Shares of Kilroy Realty (NYSE:KRC) have had a challenging year, losing over one-third of their value. Higher rates have weighed on real estate valuations, across all sectors, but office has been hit particularly hard as long-term questions about remote working and rental demand weigh. Shares now offer a 7.5% dividend yield with solid funds from operations (FFO) coverage, making the stock an interesting one to consider, particularly with its just-reported set of earnings. While the dividend is secure, I struggle to see much upside.

Seeking Alpha

In the company’s third quarter, it generated $1.12 in funds from operation on revenue of $283.6 million. This beat consensus by $0.05. FFO was down just under 5% from last year even as revenue rose by 3%. Property costs rose by $7 million, representing almost 14% cost inflation, which is relatively high but should moderate in coming quarters. Additionally, there was $10 million increase in interest expense as debt rose by $670 million. These cost increases more than offset the higher topline.

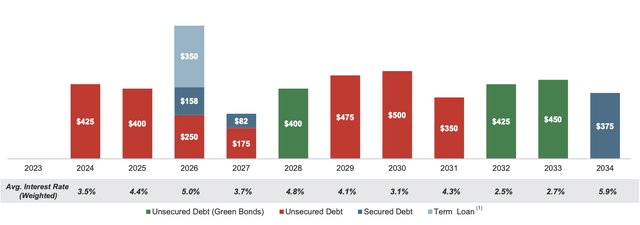

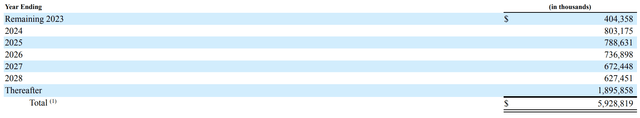

Interest expense should rise much more slowly from here, but it will likely see gradual increases. 95% of Kilroy’s debt is fixed rate, a definite positive. It also is carrying $790 million in cash on hand as it has pre-funded its 2024 maturity. As you can see below, Kilroy has a well-laddered set of maturities with no single year dominating its debt obligations. It also retains about $250 million in cash after dividends.

It likely will not need to tap the debt market until 2025. There will be a small sequential increase in interest expense next quarter as it drew down $170 million on a revolver, which was required per the credit agreement, but that will be a roughly $2 million quarterly impact.

Kilroy

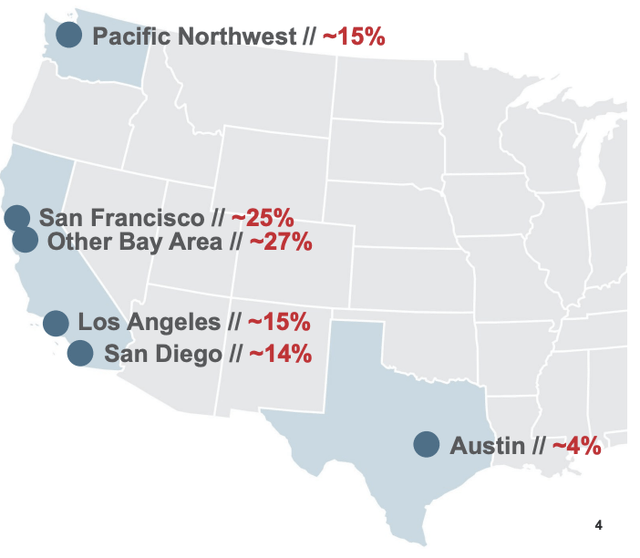

Kilroy’s balance sheet is well structured; the problem it faces is the end demand for office space. Kilroy is in the center of the storm to a degree, given its West Coast focus. That said it does operate relatively young, high-quality office buildings, which should help it outperform local market dynamics. Still, it is hard to feel bullish about office demand—there are simply degrees of bearishness. 65% of Kilroy’s properties are office, 25% life science, and 10% mixed-use. 55% of its $1.8 billion development pipeline is life sciences as it slowly tries to pivot.

Kilroy

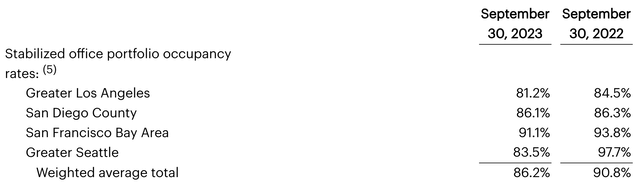

The steady decline in demand can be seen in the fact that Kilroy reported 86.2% of its portfolio was occupied in Q3 and 87.5% leased. Occupancy fell by 40bp sequentially with leases falling by 110bp. New leasing activity was modest in the quarter as it signed just 188k square feet of new and renewed leases (1.2% of its square footage). October has been a stronger month so far at 117k square feet. As you can see below, occupancy has fallen across all of Kilroy’s portfolio over the past year with the drop in Seattle quite jarring.

