Co-authored by Treading Softly.

These days, the mindset of “a dollar saved is a dollar earned” rings exceptionally true. Everything from gasoline to eggs and coffee to clothes has seen a sharp rise in cost.

I’ve long been zeroed in on value. Cost is what you pay; value is what you get. For some purchases, the value is vastly overshadowed by what you paid – coffee is an excellent example of this. Other times, you may pay a high price but get a much greater value – for example, heritage-style leather boots made authentically.

When it comes to investing, investors seeking a livable income have many levers available to pull to achieve a greater degree of after-tax value. This could be the strategic placement of certain types of investments into retirement accounts that are tax-advantaged, harvesting tax losses throughout the year to reduce their taxable income, and investing in tax-advantaged holdings. As a professional income investor, I don’t give tax advice as each person’s tax situation is as unique as they are. However, I do love maximizing my after-tax income, and today, I want to look at one holding of mine that provides massive levels of tax-free income.

Let’s dive in!

Step Into the Grey

Greystone Housing Impact Investors LP (NYSE:GHI), yielding 9.7%, provided us with yet another $0.07 “supplemental” dividend that we will collect in October. We predicted that a supplemental was likely this year back in January, writing:

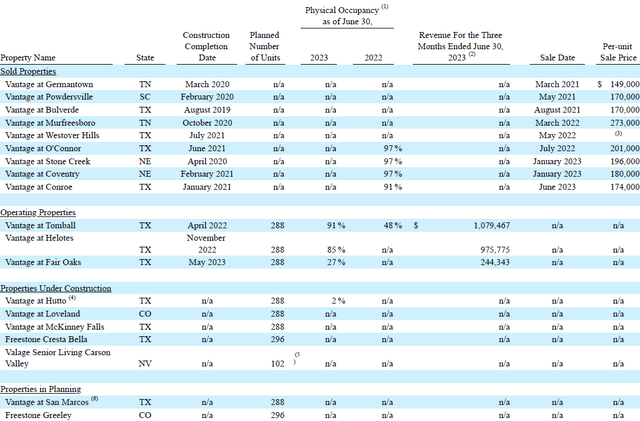

“Not even two weeks into the year, we discover properties are still being sold at significant gains. Vantage at Stone Creek and Vantage at Coventry were both sold in the first week of 2023. These sales generated $0.51/unit in Cash Available for Distribution. In other words, over 1/3rd of GHI’s annual distribution was generated in the first week of the year. A great way to start the year and a very strong indicator that we could see some more supplemental dividends in 2023.”

In addition to the supplemental that is being paid in October, GHI announced the intention to pay an additional $0.07 supplemental in shares for Q4 2023 and Q1 2024.

Supplemental dividends are likely to become a recurring feature for GHI. The reason is that GHI’s strategy has become dominated by two distinct business models.

The MRB & GIL Segment

The first is their MRB (Mortgage Revenue Bond) and GIL (Government Issuer Loan) segment. MRBs and GILs are different names for essentially similar bonds. Both are bonds that state-level government housing agencies issue to encourage the construction of affordable housing. The bonds are secured by a first-lien mortgage on the apartment building. One benefit to investors is that the interest on these bonds is Federal Tax Exempt, a benefit that is passed along to GHI investors through the partnership structure. The portion of your dividend attributable to this segment will be Federal Tax Exempt.

The MRB segment is similar to what we see with many bond funds. GHI buys bonds using a combination of equity and debt. GHI profits from the difference between the interest it receives and its cost of funds.

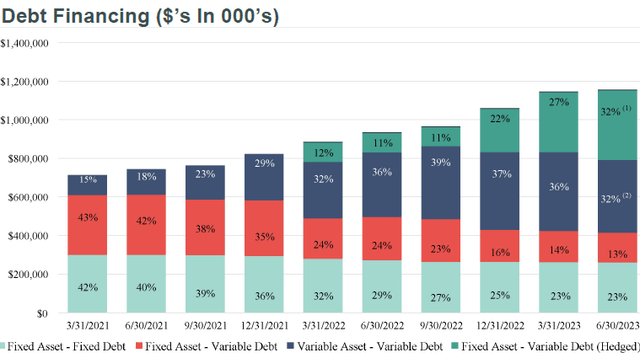

Like many other debt funds, this segment for GHI benefits most when interest rates are low. In 2021, 43% of GHI’s portfolio was fixed-rate assets supported by variable debt. This is not the ideal scenario in a rising rate environment as the cost of variable debt rises. Over the past two years, we’ve seen GHI adjust its portfolio, and today, only 13% of its portfolio is fixed-rate assets with variable debt. Source.

