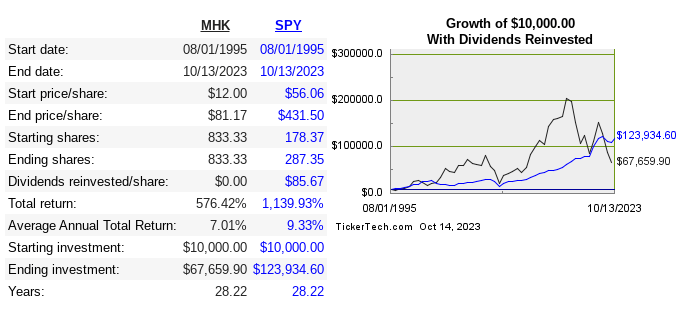

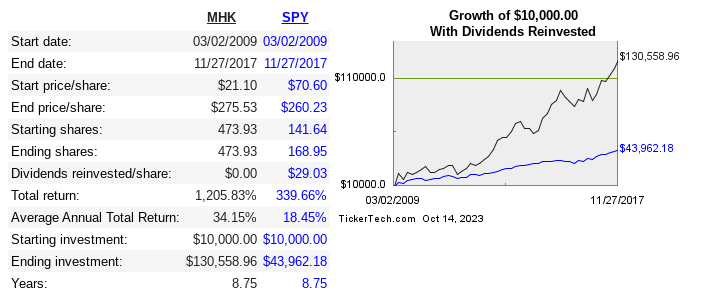

Mohawk Industries (NYSE:MHK) is the world’s largest flooring manufacturer, headquartered in Calhoun, GA. Their manufacturing operations span 19 countries, and they sell to around 170 different countries, with around 40,000 employees. They’ve been publicly traded since 1992. Below is their long term share price performance and period of the best performance:

dividend channel dividend channel

The revenue breaks down into Global Ceramics (36.7%), Flooring North America (35.8%), and Flooring Rest of the World (27.5%). They help supply every category of flooring, from rugs to wooden flooring and everything in between. Despite being in a cyclical industry, they’ve been free cash flow positive or almost 30 years. The global flooring industry is estimated to grow at a 5.3% rate till 2030.

Below is the return metrics versus peers:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

MHK |

7.3% |

11.9% |

8.1% |

-20% |

-4.5% |

|

TILE |

3.4% |

15.5% |

7.2% |

13.9% |

18.6 |

|

OTC:TKFTF |

3.9% |

5.5% |

2.8% |

n/a |

n/a |

Capital Allocation

They have been in growth mode for a while, particularly with acquisitions. They don’t pay a dividend and have only recently begun to buy back shares, so no track record of cannibalizing their share count. Below, we see how capital was allocated in USD millions:

|

Year |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

EBIT |

547 |

773 |

838 |

1,280 |

1,354 |

1,095 |

827 |

636 |

1,335 |

940 |

|

FCF |

159 |

100 |

408 |

655 |

288 |

387 |

873 |

1,344 |

633 |

88 |

|

Acquisitions |

443 |

4 |

1,371 |

251 |

569 |

81 |

124 |

210 |

||

|

Debt Repayment |

3,988 |

9,391 |

17,320 |

21,563 |

16,557 |

17,639 |

15,993 |

6,356 |

1,503 |

20,018 |

|

SBC |

18 |

28 |

33 |

35 |

36 |

31 |

24 |

20 |

26 |

22 |

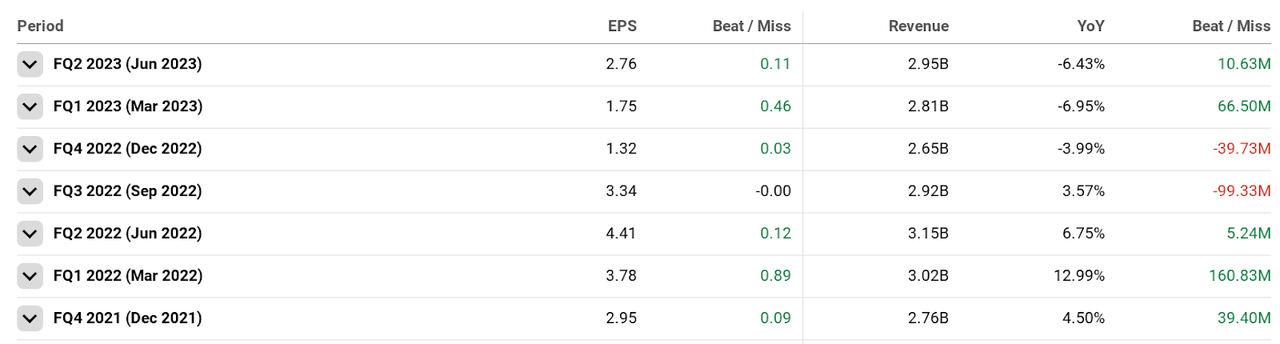

FQ3 Earnings

Below, we see recent earnings beats/misses:

Seeking Alpha

They currently have negative TTM earnings, but have been FCF positive for almost 30 years, which tells us about their true stability despite being pretty volatile and cyclical. It’s certainly possible for them to show negative earnings again, but FCF will be the key indicator. If this becomes negative, the narrative shifts.

