It has been a significant swoon for major AI-related companies since the group rallied in June and July. Tech stocks writ large peaked on July 31, and a tough August and September ensued. Further selling this week, following bearish news regarding US-China tensions, have sent AI plays lower, too. Investors will soon turn their eyes to earnings and cash flow, though.

I reiterate my buy rating on Marvell Technology (NASDAQ:MRVL) as shares have fallen into deeper “GARP” territory while key developments on the chart are taking place.

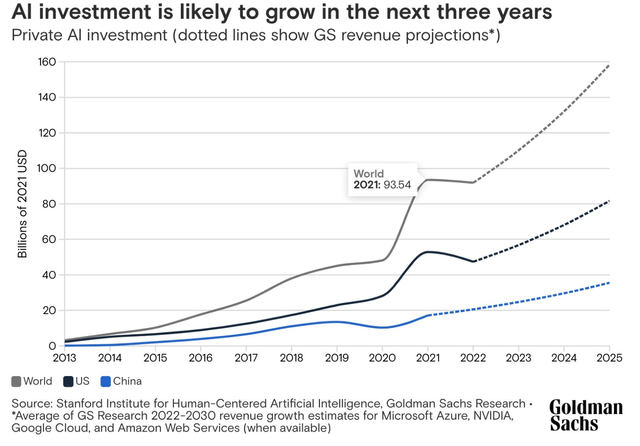

Goldman: AI Investments Set to Surge From $92 Billion in 2022 to $158 Billion by 2025

Goldman Sachs, @tahneeperry

According to Bank of America Global Research, Marvell is a leading fabless supplier of high-performance standard and semi-custom products with a core strength in developing complex System-on-Chip architectures and integrating analog, mixed-signal, and digital signal processing functionality. Marvell’s broad portfolio of IP spans computing, optics, networking, storage, and security and addresses the enterprise, cloud, telecom, auto, and industrial markets.

The Delaware-based $45.9 billion market cap Semiconductors industry company within the Information Technology sector has negative trailing 12-month GAAP earnings and has a small 0.5% forward 12-month dividend yield. Ahead of earnings in November, the stock carries a low 1.6% short interest and an implied volatility percentage of 39% as of Oct. 17, 2023, down about 15 percentage points from my previous analysis.

Marvell continues to grapple with its legacy business while competing heavily in emerging AI technologies. BofA notes that the firm has a compelling mix of data center and infrastructure assets exposed to AI, including electro-optics, Ethernet switching, and custom ASIC chips. Such assets are expected to help sales grow at a double-digit clip with potential bottom-line growth near 30%. The major risk is that growth expectations are too high, but I believe much of that doubt has now been priced in. Be sure to watch gross margin trends in its Q4 earnings report next month along with how much AI is contributing to profits and free cash flow. Risks include troubles in the storage market, weakness in MRVL’s legacy businesses, and intense competition from major players in the silicon space. Also keep your eye on the firm’s debt burden amid higher borrowing rates today.

In its Q2 report, the company posted EPS of $0.33, a penny better than consensus, while revenue of $1.35 billion was 12% below the year-ago level, also a modest beat. Shares sold off the following day as investors were uncertain about how MRVL’s old business lines would impact future profitability. Guidance, however, was about in-line with expectations, and the current quarter’s EPS is seen in the $0.35 to $0.45 range.

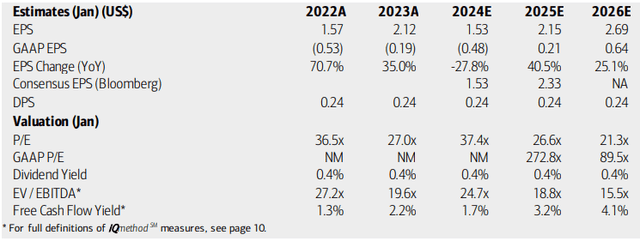

On valuation, analysts at BofA see earnings falling 28% this year (the firm is currently operating in its 2024 third quarter). Operating per-share profits are expected to grow sharply in its next fiscal year with continued robust growth looking out to 2026. The consensus forecast is for $1.54 of non-GAAP EPS this year with a steady increase to above $3 by 2026. Dividends, meanwhile, are expected to hold at $0.24 annually. The valuation continues to appear high when assessing both the P/E situation and its EV/EBITDA, which is close to 2x that of the broader market. MRVL’s free cash flow yield also is very low.

Marvell: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

I continue to assert that $2.25 of EPS is a reasonable normalized earnings figure based on where consensus expectations are. Moreover, a 20% long-term EPS growth trajectory still appears about right based on last quarter’s results and comments from the management team. That gives us a 23.6x normalized operating P/E. With the assumed growth rate, we’re now talking about a PEG ratio barely above 1. Not a bad deal for what should be an AI beneficiary. I continue to suggest that a fair value of around $75 is reasonable if we assign a PEG closer to the sector average and MRVL’s five-year norm.

