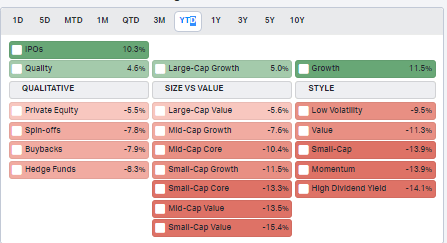

High-dividend stocks have been battered on a relative basis in 2023 as rising interest rates have made big-yielders less attractive. Rebounding oil prices and continued development among key shale regions, along with a hot summer, have benefitted midstream energy companies, though.

2023 Factor Performances

Koyfin Charts

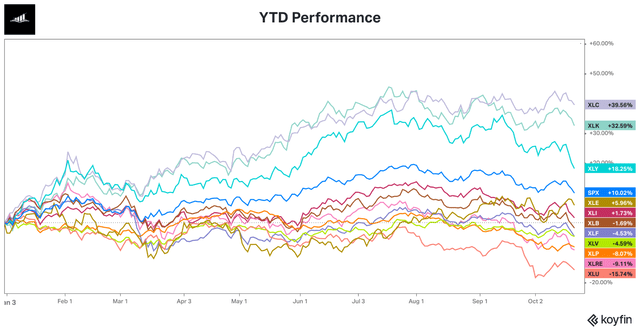

Energy Sector Leads Outside of TMT in 2023

Daily Chartbook

According to Bank of America Global Research, EPD, one of the largest publicly traded MLPs, provides a wide variety of midstream energy services, including gathering, processing, transportation, and storage of natural gas, natural gas liquids (NGL) fractionation, import and export terminalling and offshore production platform services. EPD has four reportable business segments: Natural Gas Pipelines and Services, NGL Pipelines and Services, Petrochemical (petchem) Services, and Crude Oil Pipelines and Services.

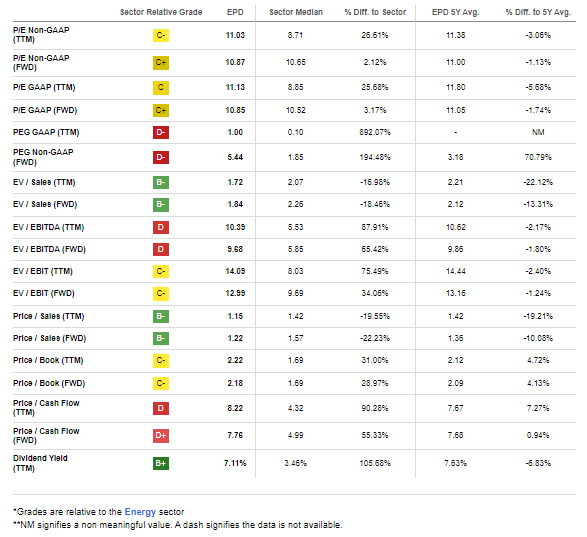

The Houston-based Oil and Gas Storage and Transportation industry company within the Energy sector trades at a low 10.9 trailing 12-month GAAP price-to-earnings ratio and pays a high 7.3% forward yield, according to Seeking Alpha. Ahead of earnings due out on Halloween morning, the stock has a low 15% implied volatility percentage and short interest is modest at just 1.4%.

Back in August, EPD reported a soft quarter, missing on both the top and bottom lines. Q2 GAAP earnings verified at $0.57, missing estimates by a penny, while revenue of $10.65 billion was a significant 1.67 billion miss. With a 33.7% year-on-year decline in net sales, distributable cash flow likewise dropped compared to the same period in 2022.

Second-quarter adjusted EBITDA was $2.2 billion, compared to $2.4 billion in Q2 last year. The management team reaffirmed its outlook and mentioned on the call that the company had established six operational records during the quarter, including record natural gas pipeline volumes and NGL fractionation volumes. BofA notes that in Q3, EPD will have benefitted from a one-off gain by selling stored ethane in the spot market to downstream customers at favorable prices.

