering that TriplePoint Venture had 4.7% of its loans marked as non-performing, I would need at least a 20% discount to NAV before buying into this BDC at this point!

Previous coverage

I have not covered TriplePoint Venture Growth before, but covered a rival, Hercules Capital (HTGC), just a few days ago: A Magnificent 10% Yield For Long-Term Investors.

Hercules Capital essentially operates in the same industry as TriplePoint Venture, but this BDC has earned a strong buy rating from me due to the fact that it has impressive NII/dividend coverage. Investors do pay for the premium, however, as Hercules Capital is trading at a 40%+ premium to net asset value.

Poor loan quality may be a problem for dividend investors…

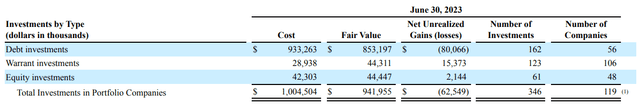

TriplePoint Venture is an externally-managed, closed-end BDC with a narrow niche focus on technology, life sciences, and other high-growth industries that have been backed by the venture industry. The portfolio was comprised, at the end of the June quarter chiefly of debt investments: TriplePoint Venture’s debt investments totaled $853.2M and the BDC’s total portfolio was valued at $941.5M.

Source: TriplePoint Venture

The problem with TriplePoint Venture is that the BDC has seen a rise in problem loans in its portfolio with the non-accrual percentage rising from 1.1% in Q4’22 to 4.7% in Q2’23, showing a massive increase of 3.6 PP.

Non-accrual investments as of June 30, 2023 totaled $40.1M and a total of six portfolio companies fell behind on payments. The total dollar value of non-accruals increased by a factor of 4.4X between the end of FY 2022 and the end of the second-quarter… which represents a stunning decline in loan quality. For context, Hercules Capital’s Q2’23 earnings report showed a non-accrual percentage of 0.0% (Source)… which is why I believe that Hercules Capital is by far the superior investment choice.

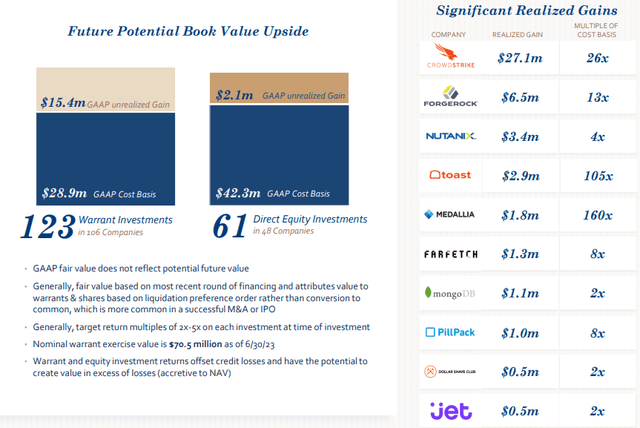

In addition to debt investments, TriplePoint Venture takes equity in companies and utilizes warrant structures that represent out-sized return potential. Like Hercules Capital, TriplePoint Venture has struck some real winners with its investment strategy. However, returns from equity and warrant investments are impossible to project.

Source: TriplePoint Venture

So far the dividend has been covered with NII…

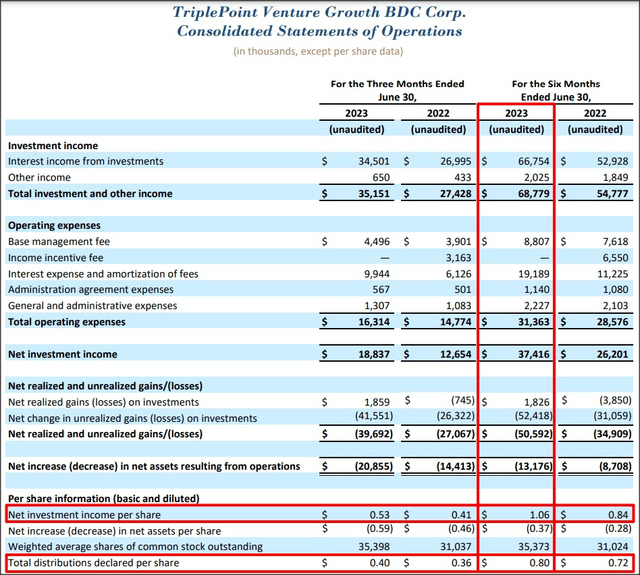

TriplePoint Venture’s dividend, at least so far, is supported by NII, but an additional uptick in the non-accrual percentage, as it relates to the debt portion of the BDC’s portfolio, may eventually trigger a dividend cut.

