Investment thesis

Our current investment thesis is:

- GWW is a quality business, owing to its strong market presence, deep expertise allowing it to respond to industry/customer needs, and its broad reach within the US.

- The industry, and GWW’s business model, are robust against economic/social changes, allowing for an incredibly consistent revenue profile. Even during the current inflationary issues, the business has achieved impressive growth.

- Management has positioned the business to distribute aggressively (but sustainably) to shareholders, allowing for healthy returns long term.

- With the share price up over +25% in the YTD, we suggest patience to identify an attractive entry point, with the stock slightly overvalued.

Company description

W.W. Grainger, Inc. (NYSE:GWW) is a Fortune 500 industrial supply company based in the United States. It provides a wide range of products and services to businesses and institutions for maintenance, repair, and operations (MRO) needs.

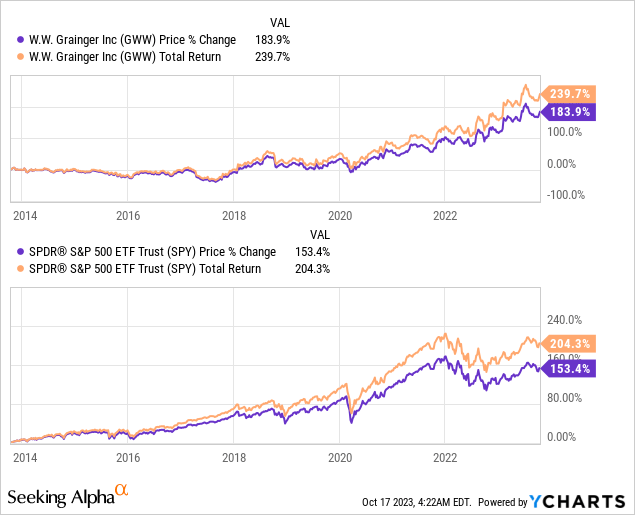

Share price

GWW’s share price has performed well in the last decade, outperforming the wider market. This has been driven by strong financial returns and a lucrative capital allocation ratio.

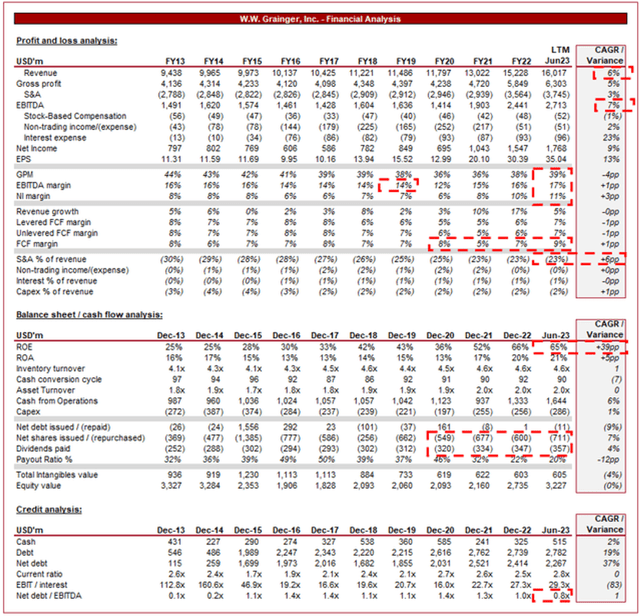

Financial analysis

W.W. Grainger Financials (Capital IQ)

Presented above is GWW’s financial performance.

Revenue & Commercial Factors

GWW’s revenue has grown well in the last 10 years, with a CAGR of 6%. The company’s growth has been supremely consistent, with only a single period below 2%.

Business Model

GWW offers an extensive catalog of MRO products, including tools, safety equipment, cleaning supplies, janitorial products, plumbing and HVAC equipment, electrical components, and more. GWW serves a diverse customer base, including businesses of all sizes, government institutions, healthcare organizations, and more. Its products are essential for maintenance and operations across industries.

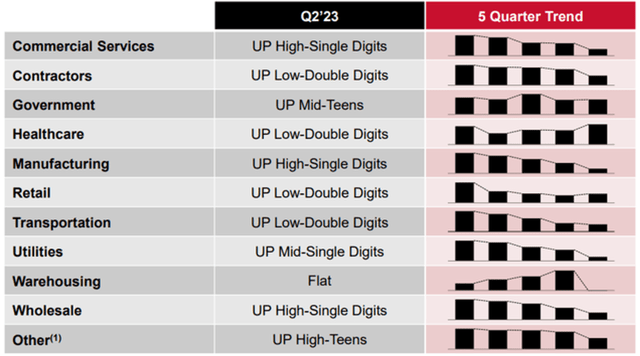

Unlike many other industrial businesses, its vast product assortment caters to the needs of various industries and sectors. As the following shows, the range of end markets is broad. The benefit of this is diversification, as it reduces GWW’s reliance on any single industry, many of which are cyclical in nature.