GHI Q2 2023 Supplement

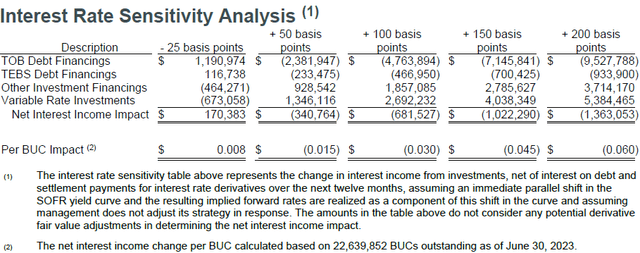

As a result, GHI has significantly mitigated the negative headwinds of rising interest rates. However, rising interest rates are still a slight negative.

GHI Q2 2023 Supplement

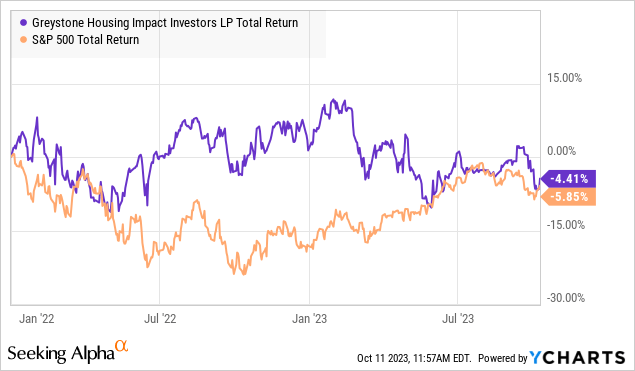

On the other hand, this portion of GHI’s business will benefit greatly when the Fed does pivot, and interest rates decline. We would expect GHI’s core business to struggle in a rising interest rate environment. Yet, when we look at GHI’s actual experience, it has held up remarkably well through one of the worst bond markets in history.

Why?

The Joint Venture Segment

Their second segment has been taking on an increasingly large role. Prior to COVID, GHI had a joint venture called the Vantage JV. This joint venture had the business plan of developing apartments in growing sunbelt markets. GHI provides upfront capital in exchange for a preferred equity interest and a minority common equity interest in the project. Their partner builds the apartment and leases it up, with the ultimate goal of selling the property as a stabilized multifamily investment property. GHI collects a little bit of cash flow when the property becomes cash-flow positive, but the primary gain is made when the property sells.

Since 2021, GHI has realized gains on the sale of 9 properties, and the pipeline is full. Another three properties are already up and running, five are under construction, and two more are in the planning stages. Source.

GHI Q2 2023 10-Q

Last quarter, GHI announced that they signed a JV agreement with another developer to follow a similar business model. One drawback of this business model is that the returns are lumpy. GHI doesn’t get a significant return until the property is sold, and the timing of property sales is uncertain. As a result, GHI’s earnings from this segment are very lumpy.

Prior management attempted to pay out a flat distribution, assuming that the averages would work out and the proceeds from Vantage sales would come eventually. However, when COVID hit, that strategy proved to be problematic because the JV was unwilling to sell any properties into a bad market. It was a smart decision but one that meant poor returns from this segment for 2020. As a result, GHI cut its dividend to a level that was sustainable from the bond segment alone.

The new manager is taking a different approach. GHI has two segments: a bond business that provides relatively stable and predictable cash flow, and a development business that provides significant but lumpy and unpredictable cash flow. GHI’s management has taken to a bifurcated dividend policy, with a “regular” quarterly distribution that is covered by the bond portfolio and minimal sales from the development side, and a supplemental distribution that is paid out of excess gains from sold developments.

While there will likely be years in the future where these JVs might choose not to sell properties because the market is poor, GHI is doubling down on the strategy, which means that there will be more property sales more frequently. As investors, supplemental distributions are likely to occur quite often.

We are quite happy to receive the $0.37 “regular” distribution, which is a 9.7% yield. The extra $0.07/quarter we expect over the next two quarters is just a cherry on top that brings our expected yield over the next 12 months above 11%.

Note: GHI issues a Schedule K-1 tax form.

Conclusion

With Greystone Housing Impact Investors LP, you get a steady stream of high-quality tax-free income, plus regular bonus distributions of taxable income to supplement it. This allows you to greatly benefit from efforts to build affordable and sustainable housing – which provides tax-free income – and benefit from traditional multi-family building projects.

When it comes to retirement, the less you need to pay in taxes, the more you get to keep for yourself. This is true at all stages of life, but retirement planning tax considerations often are heightened. I don’t want you to have to worry about Uncle Sam knocking on your door with his hand out; I want you to enjoy your income with the added benefit of knowing you’re helping out the less fortunate. This week, take a moment and imagine what it’d be like to get more income and pay less taxes. If that sounds good to you, you should take a look at GHI and our other income investment ideas.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here