Back in March, I placed a “Buy” rating on Pinterest (NYSE:PINS), saying the company has a huge opportunity to better monetize its user base and close the ARPU gap versus competitors. The stock is up 14% since then, outpacing the 10% gain in the S&P over the same period. Let’s catch up on the name.

Company Profile

As a quick refresher, PINS operates an online vision board that tries to inspire users and help them find and shop products and experiences personalized to their taste. The platform has over 450 million monthly active users (MAUs), most of whom are women between the ages of 18-64.

Users can search for, save, and organize visual content called Pins into collections, while the platform makes recommendations based on machine learning. The company provides several types of Pins, including images with links to web content, short videos with links to web content, products that can be purchased from a retailer’s website, and multi-page ideas that can include a combination of videos, images, texts and lists.

PINS primarily generates revenue from advertising, with performance advertising about two-thirds of its revenue and brand advertising about one-third. Advertisers buy ads through an auction-based system, and can base their campaigns on things such as impressions (CPM), clicks [CPC], video views [CPV], and conversion events (oCPM).

ARPU Opportunity

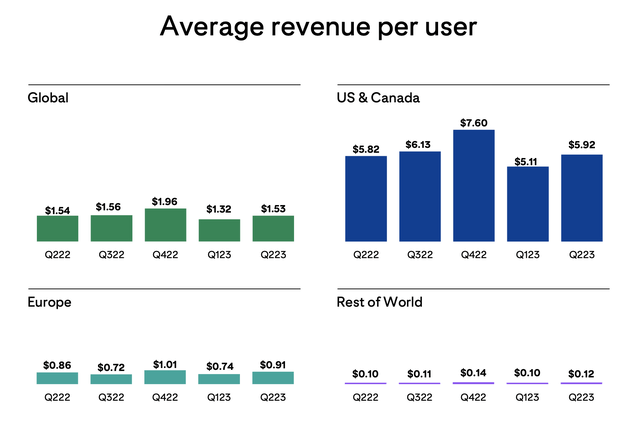

One of the big opportunities I discussed in my initial write-up for PINS was improving the monetization and ARPU of its user base, especially with international users. On this front, the company has mixed results for Q2.

For the quarter, overall ARPU fell -1% from $1.54 to $1.53, in large part due to mix shift more towards international. U.S. & Canada ARPU rose 2% from $5.82 to $5.92. European APRU, meanwhile, climbed 6% from 86 cents to 91 cents, while rest of world ARPU jumped 20% from 10 cents to 12 cents.

Company Presentation

At its investor day last month, the company noted that ARPU has increased by 3.5x in Europe over the past 3 years from 26 cents in Q2 2020 to 91 cents the most recent quarter. It noted some larger, more established markets also have much higher ARPU, with the U.K. checking in a $2.50 and Germany at $2.24.

At its investor day, CFO Julia Donnelly said:

“International is another source of revenue growth. Let’s start with Europe and our efforts to increase ARPU. Over the last year, we have focused on improving monetization on Pinterest by more deeply integrating ads into our products. We focused on UCAN (U.S.- Canada) first, and we are now beginning to execute the same strategy in Europe, by applying our third-party demand strategy to grow ad demand, accelerating lower funnel ad products and API for conversions adoption as we have in UCAN, partnering with agencies to expand advertiser relationships, and creating an export strategy to bring demand from non-monetized geographies to UCAN and Europe. As we deploy these strategies, we are confident that we can continue to grow our Europe ARPU. In Rest of World, our ARPU has increased 6x in the last 3 years, but really we’ve barely scratched the surface. We’ve recently focused the most on U.K. and monetization, followed by Europe monetization, and Rest of World last. But we are increasingly focused on Rest of World’s given the growth opportunities available. Our strategy in Rest of World will look similar to our strategy in Europe, but with a few key differences. We will grow ARPU and also grow users, apply our third-party demand strategy, replicate tenets of our UCAN strategy, including lower funnel and API for conversions, leverage reseller partnerships to drive increased ad budgets, and strategically target the largest market opportunities in Rest of World, such as Australia, Japan and LatAm. We believe there is significant upside remaining in our Rest of World monetization potential.”

Over the next three to five years, the company expects to grow revenue in the mid to high teens and achieve EBITDA margin to the low 30% range. That would be an acceleration from the 6% revenue growth it saw in Q2 and the mid to high single digit revenue growth over the past 5 quarters. It is expecting revenue to accelerate to the high single digit range in Q3.

It would also more than double the 15% adjusted EBITDA gross margin it saw in Q2. Adjusted EBITDA margins have ranged from 4% to 22% over the past five quarters.

The company has once again started to grow monthly active users, although this is largely coming from lower ARPU Rest of World users. Overall MAUs grew 8% year over year in Q2 to 465 million, and were up less than 1% sequentially to 465 million. U.S. & Canada MAUs increased 3% year over year to 95 million but have been flat the past several quarters. European MAUs climbed 6% year over year but declined -3% sequentially. ROW MAUs, meanwhile, jumped 10% year over year and nearly 3% sequentially.

Given that user growth at PINs is pretty limited, better monetization of its user base will be the biggest key to its success moving forward. It still has a lot of room for its ARPU to catch up to that of other social media players, and while its users are a bit less active, they also tend to be much more lower funnel, making them particularly attractive to advertisers.

And while international ARPU will likely never catch-up to U.S. & Canada ARPU, the company should nonetheless see its efforts significantly increase monetization in these markets. The company is seeing good progress in some more established markets on this front, and with ROW ARPU only at 12 cents versus $3.76 a Facebook (META), there is plenty of room for this to grow as well.

With the company set to report earnings next week, international APRU would be one of the main areas investors should focus on, as it should be the ultimate driver of the stock moving forward. Overall, I’d expect the company to be somewhat cautious ahead of the holiday season given the uncertain macro and advertising backdrop. Analysts are looking for an 11% increase in revenue in Q4, which would be a continued acceleration of growth over Q3 levels. That seems like it might be a little aggressive, although early indications are that its one click direct links are resonating with advertisers and leading to better conversions.

Valuation

PINS stock currently trades around 26x the 2023 consensus EBITDA of $605.8 million and about 19.5x the 2024 consensus of $802.8 million.

It trades at a forward PE of 28x the 2023 consensus of 95 cents and just over 22.4x the 2024 consensus of $1.19.

Revenue growth is expected to be 8.3% this year, and then grow around 14-18% a year over the next few years.

From an MAU perspective, each MAU is worth about $33.75. By comparison, each Facebook MAU is worth about $265, while a Snap (SNAP) MAU is worth about $21 and its DAU are worth nearly $40.

Given Facebook’s much better monetization it should be no surprise its users are worth a lot more, while SNAP has had a lot of issues over the past year or so. The opportunity for PINS is obviously to close the huge monetization gap with Facebook, which would help drive up its stock price.

Conclusion

Overall, I continue to like the long-term PINS story, and think it has a big opportunity to better monetize its international user base, which should really improve the company’s revenue growth and margins down the road. The company also continues to innovate under CEO William Ready, who has done a really nice job since taking over the helm last year.

I continue to rate PINS a “Buy” based on its user monetization potential. The biggest downside risks to the stock in the near term would be a weakening consumer and ad markets. Longer term the risk would be if the company struggled to increase international monetization.

Read the full article here