Strong Growth Ahead More Than Offsets A High P/E

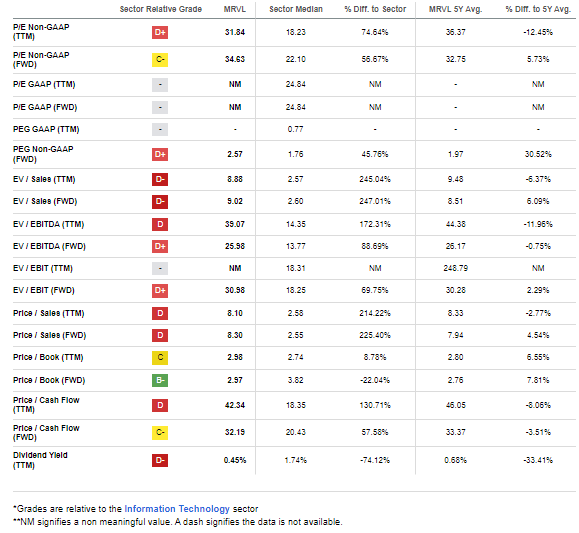

Seeking Alpha

Compared to its peers, MRVL features a poor valuation grade, but, as I outlined above, certain adjustments to traditional valuation methods should be made. Additionally, recent growth has been weak, but the look-ahead EPS and free cash flow situations are more sanguine in my view. Nearly all firms in the industry are solidly profitable, and MRVL is no different. Where we do see some better-than-average metrics are in the stock price momentum space, though price action very recently has been lackluster (which I will detail later). EPS revisions have cooled off from strong levels earlier this year as traders try to suss out winners from losers in the AI trade.

Competitor Analysis

Seeking Alpha

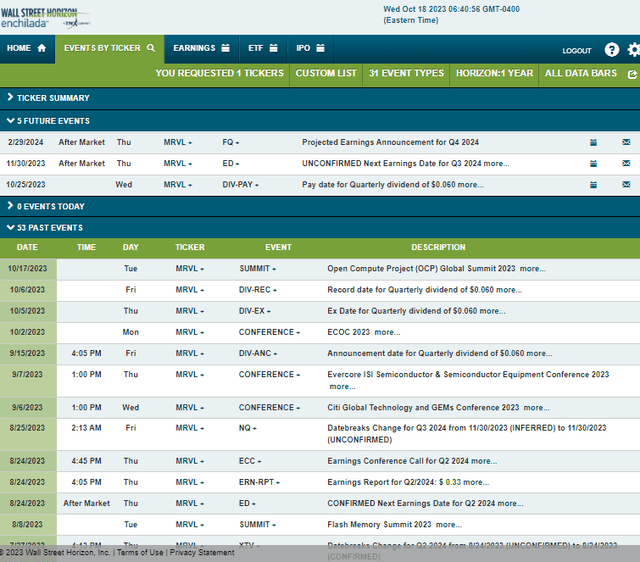

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2024 earnings date of Thursday, Nov. 30 after market close. No other event volatility catalysts are expected.

Corporate Event Risk Calendar

Wall Street Horizon

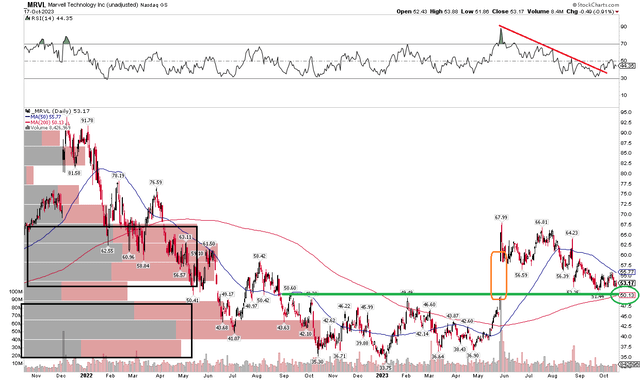

The Technical Take

I normally don’t give such quick updates on a stock after an initial analysis, but there have been some interesting technical developments. Notice in the chart below that MRVL has held support which I pointed out back in early August. The gap-fill has just about been completed – stocks with air pockets of volume often move quickly through such price gaps. With the long-term rising 200-day moving average coming into play, I would expect buyers to begin to step up.

Maybe they’re already doing so as the RSI momentum indicator at the top of the graph illustrates that the downtrend in momentum has broken. The presumption is that price will follow suit. Interestingly, there’s a decent amount of volume by price both above and below the current price, so the low $50s is a key battleground between the bulls and the bears. Overall, long here with a stop under $50 is a tight risk/reward play for active investors. Resistance is seen in the mid-$60s.

MRVL: Shares Dip To Critical Support, RSI Firming Up

Stockcharts.com

The Bottom Line

I reiterate my buy rating on MRVL. I continue to assert that the valuation is compelling while the technical setup following poor price action since July has finally reached pivotal support.

Read the full article here