This article was coproduced with Leo Nelissen.

A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.”

– Warren Buffett.

Let’s start with some bad news.

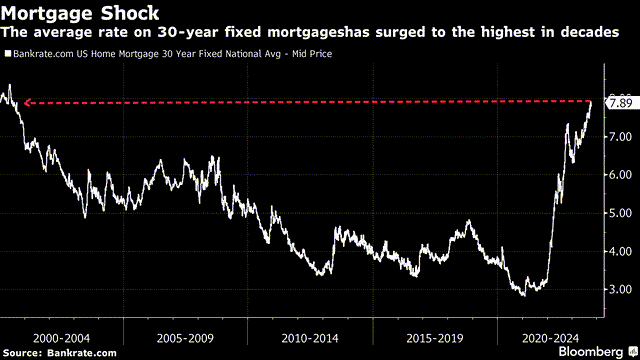

In 2020, people were closing on mortgages with yields close to 3.0%. Now, the 30-year mortgage rate is rapidly approaching 8%.

Bloomberg

As one can imagine, this is doing a number on real estate.

Rates are elevated, inflation is sticky, and economic growth is down.

While we’re far from stagflation, the market is increasingly fearful of a scenario that is, historically speaking, highly unfavorable for the real estate market – and the economy in general.

This includes an increasing wall of distressed commercial real estate debt.

According to GlobeSt.com, the balance of distressed CRE debt in the United States has risen to $79.7 billion at the end of September. That’s a 10-year high.

Here’s which sectors account for the biggest part of distressed debt:

- Office: 40.8%

- Retail: 26.6%

- Hotel: 17.9%

- Apartment/multifamily: 9.4%

- Self-storage/manufactured housing: 3.1%

- Industrial: 2.1%

We don’t think anyone is surprised that office credit is the worst.

What we found interesting is how healthy industrial real estate is.

Over the past few months, we have discussed this sector a lot as it still benefits from strong secular growth, including e-commerce, automation, and economic re-shoring.

Even self-storage is among the best sectors.

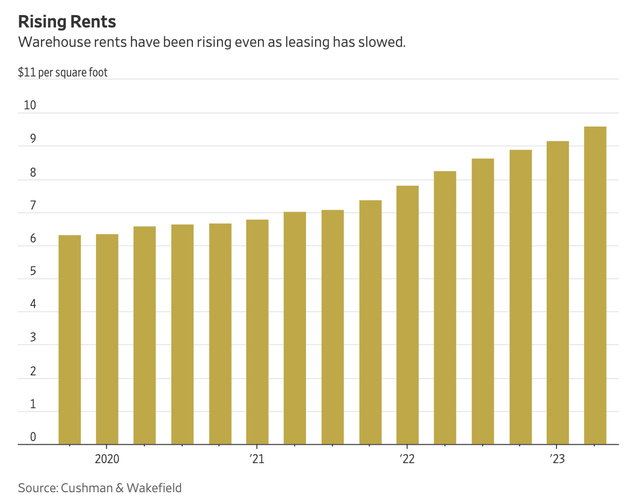

Especially warehousing (the biggest industrial REIT sector) is doing well.

Wall Street Journal

Last month, The Wall Street Journal wrote an article dedicated to what may very well be America’s strongest (cyclical) real estate sector.

A strong market in a downtrend.

After experiencing an unprecedented surge in demand for warehouse spaces between 2020 and 2022, driven by the e-commerce boom during the pandemic, the industrial real estate market is transitioning to a steadier pace.

While the frenzied growth has decelerated, the market has not come to a halt.

Companies have added hundreds of millions of square feet of warehousing during this period, leading to a nationwide vacancy rate drop to nearly 3% as of last year.

In light of what we just discussed, this shift in the industrial property sector contrasts with the commercial real estate market, which has been grappling with declining demand for office spaces.

Although industrial leasing activity has slowed, and vacancy rates have started to rise, the market is still strong by historical standards, with rents for warehouse spaces continuing to climb.

