DoubleVerify (NYSE:DV) provides advertising technology. The company has achieved a stable and high growth and has stayed profitable on a net income basis in the entire period, contrary to many growing software companies. DoubleVerify’s software offering seems to be very competitive in the ad-tech industry with multiple promising KPIs. Although the company is great in quality, I only have a hold rating as the current price already reflects the fantastic prospects.

The Company and Stock

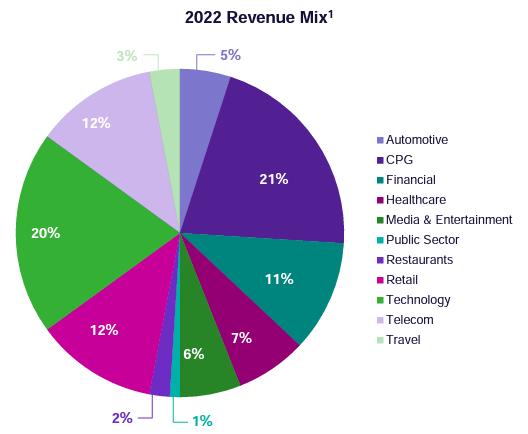

DoubleVerify offers digital advertising solutions that help businesses in optimizing geographical targeting, viewability, prevention of fraud, and brand safety along with other applications. The offering targets to optimize customers’ advertising spend’s effectiveness. The company offers the solution in multiple industries – DoubleVerify’s customers are highly diversified with industries ranging from Automotive to Telecom:

DoubleVerify Q2 Earnings Presentation

DoubleVerify’s high customer retention rate speaks about the platform’s competitiveness – from 2019 to 2022, the company boasts a 100% customer retention within the top 75 customers, while the average revenue per customer has gone up from $1.1 million to $2.6 million per customer in the same period. In addition, DoubleVerify is positioning itself for the AI revolution with the company’s Scibids AI platform that was launched in 2023. The company expects Scidibs to achieve $15 million to $17 million in revenue in 2024, but expects a very high growth into $100 million in revenues in 2028.

After an IPO in the first half of 2021, DoubleVerify’s stock price has decreased by 20%. As technology stocks have seen a difficult period after the IPO, the decrease is quite expected.

Stock Chart From IPO (Seeking Alpha)

Financials

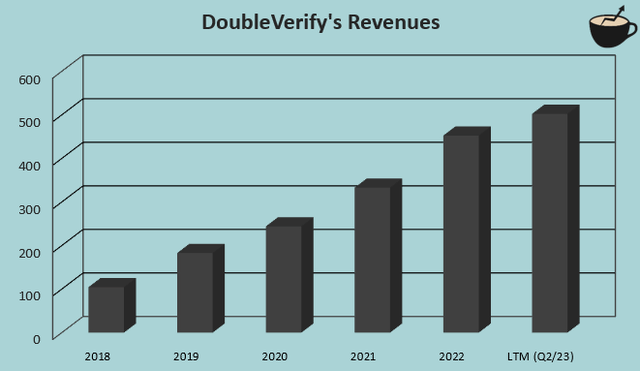

DoubleVerify’s compounded annual growth rate from 2018 to 2022 is 44.3%:

Author’s Calculation Using Seeking Alpha Data

The growth has been mostly organic as DoubleVerify only has three cash acquisitions in the period that add up to less than 5% of the company’s current market capitalization. The ad-tech industry is also growing as a market. For example, DoubleVerify estimates a five-year CAGR of 12% for digital ad spend from 2020 to 2025 with Magna Global forecast’s data, as told in DoubleVerify’s Q2 earnings presentation.

The company has been able to keep its operating earnings profitable on a GAAP basis in every year of public financial history. The EBIT margin has been quite turbulent with an average figure of 11.4% from 2018 to 2022. I believe that DoubleVerify’s margins have a good amount of room to scale in the future – as with many SaaS platforms, variable costs are quite stable even with growing revenues, providing significant operating leverage. DoubleVerify’s also has a very high gross margin, currently standing at 81.6% with trailing figures.

DoubleVerify has a strong balance sheet. The company doesn’t currently hold any interest-bearing debt intended for financing purposes. The balance sheet also shows cash and equivalents of $295 million – DoubleVerify has room for a strategic acquisition. I believe that DoubleVerify should leverage some debt as a form of cheaper financing; the company already has healthy cash flows, so moderate debt shouldn’t pose a threat for the operations.

