As the S&P 500 sits on its 200-day moving average – in the vicinity of which it closed on Friday – I went back to reread some of my thinking on the way to this target (see “Target for the Correction in Equities is Still the 200-day Moving Average”).

Clearly, the war in Israel is an added concern that is pressuring the market – a flashpoint that was not anywhere on the horizon just a couple of weeks ago.

I think this war is as big of a problem as the bond market, as we don’t know yet if it will go regional. Until we know that, the stock market will remain volatile, as such big risks tend to pressure equities.

Still, musing in late September that the target for the 10-year Treasury was 5.25%, and then seeing it near 5% not even a month later, are two very different things.

This is troublesome behavior from the bond market, which is becoming more or less unhinged. I listened to Jerome Powell’s speech last week and even though he tried hard to have a more middle-of-the-road attitude, he struck me as tone-deaf.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Any Fed Chairman should be able to conclude that calming down the bond market should have been a top priority, and I did not get that vibe from Powell.

I think inflation will decline further in 2024, even if the Fed does not do anything more, yet he is still wedded to channeling Paul Volcker, who oversaw not one but two nasty recessions in his fight against inflation.

There still may be a soft economic landing in the U.S., but for that the bond market and the Fed needs to back off, in addition to the Middle East calming down, neither of which has happened yet.

How will we know if the bond market is calming down? Instead of making a perfect series of higher highs and higher lows since May, the 10-year Treasury yields (at a minimum) need to go sideways and make some lower lows.

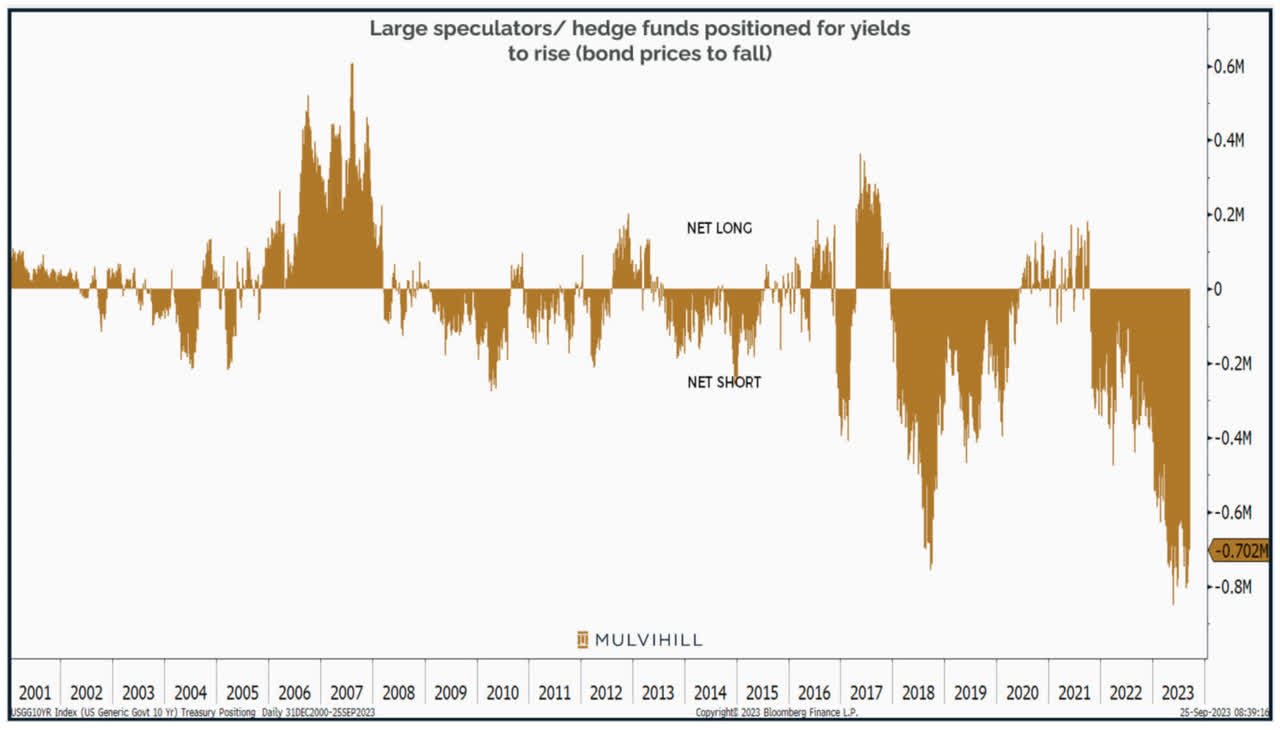

There is no sign of exhaustion yet, but it has to be noted that if the Middle East situation spreads (that is, goes regional), bonds can have an explosive move and Treasury yields can move sharply lower, due to the record short position in Treasury futures.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Any sustained trading below 4.50% on the 10-year Treasury would likely indicate that the top in the 10-year Treasury yield is in.

The Broad Market Is Flat Since October 2022

Although the S&P 500 and other cap-weighted indexes are up over the last year, two indexes are flat. Last October 25, 2022, the S&P 500 Equal Weight Index (SPXEW) stood at 5562.84. Last Friday, it closed at 5562.71 – no change. The Russell 2000 ETF (IWM) has actually fallen somewhat in the last 12 months.

A big part of this sideways action is due to rising interest rates, but we have to wonder about the heavy correlation between the Russell 2000 ETF and the S&P 500 Equal Weight Index, in the chart (below). In fact, I had to go back and make sure I had the right symbols, because this is how close the chart looked.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

It is normal for small caps to be down a little more, but over the past year they have moved in tandem.

If we get an economic soft landing, you will see both the S&P 500 Equal Weight and the Russell 2000 Index surge and the big gap between SPXEW and SPX close.

Until then, we can observe developments in the Middle East and hope that the Fed stops making policy mistakes, of which there have been too many.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here