Your continued feedback is greatly appreciated, so please leave a comment with suggestions.

A month of wealth destruction is upon us. Book values and share prices plunged. These losses are not all temporary. Sorry, that’s not how it works. Prices go up and down, but huge swings in interest rates create permanent losses.

I warned investors about this in September. I warned investors several times. To those of you who protected yourselves, congratulations.

Let’s go over some recent results.

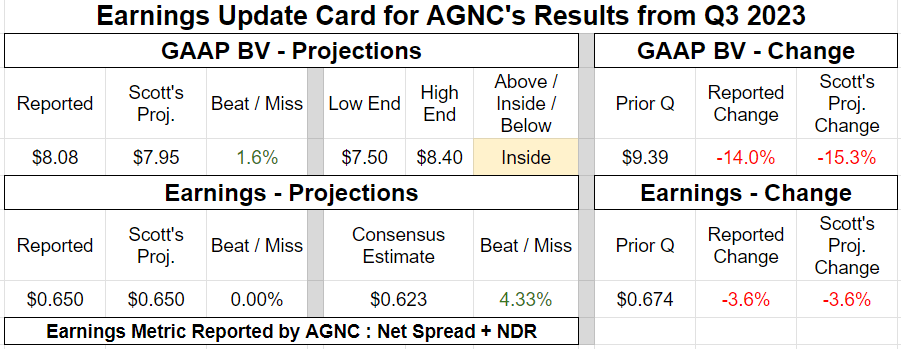

AGNC Investment (AGNC) preannounced their results. Can’t blame them. When an analyst comes out calling for tangible BV of $7.85 with net spread and dollar roll income at $.65 per share, they’ve gotta do something. That estimate was just too good.

The REIT Forum

They also announced their estimated BV as of 10/20/2023.

-

The mid-point of their range was $6.90.

-

Scott’s estimate for the same day was $6.85.

Did Halloween come early? Those book values are so accurate it’s spooky.

The REIT Forum

I think AGNC was hoping the shares wouldn’t drop nearly as far as they did. If shares only declined moderately, it would’ve been a great opportunity to issue shares. AGNC had an absolutely massive premium to tangible book value. Shares closed 10/23/29023 at $8.11. They’re presently $7.16. Down 11.7%.

They were down as much as 10% after hours on the report. All the bears were feeling pretty good.

The REIT Forum

How did we see this coming?

Forecasting Obvious Price Declines

AGNC was trading at about 1.2x tangible book value. That was hilariously overpriced. Investors could buy peers around book value.

Which one sounds better?

-

$100 for $100 of equity in a peer

-

$120 for $100 of equity in AGNC

Most of you can guess which one is better, but it’s the $100 of equity in a peer. There are peers that are every bit as good as AGNC. When there’s a huge gap in valuation, you don’t want to own the expense one.

That’s how we forecasted the decline in share price.

But the real question is:

How did we forecast the plunge in book value?

Great question! Thanks for asking.

I could put together 4,000 words. Boring. No thanks. Most of you don’t want to read 4,000 words, and I don’t want to type them. Brevity is the soul of wit.

Forecasting Book Values

This is meant to be concise.

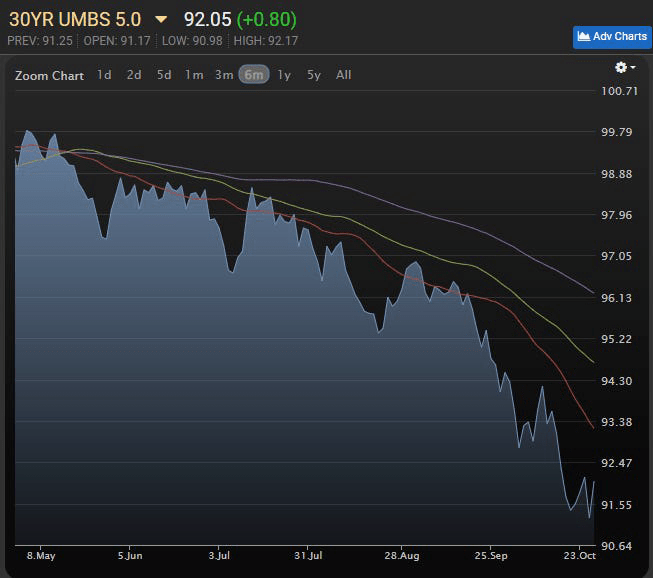

Asset values plunged:

MBSLive

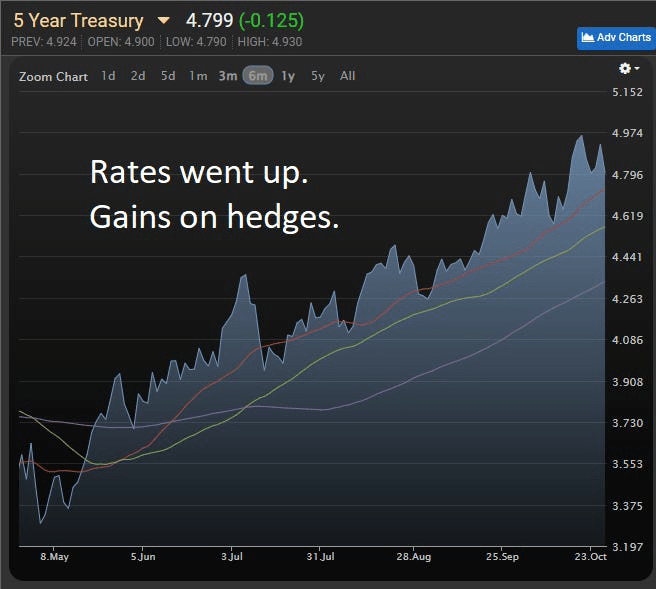

Hedges produced some gains:

MBSLive

The decline in assets was materially larger than the gain from hedges.

The business model is highly leveraged, so the book value swung much further.

Book Value

Quick lesson. Should an agency mortgage REIT trade at a huge premium to book value? No. A new one can be created at book value. Why would you pay a big premium to buy a portfolio of MBS and hedges? What should a mortgage REIT do if it trades at a big premium? It should issue a bunch of shares. Why? Because they can take the cash and immediately invest it into their model. If you have $100 of book value, why wouldn’t you want someone else to give the REIT $115 for a share? His share is no better than yours. He’s lifting your book value.

Sorry, think about mutual funds.

You own 1/10th of a mutual fund that only has $1,000 of assets. Pretend there are no overhead expenses.

Your position is worth $100.

Now imagine there is some sucker who will buy 5 shares for $115 per share. Pretend this is legal because it is legal when we deal with publicly traded REITs.

So the fund issues 5 shares at $115 and adds the cash to the fund.

There are 15 shares outstanding and the total value of the fund is $1,575.

How much is your 1 share worth?

$1,575 / 15 = $105.

The value of your position just increased by $5.

There’s nothing proprietary about the assets this fund owns. The fund simply invests the new capital in similar assets to the existing capital. Your position has 5% more of everything.

That’s better. That’s how the market works. More is better. You want more.

In practice, the company isn’t going to issue enough stock to increase shares outstanding by 50%. It’s going to be a smaller increase and a smaller gain to book value. However, getting 1% more of everything is still great. Who doesn’t want an extra 1% of everything?

If your broker could give you an extra 1% to your share count in every position, wouldn’t you want that?

That’s the lesson. Issuing shares above book value is great.

Why don’t we do that for equity REITs? Equity REITs have at least moderately unique assets and book value under GAAP is meaningless for them. However, when equity REITs trade above NAV (Net Asset Value) we generally want them to issue shares.

Battle Call of the Fish

At most poker tables, there is a mix of sharks and fish. Over the course of many hands, the sharks take money off the fish.

There’s a saying in poker. If you can’t spot the fish, you are the fish.

The REIT Forum

There’s a common battle call I hear from fish. It goes like this:

“When interest rates decline, we’re going to win so big. AGNC is going to rip higher.”