Risk

This is another stock that I would say could blur the lines between being a cyclical or compounder. The major risks here would be either buying at the wrong part of the cycle, or having too high of a growth estimate.

The industry is highly fragmented, but it’s safe to say MHK is the global leader due to size. The law of large numbers would indicate that their future growth is limited. This is a case where I think the company should focus on shareholder yield above all else. Capital allocation is more important now than ever, and the company trying to force more growth at this size is one of the biggest risks here.

Overall, the key risk I see is the company trying to force growth by any means instead of returning capital to shareholders. I almost always favor a repurchase-intensive strategy, and I would prefer to see that here too.

Valuation

Tech stocks were soaring to bubble like levels in 2021, but MHK got caught up in the mania as well. MHK shares reached close to an all-time high, hitting a price of $229.74, and have come down 64% since then. As mentioned before, the stock has shown growth traits and also cyclicality. Below is the multiples comp versus peers, followed by my DCF:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

MHK |

0.6 |

5.6 |

14.7 |

0.6 |

n/a |

|

TILE |

0.7 |

7 |

10.2 |

1.4 |

0.4% |

|

TKTT |

0.3 |

5.8 |

6.4 |

0.7 |

n/a |

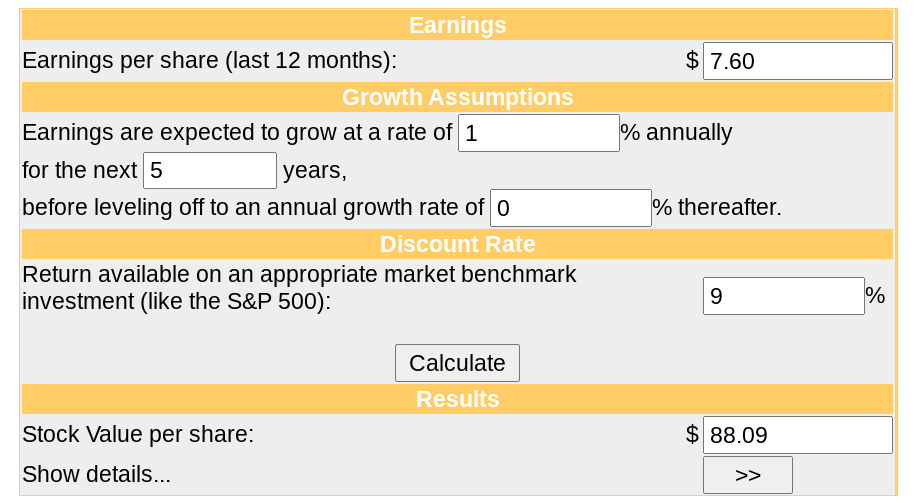

I normalized EPS by averaging the past 13 years, but the inherent difficulties of projecting future earnings are apparent in the DCF:

money chimp

The biggest problem with using the DCF in this particular case is what I mentioned earlier regarding shareholder yield. I think now is the time to return capital to shareholders and make growth a lower priority. It’s hard to precisely quantify this for valuation purposes, as it’s a capital allocation issue.

This is why I’ll be giving this stock a “hold” rating today, but there are some reasons to keep an eye on it. For one, I have no idea when the US housing market will turn around, but I don’t see it happening within the next year or so. This will give more time to see if shares come down some more, and offer a chance to hopefully ride the up part of the cycle. I also like the 17% insider ownership for a company this size, with a market cap around $5.1 billion currently.

Conclusion

MHK has grown to be the big dog in all things flooring, worldwide. The previous growth is now slowing due to size, and I think we are in the part of the company’s lifecycle where it should start returning capital to shareholders. The problem is that this hasn’t really happened yet. MHK is high enough quality to withstand a bear market in housing, but the cyclicality remains.

This isn’t a growth stock, despite certain periods of impressive share price performance. The best returns possible have long passed for investors in my opinion, and the best path forward is one that focuses on shareholder yield. Since housing might take a while to turn around, I will wait for a better opportunity with this stock.

Read the full article here