Analysis is the art of creation through destruction.”― P.S. Baber

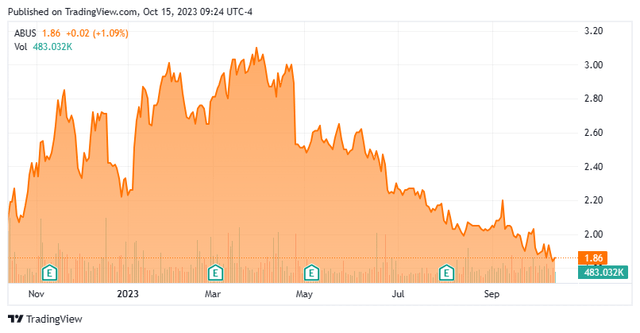

It has been a bit over a year since we had Arbutus Biopharma Corporation (NASDAQ:ABUS) in the spotlight here at The Biotech Forum. We concluded that article by saying the stock merited a small, covered call holding as liquidity was good against the equity and the option premiums were lucrative. That turned out to be the right investment strategy on this name as the stock pretty much trades exactly where we profiled in September of 2022. It also seems a good time to circle back on Arbutus. An updated analysis follows in the paragraphs below.

Seeking Alpha

Company Overview

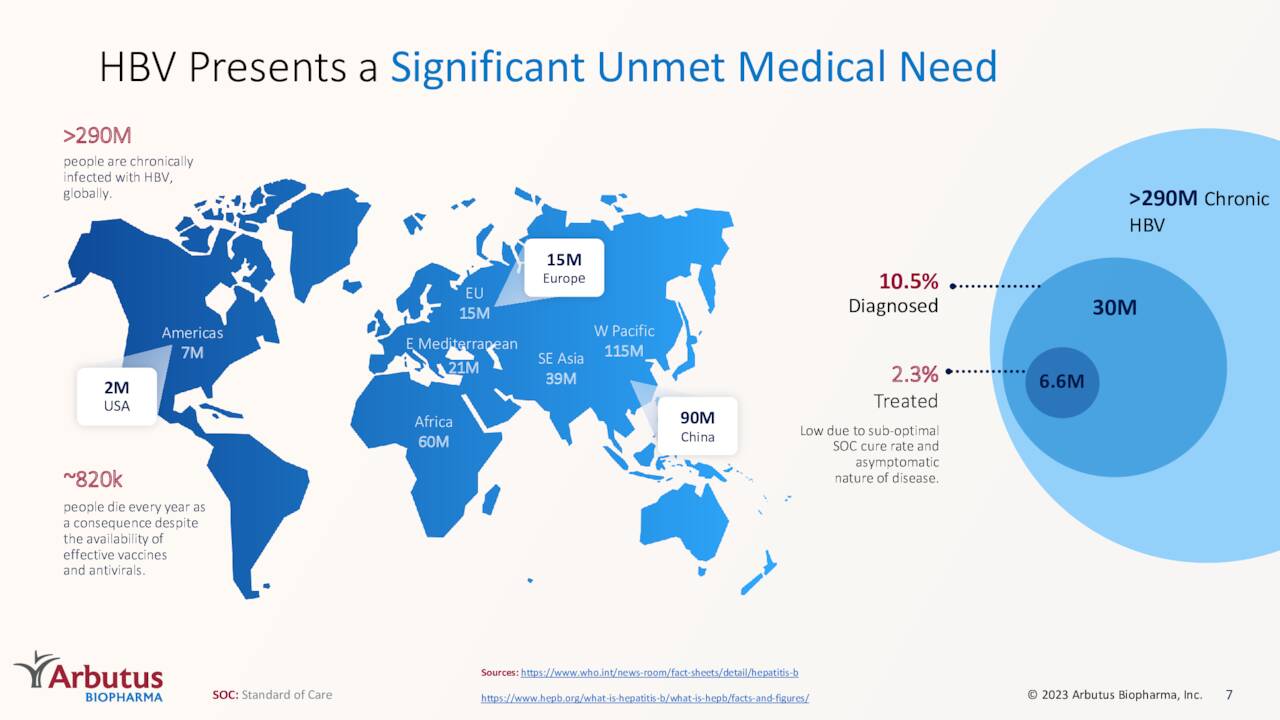

This small biopharma concern is primarily focused on developing novel therapeutics for chronic Hepatitis B virus (HBV) infection. The company is headquartered just outside of Philadelphia in Warminster, PA. The stock trades just south of two bucks a share and sports an approximate market capitalization of $310 million.

Recent Developments

Last week, the FDA decided not to approve a label expansion for Alnylam Pharmaceuticals (ALNY) amyloidosis therapy patisiran, a compound that Alnylam has a license from Arbutus to develop and commercialize.

Five weeks ago, Arbutus announced it was discontinuing development on two candidates in its pipeline. The first was AB-343 that was targeting Covid and second was for AB-161 that was an oral RNA destabilizer targeting HBV.