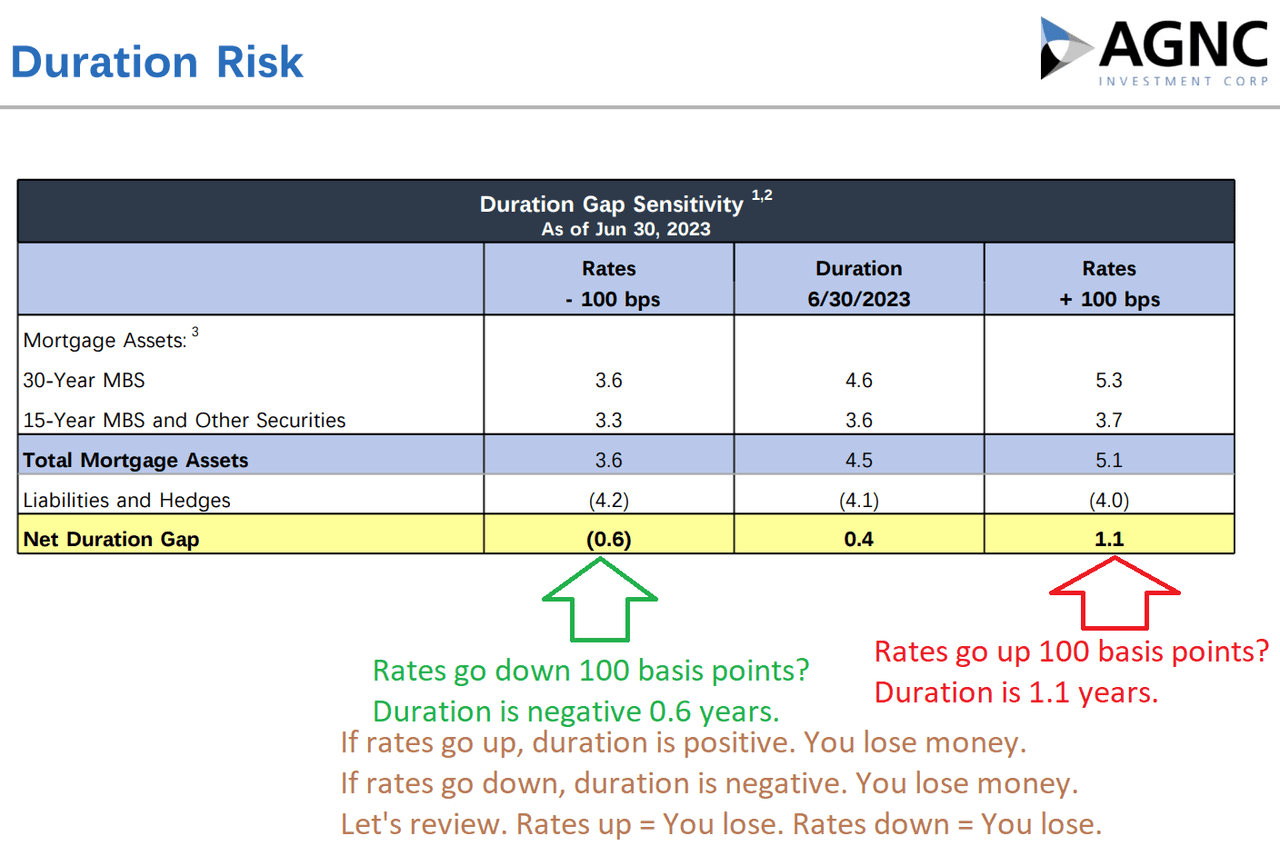

That’s just wrong. You don’t have to believe me. AGNC told you.

