Headwinds That Lowers Confidence in VWE

Vintage Wine Estates (NASDAQ:VWE) has been a fumble recently, with declining gross margins and a shift in management that caused downward revisions from consensus estimates, which really upset Mr. Market, causing the shares to drop from $2.02 down to $1.28 a share (at the time of this writing). For these reasons, I’m not optimistic about where VWE is headed unless they show significant improvements in their management and financial performance in the near future, which could restore investor confidence and drive the stock price back up.

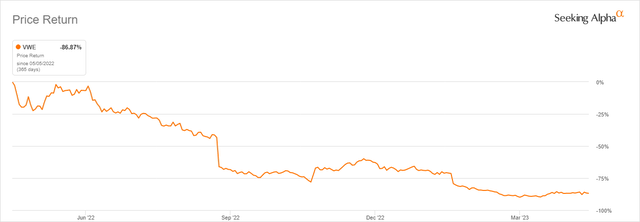

VWE Stock Price Movement

Just for some context, I’d like to show you the price action of the stock. As of this writing, VWE is currently on an 86% decline year-over-year. From its 52-week high of $9.91 down to its lowest low of $0.96, there surely is something causing this issue.

Stock’s been down on a Year-Over-Year basis (VWE Price Return – Seeking Alpha)

I guess we could blame the pandemic for it, right? As a retail company, it would be normal for a company’s stock to spiral downward because of lower sales in the pandemic era. However, that is not the case for VWE; in fact, the company’s annual revenue in 2020 of $189.92 million grew by 16.23%, or $220.74 million, in 2021. Not too bad of a pandemic run for VWE, huh? Surely it’s not caused by poor inventory management, downward revisions, low investor confidence, a change in management, and delayed quarterly report filing, right (it was)?

Why I’m Not Too Confident

This is why I’m not too confident with VWE. Sure, its revenue growth YoY is a lot better than its sector median, but these factors are what lessen my confidence in VWE. Namely, its poor inventory management, which caused a major dip in its stock price back in September of 2022, its sudden transition in management, which influenced the lower management guidance, hence underperforming once again, and the company’s delayed quarterly report timings.

If you think about it, these issues are indicative of deeper underlying problems within the company’s operations and decision-making processes. It will take significant effort and strategic changes to regain investor confidence and turn the company’s performance around.

The problems are fundamental; with poor inventory management come large write-offs that can affect the company’s margins. As you can see on the price chart above, one of the main reasons for this significant price drop was poor inventory management, with its CFO having this to say about the situation:

We are now diligently applying this focus and intensity in our financial processes in order to remediate our material weakness”

– Kristina Johnson, VWE CFO

There’s also an issue with the company transitioning to a new line of management. The current CEO and founder, Pat Roney, will shift to a role as executive chairman from his current role, and with the current director, John Moramarco, as the interim CEO, a search for a replacement will be launched. What should we expect here? Well, with Pat Roney as executive chairman, my best guess is that the vision will remain the same. With its singular focus on “producing the finest quality wines and incredible customer experiences”, I wouldn’t expect the company to lose its vision; however, with shifting management can come inconsistencies, which investors should look out for.

Personally, I think the revision of guidance due to the “misclarification and accounting for certain assets and also the timing of recording certain costs”, is a good move since interested investors and current holders would appreciate the transparency, the first step in gaining trust. The restated results are expected to have a $700,000 increase in net revenue but a whopping $2.9 million increase in COGS, which resulted in a cut in EPS of $0.02 down to $0.00, which is fairly disappointing. Additionally, the company provided a lower guidance of $81 million, below the consensus of $86 million in the second quarter, and a 35% gross margin, well below the 43% analyst expectations.

There’s also a minor issue with the VWE’s delayed quarterly report filing. Sure, this notice has no “impact on the listing or trading of the stock”, but to me, it poses a moral issue. If even its bare foundations aren’t being addressed (misclassifications, accounting errors, etc.), how would an investor trust them with their money? Some would say that this is pure irresponsibility and a (potential) empire built on shaky ground.

It’s important for companies to have transparency and accountability, especially when it comes to financial reporting. As an investor, it’s crucial to consider these factors before making any investment decisions, which is why I’m not too confident with VWE right now. That leads me to the conclusion that I think VWE is a hold.

Steps Taken in the Right Direction

To date, VWE has taken steps to improve annualized profits by about $10 million through a combination of price increases, cost recovery measures, and expense reductions. This sounds very promising, but to me, it’s a “see to believe” kind of thing. If I don’t see early signs of reliability, then I don’t think VWE is going to convince me or anybody else. VWE has strategically increased prices across the Direct to Consumer (“DTC”) segment (which could be good if their customers rave about it and really enjoy their products, so a price increase wouldn’t matter), is taking pricing on select wholesale brands, increased DTC shipping fees by an average of over 50%, and restructured a B2B customer contract to lower freight costs. Again, these changes sound promising, but without a solid display of good execution, plans remain as plans.

It has also reduced its full-time headcount by about 4%, which is normal if the company is aiming to lay off some workers to reduce costs. The plan’s estimated $2 million execution costs will be recorded during the third quarter of fiscal 2023, so to summarize, at a cost of $2 million, the company is in the process of creating a thorough business development and restructuring plan that will evaluate a number of options for additional cost savings, such as customer contract renegotiations, business simplification, a focus on key brands, and SKU (stock keeping unit) reductions. I mean, hey, a $2 million upfront cost could shake the near-term price action, but if it’s an expense the VWE is willing to make to improve its annualized profits, then I’m all up for it.

Investor Takeaway

Overall, it’s pretty clear that VWE is in a weak state, and it all comes down to how much an investor can stomach the near-term headwinds. I say near-term headwinds because if the company can drive great top-line strength while sorting out management issues and trying to improve its annual profits, things can take a turn pretty fast. From a momentum-based perspective and relative to its current price, the $1.28 share price could be tempting. Again, it all comes down to how much an investor can stomach in the near term since the company hasn’t really shown great executions yet; if they do manage to pull off all their plans and get their stuff together, then my narrative on VWE would change. For now, given the company’s poor inventory management, shifts in management, VWE’s responsibility issue, and potential decline in margins, I’m not too confident in pushing through with VWE. Sure, the low price is tempting, but the uncertainty and risk outweigh the reward, which is not really that worth it. I wouldn’t want to be stuck in HOFDL [holding on for dear life] trying to look for a bottom with this stock.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here