Introduction

Great-West Lifeco Inc. (TSX:GWO:CA) (OTCPK:GWLIF) is one of Canada’s largest financial services companies. It has a strong focus on health insurance, life insurance, and an increasing focus on retirement and investment services. The company should be seen as a crossover between an insurance company and an asset manager as it has been expanding its wealth and retirement platform.

Great-West’s operating performance rarely disappoints

Great-West Lifeco traditionally is a solid performer but there are some one-off items sometimes that weigh on the reported result. That was also the case in the second quarter of this year as the company reported an EPS of just C$0.53 while the ‘basic’ EPS was C$0.99. The reason for this large difference is simple: there were costs associated with the recent acquisitions and divestitures.

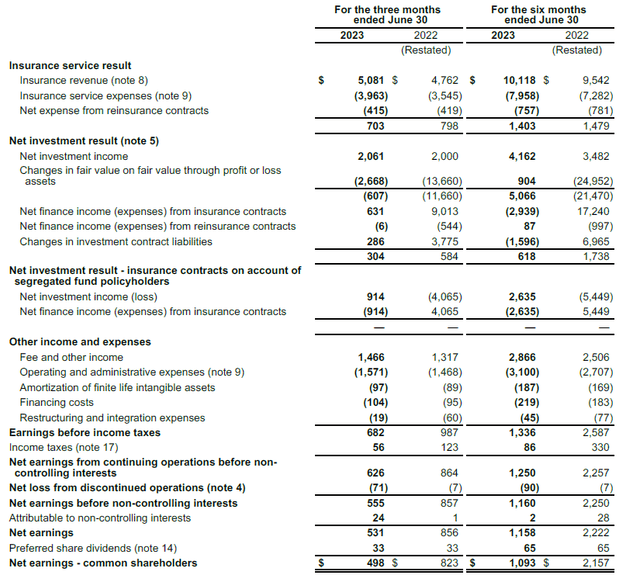

As you can see below, the total insurance division contributed about C$703M to the top line result while the net investment result of C$304M was quite decent. It is quite obvious the large (unrealized) losses on the portfolio of fixed income securities are slowing down.

GWO Investor Relations

An additional strength of Great-West Lifeco is its ability to almost fully cover its G&A expenses with its fee income. The total pre-tax income generated by the company in the second quarter of the year was C$682M resulting in a net profit of C$626M. That’s the result on an underlying basis, and we still have to deduct the C$71M loss from discontinued operations from that number, ending up with C$555M. That still isn’t the net income attributable to the common shareholders of Great-West Lifeco as we still have to deduct the C$24M attributable to the non-controlling interests and the C$33M in preferred dividends. That’s why the reported net income was C$498M for an EPS of C$0.53 while the earnings from continuing operations were substantially higher, at C$0.61 per share.

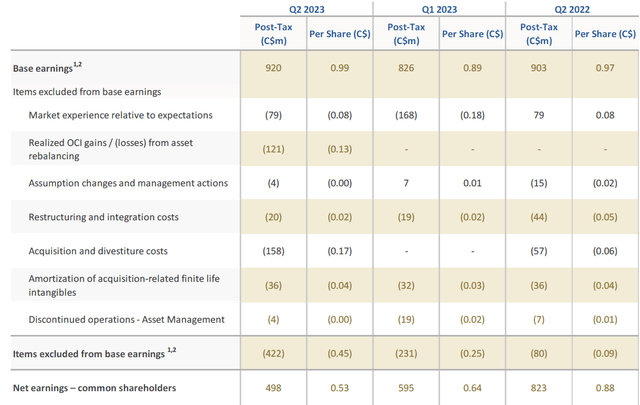

And of course an annualized EPS of just under C$2.50 is not a good enough reason to consider an investment in Great-West Lifeco, but the detailed earnings reconciliation below shows the non-recurring elements that are included in the C$0.61 EPS from continuing operations.

GWO Investor Relations

As you can see above, there was a pretty heavy impact from the rebalancing of assets (C$121M) and the acquisition and divestiture costs (C$158M). And on top of that, there was a C$36M amortization of acquisition-related intangibles. These three elements weighed on the reported income to the tune of C$0.34 per share.