Kilroy

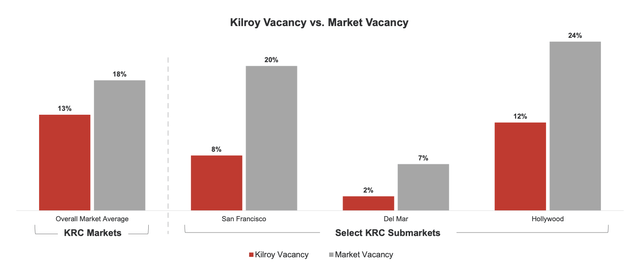

It is interesting to note that currently San Francisco has the highest utilization of any of Kilroy’s markets. This is partially due to the fact it operates young buildings with attractive amenities, energy-usage profiles, etc. As you can see below, Kilroy is markedly outperforming market averages.

Kilroy

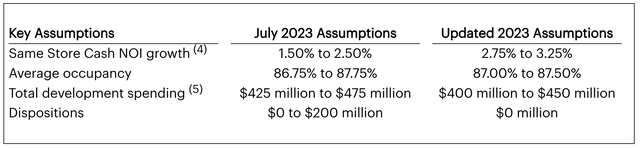

Overall, I do believe it is safe to view Kilroy as a firm that can outperform the average office building in its geographies, but this may amount to declining less. As you can see below, alongside the quarter, management did update guidance and slightly raised net operating income growth, though it no longer expects any dispositions, which speaks to the weak market for office properties.

Kilroy

Alongside this guidance, management expects $4.55-$4.60 in FFO this year. Given year-to-date results this implies $1.01-$1.06 in Q4 FFO. That would be down from $1.17 last year, a notable decline and a worse result than Q3.

To some extent, it feels like office real estate is experiencing more like a slow-motion train wreck than a sudden crash. This is because most office lease contracts are five years or more; even if tenants do not need as much space, they are stuck with leases for a long time. For instance, Kilroy has already locked in 75% of its Q3 revenue run rate for 2024, and there will certainly be some renewals and new leases signed.

Kilroy

This is a reason why occupancy is steadily moving down but doing so incrementally rather than in dramatic fashion. I am skeptical that KRC will be able to consistently re-lease to keep FFO flat to current levels, particularly past 2025, but this is a business more likely to face mid-single digit declines than dramatic ones.

Now, it is possible there is a pivot away from remote working. It is also unclear what hybrid work means. 3 days in the office probably does not mean a business can operate at 60% of the space it used to, but it likely does not need the full 100% it had. Where these things shake out can limit the decline.

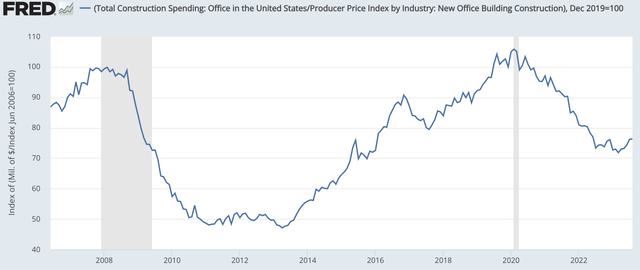

One positive for Kilroy and the office sector at large is that office construction is slowing. Because there is so much bearishness about the demand for office space over the medium term, few developers are backing new buildings. Declining supply can help to offset to some degree lower demand. In real terms (i.e., inflation-adjusted), office construction is about 25% below pre-COVID levels. If you are surprised it isn’t down more, remember that these structures can take several years to build, and even if the outlook is worse, it is almost assuredly economical to complete a half-built structure, especially as many do pre-lease to some degree. As such, I would expect construction activity to continue to slow and new supply to continue to lessen over the next 3-5 years.

St. Louis Federal Reserve

Kilroy has a market cap of $3.4 billion, $2 billion less than its book equity of $5.4 billion. Its real estate has a carrying value of $9.7 billion, so the stock market is essentially implying its buildings and properties are worth about 20% less than the carrying cost of them. Given office values have definitely fallen, this does not strike me as a valuation out of step with market dynamics, and it seems appropriate to value KRC at a discount to the cost of its properties.

Now, shares have a dividend yield of 7.5%, and its FFO provides 2x coverage of its dividend, so KRC could post 5-10% declines in FFO for several years and still maintain its dividend, which is why I view it as secure. However, the low level of new leases and implied sequential decline in Q4 do make me concerned we are likely to see these declines manifest themselves slowly but steadily. Between higher rates weighing on property values generally and the particular issues hitting office, a 20% discount to carrying value does not strike me as cheap.

KRC increasingly looks like a melting ice cube business, throwing off cash today, but steadily seeing declines. It would take about a 25% decline in revenue to bring its FFO coverage down to 1x, and with leases in place, that would take several years to occur. This provides time for investors solely focused on earning dividend income today, but ultimately I would be a seller of shares after reviewing these results. This is a business declining, facing major secular headwinds, that does not appear to have a particularly discounted asset valuation. I believe investors can find better opportunities elsewhere.

Read the full article here