If the fourth quarter stock market rally doesn’t come in 2023, blame the bond market. This past trading week offers a good example of what will likely come for the rest of this year as the relationship between stocks and bonds grows stronger.

Giving Back Big Gains

Stocks gave back most of their gains from early last week as volatility in interest rates saw credit spreads widen. The inter-market relationship at play currently runs very deep and has everything to do with fluctuations in interest rate volatility.

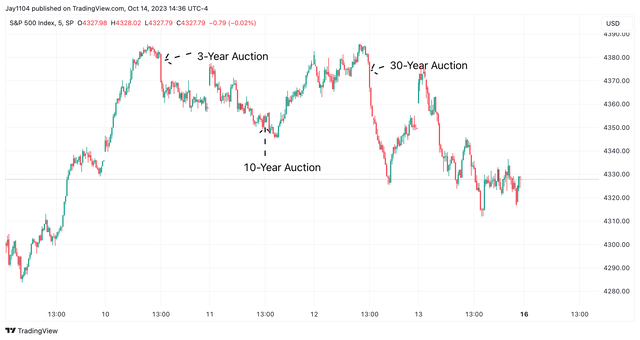

As previously noted, Treasury auctions have become very important parts of the trading day, and last week’s auctions were not strong for the 3- and 10-year notes, with the 30-year auction being the weakest. This created a great deal of bond market volatility on top of the hotter-than-expected CPI report.

The Treasury auctions resulted in big intraday reversals in the stock market and were witnessed on Tuesday and Thursday. The S&P 500 saw a sharp intraday reversal following the 3-year auction on Tuesday and the 30-year auction on Thursday. There was even some mild weakness immediately following the 10-year auction.

Trading View

20-Year Auction

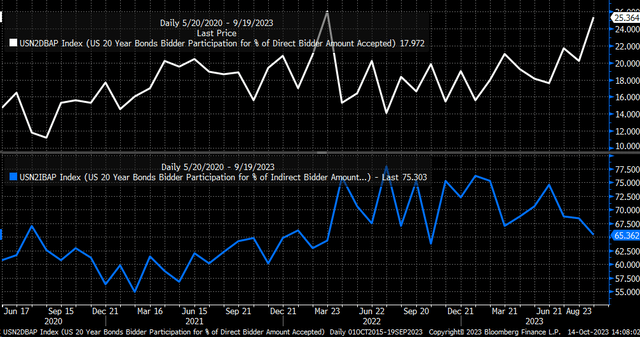

This coming week will feature the 20-year auction, which has seen indirect demand for the issue plummet, typically representing foreign buyers. Meanwhile, direct bidders, which tend to be dealers or institutions, have taken down bigger pieces of these deals.

Bloomberg

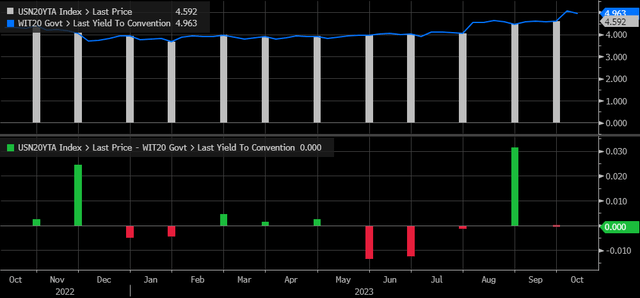

Most of these auctions have gone smoothly with the high-yield rate pricing around the when-issued rate. However, the auction in August saw a wide tail of about three bps, and certainly, another auction this week that saw a large tail and weak indirect demand would probably not be digested well by the bond market, leading to rates going higher.

