Thesis:

Apple (NASDAQ:AAPL) is the largest listed company in the world by market capitalization, standing tall at $2.73 trillion. 28% of this value was added this year alone.

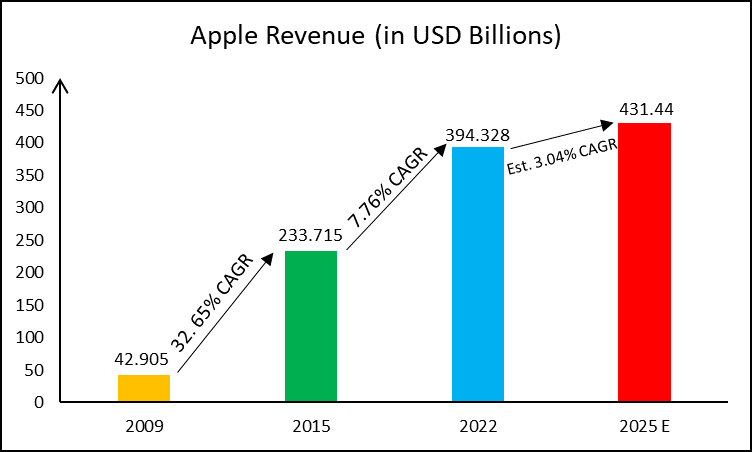

However, the company is currently witnessing a contraction in terms of its key financial metrics and future growth, per consensus estimates. This implies lower multiple valuations. The below graph shows the growth rate in Apple’s revenues and key inflection points. Revenue grew at a CAGR of 32.65% after the Great Financial Crisis from 2009 to 2015. Revenue growth rates slowed between 2015 and 2022, possibly due to the European Debt Crisis and the small-scale U.S.-China Trade War. Growth rates between 2022 and 2025 are estimated to slow down to 3.04%, which could be due to a variety of factors such as high inflation, high-interest rates, increasing instances of geopolitical conflicts, and the ban in China’s public sector on using iPhones, present strong headwinds to the already stagnating revenues of Apple.

Apple’s Historical Revenue Growth (Apple Annual Reports)

Catalysts:

Apple Banned in China’s Public Sector

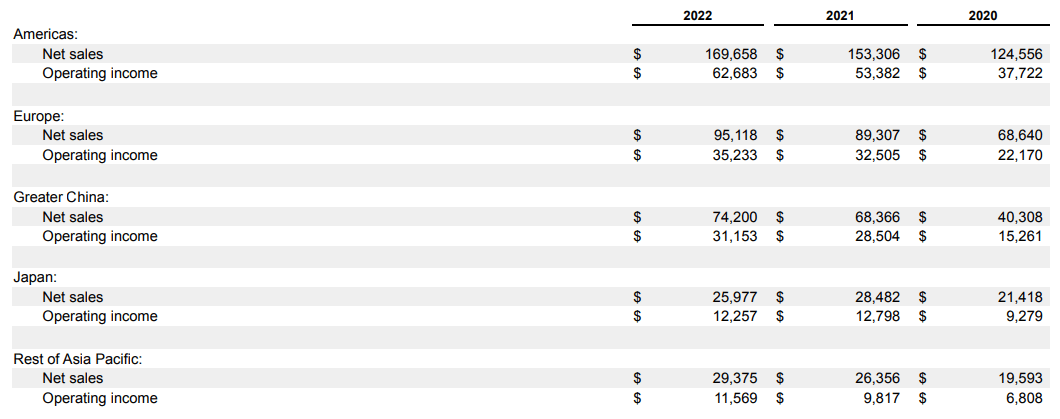

The below image has been taken from Apple’s 10-K Filing for the Financial Year ended September 2022, which shows the distribution of revenue and operating income for various geographical segments of the company. In 2022, Greater China, which comprises the Chinese mainland, Hong Kong, and Taiwan, accounted for ~19% of Apple’s revenue and ~26% of the company’s operating income.

