Investment Thesis

Daiichi Sankyo (OTCPK:DSKYF) has a competitive breast cancer treatment drug with Enhertu, and its application could widen to a broad range of cancers and substitute chemotherapy treatment. Its long-term earnings outlook is positive, but premium valuation indicates high market expectations. We rate the shares as neutral.

Quick Primer

Initially established in 1899 as Sankyo and undergoing a merger with Daiichi Pharmaceuticals in 2005, Daiichi Sankyo is a Japanese pharmaceutical company. The business initially developed stomach medicine, and its current flagship products are Lixiana (anticoagulant medicine, that prevents blood clots) and Enhertu (breast cancer treatment with potential applications elsewhere). The company is pioneering the development of antibody-drug conjugates (or ADC), of which Enhertu is the first significant commercial example.

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

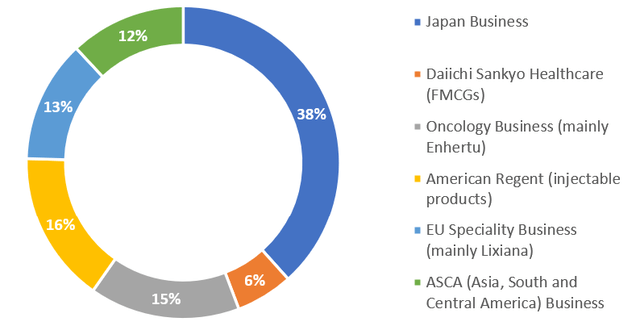

Sales mix by business unit (excluding foreign currency impact) – FY3/2023

Sales mix by business unit (excluding foreign currency impact) – FY3/2023 (Company)

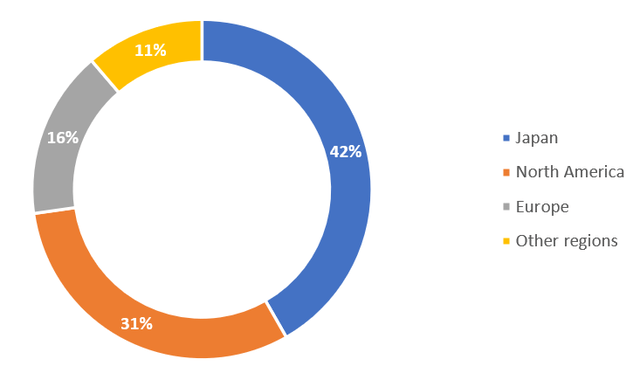

Sales mix by geography – FY3/2023

Sales mix by geography – FY3/2023 (Company)

Forming Our Thesis

Daiichi Sankyo pioneered ADC (antibody-drug conjugate) technology, initially working with Seagen (SGEN) between 2008 and 2015. Enhertu, the successful breast cancer ADC that was developed with AstraZeneca (AZN), is expected to generate USD2.4 billion in sales in FY3/2024.

ADC is a fast-growing anticancer drug and is viewed as an attractive alternative to chemotherapy. Standard chemotherapy works by attacking fast-growing cells but is not selective, affecting both cancer cells and healthy cells. ADCs bring together chemotherapy and targeted therapy into one treatment. The total addressable market is seen as being significant.

Merck (MRK) recently announced that it will pay Daiichi Sankyo USD5.5 billion to jointly develop three candidate cancer drugs in a deal that could be worth up to $22 billion depending on the success of the therapies. Merck’s key oncology drug Keytruda (pembrolizumab) will see its patent expire in 2028.

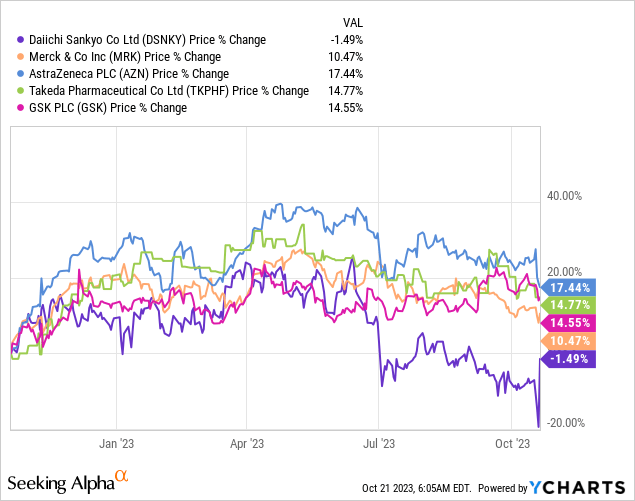

Despite the decent growth prospects overseas in the oncology market for Daiichi Sankyo, the shares have underperformed its key partners and domestic peer Takeda (OTCPK:TKPHF). We want to assess 1) the earnings outlook, and 2) the risks and valuations for the shares.

Earnings Visibility Looks Solid

Although the timing of recognizing milestone payments for drug developments can be difficult to judge, the sale of commercial blockbuster drugs is more visible for Daiichi Sankyo. Enhertu sales grew 160% YoY for Q1 FY3/2024 (page 8) indicating strong global demand. The company has also disclosed the potential application for the treatment of other types of cancers such as non-small cell lung cancer and gastroesophageal junction adenocarcinoma, expanding the addressable market significantly.

The recent partnership with Merck underlines the competitiveness of ADC technology, and we expect to see a strengthening development pipeline. Currently, the R&D pipeline is dominated by oncology treatments at Phase 1 (page 36), illustrating where the company is allocating most of its resources. With competitive technology and two strong partnerships with AstraZeneca and Merck, overseas expansion is set to accelerate.

High Japan Weighting and R&D Spend

If we were to poke holes in Daiichi Sankyo’s business model, two areas of relative weakness appear in our view – Japanese sales making up 38% of sales, and the high level of R&D spending.

High sales exposure to Japan should not be a surprise given the company’s background. However, there can be an element of negativity given that pricing in the domestic market is controlled by the National Health Insurance system which mandates annual price reduction; as a rule of thumb, prices are cut by around 2% to 8%. Consequently, overseas expansion is seen as a way of improving the sales mix.

R&D spending is necessary and provides the key competitive advantage. We note that Daiichi Sankyo spent 26% of FY3/2023 sales on R&D, which is significantly higher than its global and domestic peer group average of just under 20%. Investment into ADC technology is beginning to yield returns, but overall the high cost base results in Daiichi Sankyo having the lowest operating margins in its peer group at 9% versus the peer group average of 18%. There has been no indication that R&D spending will fall in the short to medium term, which means demonstrating operating leverage from increasing sales volume may be difficult.

Valuation

On consensus forecasts the shares are trading on PER FY3/2024 46.2x, and a dividend yield of 1.0%. With very high expectations of growth, these metrics do not denote a major undervaluation and an indication of fair value. This is perhaps what has been the major factor related to the underperformance of its shares.

Thesis Catalysts

Strong growth from the oncology business is tempered by relatively slow growth in the domestic business and rising R&D costs. The long-term growth potential remains intact, justifying premium valuations. Peers such as Pfizer (PFE) and Gilead Sciences (GILD) make inroads with their own ADC products.

Risks to Thesis

Growth accelerates with Enhertu being certified for application to a broad range of cancers, enlarging the potential addressable market. Daiichi Sankyo becomes the de facto provider of anticancer drug treatment.

Conclusion

Daiichi Sankyo is making rapid progress with Enhertu and its ADC technology, and the outlook is positive. However, we believe market expectations are already at a high level, and consequently, the shares do not look undervalued. Although upside risk remains from Enhertu becoming approved for a broad range of cancers, for the time being, we believe the shares are fairly priced and rate the shares as neutral.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here