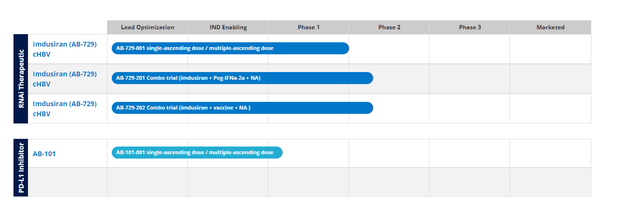

Company Website

This left Arbutus with one late-stage RNAi therapeutic candidate ‘AB-729’ within its pipeline, that is being evaluated to treat HBV as part of several combination therapies.

August Company Presentation

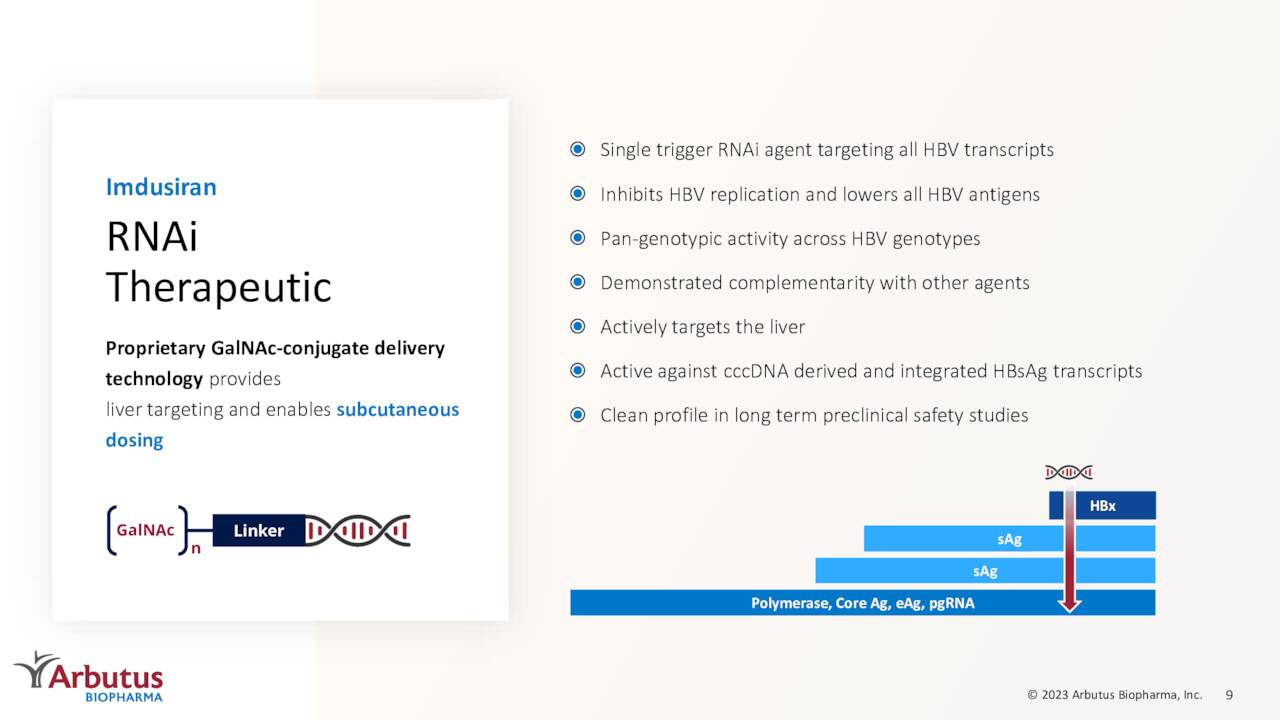

AB-729 also goes by its generic name, imdusiran, and management believes it has the potential to be a cornerstone therapy to functionally cure chronic HBV.

August Company Presentation

This is a potentially a large market. Data from early staged studies showed that imdusiran appears to be the only RNAi therapy to impact both the surface antigen and the reawakening of the HBV specific immune response. Arbutus has a collaboration/license deal with Qilu Pharmaceutical which is paying Arbutus to develop the drug for use in China.