TriplePoint Venture disclosed $37.4M in NII for the first six months which calculated to $1.06 per-share in NII. The BDC set a quarterly dividend rate of $0.40 in the first-quarter of FY 2023 and has since distributed $0.80 per-share. The NII/dividend coverage ratio has been 133%. However, the BDC’s portfolio quality is a critical issue that investors should carefully pay attention to. A rising amount of loans for which the payer has stopped making payments ultimately indicates a dividend cut… and I believe this is what the near-16% yield already signals to the market.

Source: TriplePoint Venture

TriplePoint Venture Growth compared against Hercules Capital

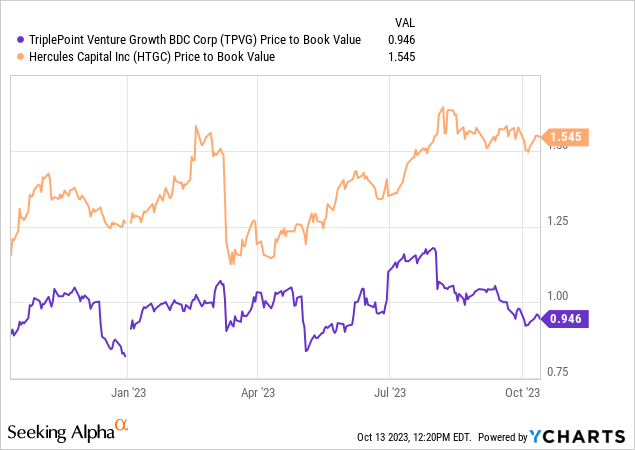

Dividend investors practically have two choices here: They could buy a high-quality BDC like Hercules Capital… which sustainably earns its dividend with NII and trades at an admittedly high premium to NAV. Or they can buy a lower-quality BDC like TriplePoint Venture… which has significantly higher NII and dividend risks… and that sells at a discount to NAV. Which one to choose depends on investors’ risk acceptance: if secure dividend income matters to you more than anything else, then HTGC may be the better choice. If you have a higher risk acceptance and you believe that TPVG is a play on recovering portfolio quality, then an in investment in TPVG may pay off.

Besides the difference in portfolio quality discussed above, the valuation gap between HTGC and TPVG shows that dividend investors value the former much more highly while the market appears to expect that the dividend will be cut for TriplePoint Venture: TPVG currently trades at a P/NAV ratio of 0.95X… implying a 5% NAV discount. HTGC, as indicated by its P/NAV, is a truly expensive BDC investment. TPVG’s poor asset quality as well as growing dividend risks are likely the reasons for the large relative valuation discrepancy between those two BDCs.

I would need at least a 20% discount (0.8X P/NAV) ratio to feel enticed enough to invest in TriplePoint Venture as the risk profile looks truly unattractive. The BDC’s third-quarter earnings report will show what direction the TriplePoint’s non-accrual percentage has taken.

Risks with TPVG

The risks obviously center around the BDC’s investment portfolio and the quality of the loans contained therein. TriplePoint Venture’s surge in the non-accrual percentage indicates that the company is facing serious quality issues and this may ultimately be reflected in a dividend cut.

Final thoughts

TriplePoint Venture is not a high-quality BDC and loses in a direct comparison to HTGC, in my opinion. Hercules Capital has no credit issues whereas TriplePoint Venture has a lot of them. TriplePoint Venture Growth sells at a much lower P/NAV ratio than Hercules Capital (at a 5% discount to NAV actually), but the discount is not large enough to compensate me for the high amount of NII and dividend risks that are associated with an under-performing debt portfolio. Therefore, I believe there is a high probability that TriplePoint Venture Growth will see a down-trend in its NII in the coming quarters and they dividend might be put on the chopping block. Investors that prefer quality, should consider buying Hercules Capital instead, in my opinion!

Read the full article here