The image also clearly shows the QoQ and YOY improvement in the basic earnings per share. While the reported EPS in Q2 was lower than in Q1 2023 and Q2 2022, the base earnings actually increased and that is encouraging.

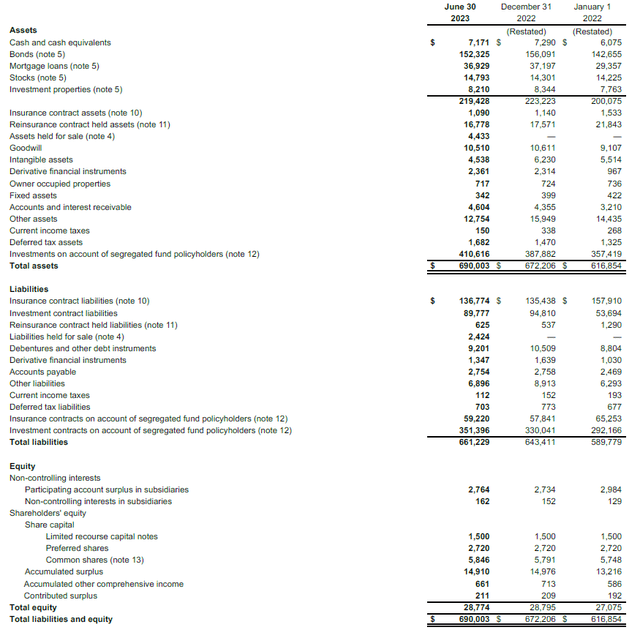

Unfortunately it’s not the base earnings but the actual reported earnings that determine the evolution of the book value. As of the end of June, the total equity value on the balance sheet decreased slightly to C$28.77B of which about C$2.9B is attributable to non-controlling interests with an additional C$1.5B and C$2.72B attributable to limited recourse capital note holders and preferred shareholders.

GWO Investor Relations

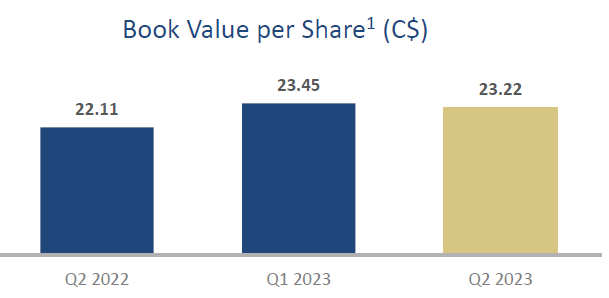

On a per-share basis, there was a slight decrease in the company’s book value, which means the stock is now trading at a premium of 65% to the book value per share.

GWO Investor Relations

While I remain convinced about the long-term value creation of the recent acquisitions (which I discussed in this article), I’m not very keen on paying a large premium to the book value. Sure, I should not consider Great-West to be a pure insurance company but as a combination of an insurance company and asset manager. This means a higher valuation is definitely warranted and considering the stock is trading at approximately 10 times its base earnings, the company definitely is not expensive from an earnings multiple perspective.

Investment thesis

The common shares are currently paying a quarterly dividend of C$0.52 which works out to C$2.08 per year. As shown in this article, the quarterly dividend is very comfortably covered by the base earnings and even the reported earnings are sufficient to cover the common dividends. The main question however is whether or not I am willing to pay a large premium to the book value of Great-West’s shares. Back in 2021 the value proposition was much more clear while at this point you have to be convinced about the potential to grow the asset management division. I think the recent series of acquisitions will allow the company to indeed grow its earnings but I am in no rush to buy the stock as there are plenty of attractively valued companies out there.

The preferred shares offer an interesting investment possibility as well. While the preferred shares obviously won’t share in the potential capital gains (the only capital gains will have to come from lower market yields which will push the share prices of fixed income securities higher) but as far as having a reliable stream of quarterly income, I do like the preferred shares and their 7% yield, despite their non-cumulative feature.

I currently have no position in any type of securities issued by Great-West Lifeco but I am keeping an eye on the common shares and preferred shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here