By Elizabeth Bebb

Factor indices aim to provide investors the means to access factor exposure in a cost-effective and transparent way. S&P DJI offers sustainability versions of factor indices that incorporate environmental, social and governance (ESG) scores, which allow investors to align their investments with their interests while seeking to improve risk/return dynamics. Launched in 2021, our suite of S&P 500 ESG Indices encompasses single-factor indices based on quality, momentum, enhanced value and low volatility.

Combining Factors and ESG Methodologies

The creation of the indices starts with the S&P 500® ESG Index. This version of the index has already undergone a transformation from the S&P 500 by including sustainability criteria. The index focuses on those companies with higher S&P DJI ESG Scores in each industry group, which add up to 75% of the underlying index universe’s cumulative float-adjusted market capitalization (FMC). The GICS® industry weightings therefore remain similar to those of the underlying S&P 500.

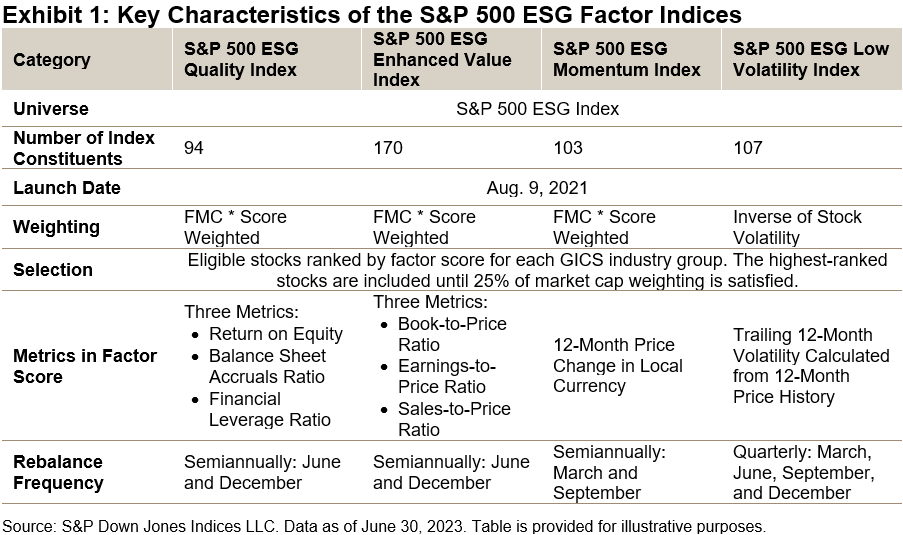

Taking the S&P 500 ESG Index as the base universe, the factor indices select stocks characterized as having relatively better factor scores within their respective GICS industry group. This sequence is followed to ensure that the factor’s exposure is prioritized and to help avoid factor dilution as compared to the non-ESG equivalent. The indices target 25% FMC of each industry group, using our S&P DJI factor scores that are calculated using the metrics detailed in Exhibit 1. Additional information can also be found in the methodology.

