In January 2023, the clues appeared to be aligning in favor of an end to the Federal Reserve’s rate hikes. It was a false dawn – the Fed lifted its target rate four times in subsequent months, by a total of 100 basis points.

Fast forward to today, and once again the numbers leave room for speculating that rate hikes have peaked. Rate cuts are a separate issue, and on that front the outlook looks much weaker for unwinding tight policy. By contrast, the case for thinking that the central bank may stay its monetary hand is relatively compelling.

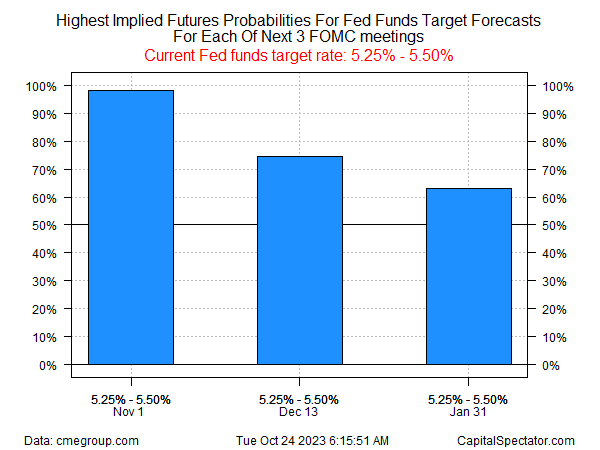

Exhibit A is the implied probabilities for policy changes via the Fed funds futures market. Sentiment is currently pricing in a virtual certainty of no change in the upcoming FOMC meeting on Nov. 1, followed by moderately confident estimates of holding rates steady at the next two meetings.

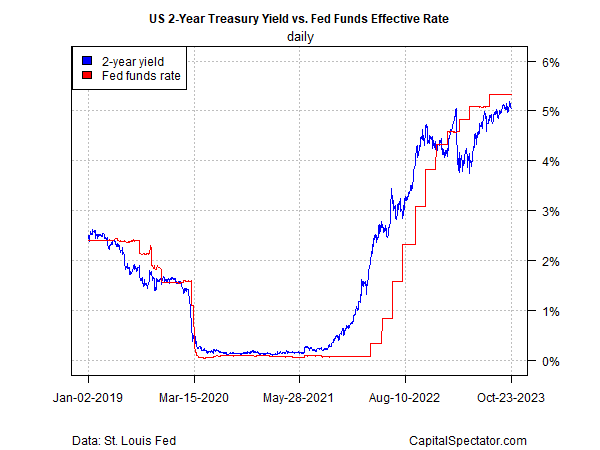

Meanwhile, the policy-sensitive 2-year US Treasury yield has been trading in a range recently, which suggests that bond market sentiment is cautiously pricing a peak rates scenario.

In addition, the 2-year yield (5.05% as of Oct. 23) continues to trade modestly below the current 5.25%-5.50% Fed Funds target range. That’s another hint that the crowd is still leaning toward expectations that the hikes are history.

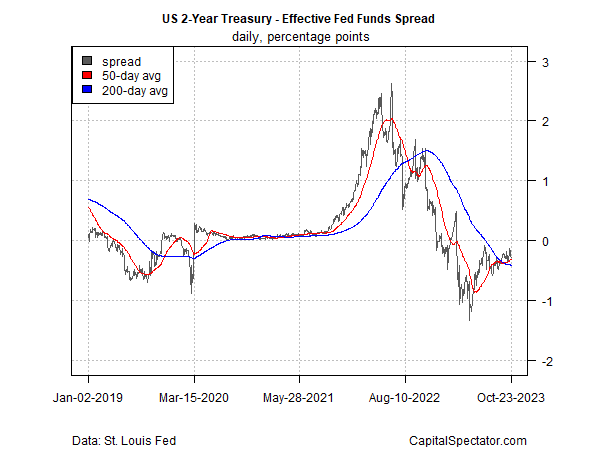

Looking at the 2-year yield/Fed funds spread highlights the relative stability in the relationship recently. Although the Treasury market got ahead of itself in previous months in pricing in peak rates, the crowd is coming back to the idea.

If the downside bias strengthens in the weeks ahead, that will be a new sign that confidence is building that the rate hikes have peaked.

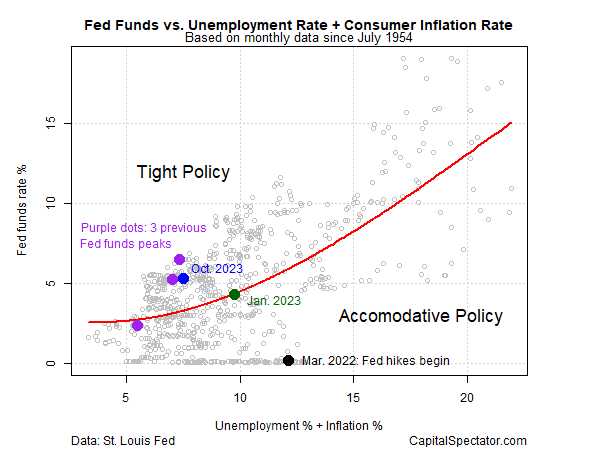

Another reason for thinking the Fed may be more comfortable with the level of monetary tightness: Fed funds relative to unemployment and inflation are more restrictive now vs. the level in January 2023, when the inflation was higher and monetary conditions were looser.

The combination of softer inflation and tighter policy by itself is no guarantee that the Fed’s hiking cycle has ended, but it’s a factor that supports the forecast.

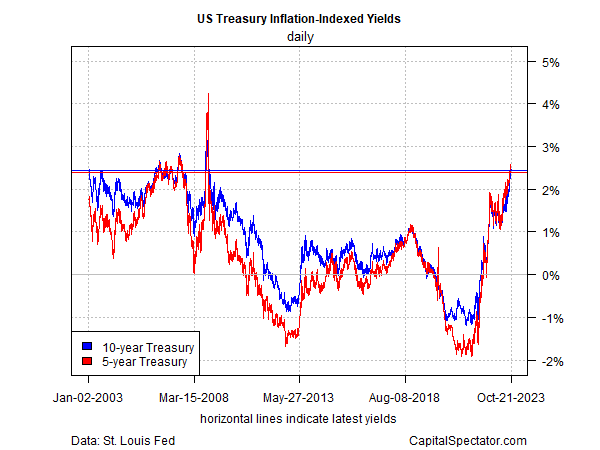

Another is the fact that real (inflation-adjusted) interest rates are higher today vs. January 2023, based on inflation-indexed Treasuries.

The Fed, in other words, can leave its policy rate unchanged and let the market do the tightening through higher real yields – a passive tightening policy.

Despite the analysis above, no one can rule out additional rate hikes entirely. The main threats to the peak rate forecast at this point: US economic resilience, particularly if it ramps up, and sticky inflation.

For the moment, though, both of those risks appear moderate in terms of persuading the Fed that more rate hikes are necessary. For what it’s worth, the Treasury and Fed funds futures markets agree.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here