Zions Bancorporation, National Association (NASDAQ:ZION) saw 5% customer deposit growth in the third-quarter, but the bank continues to suffer from high provisions as well as pressure on its net interest margin, as expected. However, a decline in short term borrowings is taking pressure off of earnings so that the regional bank reported almost flat earnings quarter over quarter in Q3’23. Overall I am satisfied with Zions Bancorporation’s third-quarter earnings sheet (Source) and I believe shares continue to have revaluation potential. With shares trading again at a discount to book value and a low P/E ratio, I believe a further reduction in short term borrowings could provide a catalyst for earnings growth going forward. The 5.5% yield is also attractive for investors!

Zions Bancorporation Q3 missed on earnings

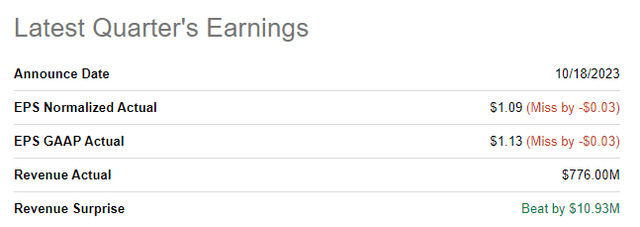

Zions Bancorporation missed earnings estimates for the third-quarter last week. The bank reported adjusted earnings of $1.09 per share, missing estimates by $0.03 per-share. However, the lender slightly beat on the top line.

Source: Seeking Alpha

Previous rating

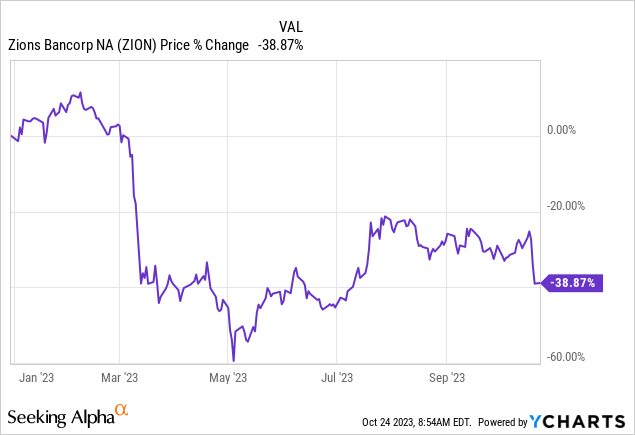

I recommended Zions Bancorporation after the second-quarter earnings report (as well as during the financial crisis in the first-quarter) due to the possibility of stabilizing deposit flows as well as a recovery potential: ZION: A Strong Buy After Q2. Since my last recommendation, shares of Zions Bancorporation have declined approximately 18% as the market continues to be overly focused on the impact of high interest rates on the banking sector and the decline in net interest margins. While I continue to stand by my previous arguments, I believe a reduction in short term borrowings could now also be added as a reason to consider the regional bank’s shares.

Favorable deposit trends

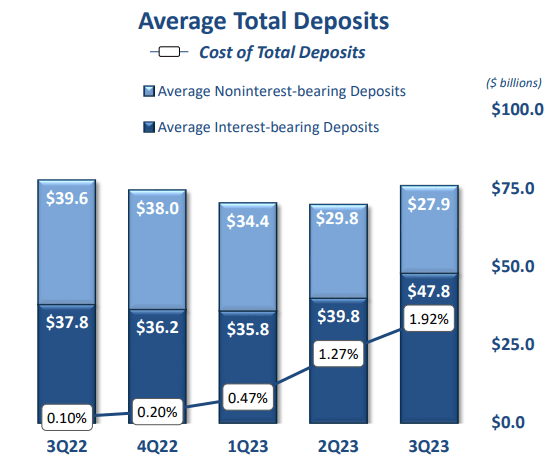

Average deposits in the third-quarter were up due to growth in interest-bearing deposits whose balances rose from $39.8B in Q2’23 to $47.8B in Q3’23, showing an increase of $8.0B. Customer deposits were up 5% quarter over quarter and the bank ended the September quarter with a total of $75.8B in deposits, showing an increase of $1.1B (+1%). The growth in average deposits is a favorable development and it indicates that the panic in the first-quarter was not justified.

Source: Zions Bancorporation

Credit situation

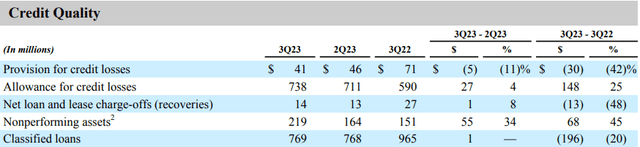

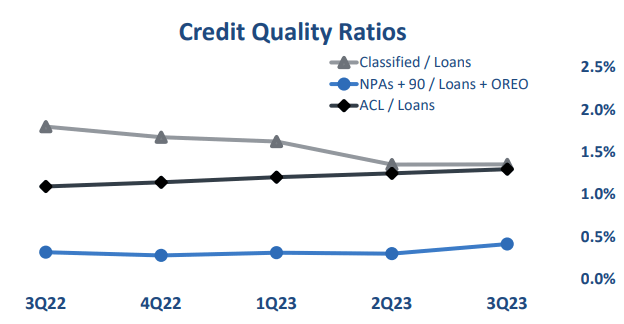

For the third-quarter, banks, both big and small, reported elevated provisions for credit losses… indicating that investors may have a reason to be concerned about loan quality, broadly speaking. Zions Bancorporation still has good credit quality, but the issue of growing loan defaults could become a bigger one during a recession when loan defaults are on the rise. In the third-quarter, Zions Bancorporation reported $41M in provisions related to estimated credit losses compared to $46M in Q2’23.

