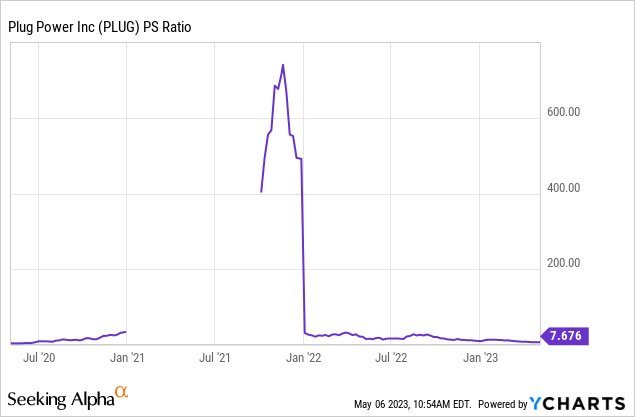

The last year has been brutal for hydrogen stocks with Plug Power (NASDAQ:PLUG) down 56% to trade at its lowest level in three years. The company is now swapping hands at a 7.68x price-to-sales multiple, an 83% decline versus its five-year average multiple of 45.18x. The pandemic years were abnormal with widespread euphoria around the potential of hydrogen to facilitate the decarbonization of carbon-heavy industries driving Plug Power’s multiple to highs that could only be prudently described as stratospheric. Indeed, the Latham, New York-based company would see its sales multiple go north of 700x. Hence, the current pullback has realigned Plug Power with its pre-pandemic trajectory in many ways. Is the stock now a buy? It depends.

The company is still trading at a sales multiple that is 500% more than the median multiple for its peer group. Bulls would of course be right to highlight that the post-pandemic reality is increasingly being defined by a near-visceral need by most developed economies to transition to greener sources of energy. The 2022 US Inflation Reduction Act looks set to open the floodgates to North American hydrogen adoption and provides a significant $3/kg production tax credit for green hydrogen production. The global momentum is getting intense with the EU boosting a target for the share of renewable energy in its energy mix to 42.5% of total consumption from 32% by 2030. Hydrogen is set to play a material role in this.

Hydrogen To Tackle Climate Change As Partnerships Ramp Up And Down

Plug Power just announced a partnership with SK E&S, a South Korean LNG company, to jointly build a $710 million gigafactory for the production of hydrogen fuel cells and water electrolysis systems. Plug Power is set to contribute just under half of this amount, corresponding with its 49% stake in the partnership. The company also notched a partnership with Germany’s Uniper for the design of a 100 MW electrolyzer. This is not expected to start production until 2026 and is still subject to a positive FID by Uniper. Whilst these new partnerships lay at the core of the company’s long-term investment case and would complement management’s target to increase liquid green hydrogen production to 1,000 tons per day by 2028, Plug Power has to be able to prioritize its capital expenditure. The highly lauded partnership with Fortescue Metals to build what would have been the world’s biggest electrolyzer manufacturing plant in Australia was ended due to unit economics that management stated “they could do better” on.

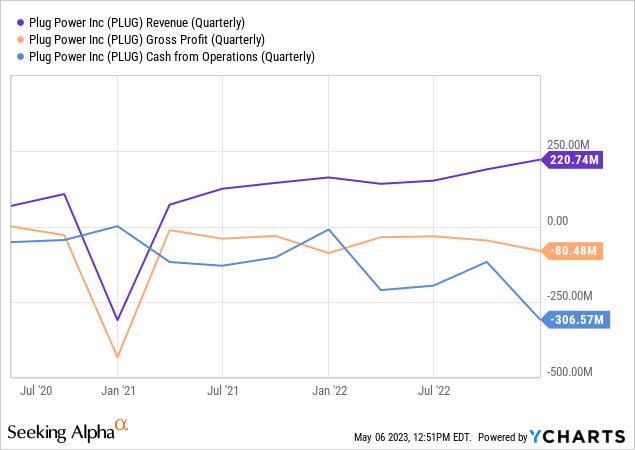

Critically, Plug Power’s own economics did not matter to shareholders for some time. The company’s surge to new highs came on the back of broadly negative gross profit margins, high net losses, and deepening cash outflows from operations. Plug Power would report revenue of $220.7 million for its fiscal 2022 fourth quarter, a 36.3% increase over the year-ago comp but a miss by $48 million on consensus estimates. Net income was negative at $223.5 million with cash burn from operations at $306.57 million.

The Economics Have Never Mattered

Whilst Plug Power would see its fourth-quarter gross margins improve year-over-year from negative 54% to 36%, the overall direction of its operations is likely still poor. Cash and equivalents are declining precipitously and reached $2.16 billion as of the end of the fourth quarter, down from $3.9 billion in the year-ago comp. The company is guiding for brighter days ahead. 2023 revenue is set to be around $1.4 billion with gross profit margins at 10%, this will rise to sales of $2.1 billion in 2024 with gross profit margins of 25%. The longer-term story is a marked improvement in profitability against cash flows that are set to remain negative. This sets the backdrop for an equity raise within the next 12 months.

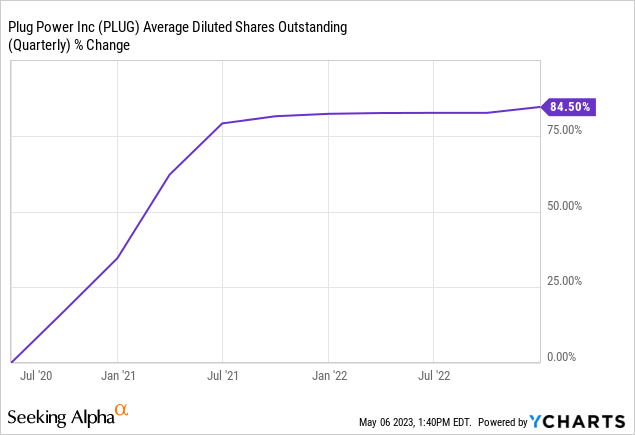

The company’s average diluted shares outstanding are up 85% over the last three years, with the pace of sales only slowing on the back of the retrenchment of its share price. Its quarterly cash burn, including capital expenditure, came in at $430 million during the fourth quarter. Assuming cash burn is around 70% of this through 2023 would see the company’s cash and equivalents fall to $956 million exiting the year. With the Fed funds rate set to remain elevated in the 5% to 5.25% range through 2023 and into the next year, the cheap capital required to facilitate the risk-off sentiment that drove much of the previous share price gains is not likely to return for a while.

Hence, whilst hydrogen is fast being adopted and is required for the decarbonization of markets from heavy-duty trucking to stationary power systems, Plug Power’s innate ability to create value this year will be hinged on a number of broader catalysts. Story stocks are temporarily out of favor but the company’s short interest has grown to sit just under 20%. To be clear, almost 1 in 5 of its shares are sold short, a huge number that places the company on the list of Nasdaq’s top most shorted stocks. The long-term play here for bulls is realizing the growth of gross margins on the back of fast-ramping revenues, in the short-term there is a possibility that there is a broad market rally if the next two inflation readings before summer come in better than market expectations. The Fed is teetering on the brink of a dovish pause and a potential cut later this year could serve as a catalyst for a short squeeze. This isn’t a clear sell on the back of this, but I’m not enthusiastic about taking a position until gross profit margins are positive.

Read the full article here