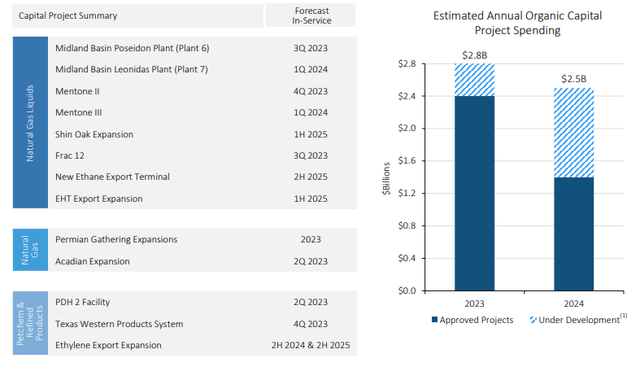

Growth Capital Updates

EPD IR

With 25 straight years of distribution growth, the yield remains strong, and operational performance is steady as she goes – the reduced sales and earnings were largely due to seasonality and weak commodity prices in the midstream segment.

A second-half rebound may be in full flight – the team expects a more favorable outlook for the second half of the year in terms of processing margins and outsized spreads with positive demand for petrochemical products with healthy exports and robust performance on the non-durables side. Still, key risks include supply chain disruptions, lower energy prices, as well as macroeconomic factors.

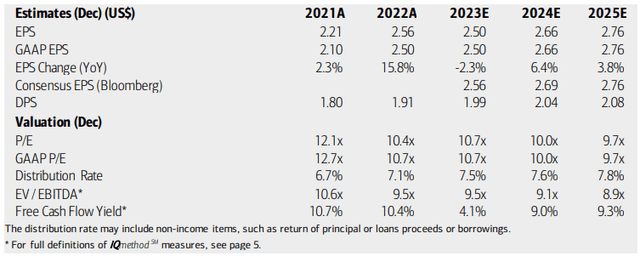

On valuation, analysts at BofA see earnings falling modestly this year before resuming higher in 2024. Later-year estimates show modest growth both from BofA and among the consensus analyst opinion. Dividends, meanwhile, are seen as climbing at a steady pace over the coming quarters.

With current forward operating P/E ratios under 11, shares are decently priced considering the reliable yield. What’s particularly attractive is EPD’s low 11x free cash flow multiple using out-year estimates. On a trailing basis, the company has generated $2.11 of per-share FCF.

EPD: Earnings, Valuation, Dividend, Free Cash Flow Forecasts

BofA Global Research

If we assume normalized operating earnings of $2.65 over the next 12 months and apply a 12 multiple – slightly above the stock’s 5-year average and around where the sector median P/E rests – then shares should be near $32. Historically, EPD has traded at a high-teens P/E (looking back to 2010), but today’s higher rates would discount that premium significantly.

EPD: Low Teens P/E, High FCF Yield

Seeking Alpha

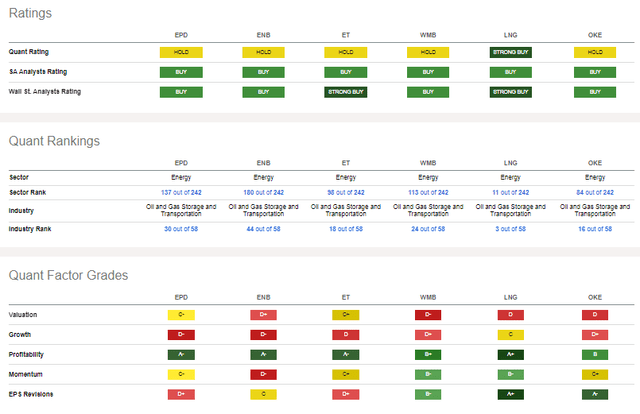

Compared to its peers, EPD features a lukewarm valuation, though I assert it’s to the cheap side, while its growth rate is not all that impressive either. Where the firm shines, though, is with its steady profitability and free cash flow generation. With significant capex spending, it is key to focus on how impressive FCF is with EPD.