AGNC, Commentary by The REIT Forum

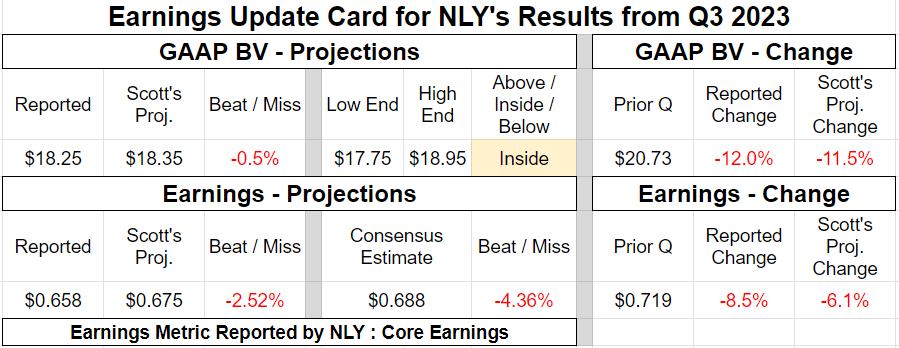

Moving on to Annaly Capital Management (NLY). Annaly recently announced their results. The BV loss for NLY was smaller than for AGNC. NLY “only” lost 12%.

The REIT Forum

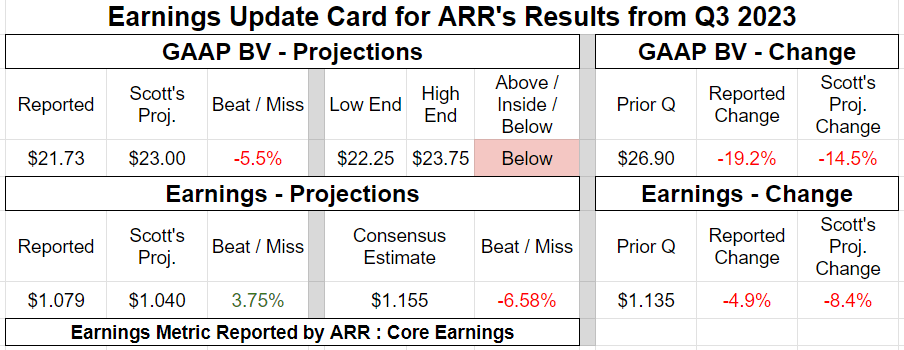

That’s much better than ARMOUR Residential REIT (ARR).

The REIT Forum

ARR could’ve used some mid-quarter adjustments to protect their book value. Instead, they burned through book value faster than a bonfire at a library.

The REIT Forum

What else to expect?

More carnage in the agency mortgage REITs. Moderate book value losses for most other mortgage REITs. The biggest damage is on the agency mortgage REITs because they have the most exposure to interest rates. Dynex Capital (DX) already reported. Results were very close to our projections. Same for Orchid Island Capital (ORC). We’re still awaiting results from Two Harbors (TWO), Cherry Hill Mortgage (CHMI), and Invesco Mortgage (IVR).

On the other hand, as predicted, BDCs are doing much better.

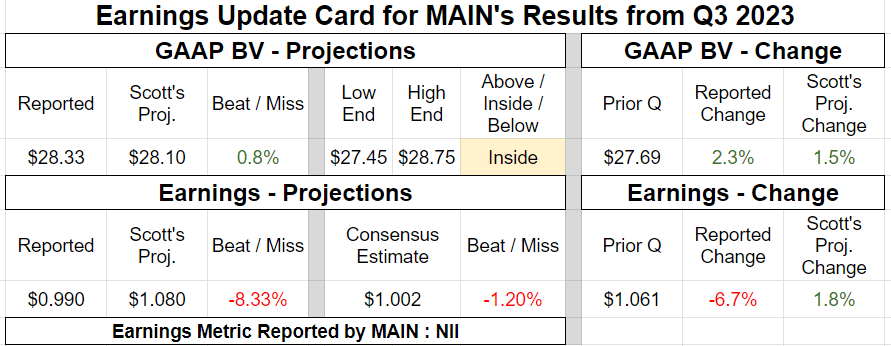

Main Street Capital (MAIN) had a modest gain in book value as they continue to smoothly navigate the environment.

The REIT Forum

Conclusion

It’s been a rough quarter for agency mortgage REITs. Investors are counting on rates to remain steady. If you’re projecting rates to plunge, you really don’t want to buy into the sector.

If rates actually stabilize, they could perform very well. Until then, it’s a very dangerous area. To be fair, it’s always dangerous to play with stocks if you don’t understand them. Holding until the reverse split and dividend cut doesn’t make it safer.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here