Bristol-Myers Squibb (NYSE:BMY) is one of the largest pharmaceutical companies in the world with a market cap of almost $120 billion. The company has a strong 4% dividend yield and an impressive portfolio of assets. As we’ll see throughout this article, the company’s growth and recent acquisition of Mirati Therapeutics will support long-term shareholder returns.

Mirati Therapeutics Overview

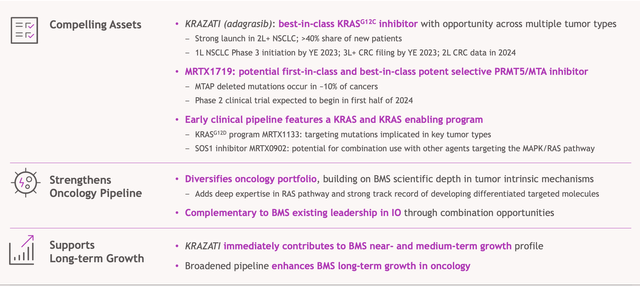

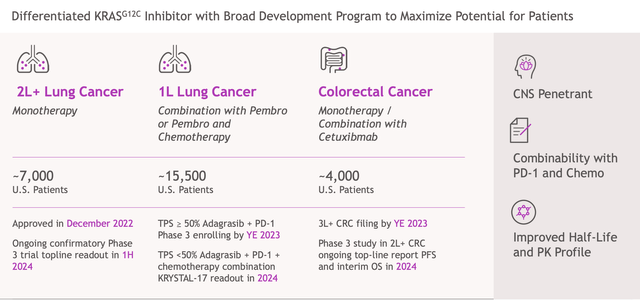

Mirati Therapeutics primary asset is Krazati, an oncology drug, operating as a KRAS inhibitor.

Bristol-Myers Squibb Investor Presentation

The drug has launched for 2L+NSCLC, and has managed to capture a >40% share of new patients. Current work is being done for Phase 3 trials etc., to expand the potential indications of the drug. Data is expected to come this year and next year for these potentially expanded indications, which could help expand sales.

Additionally, the company has a clinical pipeline focused on KRAS inhibiting / enabling, which is seen in a number of different key tumor types. The company’s MRTX1719 is among the most existing, as a potent select MTA inhibitor. MTAP deletion mutations are seen in ~10% of cancers, which could be a large target market.

Phase 2 trials are expected to begin next year 1H, so the drug is still a ways away from reaching commercialization and making any actual earnings.

Transaction Overview

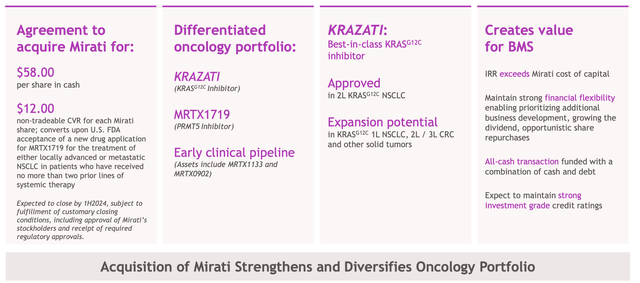

The acquisition price is $58 / share as the base. The company is paying it all in cash, which in general, we like to see.

Bristol-Myers Squibb Investor Presentation

The company is also including a $12 non-tradable CVR for each share, based on FDA acceptance of MRTX1719. These have become more popular recently, and while we have nothing against it, we do like the see them being tradable, offering a valuation and much more direct liquidity to shareholders. Still it’s just a side effect of the deal.

Bristol Myers Squibb expects to maintain a strong investment grade credit rating, with the IRR exceeding cost of capital. The net result is based on both peak sales and continued approval.

Bristol Myers Squibb Oncology Portfolio

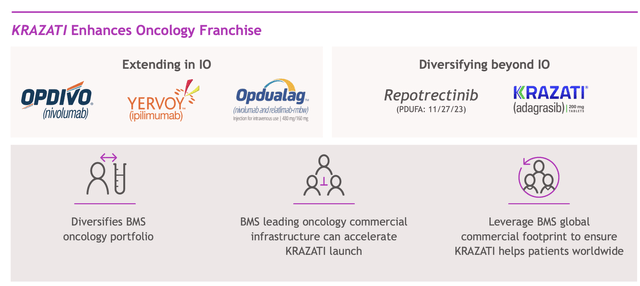

Bristol Myers Squibb has an impressive oncology portfolio and its hope is to continue growing it.

Bristol-Myers Squibb Investor Presentation

The company is focused on both continuing its existing strong drug portfolio, and diversifying into new drugs. Krazati is additionally a drug that’ll enable the company to expand past its existing franchise. The company has a strong commercial and sales infrastructure that it thinks can accelerate its Krazati launch and help the overall portfolio.

Bristol-Myers Squibb Investor Presentation

The base indication that Krazati has been approved for has ~7000 patients in the U.S., the most profitable market. The company expects a confirmatory data readout next year, which can help the drug improve from 40% of new starts to a larger number. The company is working to expand that with 1L Lung Cancer and Colorectal Cancer programs.

These Phase 3 programs should provide data next year. The total U.S. patient count of 19k is almost triple the current market size. That will help the company’s overall Oncology portfolio to continue its growth.

Thesis Risk

The largest risk to our thesis is that the pharmaceutical industry is an industry of discovery. Bristol Myers Squibb is making a multi-billion dollar acquisition to attempt to take advantage of a drug that it expects will be able to have long-term success. However, as the CVR shows, there’s no guarantee of widespread success, and when such compounds fail, it’s simply a multi-billion dollar loss.

The company has the scale to handle several losses, but it’s still a tough business.

Conclusion

Bristol Myers Squibb has an impressive portfolio of assets, especially in the oncology space, which is the company’s focus. The company is taking an intelligent risk by making an offer to include Mirati Therapeutics as a part of that portfolio. Mirati Therapeutics already has an exciting drug in the market and it’s working to expand indications.

Going forward, the CVR offers value for shareholders of Mirati Therapeutics and the potential for expanded indications can help shareholder returns substantially. We expect the acquisition to help Bristol Myers Squibb to deliver long-term shareholder returns. Let us know your thoughts in the comments below.

Read the full article here