Wall Street Journal

A portion of the increased demand for warehouse space comes from companies seeking to maintain more inventory closer to their customers.

This strategy aims to address supply-chain disruptions experienced in recent years when companies found themselves running low on stock during adverse events.

Adding to that, geopolitical tensions are driving North American companies toward nearshoring, which involves returning production that was previously outsourced to Asia.

This shift has led to increased demand for warehouse spaces as manufacturing facilities in the U.S. and Mexico require distribution centers to serve the growing market.

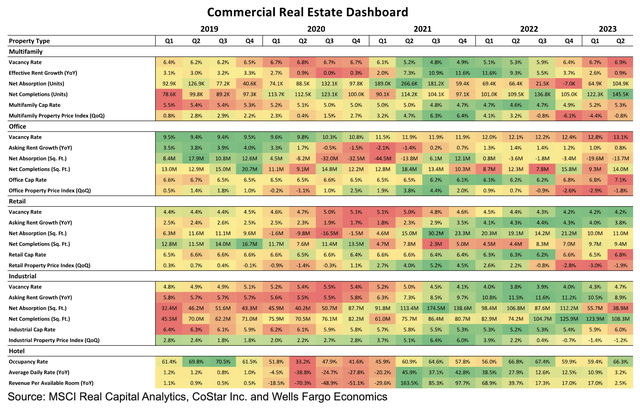

While we’re seeing slower rent growth, a lower absorption rate, and a slowly rising vacancy rate in industrial properties (see the overview below), it remains a fantastic place to be.

Wells Fargo

This brings us to Rexford Industrial Realty (NYSE:REXR).

This REIT has been on our Buy list. We’re big fans of this company.

Now, REXR continues to sell off, which offers tremendous opportunities. After all, it helps that the company just reported strong earnings.

While analysts are seeing some weakness down the road (that’s no surprise), REXR proves that it brings stability and value to the table, which is why we’re watching this stock like a hawk.

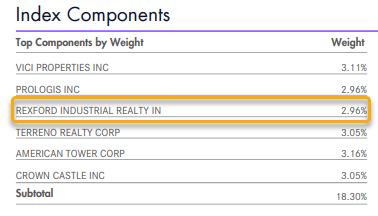

Vanguard Real Estate ETF (VNQ) has REXR weighed at .69% and the iREIT MarketVector Quality REIT Index has REXR weighted at 2.96%.

iRIET-MarketVectorTM Quality REIT Index (IRET)

A Truly Special Industrial REIT

Before we dive into market developments and quarterly earnings, which did a number on its stock price, let’s take a step back and look at what makes REXR so special.

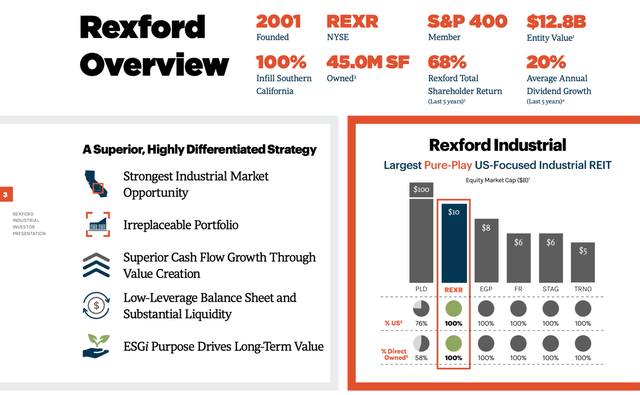

Founded in 2001, REXR is one of America’s largest industrial REITs. The S&P 400 member owns roughly 45 million square-feet of real estate in the strongest industrial market in the U.S.: Southern California.

Rexford Industrial

While a lot of readers dislike California due to its progressive policies, it’s a terrific industrial market. REXR, which generates 100% of its money in the SoCal infill markets, benefits from a significantly constrained supply.

