Progyny (NASDAQ:PGNY) is a company you may not be familiar with, but it is definitely worth a look. Its fundamentals, growth, profitability, and niche make it an attractive company. It would also be an excellent acquisition target due to its hidden value.

Let’s take a closer look at four reasons to consider Progyny:

- Secular demographic tailwinds;

- Accelerating client growth;

- Raised guidance and fundamentals; and

- Hidden value, making it an attractive acquisition target.

What is Progyny?

Progyny provides employer-sponsored coverage for family planning, mostly fertility treatments, but also adoption, surrogacy, cryopreservation, and others—Progyny contracts with a network of specialists available in all 50 states. While several of the larger health insurance companies offer some fertility benefits, Progyny is considered the industry’s gold standard.

It works simply enough. Participating employers offer coverage to employees as part of a benefits package. For instance, you could receive health insurance and options for things like Vision, Family Planning, Short and Long-term disability, etc. Progyny charges the employer a monthly fee for each individual who is signed up and then usage-based charges – very similar to other health benefits.

Progyny is mainly offered by large corporations or collectively bargained benefit plans. Here are examples of some of its current 384 clients:

Source: Progyny.

Progyny reported 5.3 million covered lives as of last quarter, an increase of 25% year over year. Its 384 clients was an increase of 41%.

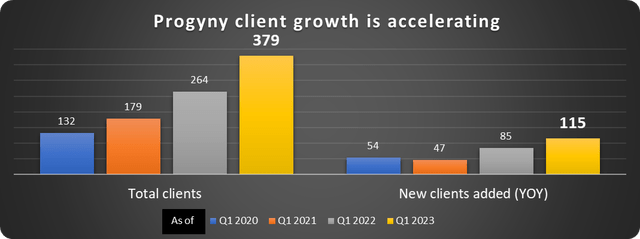

Customer acquisition is the most important indicator of success for Progyny right now, and it is accelerating, as shown below.

Data source: Progyny. Chart by the author.

The 115 clients added is an impressive acceleration, especially given the challenging 2022 conditions.

Two massive secular trends

US Women are waiting longer than ever to have children, choosing to finish their education, advance their careers, increase financial stability, or just enjoy a few more child-free years. Whatever the reason, birthrates for women in their 20s are falling, while birthrates for women in their 30s and 40s are soaring.

This often complicates fertility planning and creates demand for Progyny’s services. The trend will probably not reverse anytime soon. In addition, nontraditional families are becoming more frequent.

The second tailwind Progyny is riding is the competitive labor market. Competition is fierce in many industries, especially those requiring top talent and advanced skills or degrees. A top-tier benefits package can push some companies over the top. Progyny’s management has also mentioned that once one company in an industry gets on board, many tend to follow.

Progyny raised guidance again last quarter and now expects $1.1 billion in sales on 38% growth. The company is compelling on its own accord, and that is the subject of my prior article, which can be found here.

I also want to point out the value and acquisition potential in this article. Note that there are no indications that this will happen right away; this is still a long-term investment.

Compelling value for a potential acquisition

Progyny is a terrific value stock, and with a market cap of just $3 billion, I can see it being acquired for a premium in the future. The purchase would be just a snack for a company like UnitedHealth Group (UNH), with a market cap of $486 billion, or Cigna (CI) at $85 billion. There are also private insurance giants like Blue Cross and Anthem Health.

But wait! The company has a forward price-to-earnings (P/E) ratio of 60. This is not a value stock. Au Contraire. It is a value stock, and here is how to measure it.

First, forget P/E. P/E is for TV. It gives the talking heads something to reference that ((a)) takes no research, ((b)) is familiar, and ((c)) makes the commentator sound discerning.

But there are better ways to measure value.

Consider two simple examples:

- Company A and Company B have the same results for a year. Same revenue, same expenses. Except that Company B is amortizing Goodwill from an acquisition many years ago, in accordance with GAAP. This says nothing about the company’s performance or value (I won’t bore you with the details; for those interested, check out this link). However, it is an expense that lowers earnings and raises the P/E. Is company A really a better value? No! They are exactly the same. P/E has failed to show this.

