We closely follow the operational performance of institutions in the financial sector. We tend to provide a strong review of the key metrics you need to be aware of, but always do your due diligence. Today, we believe that after severe carnage in many of the banks with the erosion in margins due to the relentless march higher in rates, we need more time for Old National Bancorp (NASDAQ:ONB) to stabilize. We rate it neutral here, a hold.

While some banks strike us as good buys, with others we think you need to wait for stabilization. But after this decline, if you own it, hold it. You are still being paid a healthy dividend to wait for future capital appreciation. In this column, we discuss the justification for waiting for stabilization and review the bank’s just-reported Q3 earnings.

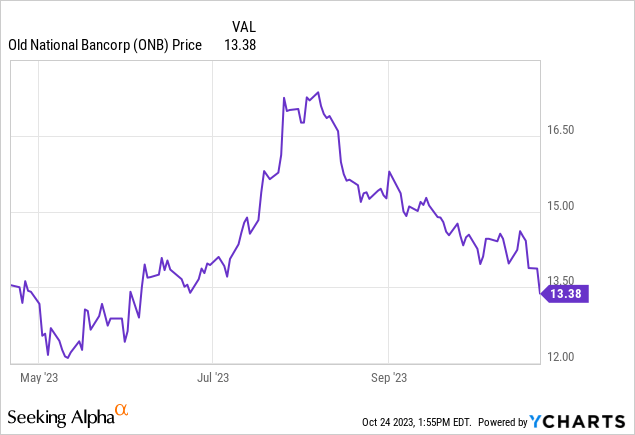

We do not like the appearance of the price chart, and it suggests strongly that shares are heading back under $13. New money should wait. In the just-reported quarter, the company did beat against analyst estimates on the headline earnings, but the quality metrics give us pause, despite loan and deposit growth.

The bank saw revenue of $456.02 million, falling 0.2% from last year. This comes despite loan growth of 0.5% to $32.7 billion from the sequential quarter and deposits up to $37.3 billion, up 2.8% from the sequential quarter. That is the good news. However, as we dig deeper, we see some things that we do not like. For example, Total commercial loan production in the third quarter was $1.5 billion with the commercial pipeline at $2.0 billion, which is down 35% from the $3.1 billion in Q2.

Like many other banks, Old National Bancorp margins are getting squeezed, though some of the stronger banks have seen stabilization if not expansion in this critical metric. For Old National, net interest income decreased to $380.9 million compared to $388.0 million in the sequential quarter, driven by higher funding costs (i.e., higher interest paid to depositors), but this was partly offset by higher yields on interest-earning assets. Overall, margin fell 11 basis points to 3.49% quarter-over-quarter.

The credit quality and return metrics here are a bit of a mixed bag. If there was a higher dividend yield here, we might be tempted, but in this environment, 4% just is not enough to get paid to wait, when other regionals are pushing 6-8% in some cases with comparable key metric profiles. One positive is that this is a highly efficient bank, with the adjusted efficiency ratio at 49.7%. That is a highlight, but it weakened from the sequential quarter by 30 basis points. Further the bank saw a big jump in provision expenses in the quarter to $19.1 million, compared to $14.8 million in Q2. Other banks of higher quality have seen reductions here.

The provisions were up due to higher net charge-offs, some loan growth, as well as macroeconomic factors. Net charge-offs in the quarter were $19.7 million, or 0.24% of average loans compared to net charge-offs of just 0.13% of average loans in Q2. This is nearly a doubling. However, the bank was quick to clarify a chunk of this impact was from one single customer and not a broader credit concern. This stands to reason, as the economy, while softening, is holding up. However, 30-day delinquencies are up to 0.18% of loans, up 50% from Q2. Allowance for credit losses was, however, about flat from Q2 at 1.03% of all loans. All in all, a mixed picture.

Finally, the return metrics have softened, with returns on average equity falling to 11.8% from 12.4% last quarter. Further, the return on tangible equity fell significantly to 20.9% from 22.1%.

Take Home

The sky is not falling here, but we would wait for the Old National Bancorp stock price to stabilize. The chart is not friendly. If there was more yield protection here, we would be a bit more willing to take a chance because the key metrics, while mixed, are not horrendous. Still, Old National Bancorp returns are falling and asset quality is diminishing, as are margins. This is a fine bank and in the long term should be fine, but there are better choices for regionals in our estimation.

Read the full article here