Source: Zions Bancorporation

Zions Bancorporation’s credit ratios worsened year over year, but not by much. The regional bank’s allowance for credit losses represented 1.3% of all total loans and leases at the end of the September quarter, showing a relatively moderate increase of 21 basis points year over year. An increase in loan defaults/provisions would likely result in a rating down-grade for ZION from my side.

Source: Zions Bancorporation

A lever for earnings growth

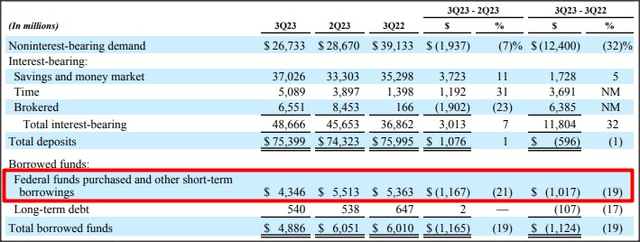

Zions Bancorporation has a lever for earnings growth which relates to the reduction in short term borrowings. During the spring turmoil, when Silicon Valley Bank went out of business and triggered multiple bank runs at smaller venture-focused regional lenders, the bank increased its short term borrowings drastically in order to have enough liquidity to meet deposit withdrawal requests.

At its peak, in Q1’23, Zions Bancorporation had $12.1B in federal funds and short term borrowings on its balance sheet, but the bank has made an effort in reducing its borrowed funds in the last two quarters: at the end of the third-quarter, this balance was down to $4.4B, showing a decline of 64%.

Source: Zions Bancorporation

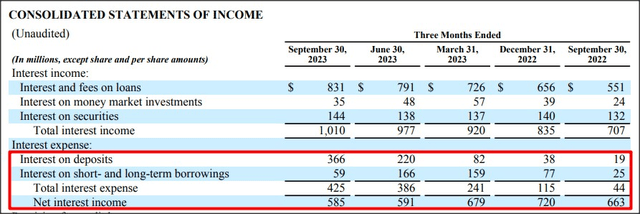

The decline in short term borrowings has been a key reason why Zions Bancorporation’s earnings didn’t fall further in the third-quarter. While deposit costs have risen due to higher interest rates prevailing in the economy, Zions Bancorporation’s total interest paid on short and long term borrowings drastically declined in Q3’23, falling from $166M in Q2’23 to $59M in Q3’23, taking pressure off of the bank’s earnings. Total net interest income therefore remained fairly flat, quarter over quarter, and the regional lender earned $585M in total NII in the third-quarter.

Source: Zions Bancorporation

Zions Bancorporation’s valuation

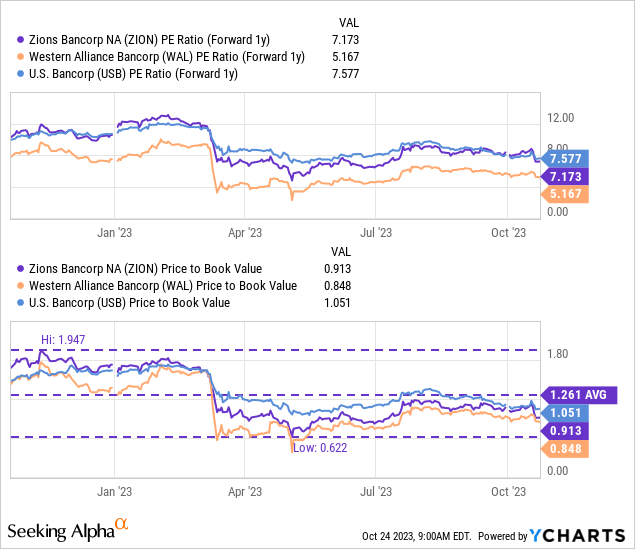

Shares of Zions Bancorporation are trading at a 9% discount to book value and approximately 28% below their 1-year average price-to-book ratio. I believe Zions Bancorporation could easily be valued at book value as long as the bank’s credit issues don’t get worse. The lender disclosed a book value of $32.91 per-share (+1% Q/Q), implying about 10% upside revaluation potential. Based off of earnings, shares of Zions Bancorporation are a bargain (P/E 7.2X)… and about as cheap as U.S. Bancorp (USB).

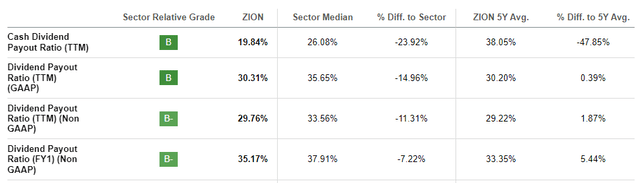

In addition to share appreciation potential, dividend investors get a 5.5% dividend yield with ZION… which is supported by the bank’s earnings. Zions Bancorporation paid out about one-third of its earnings in the last year, so the dividend is very safe here, in my opinion…

Source: Seeking Alpha

Risks with Zions Bancorporation

Zions Bancorporation still has room to lower its short term borrowings, but once this lever is pulled, investors’ focus may return to the development of the company’s earnings and net interest margin… which are set to remain under pressure in a high-rate world. What would change my mind about Zions Bancorporation is if the bank saw a drastic increase in its credit provisions.

Final thoughts

Zions Bancorporation’s earnings release for the third-quarter showed potential and although the lender’s net interest income declined Q/Q due to higher interest rates and higher costs on deposits, the bank managed to contain the fall-out through higher asset yields as well as a reduction in short term borrowings… which I would also believe could be a catalyst for earnings growth going forward. The bank’s credit quality remained fairly stable and deposit trends improved, especially in the consumer business. Since shares are trading again at a discount to book value, I consider the risk profile for Zions Bancorporation to be favorable. The 5.5% yield appears safe and alone is a reason to consider the lender’s shares!

Read the full article here