Segment Revenue Distribution (Apple 10-K Filing 2022)

Apple is likely to suffer a significant blow in this geography as the Chinese government announced a ban on iPhone and Apple products in retaliation to the Biden administration banning the sale of semiconductor chips to China, and the ban on Huawei in the U.S. Initially, this ban was limited to central government employees only but was reportedly later extended to state government and employees working in public sector companies.

While, in theory, the ban only limits them from bringing Apple products to work, it could have a huge impact on the sale of Apple products in Greater China. The World Bank estimates that the public sector and government-affiliated institutions in China employ approximately 16% of the 730 million workforce, which is roughly ~117 million employees. Apple has roughly 16% market share in China’s smartphone market, so ~19.5 million people may no longer buy iPhones, which at approximately $1000 is a $19.5 Billion hit to Apple’s revenue in China and ~5% of its overall revenue. This is before accounting for the loss of sales of other major products such as the iPad, MacBook, and the AirPods. The overall impact of this could be a headwind of 6-8% of Apple’s total revenues.

US Consumers Planning to Curtail Discretionary Spending on Consumer Electronics

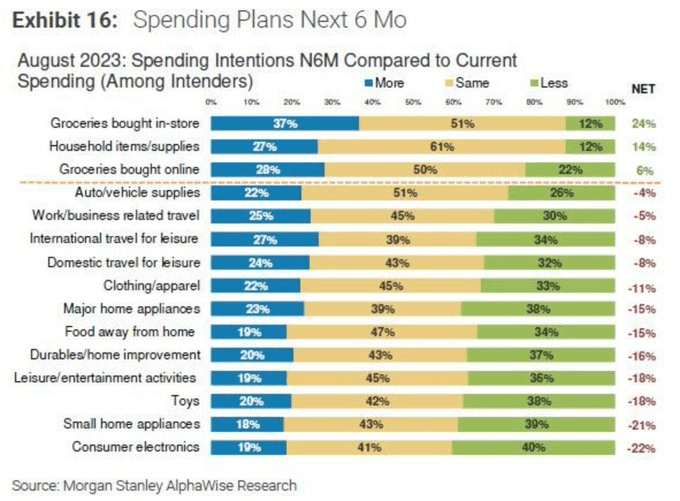

Forward Discretionary Spending Plans (Morgan Stanley AlphaWise Research)

The above image shows data from research conducted by Morgan Stanley’s AlphaWise Research, which shows the U.S. Consumer’s spending plans for the next 6 months. We see that on a net basis, 22% of U.S. consumers are looking to reduce their spending on consumer electronics, which includes smartphones and personal computers.

The next 6 months include the holiday season and the first quarter of next year. Usually, the holiday season sees an increase in consumer spending. However, this research presents a completely different picture. Consumer spending on electronics is not expected to decrease by exactly 22%, but even if it decreases by 10-15%, that could present a significant headwind for the consumer electronics industry and, consequently, Apple too.

Negative Growth in Physical Product Sales

Apple has been traditionally known for its three major products – the iPhone, the iPad, and the MacBook. While its overall revenues have stagnated, upon closer inspection, these three have been the biggest laggards among its offerings, which include Wearables, Home Appliances and Accessories, as well as Services revenue.

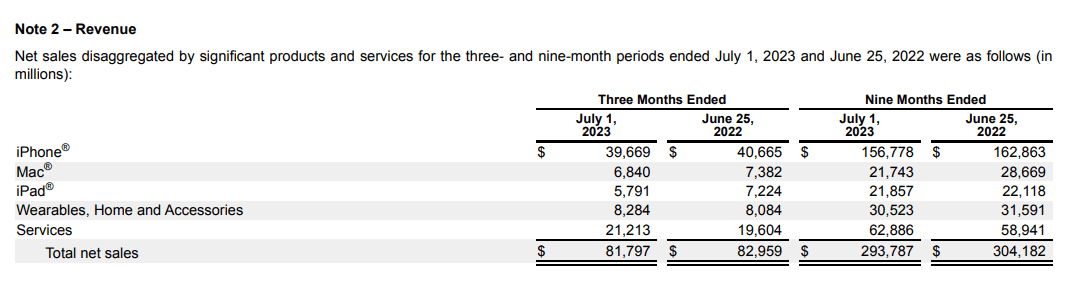

Attached below is a snippet from the company’s most recent 10-Q filing for Q3 2023, which shows YoY growth on a quarterly as well as a 9-month basis. You can clearly see that the decline in revenues has been led by the products that have traditionally been its pillars of strength. This could be attributed to the lack of innovation in its product line – barring the introduction of the Intel chip system in its Macbook.