SoCal has two major benefits:

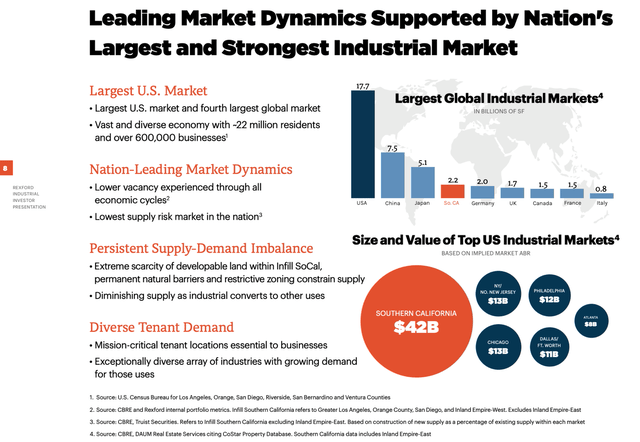

- It’s the fourth largest industrial market in the world, which comes with more than 600,000 businesses and 22 million residents. It’s a massive market that companies want to service. In order to do that, they need warehouses.

Rexford Industrial

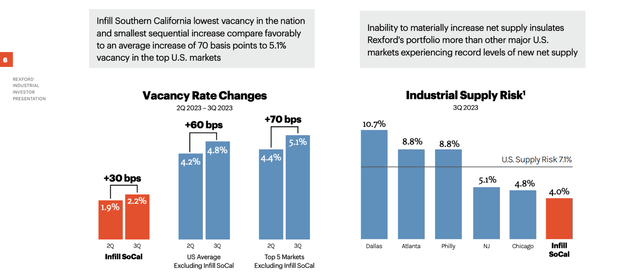

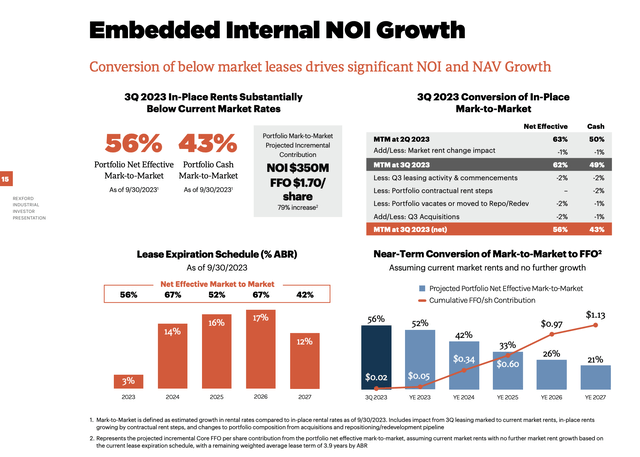

- SoCal is significantly supply-constrained. This has geographical reasons as the land is surrounded by water and mountains. Also, zoning issues keep supply growth from soaring. Looking at the data below, in 3Q23, industrial supply risk in the U.S. was 7.1%. In other words, 7.1% of the existing supply is currently under construction. The SoCal infill market has just 4.0% supply growth. It’s essentially a unique asset class. It also has the lowest vacancy rates and the slowest increase in quarter-on-quarter vacancies.

Rexford Industrial

Thanks to these benefits, the company has been able to grow its funds from operations (“FFO”) per share by 15% per year since 2018.

After all, it doesn’t just benefit from tight supply but also from the aforementioned tailwinds in the warehousing industry.

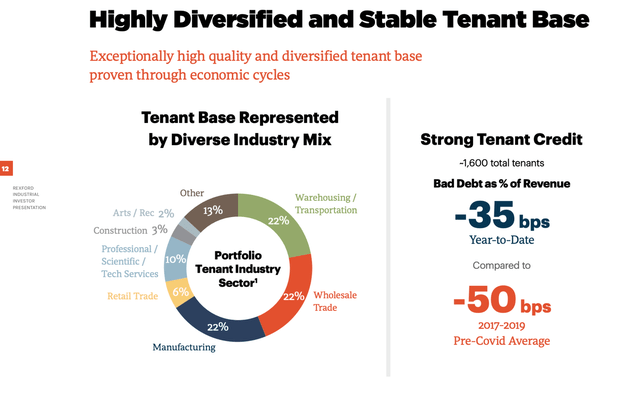

Close to half of the company’s tenants are warehousing and wholesale trade companies. A fifth are manufacturing companies.