Stock-price momentum is much better than the C- rating, in my view, and I will detail that later. Concerning, following the double-miss, is the weak trend in EPS revisions, so this upcoming quarterly report will be one to watch despite muted implied volatility per the options market.

Competitor Analysis

Seeking Alpha

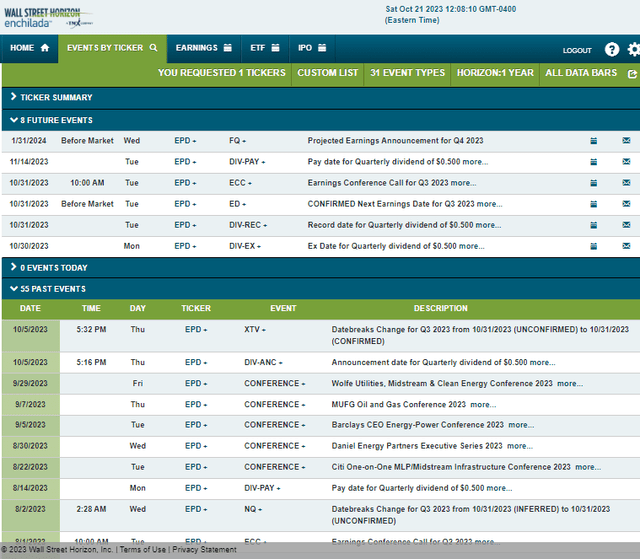

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q3 2023 earnings date of Tuesday, October 31 BMO with a conference call later that morning. You can listen live here. Shares trade ex a $0.50 quarterly dividend on the preceding Monday.

Corporate Event Risk Calendar

Wall Street Horizon

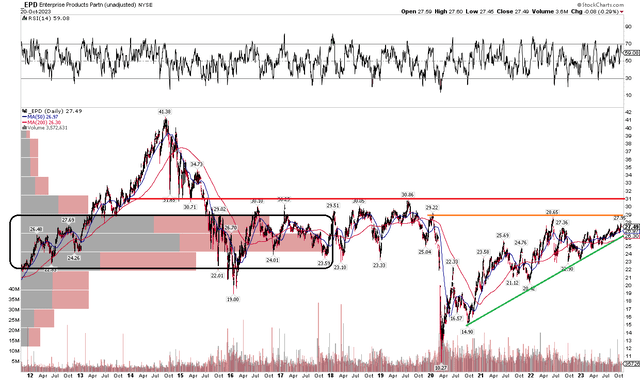

The Technical Take

EPD has performed well on a total return basis since I first analyzed the stock in July. Notice in the chart below that shares remain in an uptrend, but there are a pair of resistance levels investors should take note of. While long-term value and income-focused holders may dismiss momentum and price action, the near-term price appreciation trend we have seen could stall out around the $28 to $29 zone as well as just above $30.

What’s more, there remains a high amount of volume by price in the $22 to $29 range, which the bulls have yet to get EPD through. That also means, however, that any pullback should be met with natural buyers into the mid and low $20s. While the long-term 200-day moving average is upwardly sloped, indicating the bulls are in charge, the uptrend support line should hold to keep the momentum going – a break under $25 could put that in jeopardy.

Overall, the chart remains modestly constructive and EPD features robust relative strength to the broader market this year.

EPD: Uptrend Continues, Resistance Above

Stockcharts.com

The Bottom Line

I reiterate my buy rating on EPD. Shares have outperformed the S&P 500 this year, despite weakness among high-dividend equities. With improving profits and higher free cash flow over the quarters ahead, EPD should offer some ballast amid a volatile equity market.

Read the full article here