End user (GWW)

GWW serves customers through multiple distribution channels, including e-commerce platforms, catalogs, branch locations, and direct sales representatives. This multi-channel approach allows customers to access products through their preferred purchasing method, widening the company’s reach.

In recent years, GWW’s focus on e-commerce has been highly successful as the trend toward online purchasing has slowly impacted the industrial industry. The business has developed a compelling offering, with detailed metrics on each product, allowing for comparison between brands/options, while also making it easy to use.

GWW maintains relationships with a wide range of suppliers and manufacturers. This enables the company to offer a diverse product portfolio and ensures availability for customers’ needs. This has been highly important in recent years due to supply chain concerns, with GWW generally navigating this well.

GWW’s international presence allows it to tap into markets beyond the United States, further benefiting from diversification. Expanding its direct footprint in different regions has the potential to improve, particularly given its deep expertise and supplier relationships.

Competitive Positioning

The need for MRO products has generally been constant across industries, growing in line with economic conditions and infrastructure investment. As companies continue to operate and maintain facilities and equipment, the demand for GWW’s products will remain resilient, contributing to consistent revenue growth. As a leading player within this industry, GWW is positioned well for long-term growth through consistent product demand.

GWW focuses on building strong relationships with customers by providing reliable products (delivery and quality), a broad product range, and exceptional customer service. These relationships lead to repeat business and customer loyalty, with no reason why its customers would switch. This also develops its reputation within various industries, allowing GWW to more easily win new customers.

Given GWW’s scale, the company is positioned well to continuously add new products, improve its digital platform, and adopt to technology-driven solutions. This will allow it to maintain its market-leading position and meet customers’ evolving needs.

Economic & External Consideration

Current economic conditions represent the potential for near-term headwinds. With high inflation and elevated rates, demand for goods and services is softening, as consumers turn defensive financially and businesses look to protect margins from inflationary erosion.

The risk is that mild demand in conjunction with elevated rates will reduce infrastructure spending, particularly in the industry such as Manufacturing, Contracting, Transportation, and Home Building (among others). These activities are now far more expensive to finance, contributing to cancellations and deferrals of projects.

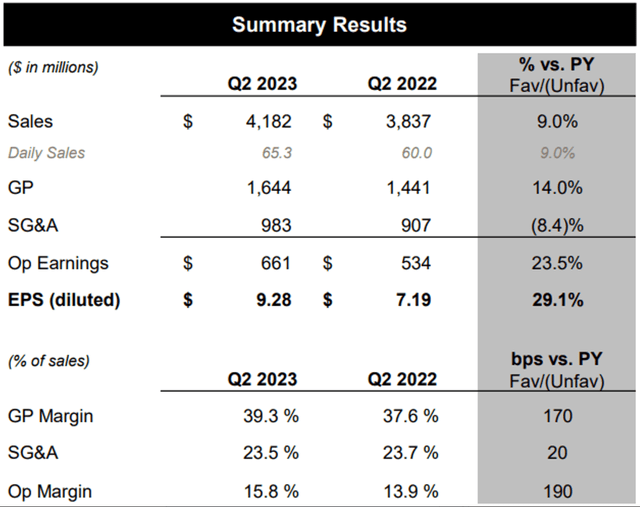

GWW’s quarterly results do not imply this is having a material impact, however. The company posted a monster Q2-23. Revenue growth was up +9%, with GPM up +14%, and EPS up +29.1%.

Quarterly results (GWW)

This has been driven by:

- High-touch solutions – This segment continues to outgrow the wider US MRO market, with pricing action and broad demand across geographies, owing to the commercial strength of the business.

- Endless Assortment – Both Zoro and MonotaRO performed exceptionally well (although MonotaRO was impacted by depreciating Yen).

- Margin improvement – through freight and supply chain efficiencies, pricing action, and softening inflationary pressures.

Margins

GWW’s margins had slightly declined in the lead-up to the pandemic, however, following this, the business has reached a decade high. With strong quarterly demand, there is a reasonable chance GWW can normalize at this current level, although it may be conservative to assume GWW’s EBITDA-M will decline to c.16% over the coming 5 years.