August Company Presentation

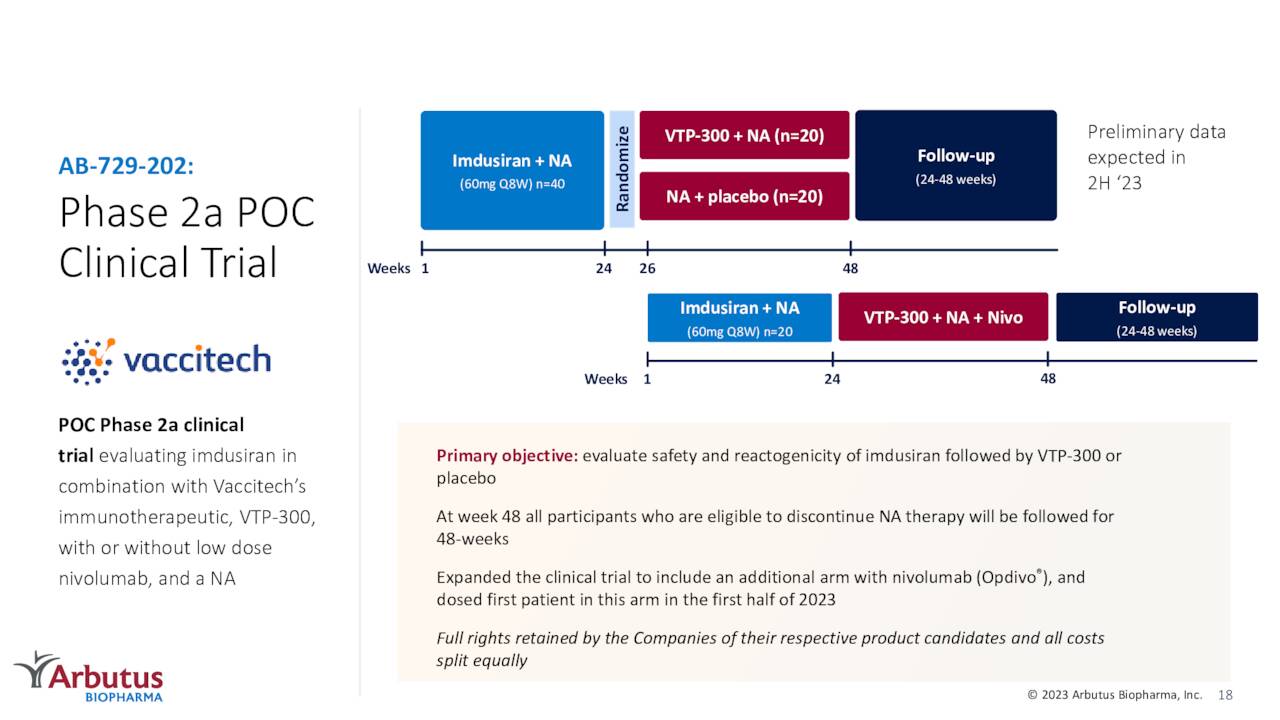

Currently, there is a 40-person Phase 2a study evaluating AB-729 with Vaccitech’s (VACC) T-cell stimulating immunotherapeutic, VTP-300, to treat chronic HBV. Results from that ongoing trial should be out before the end of this year. The company recently expanded this trial. The study will not include an additional treatment arm that will enroll approximately 20 patients to receive low-dose nivolumab, a PD-1 monoclonal antibody inhibitor also known as Octevo and that has been approved for a variety of cancer indications within a combination regime with VTP-300 and AB-729.

August Company Presentation

The company is also evaluating imdusiran in combination with ongoing nucleoside or nucleotide analog therapy and imdusiran in patients with chronic HBV within a Phase 2a study with 12 and 24 week lead in times. Leadership presented preliminary data from 12 patients in this study at the most recent EASL medical congress early this summer.

Analyst Commentary & Balance Sheet

Since Arbutus’s last quarterly report, Chardan Capital ($4 price target), H.C. Wainwright ($6 price target) and JMP Securities ($4 price target) have reissued Buy ratings on the stock while Robert W. Baird maintained its Hold rating and $4 price target on ABUS.

Approximately six percent of the outstanding float in the shares are currently held short. There has been no insider activity in this stock since December of 2021. The company ended the second quarter of this year with approximately $165 million of cash and marketable securities on its balance sheet. Here is what management had to say about its funding position on the earnings call press release:

We expect our 2023 net cash burn to range from between $90 to $95 million, excluding any proceeds received from our “at the market program”. We believe our cash runway will be sufficient to fund our operations into the first quarter of 2025. “

The company raised $25 million from their ‘at the market‘ program in the first half of the year and burned through some $47 million worth of cash to support all operations in the first two quarters of 2023.

Verdict

August Company Presentation

Arbutus continues to be an intriguing developmental concern. Dropping two candidates under development should allow the company to focus more intently on advancing AB-729 and also reduce cash burn. Frankly the decision to drop its Covid candidate was long overdue given the coronavirus had reached endemic status some time ago.

That said, almost all of Arbutus’s eggs are in one basket as far as AB-729. Other than pre-clinical assets that were not covered given how early stage they are. HBV is potentially a lucrative market to continue to hold a very small stake in Arbutus pending further developments. However, until the company’s primary asset advances further along its development pathway, it only merits a small holding for aggressive investors within a well-diversified biotech portfolio.

It´s one thing to enjoy a story, but it´s quite another to take it for the truth.”― Patrick Rothfuss

Read the full article here