Don’t look now. The Fed may be pivoting.

It isn’t elegant, graceful, or refined. And it apparently contradicts the past 10 days’ employment and inflation data, which would seem to support an increase in the federal-funds rate in November or December. But Federal Reserve officials have gone out of their way to talk down the likelihood of another hike, largely because the bond market has been doing the central bank’s work for it.

The inverse relationship between bond yields and stock prices held firm this past week. After a relentless rise since the late summer to a nearly 5% yield on the 10-year U.S. Treasury note—and several losing weeks in a row for major stock indexes—yields reversed and stocks bounced.

The

S&P 500 index

ended the week up 0.45%, the

Dow Jones Industrial Average

added 0.79%, and the

Nasdaq Composite

slipped 0.18%. The 10-year yield fell 0.16 point, to 4.63%.

The catalyst for the reversal was a parade of Fed speakers acknowledging that the surge in bond yields had resulted in tighter financial conditions—raising borrowing costs for business, consumers, and the U.S. government.

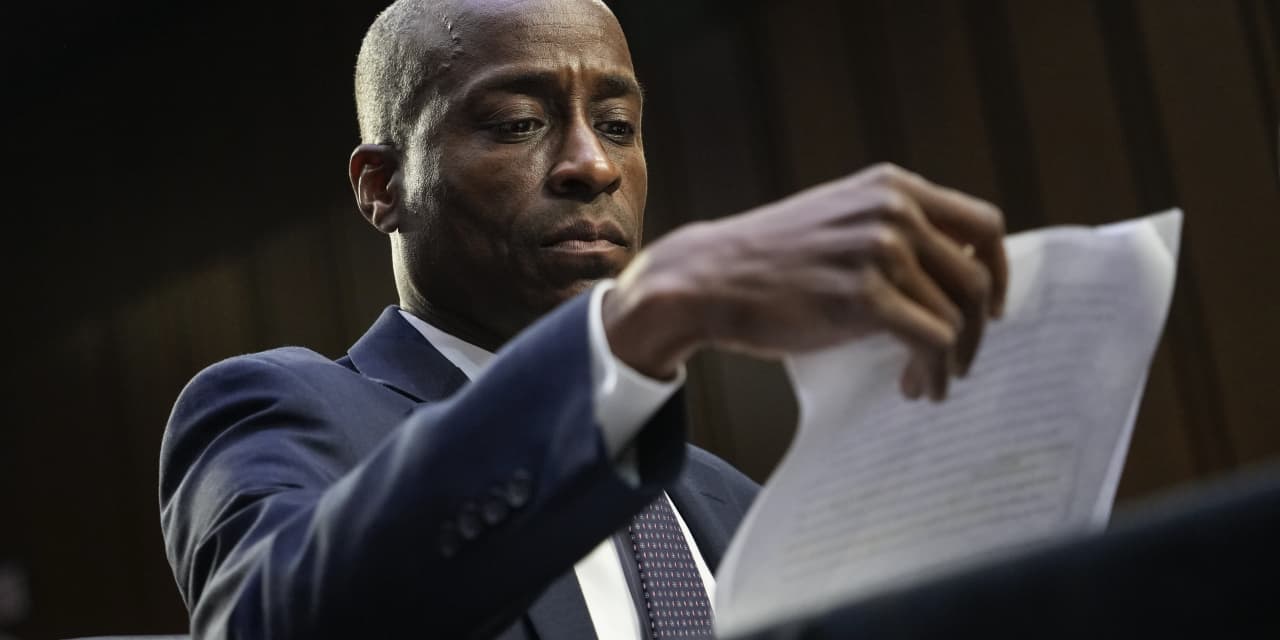

“I will remain cognizant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy,” Fed Vice Chair Philip Jefferson said on Monday, while Dallas Fed President Lorie Logan echoed that sentiment in separate remarks that same day. Atlanta Fed President Raphael Bostic cut straight to the point on Tuesday morning. “I don’t think we need to increase rates anymore,” he said. It doesn’t get any clearer than that.

It makes a lot of sense. Higher bond yields should slow the economy, dampening inflation, the thinking goes. And as the inflation rate declines, the real, or inflation-adjusted, fed-funds rate will effectively increase even if the Fed doesn’t raise its target.

“Fed officials are going out of their way to send a message that they’re done for now,” says Tom Porcelli, chief U.S. economist at PGIM Fixed Income.

The market, too, is coming around to that point of view. Interest-rate futures pricing now implies a less than one-in-three chance of an additional fed-funds increase this year, according to the CME FedWatch Tool, down from roughly 50/50 odds a few weeks ago. But that doesn’t mean they’ll come down quickly, either, even if the market is pricing in cuts of 0.75 percentage point next year. “The higher-for-longer idea is real,” Porcelli says.

That’s probably for the best. Faster Fed cuts than now expected in 2024 would require a worse economic outcome that would hurt earnings—and the stock market.

It’s far from an all-clear signal, but a Fed that’s conscious of the bond market’s tightening effect is better than one that isn’t. Maybe a soft landing is possible after all.

Write to Nicholas Jasinski at [email protected]

Read the full article here