Rexford Industrial

In light of strong fundamentals and outperforming vacancy rates, let’s take a closer look at the company’s earnings, which both confirmed its strength but also caused it to sell off more than 5%.

Good, But Not Good Enough?

As one might expect, REXR did a great job growing its business in the third quarter.

Core FFO per share grew by 12% compared to the prior year, driven by a robust same-property NOI growth of 9.5% in cash terms and 8.9% on a GAAP basis.

The leasing spreads during the third quarter outperformed expectations, with year-to-date figures reaching 62% and 82% in cash and GAAP terms, respectively.

Rexford also reported a strong occupancy rate of 97.9%. Although this is 20 basis points below the prior-year quarter, it’s outperforming the industry.

During its earnings call, the company emphasized its strong position for internal cash NOI growth in the foreseeable future.

Over the next two years, Rexford anticipates significant contributions to NOI from value-add repositioning, annual embedded rent steps, and acquisitions, projecting an overall incremental NOI of $125 million.

The total expected embedded cash NOI within its existing portfolio over the next two years is expected to be 33%, based on current rent levels.

Furthermore, the company has approximately 4 million square feet of value-adding repositioning and redevelopments in process or projected to start within the next 24 months. These projects are expected to deliver an aggregate unlevered yield on cost of 6.4%, representing an estimated $500 million of value creation.

Moreover, a net effective portfolio mark-to-market is expected to yield $77 million in incremental NOI over the next two years, contributing to a remarkable 79% growth in FFO per share.

Rexford Industrial

In other words, without too much effort, the company can use new leases and investments in existing buildings to significantly grow FFO.

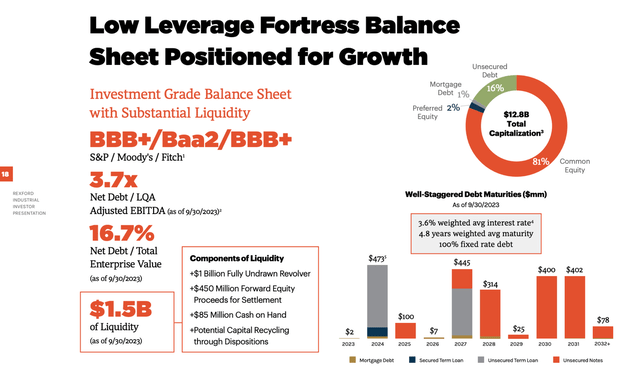

It also helps that the company has a healthy balance sheet. In fact, it has one of the best balance sheets in the business.

- The company has a 3.7x net debt ratio.

- Its weighted average interest rate is just 3.6%.

- It has a 4.8-year weighted average maturity on its debt.

- The company has almost no maturities in 2023.

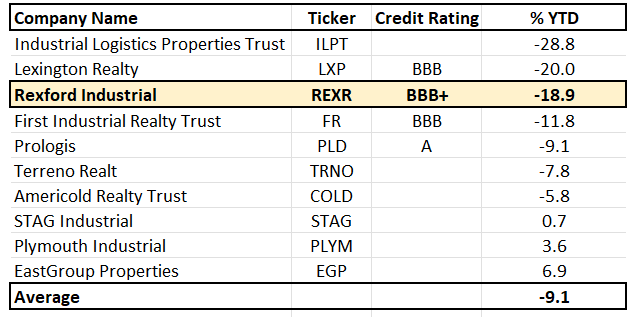

- It enjoys a BBB+ credit rating. That’s one step below the A-range.

- The company has $1.5 billion in liquidity. A big part of this consists of undrawn credit.

Rexford Industrial

Having said that, the company also commented on the health of the markets it serves.