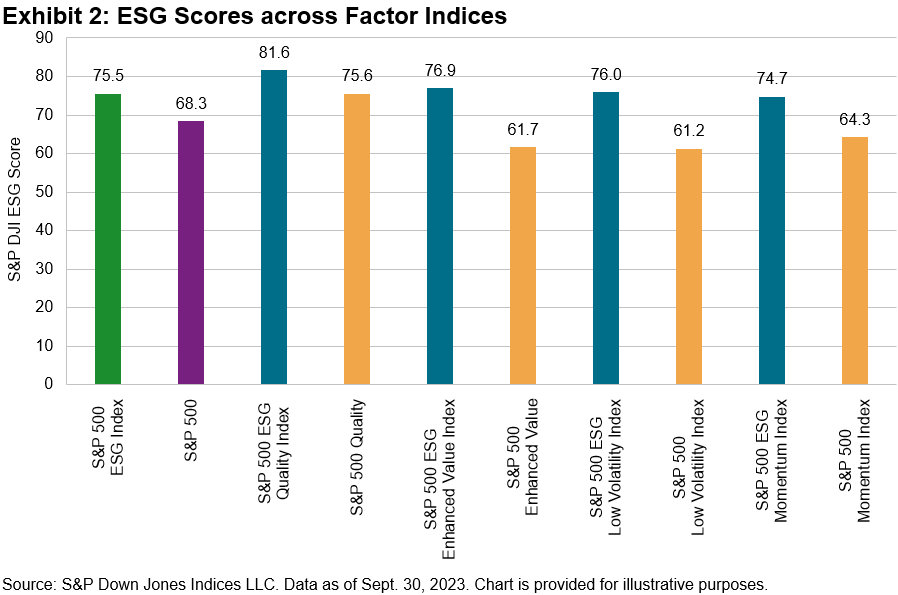

As of Sept. 30, 2023, all ESG factor indices had S&P DJI ESG Scores that were higher than those of both the non-ESG factor indices and the S&P 500 ESG Index.

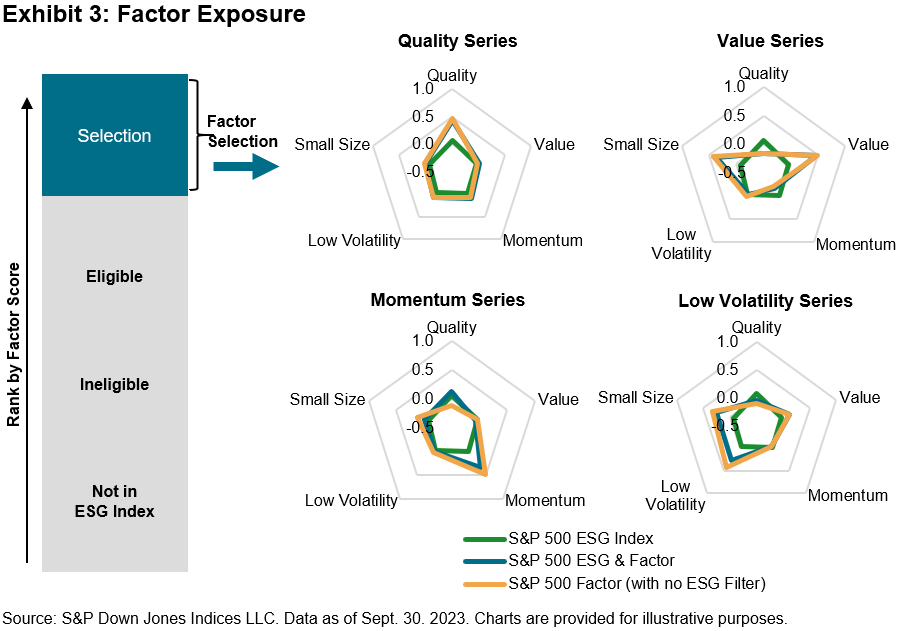

Reviewing the exposures in the ESG factor indices shows that the indices were highly focused within their primary exposures, while secondary exposures to other factors were relatively low. Exhibits 3 and 4 also show that the ESG factor indices had similar factor exposures to their non-ESG counterparts. The addition of the ESG criteria did not dilute the factor exposures.

