Investment Landscape: Inflation, Recession, or Both

The third quarter of 2023 was a wake-up call for many investors after equity markets powered relentlessly upward in the first half of the year. Global stocks and bonds sank in the third quarter, raising fears of a correlated drop in both asset classes, as was seen in 2022. The reality is likely that markets could no longer ignore the looming risks created by escalating interest rates on top of ever more ominous levels of debt. Fiscal deficits in the U.S. near 8% of GDP clearly aren’t helping, and raise the specter of a government unable to carry the burden of higher interest rates that have been so rapidly increased by its central bank.

Equity markets, perhaps surprisingly, spent the beginning of the year benefitting from a moderation in inflation and the hope that lower interest rates were on the horizon. Inconveniently, inflation has not disappeared and in fact has even turned higher again in economies such as the U.S. It’s a bold call to believe inflation will wither and die in the coming quarters considering the current backdrop. Oil prices are pushing ever higher on the back of geopolitical tensions. Wage inflation remains sticky and threatens to escalate with labor strikes across multiple industries. And mammoth fiscal deficits rarely seen outside of war time seem to necessitate a return to debt monetization. The third quarter reality check is likely the realization that interest rates will stay higher for longer and threaten to “break” parts of the economy or that a troubling recession is at the doorstep. Either way, it’s unlikely equities will escape continued weakness going forward. Indeed, it’s highly unusual to see equities hold up after rates have been ratcheted up in such an aggressive fashion.

40 Years of Debt Up and Interest Rates Down is Now Debt Up and Interest Rates Up

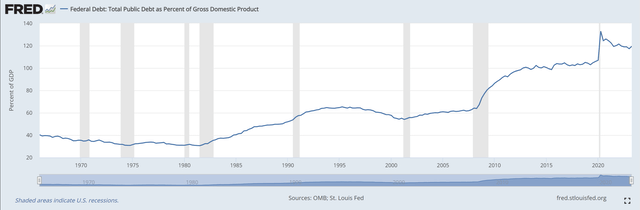

At the risk of sounding like a broken record, we want investors to seriously consider the peril of governments such as the U.S. being hopelessly in debt. In the U.S., public debt to GDP sits near 120%, essentially twice as high as it was in 2008.

U.S. Federal debt as a percent of Gross Domestic Product (OMB; St. Lous Fed; from FRED)

And these debt statistics do not include entitlements such as Social Security, Medicare, and Medicaid, which make the situation look truly dire. As legendary investor Stanley Druckenmiller explains,

“The current $31 trillion US debt load doesn’t account for future entitlement payments. Accounting for the present value of that burden, the debt load is more like $200 trillion.”

There simply isn’t a painless way out of that kind of debt burden. In the meantime, fiscal irresponsibility continues with the deficit for 2023 potentially hitting $2 trillion. And things could get much worse should a recession emerge. As macroeconomist Luke Gromen points out,

“The U.S. Federal deficit is running at approximately 8% of GDP. The last three U.S. recessions saw deficits rise by 6%, 8% and 12% of GDP. So a U.S. recession could see 14-20% of GDP deficits.”

The excessive fiscal spending so far in 2023 is likely one reason we haven’t seen more negative economic effects from central bank tightening. Investors have been concerned about debt levels for decades, but issues related to over-indebtedness were kept at bay by interest rates generally falling for 40 years from the early 1980’s to the early 2020’s, allowing debt service costs to remain manageable. The same 40-year period also saw disinflationary pressures from globalization and the opening of China and Eastern Europe. But now, debt levels continue to build while interest rates climb rapidly, making debt service burdens unbearable. Perhaps the weak third quarter in financial markets reflects a gradual acceptance that unsustainable debt and spending, combined with higher interest rates, will eventually lead to recession or inflation, or perhaps both.

Investors Need Not Despair

Markets often do have a curious way of pricing in risks and opportunities in the short-term, but there are ways for investors to achieve satisfactory results despite all of the challenges. Long-term thinking and a process to follow through the volatility are critical. On a practical level in equity markets, current circumstances call for an insistence on strong balance sheets and attractive and sustainable cash flows. Resilient businesses researched from the bottom up that aren’t reliant on cheap debt and a strong cyclical environment can provide a “hedge” to the tricky economic backdrop. Of course, attractive valuations, perhaps for companies already unloved and punished by the market, also provide a degree of downside protection. Diversifying assets such as gold may help to insulate investors from currency debasement (through inflation for example) as well as financial or geopolitical stress, while providing a potential source of liquidity to pounce on truly attractive investment opportunities as they arise.

We are convinced that investors with a structured process and the appropriate discipline can find attractive idiosyncratic investment opportunities, as well as benefit from overall market volatility. Our investment process enables us to deploy capital in what we believe to be the best possible way to navigate the current investment environment – by focusing on owning scarce and productive assets, often in the form of high-quality companies, as well as maintaining a significant level of optionality by holding liquid reserves such as physical gold.

“You make most of your money in a bear market, you just don’t realise it at the time”.

Shelby Cullom Davis, an experienced value investor

—

Professional investors can find our full quarterly commentary, which includes the Fund’s asset allocation and performance, at the following link.

Read the full article here