During its earnings call, the company pointed out the favorable market conditions in infill Southern California, emphasizing its superior long-term demand fundamentals with a substantial supply-demand imbalance.

According to CBRE data, the region saw 2.6 million square feet of positive net absorption in the third quarter.

Notably, infill Southern California boasted the nation’s lowest vacancy rate at just 2.2%, outperforming other major U.S. markets where vacancies increased by an average of 70 basis points.

Additionally, supply risks in this market remained notably lower compared to other major markets in the country.

The company also noted signs of normalization in core traffic following the resolution of the dockworkers’ contract and increased port activity, showing a 20% month-over-month growth and the second-highest volumes in the past year at the L.A. Long Beach port.

In contrast, ports on the East and Gulf Coasts experienced a decrease in activity during this period, which is confirmed by some of my railroad holdings that service ports in the East.

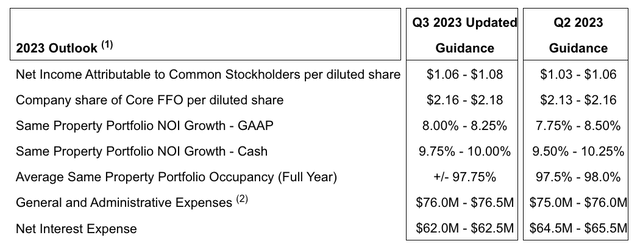

In light of these developments, Rexford has raised its 2023 core FFO per share guidance, now ranging from $2.16 to $2.18 per share, up from the prior range of $2.13 to $2.16 per share.

The guidance factors in the imminent closing of the San Gabriel Valley transaction and does not account for additional acquisitions, dispositions, or related balance sheet activities that have not yet closed.

The company’s projected 2023 cash and GAAP same property NOI growth remains consistent with previous estimates at the midpoint, with tightened ranges of 9.75% to 10% in cash terms and 8.00% to 8.25% on a GAAP basis.

The full-year same-property occupancy is expected to be approximately 97.75% at the midpoint, reflecting the prior guidance.

Rexford Industrial

Bad debt as a percent of revenue (troubled rent payments) is expected to be approximately 35 basis points, consistent with previous guidance and below the historical average of 30 basis points, underscoring the health of Rexford’s tenant base.

With that in mind, the company did well.

Its business environment remains strong, its internal growth potential is impressive, and its guidance is strong – especially in light of big-picture macro worries.

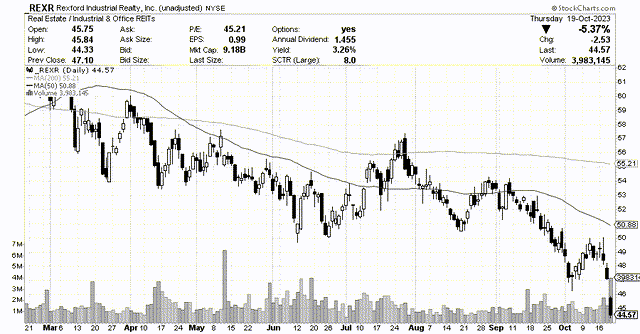

Nonetheless, its stock price was down more than 5% after earnings!

StockCharts

The problem is that analysts had expected even more.

Analysts expected core FFO guidance to be $0.01 higher and are fearful of the trend. While rents are strong, LA market rent is softening. This caused the company’s mark-to-market rent growth power to weaken a bit.

None of these developments are hurting the company. It’s just that analysts are looking beyond the current market. They are, essentially, saying that this could be the start of a bigger downtrend, hurting the company’s earnings power even more.

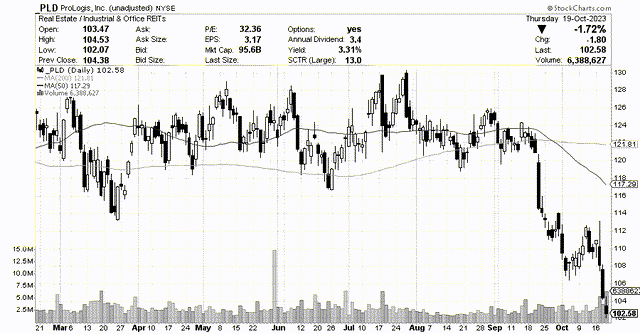

This isn’t a problem unique to REXR. Its 10x bigger peer, Prologis (PLD), also is suffering, as its stock price dropped from roughly $130 in June to currently less than $103.