This is not a good sign for the company, and if this trend continues, this is a huge cause of concern for the company and its fundamentals.

Apple Product Revenue Breakdown (Apple Q3 2023 10-Q Filing)

Stretched Valuations With No Financial Growth

Apple stock has risen 42.60% YTD, but fundamentally, the company has seen negligible, if at all, growth in its key financial metrics, such as Trailing Twelve Months (TTM) Revenue and Earnings-per-Share (EPS), since the quarter ended June 2022. This means that the entire growth in its valuation has been because of Multiple Expansion (P/E Multiple), and there has been no contribution from Earnings Expansion. This makes the stock suspect of over-valuation and possibly a sharper price decline compared to stocks that have seen earnings growing significantly over the last two years.

The stock is currently priced at approximately $178.5 and has a trailing twelve-month (TTM) basic earnings per share (EPS) of $5.95. This results in a price-to-earnings (P/E) ratio of 30. At first glance, this P/E ratio appears to be inflated for a company that hasn’t shown any growth in its revenues and earnings. This valuation becomes even more questionable when taking into account the current high risk-free rate and the fact that the 10-Year Treasury is effectively valued at 21-22 times its yield, without any associated risk.

Financials:

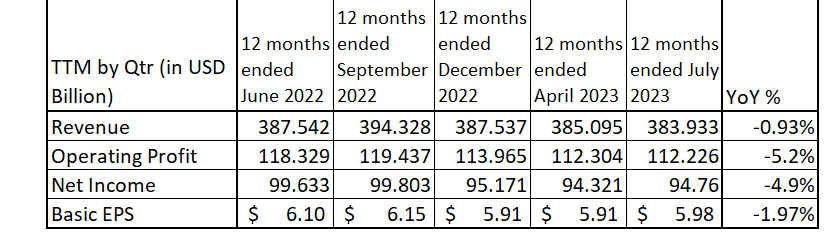

In this section, we look at key financial metrics for Apple, namely Net Sales (or Revenue), Operating Profit, Net Income, and Basic EPS on a TTM-by-quarter basis.

Apple Income Statement (TTM) (Seeking Alpha)

We see that revenue for Apple has failed to grow, decreasing by ~1%. Operating profit and net income have also both decreased by approximately 5% compared to the previous year when measured on a TTM basis. EPS declined ~2%, less than the decline in Net Income, due to Apple’s $90 billion in stock buybacks.

Apple did beat Revenue and EPS estimates in Q2 CY 2023 (Q3 FY 2023 for Apple) and earlier in Q1 CY 2023 (Q2 FY 2023 for Apple); it does not signify any financial strength in the company. While I do note that Apple’s Basic EPS grew YoY in Q2 CY 2023 (Q3 FY 2023 for Apple) from $1.20 in 2022 to $1.27 in 2023, the overall TTM Basic EPS is still lower than what it was a year ago. What it does show is that Wall Street expected Apple’s revenues and earnings to decline by a certain degree, and the actual data shows declines too, just that the decline is slightly lesser than what the consensus estimates were. This is far from a sign of strength.

With growth in these metrics expected to be lesser than what it has previously been, the only thing Apple stock has going for it right now is that the company might buy back stock, which would raise the company’s EPS and increase demand for stock, as the company sits on the largest cash stockpile among S&P 500 companies.

Valuation:

P/EG Ratio: Apple’s EPS has grown at ~15% CAGR over the past 5 years. If we assign it a rich P/EG ratio valuation of 1.5x, we get a P/E of 22.5 times earnings per share, which gives us a fair value of $135. In the future, Apple’s EPS is likely to grow at much lower than 15%, let’s say 12% CAGR in the future, we get a P/E of 18x EPS, which gives us a fair value of $108.