Bloomberg

Wider Spreads

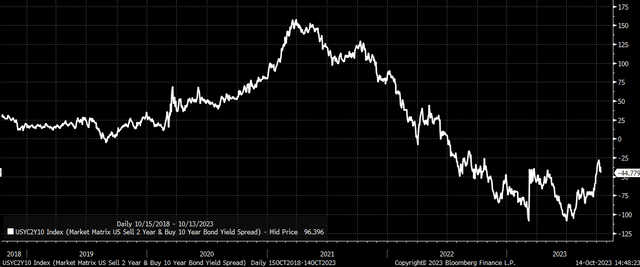

On top of this, the large amount of issuances and the sticky nature of inflation are causing the back end of the yield curve to rise. And because the Fed is nearing the end of the rate tightening cycle, the front of the curve remains fairly static, which means the yield curve is bear-steepening, with the back of the curve rising to the front of the curve.

Bloomberg

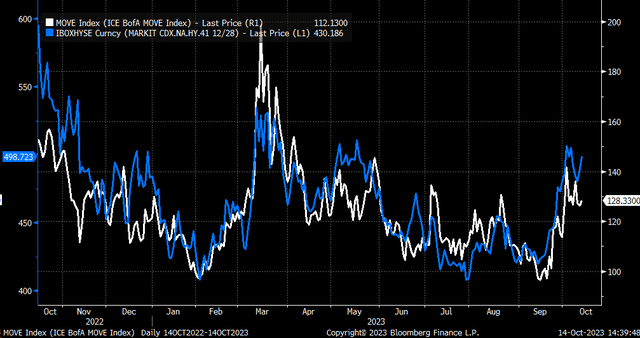

The rise in Treasury rates the past couple of weeks, along with the bond market now starting to show fatigue for the large number of issuances that are coming from the Treasury daily, likely means that the yield curve continues to steepen and is resulting in higher bond market volatility, as represented in the rising MOVE index. As bond market volatility increases, credit spreads widen, leading to stock market declines.

Bloomberg

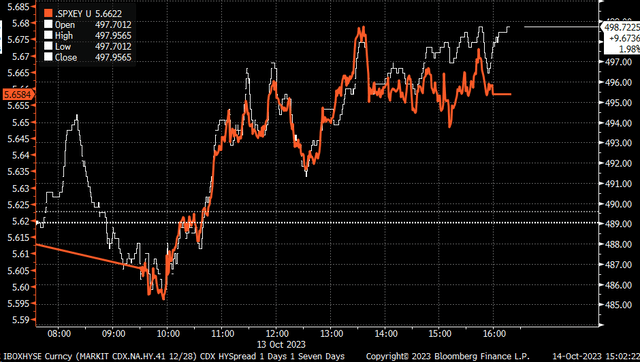

At the end of the day, stocks are trading with bonds and credit spreads, and if these spreads continue to widen, stocks will continue to move lower. One reason stocks held together on October 13 and didn’t move sharply lower was that there was no Treasury auction at 1 PM ET to disrupt things, and spreads only widened modestly. On Friday, the S&P 500 earnings yield traded tick for tick with the CDX High Yield CDSI index.

Bloomberg

Higher Rates

If volatility persists in the bond market, stock prices will likely decline. Just how volatile the bond market remains will depend on the strength of the economic data, the path of inflation, continued Treasury auctions, and geopolitical tensions.

At least at this point, the economic data remains robust, and the data suggest the third quarter GDP should come in strong. Meanwhile, the path of inflation has proven to be stickier than the market has forecast, as the last CPI report supported. Additionally, the Treasury shows no sign of easing off the issuance accelerator.

Finally, geopolitical tensions are as high as ever, which may indirectly play into higher rates. Historically, investors tend to associate war and geopolitical tensions with lower rates. But in this case, if the tension results in higher oil prices, it seems highly likely that rates won’t go down but instead go up. Because higher oil prices will only result in even higher inflation rates. This would likely catch many investors off-guard and unprepared, especially those who see a fourth-quarter stock rally coming.

There may still be a fourth-quarter seasonality tailwind for stocks; just don’t be surprised if it starts from much lower prices and doesn’t play out as expected.

Read the full article here