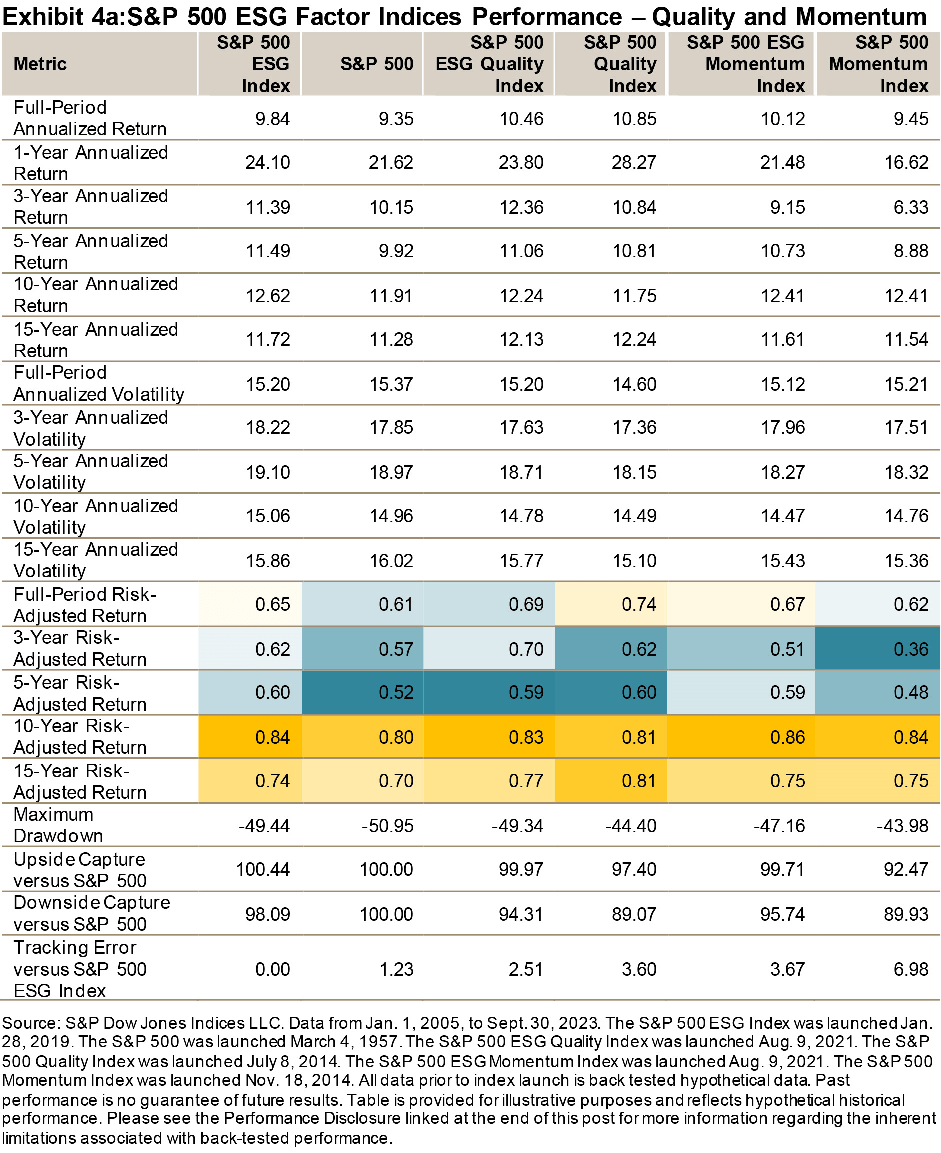

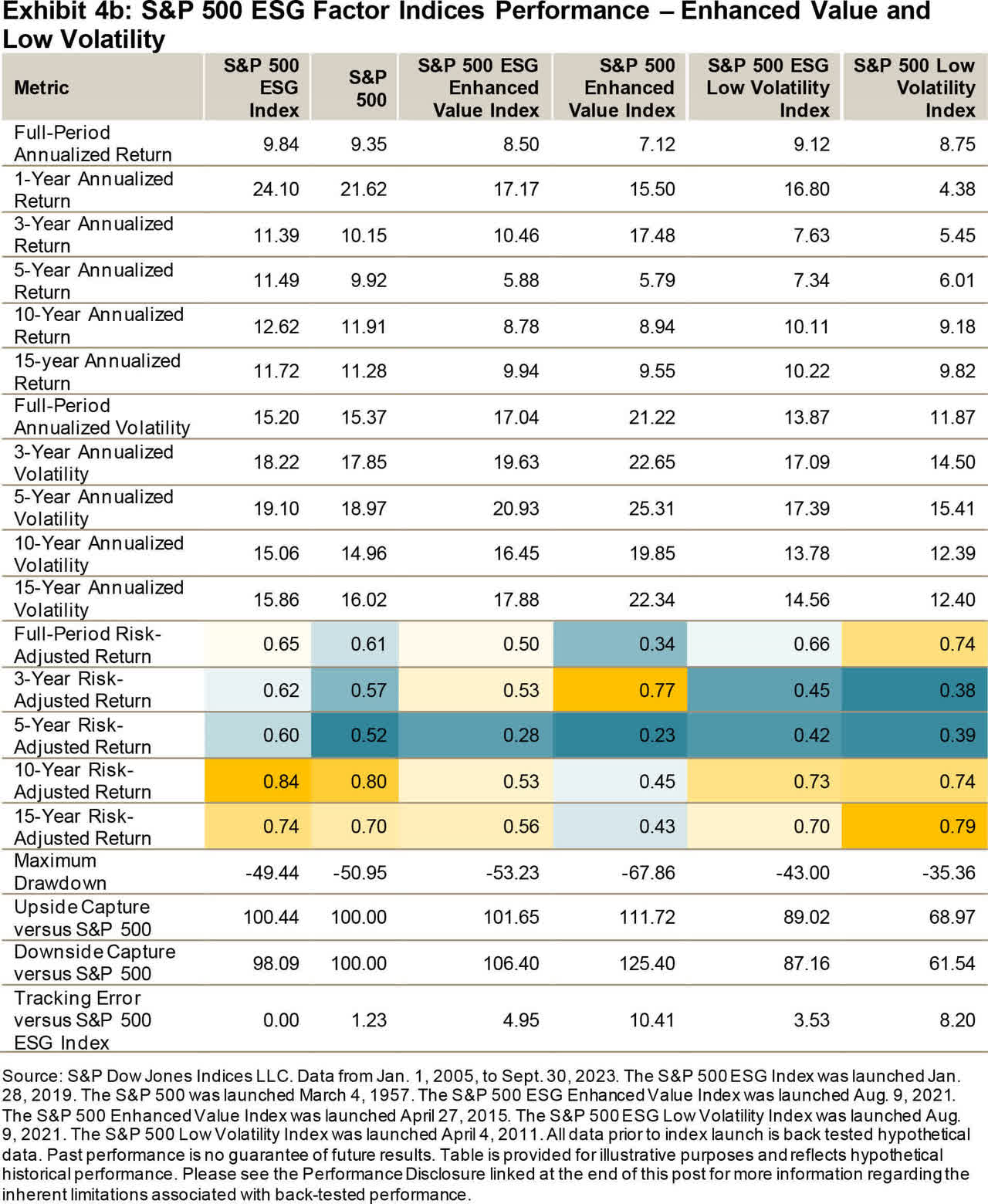

The return data for each of the indices shows that, over longer time periods, the ESG versions of the factor indices had higher risk-adjusted return ratios, indicating that higher returns were available for lower levels of risk. As expected, diverse market environments drove varying performance across factors over different time periods.

There is evidence to suggest that the selection for avoiding the lowest ESG-scoring companies relative to the S&P 500 may lead to higher performance over the longer term. S&P ESG Factor Indices have historically offered a factor return consistent with the targeted factor exposures. Over the period studied, adding the sustainability element did not affect the factor tilt, but it may have improved returns, as it allowed the companies with the highest ESG scores to be selected into the ESG factor indices. Based on the back-tested data, the S&P ESG Factor Indices have broadly outperformed their non-ESG counterparts since September 2005.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit www.spdji.com. For full terms of use and disclosures please visit www.spdji.com/terms-of-use.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here