- Now, let’s say that Company A had a slightly better year than Company B. Its earnings were marginally higher, so the P/E is lower. However, Company A has massive debt, no cash, spent tons on CapEx, and was cash-flow negative. None of this is factored into P/E. Meanwhile, Company B has a pristine balance sheet and tons of cash and doesn’t need to spend on CapEx because they have already built their facilities. P/E tells us nothing about this and considers Company A the better value. That is why it isn’t the best measure. We need to dig much deeper.

Let’s look at the real value of Progyny.

1. Cash, debt, and capital requirements

Progyny has been cash-flow positive since 2019 and pulled in $165 million in free cash flow over the trailing twelve months. The company has built a cash hoard of $283 million (or 9.4% of the market cap) with zero long-term debt or short-term borrowings.

It also has receivables and prepaid expenses in excess of payables and accrued expenses. Adding it up, Progyny has a surplus of current assets over current liabilities of $367 million, or 12% of its market cap.

The business is also extremely capital-light. It doesn’t require factories, equipment, or logistical operations. Only $4 million, or less than 1/2 a percent of Progyny’s revenue, was spent on CapEx over the TTMs.

This means that Progyny’s future profits will not go to debt payments, interest, or capital investments. They will go right into the company’s pockets and build on that $367 million.

2. Hidden assets

When looking at potential acquisitions, other assets unlock value for the buyer. In Progyny’s case, the company has $77 million in deferred tax assets on the balance sheet. This is typically caused by prior net operating losses, which can be carried forward to offset future tax expenses. The asset is stated net of any deferred tax liabilities, and in most cases, the acquirer will get to utilize these after the merger.

We have now unlocked $444 million, or 14% of the market cap, of value for an acquirer.

3. The income statement

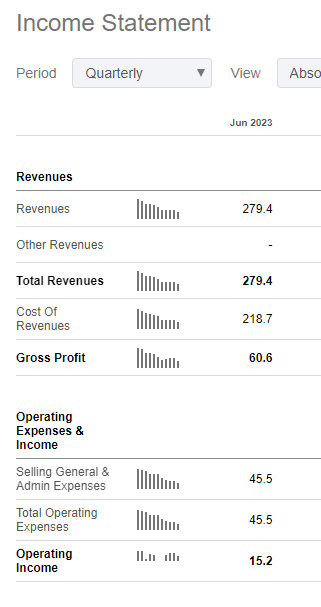

Finally, let’s take a quick look at the income statement. Here it is for the prior quarter.

Source: Seeking Alpha

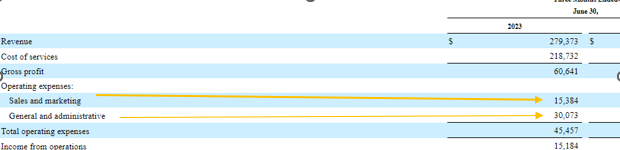

We can see that Progyny made a $60 million gross profit and spent $45 million in operating expenses. Digging deeper, we can see that $15 million was spent on sales and marketing (S&M) and $30 million on administrative costs (G&A), as shown below.

Source: Progyny SEC Filing, 10Q for Q2 2023

This is another place where a larger company makes out like a bandit. The potential acquirer already has a sales and marketing department. They may want to keep the cream of the crop salespeople, but much of this expense will be gone.

The same goes for the administrative costs. Things like payroll and other functions are merged into the larger company and cost pennies on the dollar. Instead of the $0.74 per share estimate for next year, Progyny’s operations could produce much more. An acquirer could make $1.50 or more per share. This would make the 2024 P/E just 22 for a company with 14% of the market cap in net current assets and 38% revenue growth forecast this year.

What about the risks?

Like all equities, Progyny has risks. Companies could cut expenses by limiting access to these benefits (although Progyny reports near 100% retention since 2016). The market may not see the value that I do, which could lead to a drop in the share price. Progyny isn’t the only provider of these benefits, so competition is always a risk. Finally, this isn’t a high-flying tech stock set to double our money overnight. It’s a long-term value play that requires patience.

Bottom line

As mentioned, Progyny raised guidance again last quarter, expecting to have its first $1 billion revenue year in 2023. This stock is compelling on its own merits but also holds a hidden value that would be freed by acquisition.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here