P/FCF: Based on our estimates in the DCF Valuation below, Apple’s Free Cash Flow for the year ended September 2023 is going to be $104.195 billion, and if we have a P/FCF Multiple of 20 on that, we get a fair value of $2.084 Trillion which translates to a stock price of approximately $129.

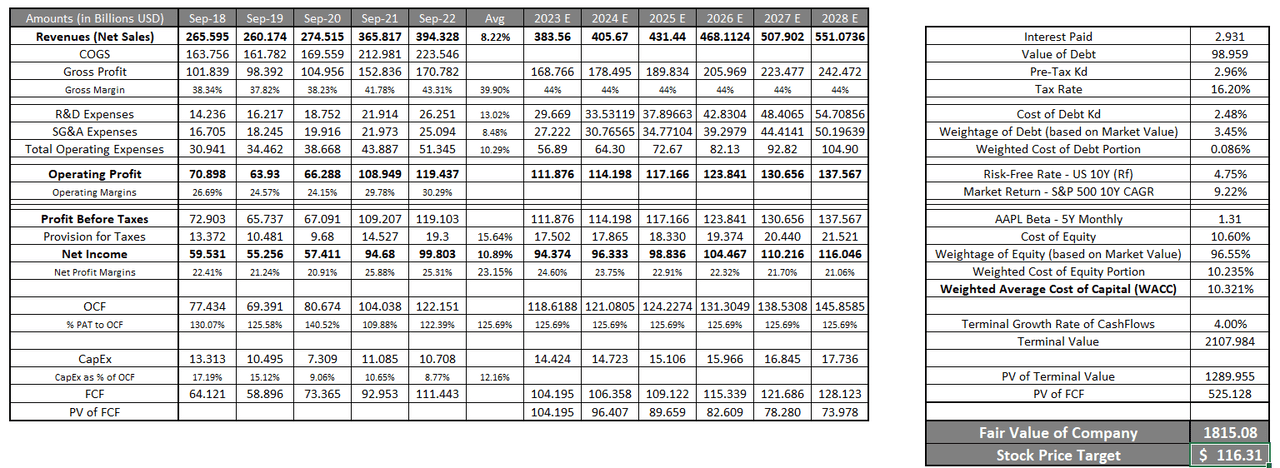

DCF: Below is an image of the DCF Valuation Analysis performed on AAPL. The 5Y CAGR of Revenue for AAPL has been 8.22%. Revenue forecasts till 2025 are based on Consensus Estimates, and thereon, we assume 8% revenue growth. Gross Margins have been assumed to be 44%, growing from 43.31% in FY 22. Operating expenses have been calculated based on the CAGR of its components – R&D Expenses and SG&A Expenses.

We observe that because Operating expenses are expected to increase at a rate faster than Revenue, there is a contraction in Operating, and consequently, Net Income Margins decrease from 25.31% in FY 2022 to as low as 21.06% in FY 2028. We assume a constant Net Income to Operating Cash Flow Conversion based on the 5-year average of data between 2018 and 2022. A similar approach is used to forecast Capital Expenditure by taking an average of how much of the Operating Cash Flow was invested back into the business.

Based on the DCF Analysis, we get a fair value of Apple stock at $116.31. This means that it is over-valued, and its fair value is ~35% lower than the last traded price of $176.80.

Discounted Cash Flow Valuation (Excel)

Conclusion:

While it is true that Apple has been a favorite, especially among retail investors, and the phrase “How can you not own Apple?” extends beyond the iPhone to its stock as well, I have sufficient reason to believe that the stock is currently overpriced in comparison to its intrinsic value. I also believe that if a company is not expected to grow as fast as it historically has, the premium given in valuing it as a growth company must reduce.

To conclude, Apple stock is a sell, in my opinion. I believe that investors must stay away from Apple stock, and re-consider their investment decisions pertaining to Apple once it is closer to our Fair Value of $116.31 (as per our DCF Valuation Model).

Read the full article here