Balance sheet & cash flows

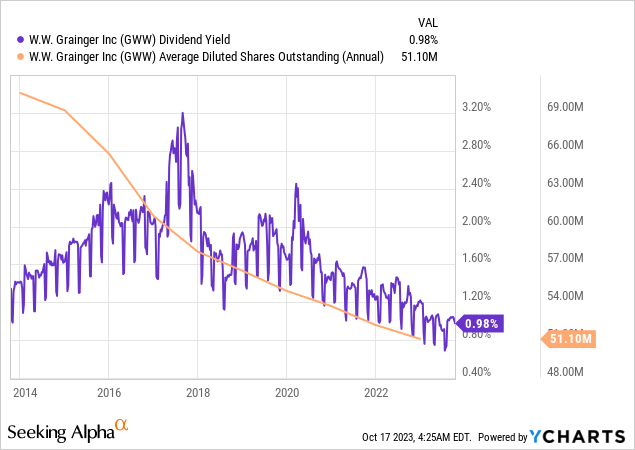

Management’s operational management and capital allocation have been nothing short of incredible. Inventory turnover and its CCC have consistently improved since Dec-13, contributing to a growing FCF margin (and a lack of volatility), allowing the business to improve distributions.

Buybacks have grown at a CAGR of 7% while dividends have grown at a CAGR of 4%, with no disruption during this period. While doing so, Management has not laddered debt, keeping the business conservatively financed. This leaves the potential for debt usage in the future for either distributions or M&A.

Industry analysis

Trading Companies and Distributors Stocks (Seeking Alpha)

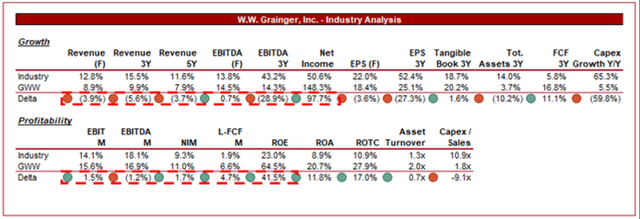

Presented above is a comparison of GWW’s growth and profitability to the average of its industry, as defined by Seeking Alpha (35 companies).

GWW performs well relative to its peer group in our view. The company is slightly lacking in revenue growth, although this is offset in some of the profitability/FCF metrics. One of the primary reasons for this is size, with GWW larger than 30 of the 35 businesses, making it difficult to achieve absolute gains in this mature industry relative to higher growth companies.

The main area of strength is the company’s profitability. It has a significantly higher ROE and FCF, while boasting moderately better margins. This is a reflection of the company’s scale and lean operations, allowing for efficient returns.

Given the maturity of the industry, our preference is toward profitability, which implies GWW should trade at a premium to this cohort.

Valuation

Valuation (Capital IQ)

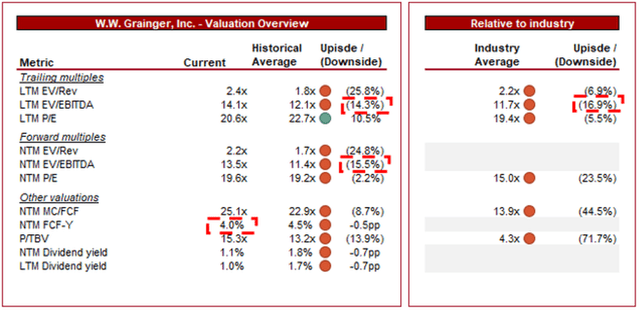

GWW is currently trading at 14x LTM EBITDA and 14x NTM EBITDA. This is a premium to its historical average.

GWW can justify a premium to its historical average multiple in our view, primarily due to its improved margins, greater scale, and robust financial performance. We do not believe this premium should be large, however, and generally comparable on a FCF yield basis, which is not currently the case.

Further, we believe GWW should trade at a premium to its peer group, for the reasons previously discussed. Again, this premium should not be significant in our view, given the growth delta.

Based on this, GWW is likely fairly valued or at least slightly overvalued. With the share price up over +25% YTD, it is likely the near-term gains have already been realized. Analysts concur with this view, with 12/13 hold ratings (Source: Capital IQ).

Final thoughts

GWW is a fantastic business. The company is a classic compounder, with strong cash flows, a good competitive position, and a consistent growth industry; allowing for aggressive distributions to shareholders. Our expectation is that over the long term, the business will be able to maintain its current trajectory, with scope for outperformance with industry tailwinds, such as increased infrastructure spending.

Following a share price rally in 2023, the stock is likely trading high, particularly due to the risks around near-term growth issues given the macro conditions.

We suggest investors remain patient and seek an attractive entry point.

Read the full article here