Valuation

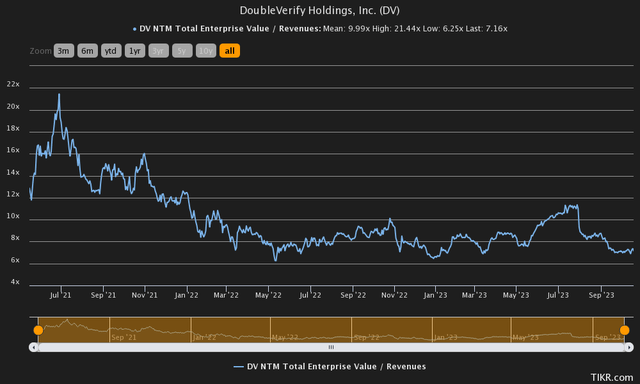

DoubleVerify’s stock has had a decreasing EV/S for most of the stock’s history in the stock market – after a high of a forward EV/S of 21.4 in 2021, the ratio has come down into a current level of 7.2.

Historical Forward EV/S (TIKR)

The EV/S ratio as an isolated figure doesn’t give a good context into a company’s valuation. Even within SaaS companies, the fair EV/S ratio varies heavily depending on the company’s expected growth and achievable margins on top of other factors. To further conceptualize the valuation and to estimate a rough fair value for the stock, I constructed a discounted cash flow model as usual.

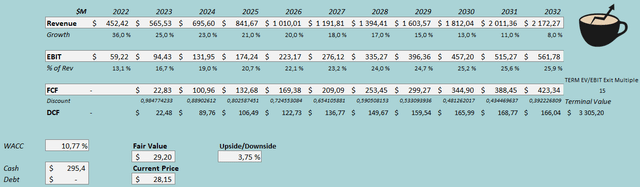

In the model, I estimate DoubleVerify’s growth to continue quite in line with the historical growth in terms of dollar figures, with slight growth in the growth in dollar figures. Percentage-wise, I estimate the growth to slow down slowly – in 2023, I estimate a growth of 25% that slows down to 23% in 2024. Beyond 2024, I estimate similar decreases in the growth pace into a growth off 8% in 2032. The estimated revenue growth represents an organic CAGR of 17.0% from 2022 to 2032.

I believe that DoubleVerify’s margins still have room to grow significantly, as explained in the financials -segment. For the current year, I estimate an EBIT margin of 16.7%, 360 basis points above the achieved 2022 level. After 2023, I estimate the operating leverage to continue along DoubleVerify’s growth – I estimate the EBIT margin to grow into a figure of 25.9% that’s achieved in 2032. The model does factor in a high amount of margin expansion, but with the company’s very high gross margin, I believe the estimate is achievable.

Contrary to my usual method of discounting cash flows with a perpetual growth rate in the terminal of the DCF model, I believe that an EV/EBIT exit multiple is more appropriate for DoubleVerify. In the model, I estimate the growth to continue at a moderate but significant level in 2032 – a perpetual rate would be difficult to determine. I believe an EV/EBIT exit multiple of 15 represents the fair value quite well, as the company still grows in the model with a high-quality product.

The mentioned estimates along with a cost of capital of 10.77% craft the following DCF model with a fair value estimate of $29.20, around 4% above the price at the time of writing:

DCF Model (Author’s Calculation)

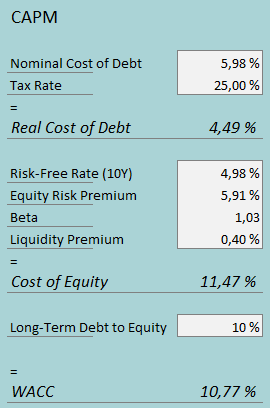

The used weighted average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

DoubleVerify doesn’t currently leverage debt in the company’s financing. I believe that at some point the company could start drawing some debt as a form of financing, as I believe the company’s cash flows to be stable. In the CAPM, I estimate a long-term debt-to-equity ratio of 10%. For the interest rate estimate, I use a figure of 5.98%. The estimate is calculated from the United States’ 10-year bond yield of 4.98%, and adding in a percentage point for a margin of safety.

I use the same US’ 10-year bond yield as the risk-free rate on the cost of equity side. The equity risk premium of 5.91% is Professor Aswath Damodaran’s estimate made in July. Yahoo Finance estimates DoubleVerify’s beta at a figure of 1.03. Finally, I add a small liquidity premium of 0.4% into the cost of equity, crafting the figure at 11.47% and the WACC at 10.77%.

Takeaway

I base my views on a stock largely on its valuation. Although DoubleVerify’s price seems very high at a forward P/E of 39, I believe the price fairly reflects the company’s promising prospects. The company has a very high retention rate along with new AI solution capabilities, fueling DoubleVerify for significant growth. As my DCF model estimates the stock to be valued fairly, I believe a hold rating is constituted.

Read the full article here