StockCharts

While we’re somewhat bearish on the CRE sector, we have to say that this offers tremendous opportunities. It’s also why we started this article with a Buffett quote.

Dividend and Valuation

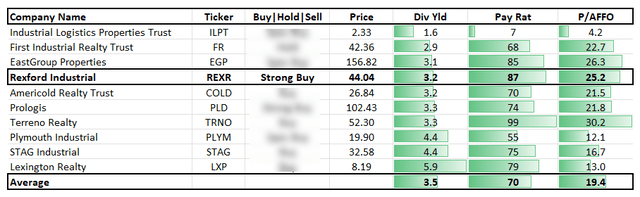

Thanks to this sell-off, the company now yields 3.4%. This dividend comes with a 2023E core FFO payout ratio of 70%.

On March 29, the dividend has been hiked by 20.6%. The five-year dividend CAGR is 18.4%, with more room for future growth, thanks to mark-to-market rent growth and internal investments.

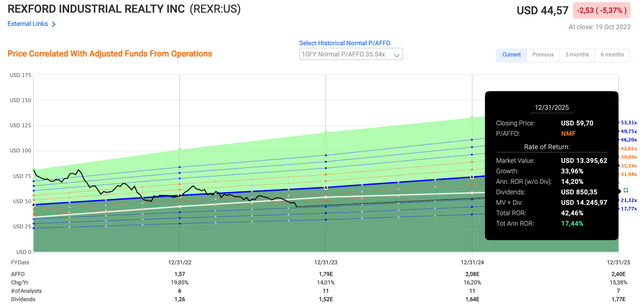

Additionally, REXR now trades at 25.5x adjusted FFO.

The 10-year normalized valuation multiple is 34.5x.

REXR is also one of the few industrial REITs that’s not expected to see AFFO contraction this year. REXR is expected to grow its AFFO by 14% this year, followed by 16% growth in 2024 and 15% growth in 2025.

So, even if the company’s valuation keeps falling to 24x AFFO and stays at that level, the company could return 17.4% through 2025! Hence, we maintain a Strong Buy rating.

FAST Graphs

Needless to say, this is a theoretical return based on expected AFFO growth and a subdued valuation.

If the economy bottoms going into 2024, allowing the Fed to cut rates without causing a recession, REXR could likely return much more.

However, we also could see a hard landing if inflation remains sticky and the Fed has to pick between protecting the economy and fighting inflation. A forced rate cut is not bullish.

So, our strategy remains unchanged.

We monitor the best REITs on the market and gradually buy on weakness. Both REXR and its peer PLD are on our buy list.

If we get the chance, we’ll start buying rather aggressively if REXR approaches $40 per share. From a long-term investing perspective, the valuation has become really attractive.

Takeaway

In today’s challenging real estate landscape, Rexford Industrial Realty stands out as a promising long-term investment. The industrial real estate sector is defying the odds, driven by factors like e-commerce, automation, and economic reshoring, which are contributing to its stability and growth.

Rexford, with its stronghold in the vibrant Southern California market, is uniquely positioned for success.

While REXR recently experienced a stock price dip due to analysts’ high expectations, its fundamentals remain robust. The company’s balance sheet is solid, and its future prospects are promising, making it an attractive choice for investors seeking dividends and capital appreciation.

iREIT®

The recent sell-off has pushed REXR’s yield to 3.4%, with room for future growth. The company’s projected growth in adjusted FFO and the potential for increasing returns make it a compelling option, even in an uncertain market.

So, if you’re keeping an eye on REITs and value investing, REXR is definitely worth considering.

iREIT®

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here